Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by androdev

(Post 5576218)

They call it cool off period. How can anybody use this bank account in this day and age where you need to wait for 4 days to make an online payment??

|

Forget cool-off period, ICICI has specific restrictions for different days and times. That too for existing payees to whom you have transferred large sums multiple times before. For example, on bank holidays and Saturday evenings, nights from 2-4 am, etc, they have lower limits for NEFT. Weird. And I know this is not NEFT or UPI restriction cause I was able to make the same transfer from another bank account.

Quote:

Originally Posted by thanixravindran

(Post 5576535)

Are you sure you cannot do any transaction during cool off period?

Their FAQ tells you can transfer upto 5L in that period in aggregate manner. https://retail.onlinesbi.sbi/sbijava...0using%20IRATA.

Is it not even showing the beneficiary under transfer funds option?

|

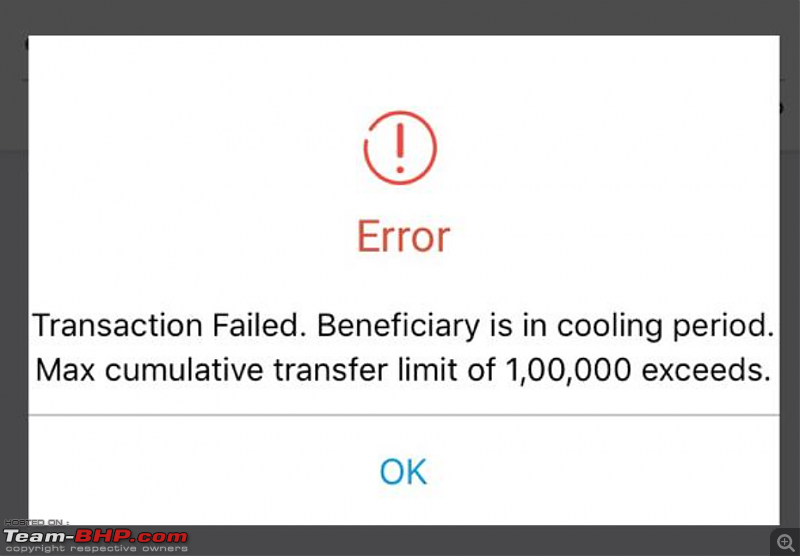

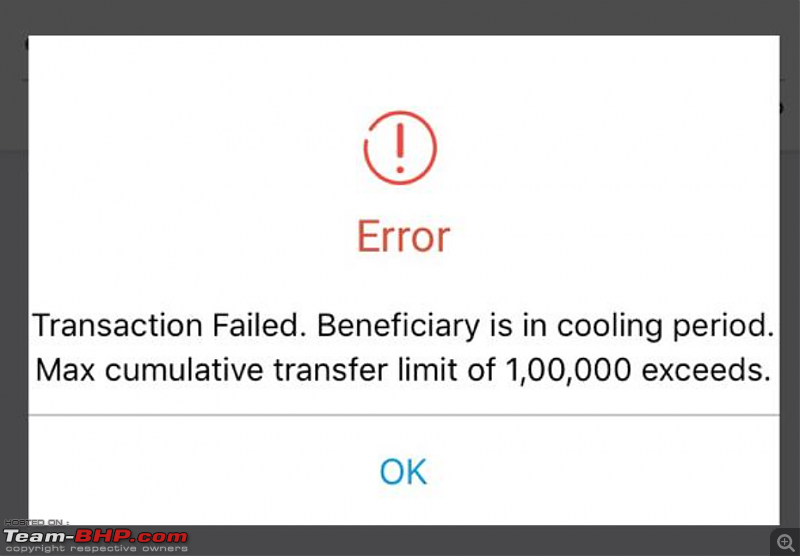

In some places it shows 1L, and in other places it shows 5L. The error message shows 1L.

I needed to transfer close to 20L but SBI max limit 10L was good enough so I could do it in two days. I am still in cooling period :-) Unable to keep cool, though. I used my wife's SBI account to setup beneficiary using their ATM approval. This allowed instant transfer of 10L and my rating for SBI has gone up compared to other banks that have minimum 24hr cooling period.

Quote:

Originally Posted by binand

(Post 5576593)

... when dealing with banks that don't have IMPS (which ones are these?)..

|

I know about Deutsche bank not having IMPS but UPI with that account works real-time like any other bank. To be honest, I know a very little about the tech behind all this. UPI has been a phenomenal convenience, kudos to the people who envisioned it.

Quote:

Originally Posted by Jaguar

(Post 5576673)

Forget cool-off period, ICICI has specific restrictions for different days and times. That too for existing payees to whom you have transferred large sums multiple times before. For example, on bank holidays and Saturday evenings, nights from 2-4 am, etc, they have lower limits for NEFT. Weird. And I know this is not NEFT or UPI restriction cause I was able to make the same transfer from another bank account.

|

Yeah, the trick is to be aware of these restrictions and workarounds. I have learned a lesson to keep two accounts in active use so that even if one account has technical glitches, you have a good plan-B.

Quote:

Originally Posted by binand

(Post 5576593)

UPI is envisaged as a common interface to the myriad of electronic payment options in India (hence the name - "Unified Payment Interface").

Of these payment options available, the one that offers instant settlement is IMPS. Hence UPI works off that by default.

Presumably when dealing with banks that don't have IMPS (which ones are these?) UPI falls back to NEFT. UPI's NEFT support has been around for a while too.

Of late UPI has started supporting Rupay - I see promo material in my UPI app about this all the time. And I saw in an ATM I visited recently that one could withdraw cash via UPI without a card, so it seems its NFS support is also live at least for that one bank (PNB or SBI I think, not sure).

|

The entire payment settlement architecture started with NEFT transfer for P2P (batch processing and slow) and RTGS (instant) for high value transfer mostly commercial entities. Underlying this is the IFSC code and account number by participating entities. Earlier both was subject to timings and holidays which is done away with few years ago. But still some banks impose restrictions on timings.

IMPS is an improvement through mobile banking. MMID which is the unique mobile identifier made it easy by linking with IFSC code and bank account. Settlement become instant for P2P itself. Not all entities participate in that and will fall back to NEFT with IFSC code and account number.

UPI is just a form of IMPS. Main reason it got hit is with Aadhar enabled mobile number after seeding of aadhar with bank for P2P transfer. No need to add beneficiary with account number or MMID. And transfer is possible without internet through SMS itself.

https://www.npci.org.in/what-we-do/imps/live-members

This link provides the list of participants of IMPS and various forms supported by each entity.

SBI saving bank account has a useful feature of auto sweep FD which automatically converts your SB deposit into chunks of FDs. Does HDFC has it too?

Quote:

Originally Posted by Bhokal

(Post 5576899)

SBI saving bank account has a useful feature of auto sweep FD which automatically converts your SB deposit into chunks of FDs. Does HDFC has it too?

|

Yes, HDFC Savings Max account has this feature.

Quote:

Originally Posted by Bhokal

(Post 5576899)

SBI saving bank account has a useful feature of auto sweep FD which automatically converts your SB deposit into chunks of FDs. Does HDFC has it too?

|

Yes, it does. Any amount over 1 lakh as of Monday (not sure if it is start-of-business-day or end-of-business-day) gets deposited into a FD. One FD, mind you, not chunks.

Closing a FD is relative simple if you're a single holder. If this account has two or more holders, I'd suggest not enabling this feature. We had a couple of FDs on a joint account, and closing such is a hassle as you have to go to the branch and fill out a form, and then it'd take anything from a day to two.

HDFC allows you close FDs on joint accounts online provided you submit an undertaking. But there has to be a separate undertaking for each such FD. So, a hassle one way or another.

We saw no value in this auto-sweep facility, and got it disabled the moment we figured it out. Eg. say you have an expense lined up for which you're saving up money. It'll go into a FD every Monday. So then, you'd have to break the FD when you need the money / put it in another account. More hassle than benefit IMO.

Slightly different question. People who have multiple accounts, are you finding it difficult to manage/track?. I and wife had accounts in multiple banks. Reduced it to 2 accounts per person. Retained accounts in SBI ( 2 separate accounts) ICICI and Axis. I like ICICI and Axis due to the overall experience service, user interface etc). And SBI due to the fact that it's a PSU. I am thinking of further reducing to ICICI and Axis. Will that be a bad idea? ( So far we haven't had any bank fail. RBI has always bailed them out. ICICI and Axis are one of the top 3 banks in terms of size. I understand HDFC is the largest among the private banks. But I find them very bad in terms of user interface and service)

Quote:

Originally Posted by adithya.kp

(Post 5576995)

And SBI due to the fact that it's a PSU. I am thinking of further reducing to ICICI and Axis.

|

Keep SBI. There are still some things you can do only at SBI. Eg. a LT Capital Gains account (for land / share sale), used to offset gains if purchasing a new flat/land.

ICICI / Axis may not provide a huge differential when it comes to products/services, so if you must, close one of them and keep that + SBI.

Quote:

Originally Posted by adithya.kp

(Post 5576995)

... And SBI due to the fact that it's a PSU. I am thinking of further reducing to ICICI and Axis. Will that be a bad idea?...

|

Keep SBI for sure. Out of Axis and ICICI, I'd suggest keeping ICICI for the sheer fact that they spam much less and have a much better UI.

If you have special privileges in Axis (like locker, privileged banking etc.) then keep it.

PS: Might not be a very useful post, but here it is.

I am a very minor shareholder of a cooperative bank at my place. Evey year the dividend of a few hundred rupees would be handed over in cash. At times, I wouldn't find time to collect it in person and it would keep on accruing for a couple of years.

The manager would keep calling me and I would promise to visit and then forget!

Today, I found some time and landed in his chamber. He suggested that I open a savings account so that my dividends could be deposited there on a regular basis. I found merit in his suggestion and shared my PAN & e-AADHAAR.

Without moving an inch from the manager's chamber, the entire process was completed - in just ten minutes. All I had to do was put in a few signatures and handover a two hundred rupee note.

Though it is not a huge bank in terms of capital, it is nevertheless a major cooperative entity with a substantial clientele and handsome balance sheet.

The way they handled me was really appreciable and worth copying by their bigger and fancier counterparts.

Quote:

Originally Posted by dailydriver

(Post 5577680)

Without moving an inch from the manager's chamber, the entire process was completed - in just ten minutes. All I had to do was put in a few signatures and handover a two hundred rupee note.

|

With most scheduled banks, you can do this without moving an inch from your home couch/bed.

The reason I don't trust cooperative banks is that they steadfastly refuse to come under RBI's regulations. Their track record, as a consequence, is dismal in my home state at least.

(This situation is changing after the union government introduced a new law that gives RBI more regulatory powers over cooperative banks.)

Tough to put money in a bank whose survival into the next week is doubtful.

Quote:

Originally Posted by binand

(Post 5578951)

The reason I don't trust cooperative banks is that they steadfastly refuse to come under RBI's regulations. Their track record, as a consequence, is dismal in my home state at least.

|

I was reviewing my wifeís AIS report other day, and surprised to see an entry of savings interest income from Cooperative bank there.

We had a locker facility with the bank, and opened the account for that purpose. Although the amount is small, itís good to see that it is being tracked under income tax. I am not sure whether the FD interests also being added to your AIS report. If it happens, that kind of curbs the black money issues with cooperative banks.

Quote:

Originally Posted by rx100

(Post 5578959)

I was reviewing my wifeís AIS report other day, and surprised to see an entry of savings interest income from Cooperative bank there.

We had a locker facility with the bank, and opened the account for that purpose. Although the amount is small, itís good to see that it is being tracked under income tax. I am not sure whether the FD interests also being added to your AIS report. If it happens, that kind of curbs the black money issues with cooperative banks.

|

Not only this, they also calculated the interest I received during ITR refund last year and entered them automatically while filing returns this year. Anything linked with your PAN is tracked, period.

Quote:

Originally Posted by Samfromindia

(Post 5579600)

Not only this, they also calculated the interest I received during ITR refund last year and entered them automatically while filing returns this year. Anything linked with your PAN is tracked, period.

|

Yes, but here the discussion was more about Cooperative banks in Kerala, which was not under the purview of RBI earlier and hence a lot of misappropriation of money and benami deposits were carried out.

Does anyone have the contact info of someone higher up in Standard Chartered Bank? I am trying to address some concerns with my mom's account and the customer care is clueless. On top of it, they are charging 800+tax per month for Priority banking, which she never opted for. The RM who opened the account is also not reachable.

PS: The quality of service of SCB has been declining at a superfast pace. I am a Priority account holder for 10+ years. My relationship manager becomes incommunicado. Another fellow called me saying he is my new relationship manager but now he has also quit. Customer care said they will ask the current RM (whomever that is) to contact me, but there has been no update.

| All times are GMT +5.5. The time now is 14:36. | |