Quote:

Originally Posted by Shan2nu  Im a novice when it comes to banking.

So, what are the steps i should follow to secure my account, so that things like this don't happen to me. |

A

"five star" novice

Just kidding, man!

This is strictly

Normally for net banking the following options are available -

1. View

2. Offline request

3. Tax Payment

4. Transfer funds from one account to another - own accounts (you can specify which account)

5. Transfer funds to somebody else's account - but within the same bank

6. Transfer funds to somebody else's account - some other bank - will be channeled through RTGS/NEFT etc.

7. Bill Payments

8. Online Shopping - from portals identified by / tied up by the Bank

9. Online trading in shares - with brokers / agencies identified by / tied up by the Bank.

Some more facilities are in the offing..

There is no compulsion that you have to opt for ALL the above facilities. 1 to 4 are the most secure. 7 and 8 somewhat secure. The rest, there is an element of risk.

You can start with tax and bill payment, and as and when you are confident proceed further. Yes, it will take some time to put in a request for upgrading the status of the account, but it is better than loosing money!

Now coming to your needs -

a. I will strongly advise you to do net banking only from your HOME or your OWN laptop.

b. Install a good anti-virus and firewall. For less than Rs. 3,000/- there are good solutions available. Take somebody's advice on this - if you are not sure which one to go for. Whatever you do, make sure you update the virus def's periodically. There are trojans which had been dormant for quite a long time, getting active for a short while and pushing out all sensitive data. (I don't mean to scare people here, but there is no point in crying later).

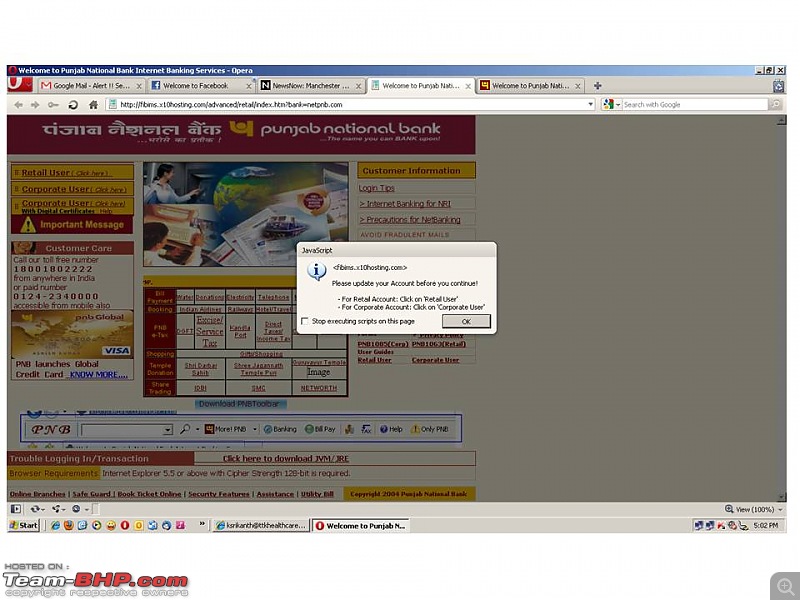

c. Always type in the URL yourself. Don't use auto complete. Don't click on hyperlinks.

d. Always type the user id and password yourself. Do not store passwords. Do not use auto complete.

e. There are plenty of techniques to create a good password. Doesn't matter if you forget your password - it is better the account is locked and you to approach the bank for a new password, rather than having it hacked!

f. Close the browser window immediately after completing the transactions. Do not leave the PC/laptop unattended when doing net banking.

g. Change password frequently.

My additional hints -

h. Check your account balance frequently. It will help you to keep a track of your expenses, and also enable to you to spot suspicious / fraudulent transactions quickly. (This includes the various charges banks hoist upon you, for whatever reasons :-))

i. Don't keep more money than necessary in the account. There is an utility called autosweep - specify a limit of say Rs. 20,000/- and any balance above this goes to a fixed deposit. This enables you earn more interest! (Of course, if you set up a reverse sweep, then it doesn't help!!)

j. Go the extra step - don't store bookmarks, browsing history etc.; clear cookies after closing the browser. Frequently clear temp folder and do disk clean up. I even clear the SSL state every now and then.

k. Keep an eye on how your net connection behaves - you might not be doing anything, but your system could be showing a lot of traffic. I believe in switching the modem OFF after I am done browsing.

l. The moment you feel something is fishy - contact the bank. It is better to bolt the stable before the horse has bolted!!