Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by Comrade

(Post 4913161)

I auto reload paytm wallet using Amex MRCC card, and they are not charging any fee for auto reload (at least currently).

|

They are charging on Paytm App, but not on the desktop site. Wonder how long it will take them to update the desktop site.

I have got cash back for loading Paytm wallet with Amex MRCC on website. No charges for loading through credit card

Quote:

Originally Posted by rkg

(Post 4913614)

I have got cash back for loading Paytm wallet with Amex MRCC on website. No charges for loading through credit card

|

You mean no net charges I believe. The cashback is temporary and introduced just to make people get used to charges. It will be over very soon. Charges are permanent.

Quote:

Originally Posted by gupta_chd

(Post 4913950)

You mean no net charges I believe.

|

Yes. No credit card MDR charges. No mention also. Cash back was mentioned as for adding money to wallet.

Earlier also they have given cash back for adding money to wallet.

Quote:

Originally Posted by Aroy

(Post 4913324)

They are charging on Paytm App, but not on the desktop site. Wonder how long it will take them to update the desktop site.

|

They didn't charge automatic load that happened 10 days back. I only use app on the phone. I dont use desktop site.

What happens after a negative statement balance? I have a HDFC Regalia credit card on which I had booked an airline ticket a few months back. It was refunded this month after I had already paid the statement balance of last month and that led to the amount spent on the card lesser than the amount totally paid, so the final amount on this month's statement is now -11,xxx. In case of my corporate credit where I faced a similar situation, the amount was transferred back to the bank account through which I paid the statement. I thought at that time that this was an arrangement by my company as a part of the negotiation for corporate card. But for my personal card I have never faced this situation. Hence I wanted to know if there is some standard policy for this card or in general.

audioholic:

I work for a bank's call center and I can vouch for the below information.

Yes, the credit balance of a credit card can always be moved to the bank account of the same person, only if the customer requests this.

No need to go to bank, call the call center and they can place the request for you.

Funny note: a bank never wants your credit card to be in credit and debit card to be in debit.:D

Quote:

Originally Posted by Comrade

(Post 4914930)

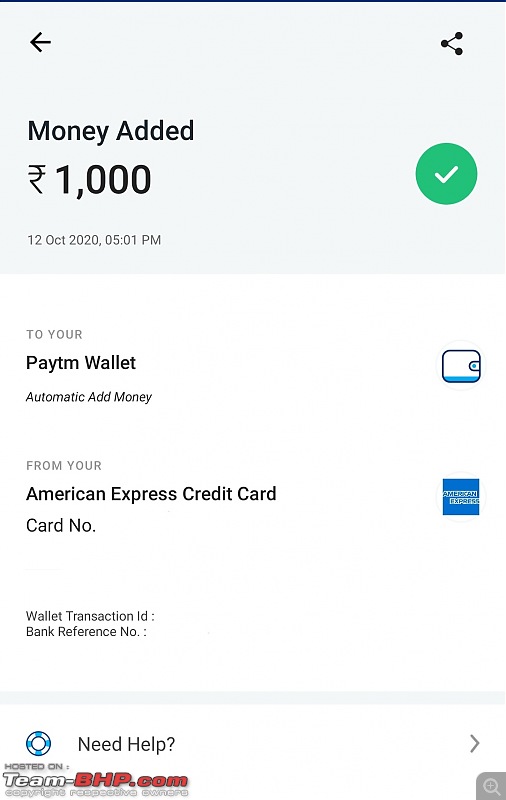

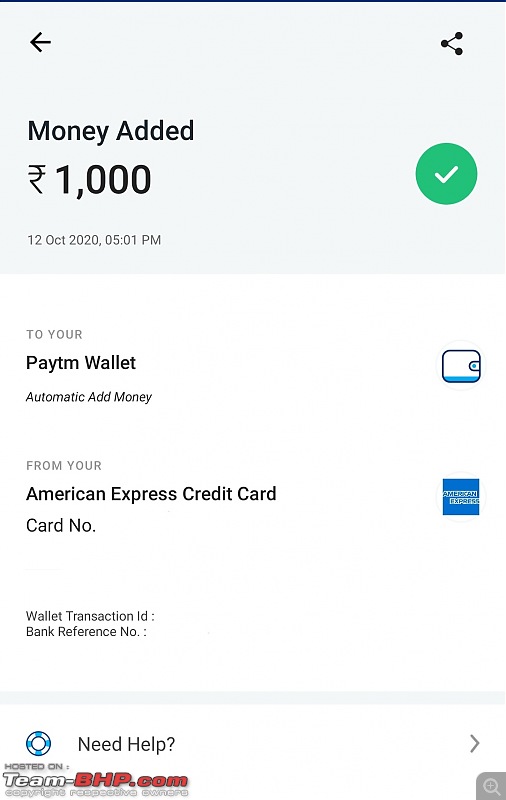

They didn't charge automatic load that happened 10 days back. I only use app on the phone. I dont use desktop site. Attachment 2071084

|

The 2% charge on loading wallet is in effect from 15th October.

I wanted to get a YouTube Premium Subscription, but I'm unable to add ANY of my new Visa Credit Card & Debit cards to Google Play AppStore. The cards are activated for all types of transactions - PoS/ECOM. My old Visa Credit card used to work, but it expired in June 2020. Tried correcting the address to whats indicated in the Bank Account Passbook, but no joy.

Even bought Google Play voucher from PayTM, but YouTube subscription accepts only a CC/DC. Last-ditch option I came across (but haven't tried) was to open a Kotak Mahindra Online account & use a virtual DC/CC. But not willing to do all that just for a YT Subscription.

Any clue what else I can try ?

Quote:

Originally Posted by speedmiester

(Post 4916244)

The 2% charge on loading wallet is in effect from 15th October.

|

I just recharged Paytm using amex and did not see any charges. The sms from amex also shows the same amount. Is the 2% going to come on the statement as a a seperate charge or in the main amount that is deducted?

Quote:

Originally Posted by Aroy

(Post 4911647)

The funny thing is that with Paytm App they charge 2%. I tried from the desktop and there was no charge.

|

When I try to add money to my wallet through their desktop website, I am not even able to see my credit cards and cannot even add a new one! And it still shows 2% surcharge when I try to add money via the app (credit cards are showing up normally over there)

Desktop add money screen:

Quote:

Originally Posted by Comrade

(Post 4913161)

I auto reload paytm wallet using Amex MRCC card, and they are not charging any fee for auto reload (at least currently).

|

Don't ever cancel the automatic payments! Guess you are grandfathered into this system. I cancelled my automatic wallet recharge to move from one card to another and was given a shocker that only certain banks' debit cards are now allowed for this service, along with paytm bank account. No credit cards.

Supported payment option for automatic add money service:

Quote:

Originally Posted by audioholic

(Post 4916228)

What happens after a negative statement balance?

|

You can leave the amount to pay the future bills. I have had a similar problem with purchase refunds. But like small amounts.

Quote:

Originally Posted by audioholic

(Post 4916228)

What happens after a negative statement balance? I have a HDFC Regalia credit card on which I had booked an airline ticket a few months back. It was refunded this month after I had already paid the statement balance of last month and that led to the amount spent on the card lesser than the amount totally paid, so the final amount on this month's statement is now -11,xxx. In case of my corporate credit where I faced a similar situation, the amount was transferred back to the bank account through which I paid the statement. I thought at that time that this was an arrangement by my company as a part of the negotiation for corporate card. But for my personal card I have never faced this situation. Hence I wanted to know if there is some standard policy for this card or in general.

|

I faced this multiple times . Majority of the time is due to my mistake of overpaying the credit card. For HDFC if I paid the amount cia net banking i will call customer care and they will refund back the amount to the account. If I made the payment via CRED or any other method, then customer care refunds it via DD . Since this is a bit of hassle, I just let it be and adjust it against future purchases.

Quote:

Originally Posted by audioholic

(Post 4916228)

What happens after a negative statement balance?

|

Actually in times gone, when my credit limit was low, I remember I had over payed a significant amount before a foreign trip just to avoid carrying cash. And it worked pretty well. No option back then of online banking to pay off the bill during the trip.

Quote:

Originally Posted by audioholic

(Post 4916228)

What happens after a negative statement balance?

|

I routinely end up in this situation. It only means the negative amount will be adjusted in the next statement. In general, go by what your statement (emailed/posted monthly) says.

(a) The statement's total outstanding is your total liability.

(b) The statement's minimum due you have to necessarily pay.

If (a) is negative, (b) will be 0. In all other cases, you have to pay something.

When in doubt, read your card issue's Most Important Terms & Conditions. For HDFC Bank:

https://www.hdfcbank.com/content/api...a-16a19eea4953 - see 4(b).

Quote:

Originally Posted by GrammarNazi

(Post 4916252)

I wanted to get a YouTube Premium Subscription, but I'm unable to add ANY of my new Visa Credit Card & Debit cards to Google Play AppStore.

|

Some Google products' billing requires your card to be enabled for forex transactions (and not for some others). Did you check that?

| All times are GMT +5.5. The time now is 06:22. | |