Team-BHP

(

https://www.team-bhp.com/forum/)

The hot topic of discussion during this festive season is the effect of GST on various trades and practices and collaterally it's effect on a common man and the end consumer.

GST was a blessing in disguise for the Oil Industry where GST @ 18% replaced the previous levies of 14% Excise Duty, State Wise variable Octroi/ Entry Tax and a Minimum State Levy of Sales Tax of 14.50%.

The existing GST rate of 18% is applicable to all Mineral Oils and Part Synthetic Oils only which have a HSN Code of 2710.

However,

the applicable GST Rate for Fully Synthetic Oils is 28% having an HSN Code of 3403.

Fully Synthetic Oils are oils which have a minimum 70% or more content of Synthetic Base Oil in it's composition. Most Fully Synthetic Products are not manufactured in India and are rather Imported from overseas.

All these years numerous companies have claimed their Oils to be the best performer and in the name of Synthetic and have extorted a quick buck from the consumer by not providing the correct product at the correct prices. Some have resorted to giving cut throat pricing to competitors by claiming their product to be Fully Synthetic in order to gain more market share and market presence and showcasing the fact that Synthetics come cheap. There has been a lot of discussion about Oils on the Team-BHP Forum as well and I have mostly been a silent spectator to such discussions.

I would like to refrain from taking names of any brand as a number of big players in the industry who have been catering to OEM's as well, have been bluffing the consumers all these years by claiming their Oils to be Fully Synthetic whereas their Oils were not even close to being Part Synthetic.

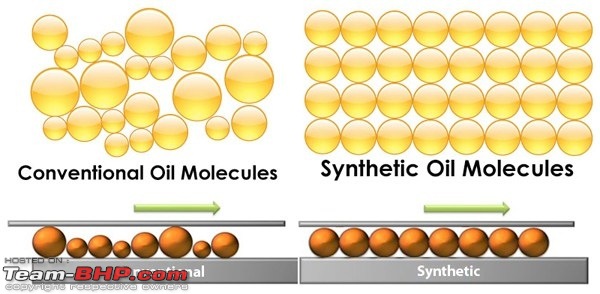

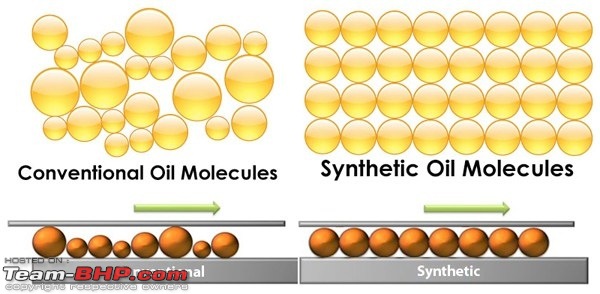

Visual Molecular Difference between Fully Synthetic & Mineral Oil :

This Classification of GST is an eye opener for the end consumer in a big way.

'Jaago Graahak Jaago' and know the applicable GST rate of the Oil that you are buying from any source before actually buying the oil in order to actually know whether it falls under the Synthetic Category or not. Don't :- Do not just go by the sticker on the pack which says "FULLY SYNTHETIC"

- Do not expect fully synthetic oils to come cheap as they cost close to Rs.1000/Liter

Do's : - Check for the HSN Code of the Oil you are buying from the Dealer or the Service Centre to determine it's sanctity

- Check for the applicable GST Rate and then make your decision to buy the product which you have chosen

Note : In absence of the know how of the HSN Code, if the pack mentions the oil to be Fully Synthetic and the applicable GST rate is said to be 18%, it means that the oil is not classified under the said category by any means

A small table underneath shall give you a gyst of the matter :

I hope this update helps the Team-BHP Forum and it's followers to make the

Right Decision w.r.t. Which Oil To Buy and how to identify and differentiate between Fully Synthetics Oil and the other genre of oils.

Jai Hind !!

Moved out of assembly line

Thanks for sharing!

Thanks AJ-got-BHP for a very logical and smart idea.

The oil manufacturers (or blenders) can still fool us. If they make semi synthetic oil or mineral oil and declare it as synthetic, GST authorities are not going to verify the composition technically. Also the authorities have no reason to doubt since they are already getting 28%. They will suspect if a company charges 18% on a fully synthetic oil (declaring it as mineral oil) to obtain a price advantage. But not vice versa since they get more tax revenue.

So the oil blenders can just import the oil ingredients labelled as fully synthetic (to satisfy the tax authorities) and label their mineral oils as fully synthetic, give 28% GST to the Govt. and sell their mineral oils at much lower prices compared to fully synthetic.

GST council has nothing to do with the real technicalities. They just want to tax the premium (luxury) product at a higher rate.

Standardization agencies and certifying bodies can play a more meaningful role in preventing the oil blenders from taking the customers for a ride.

Quote:

Originally Posted by AJ-got-BHP

(Post 4291304)

The hot topic of discussion during this festive season is the effect of GST on various trades and practices and collaterally it's effect on a common man and the end consumer.....GST was a blessing in disguise for the Oil Industry where GST @ 18% replaced the previous levies of 14% Excise Duty, State Wise variable Octroi/ Entry Tax and a Minimum State Levy of Sales Tax of 14.50%. The existing GST rate of 18% is applicable to all Mineral Oils and Part Synthetic Oils only which have a HSN Code of 2710......Jai Hind !!

|

Thanks AJ-got-BHP for a really eye-opening & informative thread. I have followed the odd Lub. related threads on our forum & contributed the occasional post too, mainly related to technical issues (mineral vs synthetic). But your post should help us (the end-users) to be wary of the sharp-end of business practices in this area. Thanks again.:thumbs up

Regards,

Shashanka

Interesting piece of information. We'll probably start seeing even 'real' synthetic oil to have 69% synthetic content to duck higher levy, something similar to Mahindra's lowering of ground clearance and the advent of 1.9 diesel engines for NCR.

Quote:

Originally Posted by AJ-got-BHP

(Post 4291304)

I would like to refrain from taking names of any brand as a number of big players in the industry who have been catering to OEM's as well, have been bluffing the consumers all these years by claiming their Oils to be Fully Synthetic whereas their Oils were not even close to being Part Synthetic.

|

Thanks for your excellent post!

If you do have any form of evidence, you can always share the specific brand names or products which are at fault here.

As consumers, we need to know what brands we can trust, and what we can't! :Frustrati

Quote:

Originally Posted by AJ-got-BHP

(Post 4291304)

GST was a blessing in disguise for the Oil Industry where GST @ 18% replaced the previous levies of 14% Excise Duty, State Wise variable Octroi/ Entry Tax and a Minimum State Levy of Sales Tax of 14.50%.

|

I am not sure if it's giving the correct picture.

Oil companies also paid excise @ 12.5% in the VAT regime and now under GST the total tax component got reduced to 18%. Hence the price for non-synthetic oil should have technically come down under GST.

For imported synthetic oil, we need to check the total tax structure including import duties. There are chances that overall tax might have been reduced even with GST @ 28%.

But yes its now easy to check the lubricants type based on HSN code or GST rate billed by the seller.

Excellent piece of information.

I have doubt, I always get oil for my bikes from a local shop and he never charged anything extra than the price printed on the can before GST was implemented (just like buying chips/coke from a local shop), so will they charge me now, or, how does that work ?

Quote:

Originally Posted by NiInJa

(Post 4292194)

Excellent piece of information.

I have doubt, I always get oil for my bikes from a local shop and he never charged anything extra than the price printed on the can before GST was implemented (just like buying chips/coke from a local shop), so will they charge me now, or, how does that work ?

|

For all over the counter items, GST is embedded in the MRP. Prior to this VAT was included in the MRP. So GST impact is appended in pricing for products carrying MRP (very similar to your grocery items).

You will find additional GST billed to you when you buy something from hotels, restaurants, hardware shops, white goods etc. on which MRP is not mentioned.

In addition to this, GST is applied to services (right from small things like calling a plumber, electrician etc. if you have used a channel say Urbanclap etc.) It it also applied when you give any of your household goods for repair say your TV or washing machine through the brand managed repair services.

Your FNG may continue to repair your car without charging GST if you are not asking for bill; even for consumables, you may get some savings without bill because only input GST will be applied which on %age basis will be same but the base cost / purchase cost of same item is lower for the FNG owner (excludes retail margin).

Let me give you an example:

MRP on 1 litre of mineral oil bottle: INR 400

Mineral Oil purchased by FNG @ INR 250 per litre with input GST of 18% resulted in a landed cost of INR 250 + INR 45 = INR 295

Now if he gives you a bill of INR 400, the output GST will be calculated as: INR 339 + 18% GST = INR 339 + INR 61 = INR 400

And the shopkeeper will pay additional GST to the Government i.e. INR 61 - INR 45 = INR 16 for this sale because INR 45 has been paid out by oil distributor when the product was sold to the FNG.

Case A: Margin of FNG = INR 400 - INR 295 - INR 16 (GST) = INR 89 per litre

The FNG is thus free to decide price below MRP i.e. INR 400 but cannot sell it below his own purchase price i.e. INR 295 (Very similar to the property business wherein you cannot get the property registered below the circle rate).

So if he decides to give you benefit / discount, he may do the billing (for government records) as INR 290 + GST @ 18% = INR 290 + INR 52 = INR 342 and sell you the product at INR 390 (INR 10 below MRP) without bill or with a bill of INR 342

You have saved INR 10 on the oil.

Additional GST paid by the FNG to Government = INR 52 - INR 45 = INR 7

Case B: Margin of FNG = INR 390 - INR 295 - INR 7 (GST) = INR 88 per litre

Thus in both case A and Case B the FNG margin is same while the additional GST paid out will be different and there is some saving

Quote:

Originally Posted by i74js

(Post 4292494)

Let me give you an example:

|

Thanks for sharing this Example !! Will be helpful for many.

Quote:

Originally Posted by Wanderers

(Post 4292144)

I am not sure if it's giving the correct picture.

Oil companies also paid excise @ 12.5% in the VAT regime and now under GST the total tax component got reduced to 18%. Hence the price for non-synthetic oil should have technically come down under GST.

|

Excise was 14%, CST 2%, Octroi was State Based from 1% to 12%, and VAT was also State Based 12.5% to 22%.

Oh Yes ! The Prices of Non-Synthetic Oils have already come down drastically under the GST regime FYI

Quote:

Originally Posted by abhishek46

(Post 4292106)

If you do have any form of evidence, you can always share the specific brand names or products which are at fault here.

As consumers, we need to know what brands we can trust, and what we can't! :Frustrati

|

I am in the process of assimilating the requisite Data. Will share once done for sure !!

Quote:

Originally Posted by i74js

(Post 4292066)

|

Thanks for sharing the Link !!

Quote:

Originally Posted by pacman2881

(Post 4291699)

Interesting piece of information. We'll probably start seeing even 'real' synthetic oil to have 69% synthetic content to duck higher levy, something similar to Mahindra's lowering of ground clearance and the advent of 1.9 diesel engines for NCR.

|

Agreed !! That is definitely a perspective. But, we must remember that these Oil Companies are not just selling their products in the replacement market. A lot of them have OEM Tie Ups as well. The OEMs will distinguish their Oil based on the HSN & GST Rate made applicable by them. This might let go of the OEM's under their belt for no good reason. Thus, it will be a blunder for the Oil Companies to do so, if they do.

I guess the topic has deviated from the title. But still, my 2 cents on the discussion of synth/ mineral and viscosity of oils.

Last time I was at Honda for my car's service, saw a nice demonstration of synthetic (0w-20) and mineral oil (5w-30) where a ball was suspended in a test tube with each of the 2 oils. You just had to invert the test tubes and watch the result yourself. Posting this more so that people can understand the 'importance' of right oil.

It was a simple experiment to put their point across. I should have recorded it on my phone, but hey, I found a similar experiment on YouTube. Please check this link and decide if it all matters.

https://youtu.be/PN07pnnNn9I

Quote:

Originally Posted by saket77

(Post 4295384)

It was a simple experiment to put their point across. I should have recorded it on my phone, but hey, I found a similar experiment on YouTube. Please check this link and decide if it all matters.

|

I doubt the premise of the video. The viscosity of the oil between moving parts is a matter for the engineer that designed them. Suggesting that it is just fine to change that, as was done above, is like saying it is just fine to swap all the bolts.

Thinner or thicker is not better or worse. Either way. Right is better.

Quote:

Originally Posted by Thad E Ginathom

(Post 4295392)

Thinner or thicker is not better or worse. Either way. Right is better.

|

Precisely why I added the word '

importance' of right oil in my post. People are suggesting cooking oils running inside engines which in my remotest imaginations cannot be 'right' in any way. Neither quality nor viscosity wise.

Regards,

Saket.

Quote:

Originally Posted by saket77

(Post 4295402)

Precisely why I added the word 'importance'

|

Gotcha! Yes indeed.

Possibly some of the stuff that is suggested, and claimed to have worked, is a tribute to modern engines rather than any sort of proof about oils.

Whilst it might seem a lot at the time, an engine oil change is a once-a-year thing. It's cost is insignificant in the context of the entire cost of owning and running the car. I'm going to use the stuff they recommend.

Especially as the vehicle is still under warranty

.

Closer to topic, I find myself wondering if they pick these tax rates out of a hat? Or if they have some weird idea that

better things should carry

higher tax? Or that things that are already higher-

priced should have their prices even further inflated by higher taxes?

Or... Mineral, synthetic: is there actually any good reason for different tax rates?

| All times are GMT +5.5. The time now is 21:30. | |