News

Rise & fall of Ford India: A comprehensive study!

Ford has tasted success as well as failures with different products, here in India. What Ford India failed to achieve, was, sustainability.

BHPian pqr recently shared this with other enthusiasts.

Note: The study takes into account data collected from the most trusted sources like the Society of Indian Automobile Manufacturers library, news reports filed by reputed publication houses, innumerable interactions with industry experts, among other reliable sources. However, the findings put forth to members of the Team BHP here, like any other study, is susceptible to error. In such a scenario, please feel free to correct the author with a polite comment or message. It’ll likewise be suitably addressed, and sincerely appreciated. Thank you, and wish you a joyous reading!

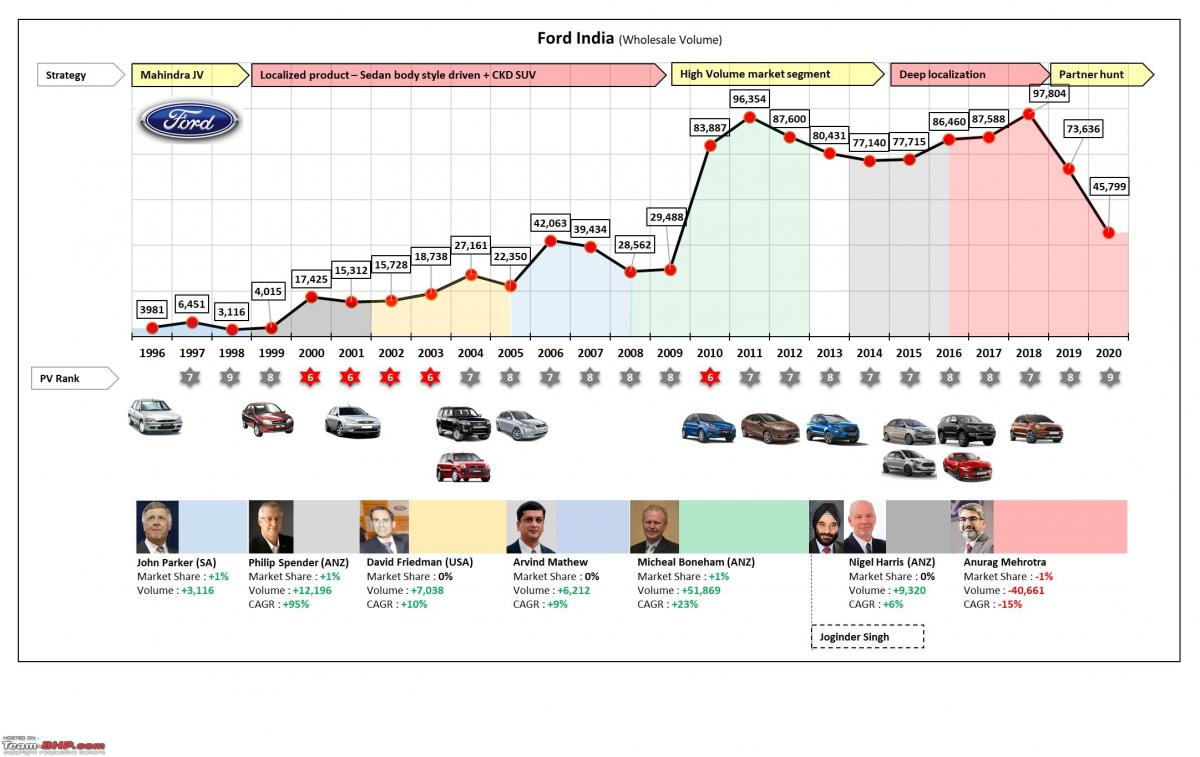

On 9th September 2021, Ford has announced its exit from India. With more than 25 years of existence in India, Ford has sold over 12 lakhs passenger vehicles here. Ford’s compatriot General Motors, has sold around 8.8 lakhs cars in India, under two different brands – first Opel and later Chevrolet, before leaving the Indian market in 2017. Contrasting to this, East Asian automotive companies have found a better foothold in the Indian market, which Europeans are also struggling to achieve.

Entering later than Ford, in the post economic liberalization era, Hyundai has sold 5 times more cars in India till date, and reached to 17% market share pinnacle of the Indian passenger vehicle (PV) industry. The Korean brand has even dwarfed the sales bar of Japanese global automotive giants (Toyota and Honda) in India.

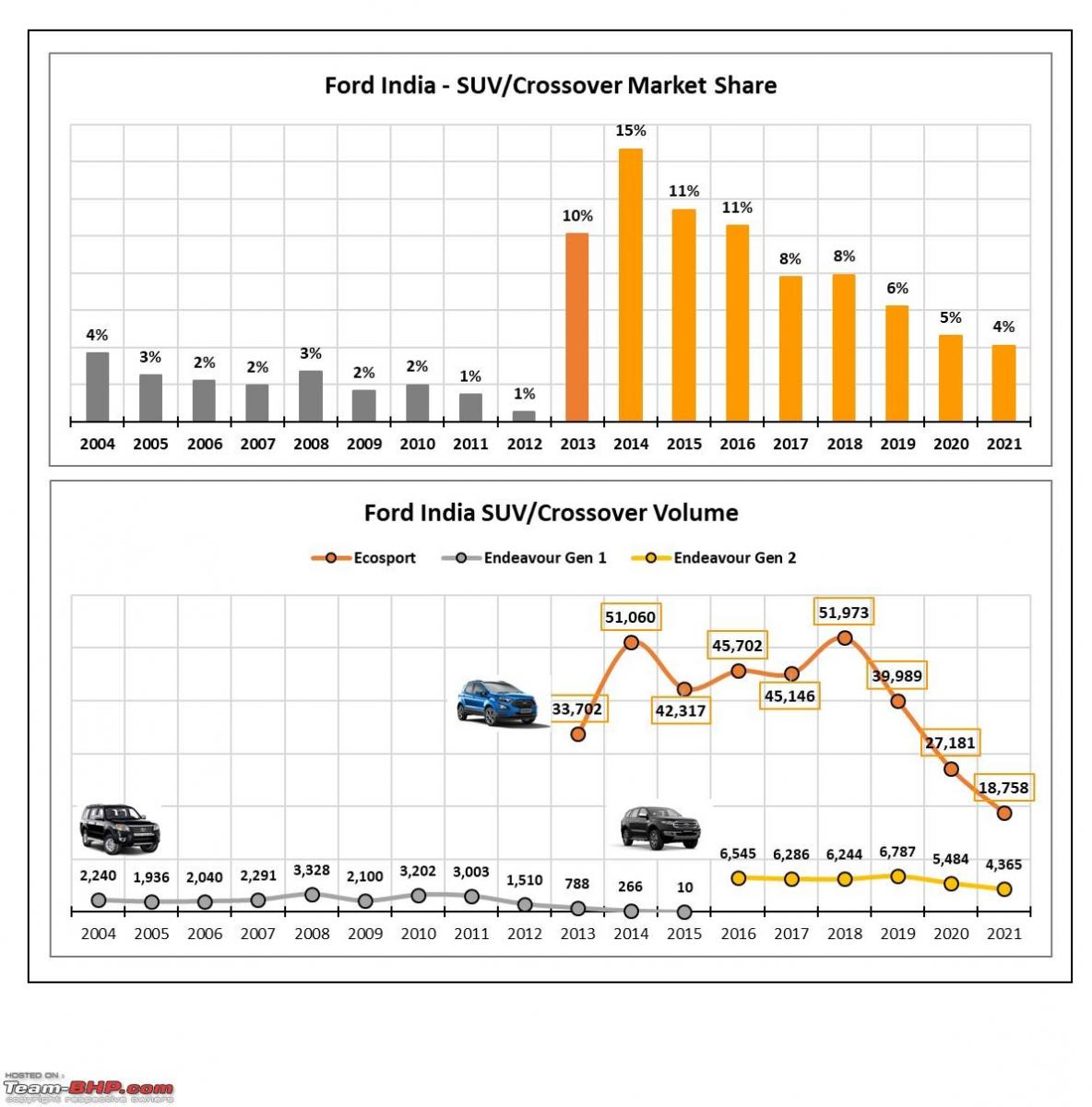

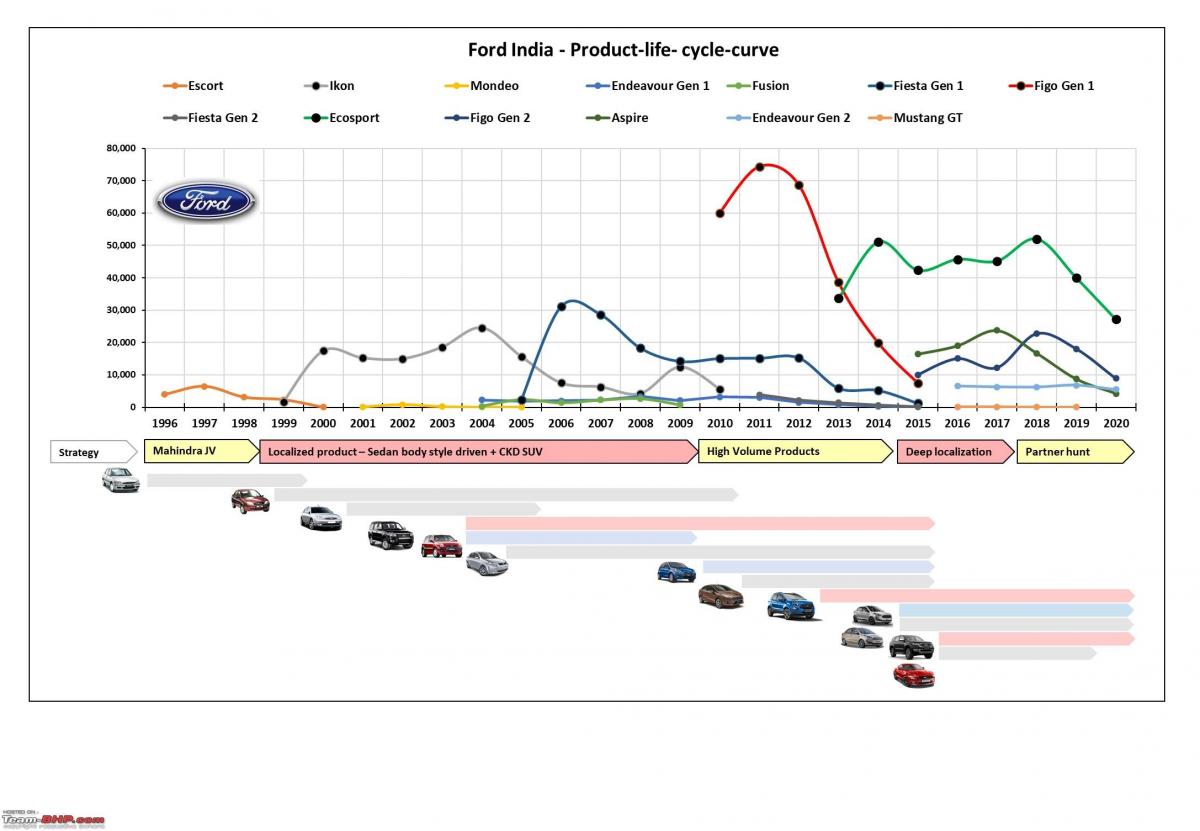

Ford has tasted success as well as failures with different products, here in India. In due course of existence, it has touched the highest PV market share of 4%, on the back of the success of generation-1 Figo (primarily diesel version). What Ford India failed to achieve, was, sustainability, thereafter.

At any given point in time, only one car in Ford’s Indian portfolio did all the heavy lifting and supported 50%+ volume. Other products were either not so successful or worse – nonexistent in the portfolio. In early years, its portfolio was dominated by mid-size sedans, namely Ikon and then Fiesta Gen-1, followed by Figo Gen-1 hatchback, and now Ecosport, since its 2013 launch.

So, in long run, Ford India has always remained one car wonder, with Endeavour as icing on the cake. To achieve sustainable market share, automakers need to have a successful product portfolio, continuously updated in line with the latest market trend, and with a staggered product-life-cycle (PLC) curve. This helps companies to maintain healthy cash flow, and fend off their territory from the competition. It’s not that Ford India didn’t try, they tried very late and missteps took a toll on the whole company.

Products

Ecosport has remained the most successful product in Ford India’s portfolio, followed by Figo gen-1 and Fiesta gen-1. Ikon, too, can be considered iconic, of course, in its own right. Profit loaded Endeavour helped to lend slight premium brand imagery to Ford in India.

Then there were massive flops like – Fiesta gen-2, Fusion and Mondeo, in respective segments. But the real products which actually doomed hell, for Ford in India, were - Figo gen-2 and Aspire (a product tailor-made to fit into the unique taxation policy India has for sub 4m passenger vehicles). The strategic direction was fine, but at times, the execution was not so good.

Ford India Corporate Strategy – shifting gears

1995 - JV route

Ford has started its Indian journey by signing a 50-50 joint-venture (JV) partnership with Mahindra (Mahindra Ford India Ltd) in the mid 90s. Then Ford was the second largest automotive company in the world. Modified European Escort, launched in late 1996, was the first offering of JV in India. It used to come to India in completely-knocked-down (CKD) form, and later was assembled at Mahindra’s Nashik plant. JV and CKD operation was presumed as a low risk way to enter and explore the newly opened Indian market, post liberalization of the economy in the early 90s.

1998 - Export oriented manufacturing plant

By March 1998, Ford took its ownership to 72%, renamed the company Ford India Private Limited and later increased its holding further. As a next strategical step, Ford decided to set up a new plant in Maraimalai Nagar in Chengalpet district, 35 km from Madras (now Chennai), with a 1 lakh annual production capacity and future expansion possibility of up to 2,50,000 units. The first car to roll out from the plant was Ikon. Ikon was based on the European Fiesta mark IV hatchback, designed and engineered in Germany and the United Kingdom, especially for India. Initial localization was 70%, in phase manner it was taken up to 90%.

Ford India has also started exporting CKD kits of Ikon to South Africa, Brazil and Mexico without engines, because, initially, 1.8L diesel engine, 1.3L and 1.6L petrol engines were imported from Britain, South Africa and Spain, respectively.

And by 2002, 65% of passenger vehicle export from India was comprised of Ford Ikon. The export oriented plant has deleveraged risk of product’s performance in the local market to a certain extent and increased cost synergy by economies of scale. Several other manufacturers have also used export lead plant template to start their Indian manufacturing journey e.g. Hyundai-KIA, GM, Nissan-Renault alliance and Volkswagen.

Localization was an important lever for Ford or for any automaker in India, to keep cost in check due to import duty structure and development of foreign exchange (could be adverse as in today’s date). This is why from 2002 they started sourcing petrol engines and transmission from Hindustan Motors Halol based plant, located in Gujarat.

With the success of Ikon, Ford continued with this strategy of picking European car and reengineering in small R&D set-ups in Europe and launching it in India. On similar lines, Fiesta Gen-1 was the next breakthrough for Ford in India. Though, diesel engine and gearbox were imported and petrol engines were assembled by Hindustan motors for Fiesta Gen-1 at Halol plant.

Meanwhile, in 2001, Ford also launched the made-in-Belgium Mondeo, which was a flop, due to its high price. 2004 witnessed two new launches from Ford India - global Everest (called as Endeavour in India), a true blue SUV and Fusion (first crossover), was brought in through CKD route, while former was super hit (then), and later was a massive flop, as it was too expensive.

In 2005, Mahindra sold its remaining stake in the company to completely end the partnership. As per media reports - Mahindra got a lot of insights, and learnt the best global practices in manufacturing, which is later used in developing Scorpio, in fact, in 2002 Scorpio has certain parts borrowed from Ford Escort’s parts bin. In turn, Ford learned about the Indian market, to expand its dealership network.

2009 - High volume game

Without a hatchback in the portfolio, Ford’s presence was limited to 35% of the total Indian PV market size, then. With the turn of the decade, Toyota (with Etios twins) and Honda (with Brio and Amaze) too has had similar plans. Tried and tested strategy came to rescue – European Fiesta mark V platform was re-used to build Indian Figo gen-1. 1.4L TDCi diesel engine won the heart of Indian buyers again. Over 80% of Figo gen-1 sold were with a diesel heart. Suddenly Ford’s volume jumped multi fold, due to competitive pricing, but the poor petrol engine was a laggard and limited its overall volume potential. Though 2013 facelift failed to bring sustainability to the nameplate, and volumes dipped thereon.

2011 ‘One Ford’ strategy in India

2011 saw the launch of all new Fiesta gen-2 (India), the outcome of much famed strategic direction from Ford’s then global CEO Alan Mulally. The intent was to produce global products with very high backend cost synergy and sell in multiple markets across the globe.

India specific Fiesta gen-1 was relegated and rebranded as ‘Classic’. Guess what, Fiesta gen-2 was a sales disaster. Mere 8,300 copies could find a home with Indian families.

But all was not bad with the ‘One Ford’ strategy. As a next product - Ecosport developed in Brazil, for global markets, has actually kick started an all new segment in India – sub 4m monocoque crossover (SUV). Wait, not really, the first sub 4m crossover, which has gone unnoticed, was Rio (rebadged Chinese Zotye T200) from Premier Auto Limited (PAL), launched in 2009. It was assembled at PAL’s Pune plant from imported CKD kits produced in China.

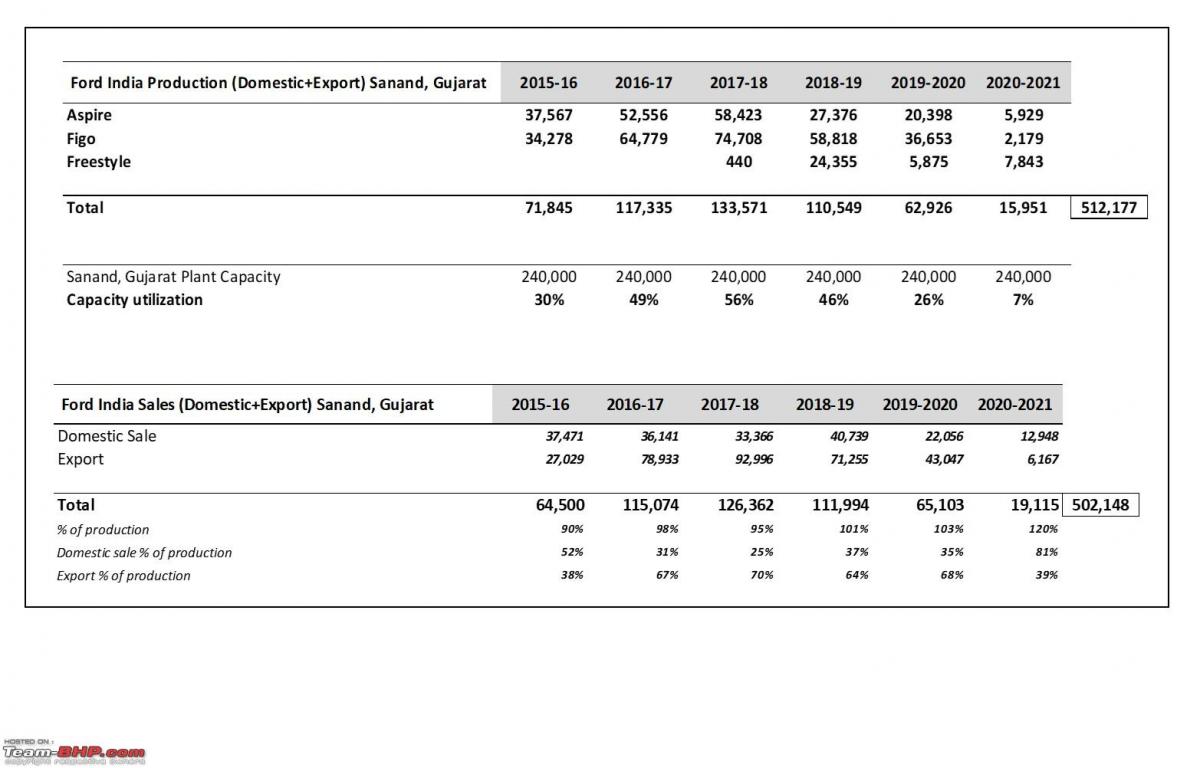

Deep localization and all new manufacturing plant

To gain a strong foothold in the Indian market, Ford decided to go for deep localization in 2011 and benchmarked, market leader Maruti’s most profitable products – Swift and Dzire. For that, Ford has built an all new plant in Sanand Gujarat, with an annual capacity of 2,40,000 units, and an overall investment of a billion dollar. The plant was meant to serve as a hub for global compact car manufacturing. Well, product performance results came out in 2015, which were so disastrous, that Ford has to wrap up its whole operation in India by 2021. More on that later.

2016 – Scouting for local partner

With the dismal performance of Aspire and Figo Gen-2 (developed under ‘One Ford’ umbrella in Brazil and deeply localized in India) by the end of 2016, Ford realized that its whole billion dollar investment in compact product development and the new plant has turned into bad assets. Solo it could not go anywhere by putting good money behind bad, and started to look out for a partner who could lend a shoulder to carry on their baggage. And they found an old friend who was also struggling with a slew of product failures (KUV100, TUV300, Marazzo, Alturas). Theoretically, it was a move to share future product development risk in form of a joint venture. The deal was struck by mid-2017 and both have started working on a new arrangement of cooperation.

The deal has manifested in a new structure of ownership, where Mahindra will take 51% control, and Ford will own the rest. Mahindra’s platform was supposed to underpin three new SUV’s for Ford in India. The new entity was supposed to be operational by mid-2020.

After a new succession plan was drawn at Mahindra in 2020, there was a change in leadership in 2021. CFO becoming CEO of Mahindra and Mahindra seems like a clear indication of what key focus is for Mahindra now – sustainable long term profitability. CFO by nature has to be prudent, and prudence lies in not owning an ailing asset without any foreseeable redemption – in this case, it seems it was Ford’s India operation, and in general, multiple times bankrupt SsangYong from Korea.

2021 – Ford’s Indian market exit strategy

To say goodbye is pretty easy and simple on paper. And Ford did it in

September 2021, after the fallout of the Mahindra deal, early in 2021. In general, it seems the public is a little less shocked, as they witnessed a similar spectre in 2017, General Motors (Chevrolet brand) redux.

Body style & segment share analysis

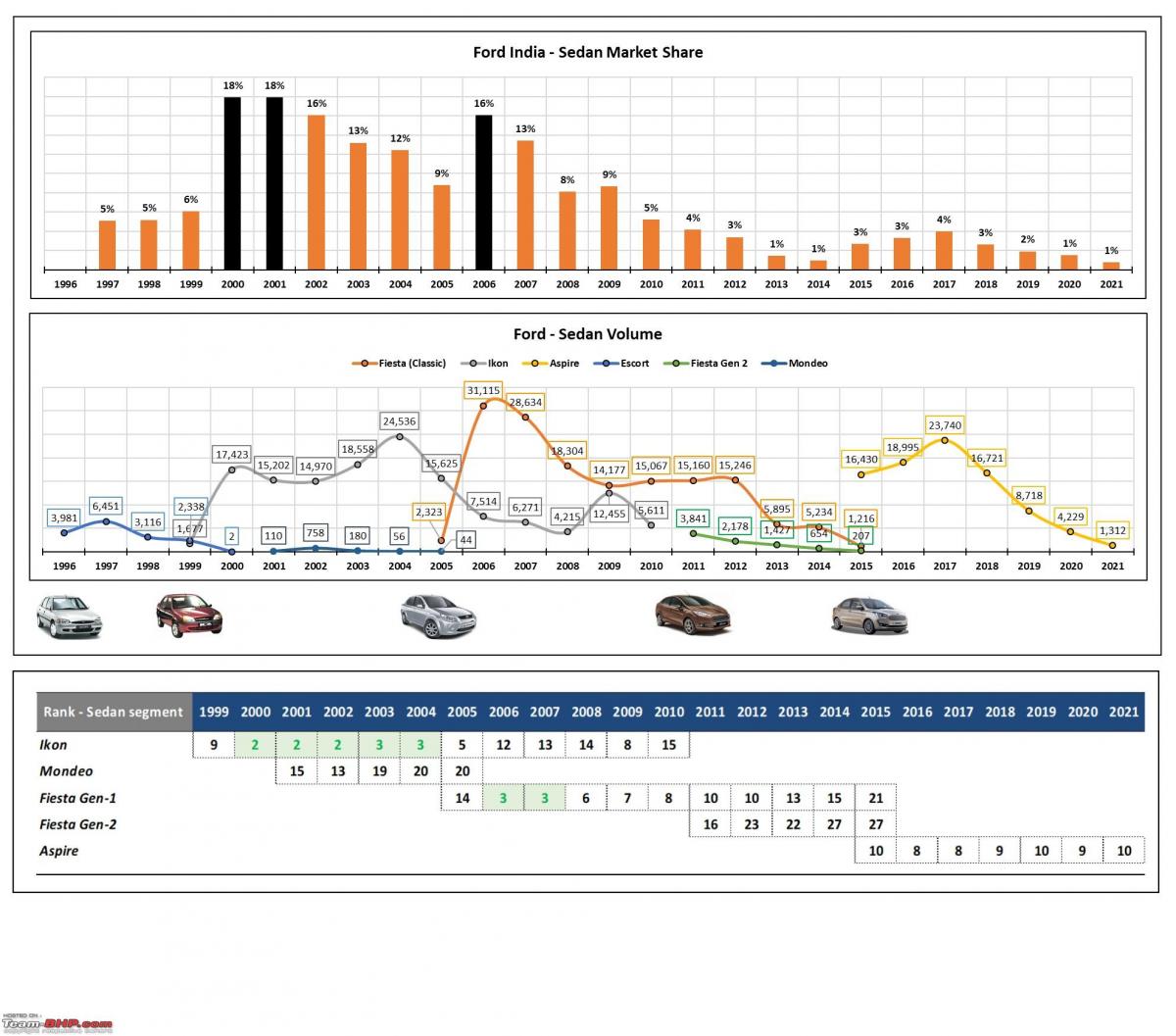

Sedan

Escort (1996-2000)

Escort was the first offering of JV in India with the option of a petrol or a diesel engine. A mid-size sedan by today’s standard, but back then, it was considered a premium sedan by many (₹ 7,30,000 price), as many Indian’s weren’t that wealthy in just liberalized economy and millennials were teens or babies. Then it was competing against the likes of Opel Astra, Daewoo Cielo and later with Honda City and Mitsubishi Lancer. Escort’s CKD kits were assembled at Mahindra’s Nashik plant. Ford has modified European Escort’s air conditioner, suspension setup and raised ground clearance to suit Indian road conditions. Engines were also modified to deliver higher efficiency and suit bad fuel quality in India.

Escort received a tepid response back then as Indian customers were sensitive to pricing and fuel economy. Still, Escort gained 6% of sedan market share at a given point of time, but then it was Ford’s guinea pig to test Indian waters.

Ikon (1999-2003-2008-2010)

Ikon was the second product of Ford in India, was smaller than Escort and came at an entry price of ₹ 4,99,677. The company claimed that 70% of its content were localized at the time of launch. It was designed and engineered in Germany and the United Kingdom but built in India, to compete against Maruti Esteem and Fiat Sienna then. Came with Endura 1.3L, Rocam 1.6L petrol and Endura 1.8L diesel engine, which were Euro II compliant, all were imported till 2002. The marketing campaign was quite exciting, as they came up with the hinglish tagline ‘Josh machine’. And Ikon did deliver that josh to Indians by taking Ford India’s sedan segment market share to the highest ever level of 18% in 2000 and became the second best-selling sedan in the country after Hindustan Motors - Ambassador. It continued to hold 2nd position till 2002, just behind Hyundai’s Accent, before Tata’s budget sedan Indigo took over pole position in 2003.

In 2003, Ford has launched a facelift of Ikon with a new 1.3 Rocam engine with a lower price tag. Ford has started sourcing petrol engines and transmission locally, from now defunct Hindustan Motors. This helped ford to sell the highest number of Ikons in a single year (2004), and maintained 3rd position in the overall sedan segment till 2004. In 2005, it handed over the baton to Fiesta nameplate, and continued to sell alongside Fiesta gen-1, thus both together covering a wider price spectrum.

In 2008, Ford launched facelift-2 with a new 1.4 TDCi diesel engine from Fiesta gen-1. Diesel did small magic, sales crossed the 12,000 mark, towards the fag end of PLC. In fact, Ikon did enjoy quite a long PLC of 10 years, as Ford India kept on altering variants and repositioning of Ikon throughout the lifecycle.

Mondeo (2001-2005)

The new millennium in India started with new found wealth, and to capitalize on the same, automakers started bringing in premium sedans to India from their global portfolio. Two possible routes were adopted – CKD with some localization or completely-build-unit (CBU). Ford brought in made in Belgium CBU Mondeo with both petrol and diesel engine option to India. To suit Indian driving conditions Ford has adapted suspension set up from the Mondeo sold to Norwegian police where cars sometimes have to travel on unpaved surfaces. Well, Honda was quite successful with petrol only CKD assembled Accord. Mondeo bombed on the sales chart. Ford has had out-priced CBU Mondeo in the segment. It was not alone, Opel’s CBU Vectra met an even worse fate.

Fiesta gen-1 (2005-2008-2011-2014)

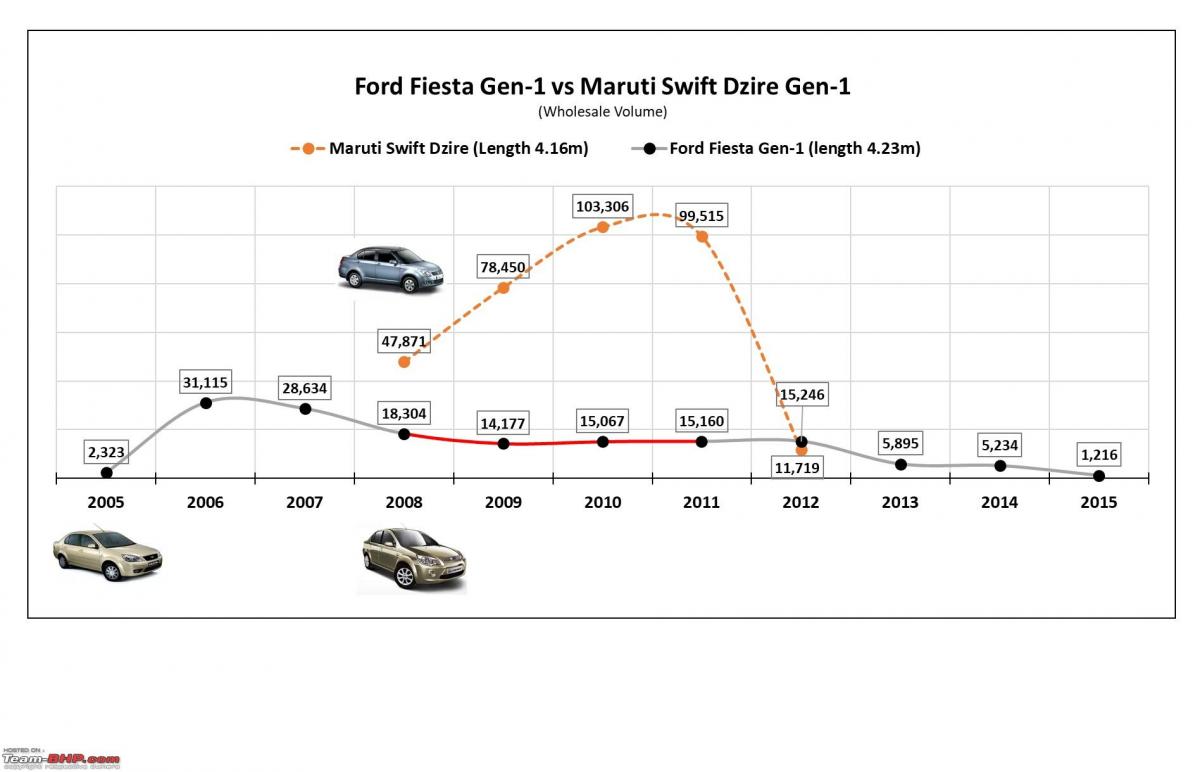

Though Ikon was based on European Fiesta hatchback but never worn that nameplate. So as the time came to introduce Ikon’s successor (next generation), Ford decided to use Fiesta nameplate in India. Ikon’s template was used and parts were borrowed from Fusion launched by Ford in 2004. A major change was the 1.4 TDCi diesel engine engineered and developed in Australia. It was a gem of an engine, fuel efficiency was brilliant. Indians lapped for the diesel powered version and it used to command over 85% of total sales. Fiesta started its journey at 3rd position in the entire sedan segment, just behind Honda City (2nd gen) and Tata Indigo.

By 2008, facelift came, surprisingly sales settled around 15,000 units thereafter. By then, it seems Maruti Swift Dzire (length 4.16m) launched in 2008 took the diesel customer away with its attractive price range of ₹ 5.4 lakhs- ₹6.7 lakhs, as Fiesta’s diesel range started at ₹ 7.2 lakhs. Though they were in a slightly different league within the sedan segment, the value proposition of Swift Dzire diesel (Fiat sourced engine) was very enticing, and Fiesta’s cabin was not very spacious either. What Fiesta’s PLC curve suggests, is that Ford wasn’t that good with managing mid-life of product, or was it too much lethargy and complacency.

Fiesta gen-2 (2011-2014-2015)

Dead on arrival - short lifecycle, short story.

Well, it came out of Ford’s global one product strategy, with a new set of competitive 1.5L Ti-VCT petrol and 1.5L TDCi diesel engines. Ford India has out priced it. Lack of space at the back compared to entrenched rival, what this segment of buyers keenly look for, was missing, and bland rear end styling too didn’t go too well with potential Indian customers. So it failed miserably and how. Re-positioned facelift came in 2014, only with diesel engine, and failed miserably again.

By the way, it was the first Ford product in India to wear Aston Martin’s front grill design, by virtue of Ford owning Aston Martin till 2007.

Figo Aspire (2015-2018-2021)

Indian sub-4m sedan segment is very unique in the world due to all new tax system introduced in 2006, and then manufacturers also started getting innovative, to fit in the right product, and take advantage of lower tax rate and fulfill the emotional need of sedan buying customers in India.

Tata was the original innovator, they bought a chainsaw and chopped off the boot of Indigo sedan (Indica hatchback based sedan) and sold it by the name of Indigo CS (compact sedan), and it did wonder. Maruti could not take advantage then, as they already launched 4.16m long Swift Dzire with 1.3L naturally aspirated petrol engine in 2008, by sticking an abnormal boot to the Swift hatchback, here solution was glue stick and not a gruesome chainsaw. But then they continued with glue stick solution when Swift second generation was introduced in 2011, this time they were having a car that fits into length criteria of sub4m, by design and not by default of course, as well as engine criteria of 1200cc, and results were remarkable since 2012. Maruti Dzire has always been ‘the sub4m segment sedan’ – commanding over 55%+ sub segment share at any given point of time. Uniquely, the hatchback body style of each brand was donor product for all sub 4m sedan products.

It is not that Honda (with Amaze) and later Hyundai (with Xcent) tried to dislodge Dzire, perched at the top rung of sub 4m sedan segment, ever since its entry. Dislodging Dzire has never happened, but then they emerged as a strong challenger and garnered respectable segment share.

Ford India wanted to crack open the lucrative sub 4m sedan segment, with an all new strategic direction - When in Rome (India), do as the Romans (Maruti) do. Though Aspire was based on Ford Ka (Figo gen-2 in India) developed in Brazil under one Ford strategy. That has manifested in a competitively priced tin can contraption, which scored 3 stars in GNCAP frontal offset crash test and was found with body shell integrity - UNSTABLE.

Wait a minute, this is not how Ford used to make cars in India since its entry, nor the reason why Indians bought Ford cars. A segment of Indian customers bought Ford’s car - for perceived strong build quality, balanced ride and handling nature, and juicy diesel. For fuel efficient tin cans, they always have had, relatively unsafe, but reliable – Japanese and Koreans. It seems that Ford’s original DNA was severely compromised, and a loyal customer base shunned Ford’s sub 4m sedan. With an all new value proposition, Aspire was not able to even challenge Tata’s Zest or Tigor and was relegated to the bottom rung of sub 4m sedan segment, to rot and die. And thereby flaming the entire, much touted, billion dollar investment in all new plant and product development. However, detuned 1.5 TDCi diesel engine from Ecosport was best in the segment, and worthy to mention that it was also having a 1.5L petrol engine with dual clutch transmission as an option at the time of launch, but when it comes to overall performance, the experience was spoil by the lackluster body, and 1.2L naturally aspirated petrol engine was lame at the best. Ironically, it came with segment first 6 airbags for the top end version.

Even the 2018 facelift was hammered down by third gen Dzire, with all new A pillar design (finally to differentiate from Swift), and later by global Honda Accord inspired second gen Honda Amaze.

Ford Fusion (2004-2007-2009)

As the name suggests, it was a fusion of oversized hatchback with the versatility of MUV like space, as Ford claimed, and semi SUV styling, as media told their audience. For the Indian audience, it was just con‘fusion’. Priced at ₹ 6,20,000 ex-showroom Delhi, with only 1.6L naturally aspirated petrol engine at the time of launch, was way above Hyundai Getz’s price tag of ₹ 5,40,000 for top end variant, and somehow reached in executive sedan price territory. That made it instant flop! Ford’s expectation was to sell in the range of 6,000 to 12,000 units a year. But it lasted with marginally less than 10,000 units sales in its entire lifespan.

2007 sales bump was due to the introduction of a re-positioned facelift with a 1.4L TDCi diesel engine borrowed from Fiesta Gen-1. But it failed again, and Ford has to discontinue it in 2009. Some say it was way ahead of its time, but in reality, its price was way too ahead of the competition. Don’t believe in the reasoning of price theory, then recall the introductory price of 1.5L naturally aspirated petrol Ecosport in 2013 – ₹ 5,59,000!

So in summary - when people first saw Fusion they thought - “It's a Bird... It's a Plane... It's Superman”, in this case, it turns out to be err… Superflop!

Hatchback segment

Figo Gen-1 (2010-2013-2015)

Till 2009 Ford was not fully mainstream in India, as it used to sell sedan and premium SUV only, and its participation was limited to 35% of the Indian PV market then. So finally Ford took that plunge by 2010, in a highly competitive and relatively low margin hatchback segment with Figo gen-1. It was based on global Fiesta hatchback Mark V, and in the interest of cost synergy, parts were drawn from the then Fiesta gen-1 parts bin. With huge cost synergy, it was launched at a very competitive price point. Similar to Fiesta it was having a highly fuel efficient 1.4 TDCi diesel engine and a lame 1.2L naturally aspirated petrol engine, but it was carrying traditional virtue of Ford’s in India - strong build quality, balanced ride and handling, and juicy diesel. 1.4L TDCi diesel engine was an immediate hit, and Ford was selling more than 74,000 copies a year by 2011 and the PV market share of Ford India reached an all-time high level of 4%.

As far as build quality is concerned, though it was awarded 0 Star in GNCAP rating in 2014 - without any airbags, still, the body shell integrity was found to be stable, just like VW’s Polo hatchback. Cars with 0 Star rating usually score a 0 point, but in the case of both, Polo (5.42) and Figo (2.63), there was a score above 0. What it means is that – if Figo gen-1 have had twin front airbags in the base variant, it would have fared quite well in the frontal offset (40%) crash test at 64 kmph.

Facelift came in 2013, but by then Hyundai too launched Grand i10, as the name suggests, it was a grand version of i10. With all fresh entry, Grand i10 took the shine away from Figo, as later was looking aged even with the facelift. Sales dropped drastically for the next two years in succession. So it became a typical Ford way of goofing up with mid-life product management for the second time.

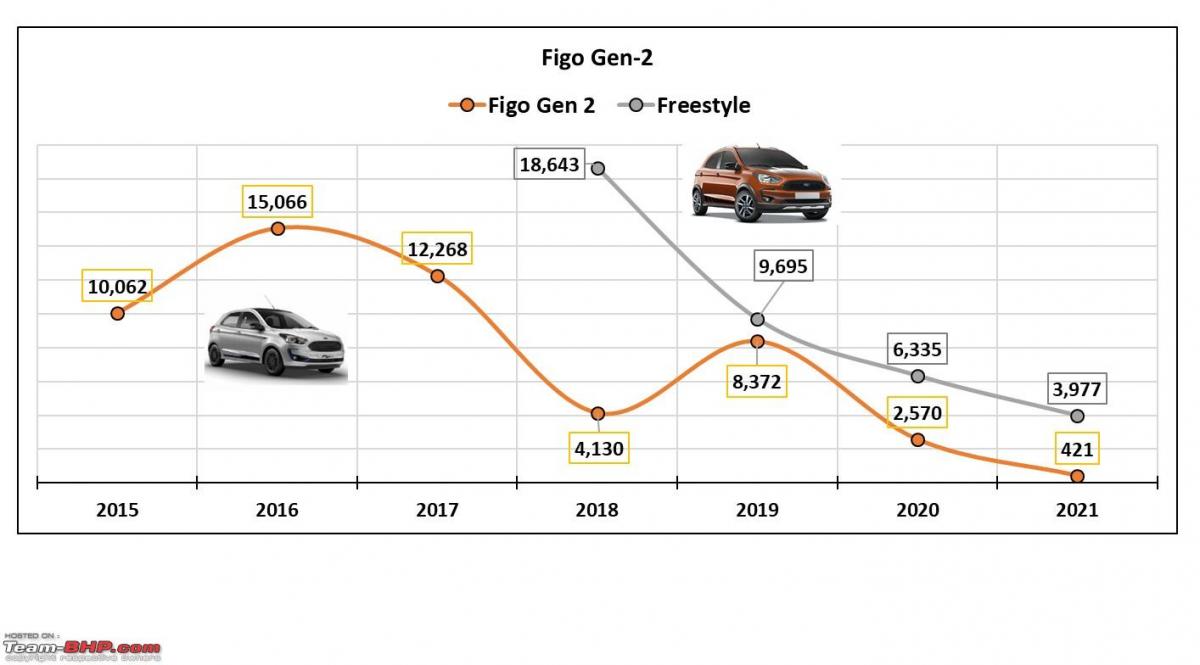

Figo Gen-2 [B562 project] (2015-2019-2021)

To rebuild Figo gen-1’s initial success, Ford has gone for deep localization by bench-marking Maruti’s ever successful Swift hatchback. Again it was based on Ford Brazil’s Ka. Design wise, it was wearing Aston Marin’s front grill. But then it was quite a departure from Figo gen-1’s inherent character of being fun and perceptive safe build. And thus it seems to become a sales dud on arrival. Though 1.5L diesel engine was very good.

Facelift came in 2019, with an all-new 1.2L dragon series petrol engine and same old 1.5L diesel engine, but couldn’t save the nameplate, and again received the same lukewarm response.

More recently Ford has introduced a 6 speed torque converter for the Figo 1.2L engine, a welcome move though, but way too late, isn’t it!

Freestyle (2018-2021)

To revive Figo’s sales, Ford India brought in a crossover version, even before actual Figo gen-2’s facelift, and at a relatively lower price point. It has a lot of cosmetic upgrades in form of several glossy black parts, cladding all around, front skid plate, smoked out headlamps, and roof rails to show off its outdoorsy credentials. Also, the suspension set up was altered to enhance ground clearance. It seems to be price re-positioning effort by Ford India marketing department. Well, volumes were slightly better than Figo gen-2’s first few years of launch, and then it fizzled out. If fundamentals are weak in first place, product cannot survive.

SUV/Crossover segment

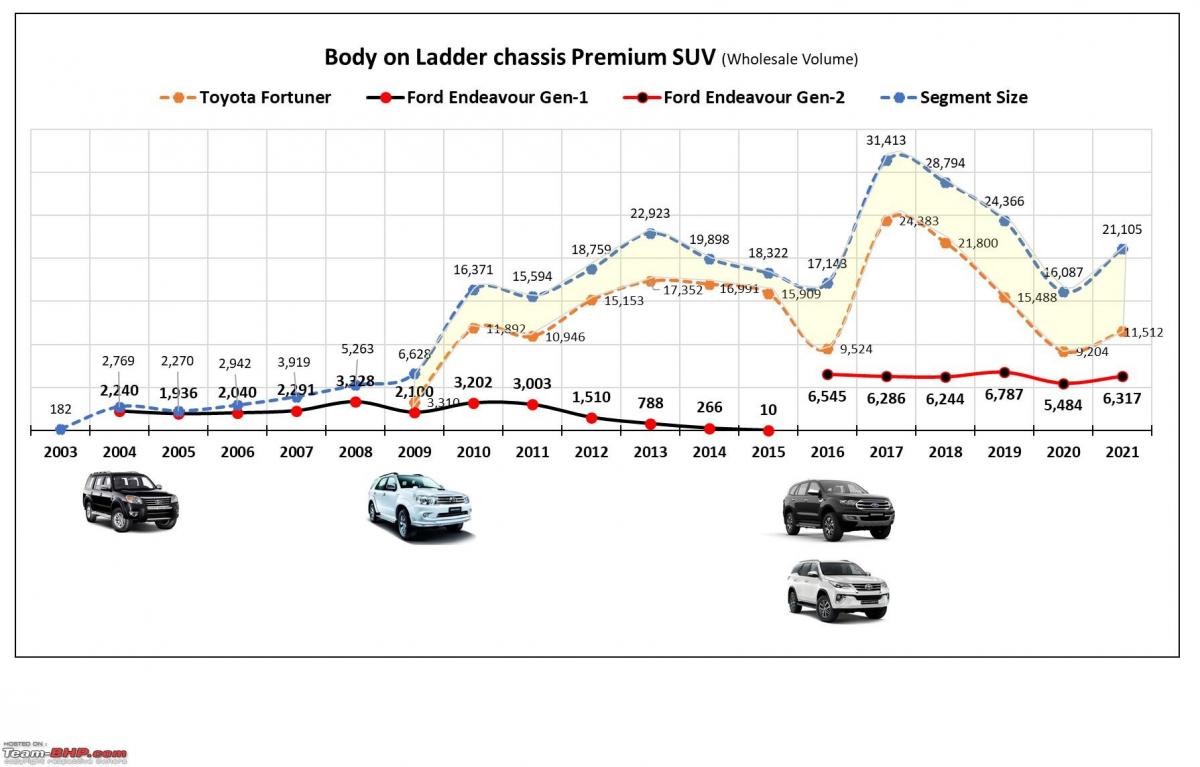

Endeavour Gen-1 (2003-2007-2009-2014-2015)

Ford’s SUV journey began in India with the introduction of a true blue ladder-chassis Endeavour at a price point of ₹12,90,000 with a 2.5L turbo diesel engine in 2003, and wholesale started from January 2004. The Endeavour was brought into India via CKD route from Auto Alliance (JV between Ford and Mazda) plant in Thailand. It was a tailor-made product for the Asian market based on the popular Ranger pick-up platform, and was first launched in Thailand in March 2003 by the name of Everest. Since the Everest brand was already in use by the maker of spices in India, Ford has rechristened it as Endeavour for India.

It quickly struck chords with the Indian customer segment, who wants to show off their muscle power – buyer segment was someone, in easy to read words – politicians and contractors. A politician in those days aspire to buy imported Toyota Landcruiser or Prado, but those who could not afford, had a choice in Ford Endeavour, and those who can’t afford Endeavour, settle down for Tata Safari or Mahindra Scorpio, relatively poor wannabe have to settle even further down to Mahindra Bolero. Look another way round, then Tata Safari or Mahindra Scorpio owners finally got something like the next natural upgrade option. Some say that Tata’s designers were also got obsessed with Endeavour’s popularity and the 2005 facelift was inspired by Ford Endeavour.

2007 facelift received a power bump of 33 bhp and some feature upgrades. Sales improved further, but Mitsubishi Pajero took away considerable market share by then.

In 2009, Ford again gave proper facelift along with an all new 3L diesel engine at ₹ 17,99,000 for 4X4 automatic transmission and ₹ 15,99,000 for the 2.5L 4X2 manual transmission variant (Ex-Showroom, Delhi). It also received a new dashboard with a 7” touchscreen based infotainment system. But then it was the year when Toyota has introduced Fortuner in the Indian market, and started expanding the segment further. Remarkably Endeavour’s volume kept its head above the 3,000 mark till 2011. But thereafter it was showing its age, and Fortuner was eating up its share.

In 2014, Endeavour received its last facelift and was priced ₹19,83,000 for a 2.5L engine with a manual transmission and two-wheel drive while the 3.0L came with an automatic transmission and in 4x2 at ₹ 21,28,000 and 4x4 ₹ 23,06,000.

Endeavour Gen-2 (2016-2019-2021)

Introduced in 2016, it was a more sophisticated, upmarket and rounded SUV than the previous generation, sporting much wanted features in India - panoramic sunroof, and two diesel engine options - 2.2L and 3.2L torque monster (its turbo spooling noise was like music for die hard semi-truck fans). Given the product attributes, it seems as it attracted a new buyer segment as well. Toyota Fortuner gen-2 introduced in 2016, even with lack of features, remained Indian politicians favorite ride, but then those who need those features bought Endeavour – business owners. Sales started at an annual rate of 6,500+, and with continuous feature upgrades, it maintained consistency.

With the 2019 facelift, it got a successful chance to eat into Fortuner’s market pie.

In 2020, a new era of emission norms kicked in and Ford responded with an under powered 2L diesel engine mated to a capable 10 speed gearbox. Fun was relatively less but the feature list was still better than the competition and it soldiered on. Feature(s) and equipment(s) deletion to reduce cost and improve margin became a habit for Ford in India, though it is not much appreciated by Indian customers.

MG was successful in taking away market share from both, Fortuner and Endeavor, with the launch of real-estate on wheels called Gloster. But its end customer segment seems a little different again, those who were looking for more features besides sheer size. That is a big achievement for MG India, as others failed to gain even a toehold in this space, like Mahindra Alturas with its relatively low entry price tag and a good feature list.

Ecosport (2013-2018-2021)

All new ingredients and all new recipe to create something definitive and incredible, that is what Ford Ecosport was. A global product developed in Brazil, with India as a major base of production. With two petrol and a diesel engine option, it was launched at a very aggressive price point of ₹5.59 lakhs, and it was a runaway hit. 1L EcoBoost branded turbo-petrol engine made its debut in India. It looks like SUV and drives like a fun hatchback, and soon caught the fancy of the Indian audience, giving impetus to all new sub 4m monocoque crossover(SUV) segment.

For the first three years, Ecosport had a free run, as virtually there was no competition, which gave Ford India a chance to raise the price and earn handsome profits. Indians were making a beeline to get one and that made Ford India way too much complacent and in some instances arrogant too.

The first time Ecosport faced competition and sales decline was after the introduction of Range Rover inspired Maruti’s Brezza in 2016. Panic could be seen on Ford India’s face as they slashed the price of diesel powered Ecosport by a whopping ₹ 1,12,000, for the petrol version it was in the range of ₹ 53,700 to ₹ 87,400. But then Brezza with only diesel drivetrain option expanded the segment size and Ecosport continued its momentum.

In the wake of competition, Ford India in 2016 introduced a halfhearted minor facelift by adding flickering tube light like DRL around headlamp which can hardly be distinguished during the day, thus defeating the very purpose. However, there were some feature upgrades on all other variants.

2017 saw two new entrants and further segment expansion. Lack of proper facelift means Ecosport was feeling the heat in the segment it actually kick started, and sales continued to remain stagnant, despite a growing segment.

2017 end was the time when Ford India has brought in a proper facelift, with all new headlamps with proper LED DRL, new grille, bumper, instrument cluster and touchscreen based SYNC 3 infotainment system. Ford’s all-new 1.5L Dragon series of petrol engine made its Indian debut in EcoSport, mated to 5 speed manual or 6 speed torque converter transmission. Market too responded well, with sales reaching back to 51,000 level of 2014.

But then came the massive Auto industry decline of 2019, but the entry of Hyundai Venue and Mahindra XUV 300 helped the segment to expand further by eating into an adjacent segment of the sedan, with a similar price point. Time for generation change was due and in absence of one, Ford India has gone for another downward revision of price up to ₹ 57,000 to counter competition. It seems, to slash price, was the only weapon left in arsenal of Ford India’s marketing department.

2020 saw a general COVID 19 induced decline. But Ford was able to upgrade their mainstay 1.5L diesel engine to comply with BS6 emission norms with LNT+DPF based exhaust-gas-after-treatment process, with a slight price increase. But later, DPF clogging became another nightmare for Ford and its customer in India.

Interestingly, 2021 sales of the sub 4m monocoque body crossover(SUV) segment has already crossed 4 lakhs size, that’s largely because of new entrants like Nissan Magnite and Renault Kiger, adding all new low-end-price-spectrum, and KIA Sonet, stretching the higher side of the price spectrum. Also, there was another Ecosport facelift in the pipeline, which unfortunately will not see the light of the day anymore!

Ford’s Export business

In 2017-18 Ford contributed 25% of Indian PV export. It is an interesting business model championed by Ford and later successfully followed by Hyundai, VW and Nissan. In fact, VW and Nissan manufacturing units survived in India due to the export of Polo/Vento and Sunny (best seller in Mexico called Versa in the local market) to Mexico, respectively. They have built export oriented plants thus producing left hand driven cars on the same assembly line. Since 2014, Ford India was exporting more cars from India than selling in the local market.

For certain years Ecosport also happens to be the best exported car from India as well. Shortfall in domestic demand was well compensated by export volume. At times Ford India was prioritizing export over domestic demand as well, thus creating artificial scarcity for certain variants. Figo Gen-2 was exported and sold in other markets by the name of Ka.

New Greenfield plant - Sanand, Gujarat

During the 2009 planning phase, capacity at Tamil Nadu based plant was appearing to be nearly full with all new products lined up by Ford then – one of the major global production base for Ecosport and new global Fiesta for the Indian market.

That might have necessitated a new plant requirement. That could be done by Greenfield expansion of their existing plant. But only 2,50,000 units overall capacity expansion was possible at the said location. But then sops would have been limited as they already have had existing benefits in place from the state government. So they must have started scouting for new benefits in some other states with similar geographical advantage of proximity to the seaport for exports, as India was envisaged as a base for a compact car and small engine manufacturing.

They zeroed it down to Sanand in Gujarat, where Tata Motors had established (relocated) Nano (PV) production plant in 2009, which is having proximity to an export oriented port. So they built a separate state of art greenfield production plant with a billion dollar investment (including product development), in Sanand Gujarat, with an annual capacity of 2,40,000 units and an engine capacity of 2,70,000. Since these two products bombed badly in 2015, production capacity remained underutilized due to a lack of domestic uptake.

It was the export which later accounted for 70% of production, still kept some momentum alive. With some export market demand drying up, Ford was struggling badly with the fixed cost of the Sanand plant. And write-off of product development cost might have even eroded the net worth section of the company’s balance sheet. That means Ford need to infuse fresh capital to keep business going.

Conclusion

Product failure is part and parcel of any business. Even Maruti and Hyundai have delivered failed products, based on their own yardstick. But the key is to learn – not only from one’s own mistake(s) but from others as well, as later is free of cost, and of course not to repeat. MG and KIA’s recent success, the resurgence of Tata Motors PV Business Unit and Nissan India, are testimony of the fact that gaining share in the Indian market can be challenging, but not unfathomable - only with the right product (read it as attributes which Indian customers and consumers actually value) at the right price.

Ford has been rewarded with a good market share for their efforts – remember how Ikon was the second best-selling sedan for three successive years in India, Ecosport kick started an all new growth segment. But then, not having a proper vision for product portfolio expansion, mismanagement of product life cycle (lethargy and complacency is a bad cocktail), and on top, heckling with its own perfected DNA, especially what a given set of customer segment does value in India, was the cardinal sin committed by Ford in India.

In a bigger context, Ford India was not even having a proper vision and solid product roadmap for India. At home, they are good at making pick-up (light trucks) and SUVs, and in Europe, they have been quite successful in selling hatchbacks, what respective market demands. In fact, they now have a purpose built electric SUV/crossover platform too in their American portfolio. Indian taste is by and large similar to the USA, for SUVs and chrome, and not for pick-up though. So, after the success of Ecosport (2013) in India, they should have a clear roadmap for SUV/Crossover, but then they never had.

For turnaround - Tata came back with an entirely new SUV/Crossover portfolio, even an electrified version of Nexon. Fallacy became a trap for Ford in India.

From a corporate strategy point of view, retrenchment from a particular market or segment is not a bad thing to do. Look at General Motors, they exited the European and Indian market in 2017. End result – their margin has improved on a consolidated level, PSA turned around Vauxhall and Opel brands (owned earlier by GM) in Europe. On a global level, this may work for Ford as well after leaving Indian and Brazilian markets in 2021, where they were losing money hands over fist.

Check out BHPian comments for more insights and information.