| India-specific Electric Vehicle report | Decoding Electric Vehicle Disruption in India

Quote:

Emkay Global Financial Services organized its first 'Electric Vehicle' conference, featuring eminent speakers and stakeholders from the entire EV value chain. The event witnessed participation of over 700 speakers and observers. The expectation of EV adoption is high, and now the debate has shifted from "when" to "how fast". Recent moves of firms across the value-chain on the product line-up and investment fronts, as well as their resolve to go 'all electric' have notably reset the expectations regarding the pace of EV adoption.

The key takeaways given below highlight initial signs of improving EV adoption:

OEMs: New products expected to drive adoption: Global OEMs already have a wide range of products, which are being introduced either directly (e.g., Mercedes Benz) or through collaborations (e.g. GreenPower). In addition, almost all domestic OEMs and startups (e.g. Ather) are also indigenously developing and launching products. These launches should drive the evolution of consumer profile from 'early adopters' and ‘technophile purchasers’ to ‘mass adopters’ over the medium to longer term. Apart from the shift in customer preference from ICE to EV for private use, there is a shift expected in the commercial and shared mobility space (e.g. Yulu) due to superior cost economics. EV penetration should be sooner in 2Ws and 3Ws, while adoption may be gradual in PVs. Emkay Global expects an increase in competition and margin pressures for incumbents in 2Ws and 3Ws over the next 2-3 years.

Government policies are in the right direction: EV penetration is expected to be driven by stringent emission norms, incentive schemes, well-defined long-term policies, standardization of charging infrastructure and a structured approach to reduce dependency on imports. FAME-2, PLI and state government EV policies are expected to promote EV demand, improve localization, increase cost competitiveness and develop a complete ecosystem.

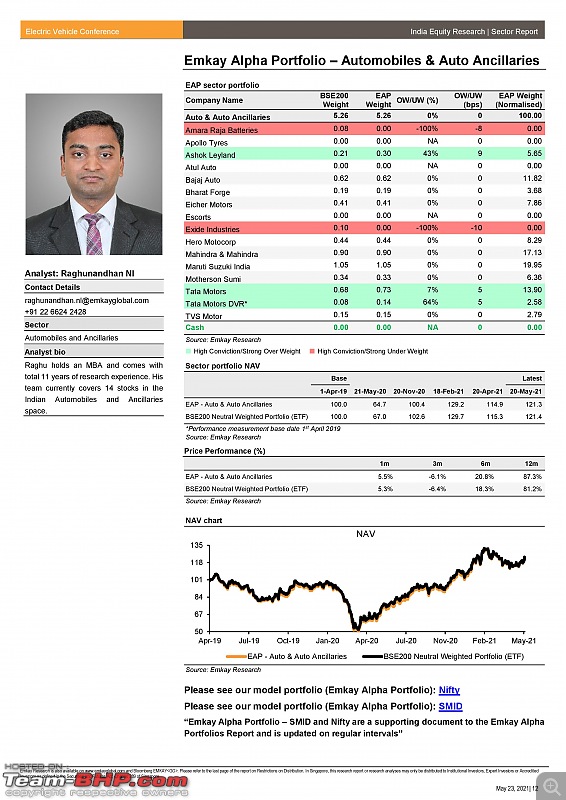

Battery manufacturing capacities are expected over the medium term as Li-ion battery cost stands at 40-50% of raw material cost and localization is necessary to achieve cost competitiveness. The government’s PLI scheme for Advanced Chemistry Cells with incentives of Rs. 18,100 crores should encourage investments. As EV demand improves over the medium term, capacities would be commissioned through investments from OEMs, international ancillaries (e.g. Octillion), domestic ancillaries and startups (e.g. Lohum), either on their own or through consortiums. Due to economies of scale and technological advancements, battery costs are expected to decrease to below USD100/KWH over the medium term. Battery swapping technology can support EV adoption and could be successful for 2Ws and 3Ws. Lead acid batteries are being used for SLI (Starting, Lighting and Ignition) functions in electric vehicles. In the near term, these batteries may continue to be used, but over the medium to long term, lead acid batteries may be replaced by Li-ion batteries. This will pose a structural risk for companies such as Exide Industries and Amara Raja Batteries.

Component suppliers are gradually adapting to EV transition through indigenous product development or global tie-ups (e.g. Minda Corp, Napino and Tata AutoComp) as components need to be localized under a phased manufacturing program. FAME-2 incentives are being provided to OEMs, only if required localization levels are achieved. The PLI scheme for components with incentives of Rs. 57,000 crores should encourage further investments. Based on global experience, only a few existing ancillaries and startups that focus on EV components are likely are to benefit, while others lose out. This will pose a structural risk for companies dependent on ICE engine/ transmission components.

Charging infrastructure is being expanded notably by existing power companies (e.g. Tata Power) and startups (e.g. Volttic and Sunergize) in highways, tourist locations, hotels, offices, malls, parking areas, dealerships, residential societies, etc. Similar to global experience, it is expected that over 70% of the charging needs would be met by home charging.

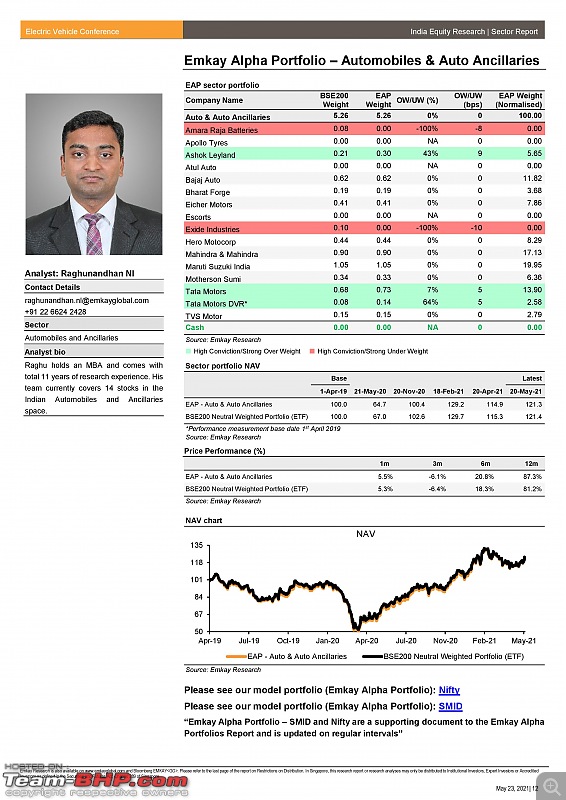

Emkay Global’s positive view on the Automobile sector is underpinned by expectations of a strong cyclical upturn, which is expected to last at least three years. The top picks among OEMs are Tata Motors (TP: Rs. 410), Ashok Leyland (TP: Rs. 155), Maruti Suzuki (TP: Rs. 8,500) and Eicher Motors (TP: Rs. 3,300). Domestic CV, PV and Premium 2W companies are not expected to be impacted by EV transition over the next 2 years.

|

Download the report here: Electric Vehicle Conference 2021 Sector Report.pdf |

(3)

Thanks

(3)

Thanks