Team-BHP

(

https://www.team-bhp.com/forum/)

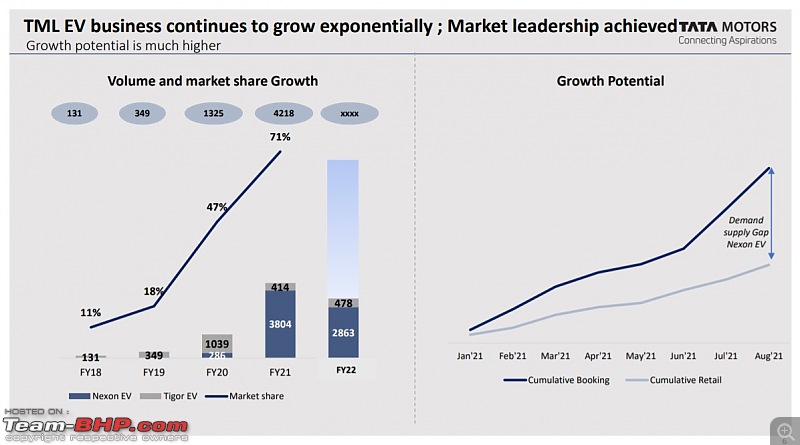

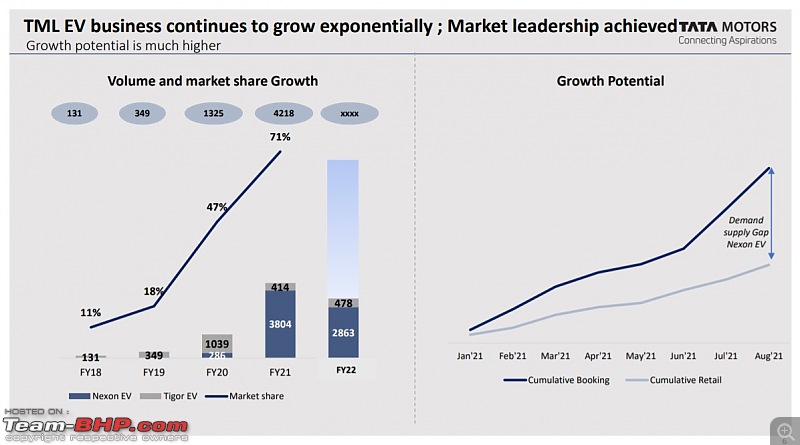

Privat Equity firm TPG is in advanced discussions with Tata Motors to invest $1 billion in Tata Motor's EV division as per an ET report. TPG's $1 billion investment, which could even go up to $1.5 billion, values the EV division at $8-9 billion. A formal announcement is expected this month. The final due diligence is ongoing but both sides, said company officials, have "had a handshake two-three weeks back."

Tata Motors has recently announced plans for 10 new electric vehicles in its domestic product portfolio by 2025.

Source:

https://auto.economictimes.indiatime...heque/86856949

Good coincidence of this investment with the new plant procurement plans.

Not that the Ford plant will get converted to an EV specific one, but apart from R&D, could this investment lead to a separate production line for EVs alone?

I invested in Tata Motors share few years back expected it to become a multi bagger. I was planning to use this money to buy my new car:D. I checked it today and it is showing ~ 0 gain. Hopefully it grows and I may be able to by my first electric car using the gain in few years.

Quote:

Originally Posted by Latheesh

(Post 5168630)

I invested in Tata Motors share few years back expected it to become a multi bagger. I was planning to use this money to buy my new car:D. I checked it today and it is showing ~ 0 gain. Hopefully it grows and I may be able to by my first electric car using the gain in few years.

|

Unfortunately the near term headwinds might not allow Tata Motors to rise much above current levels. While the JV as well as shareholder nod to hive off the PV business and the JLR market in China looking up in the near future might give hope, Tata doesn't yet have the reliability and peace of mind needed for growth in their market value.

I too am in a similar predicament, though I started out just last year. Lets see what the market offers.

Tata Motors to raise Rs. 7,500 crore in its EV subsidiary

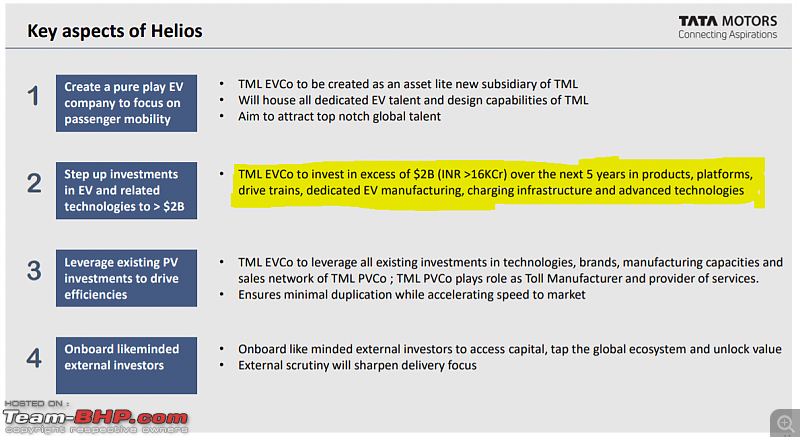

TPG Rise Climate, along with co-investor ADQ will invest Rs. 7,500 crore in Tata Motors' electric vehicle business.

TPG Rise Climate and its co-investors will secure between 11% to 15% stake in Tata's newly incorporated EV subsidiary, translating to an equity valuation of up to US$ 9.1 billion.

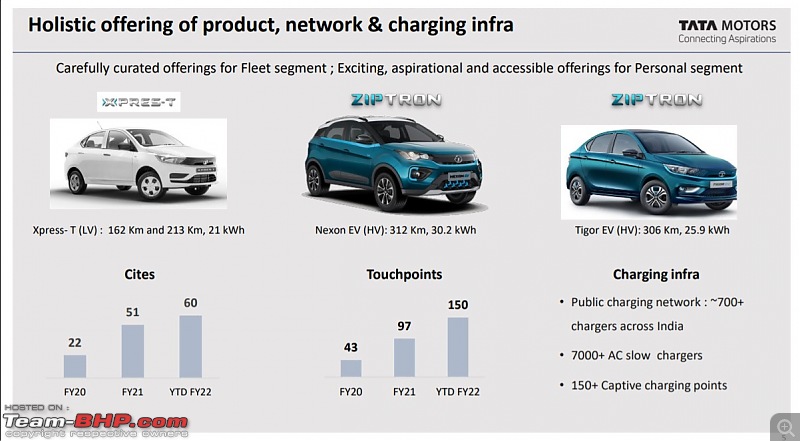

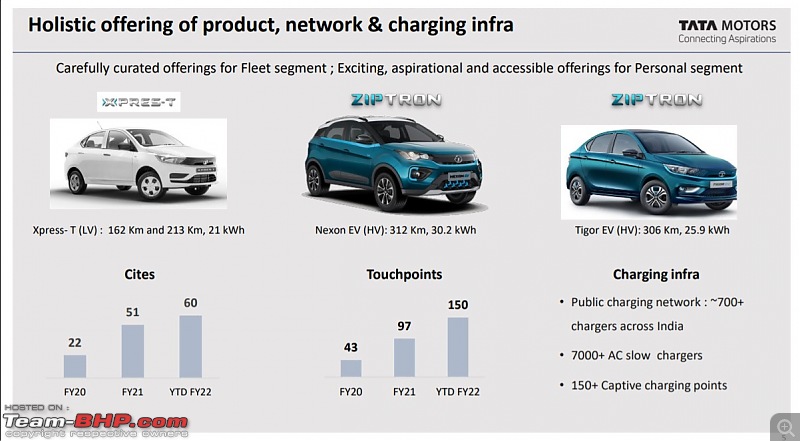

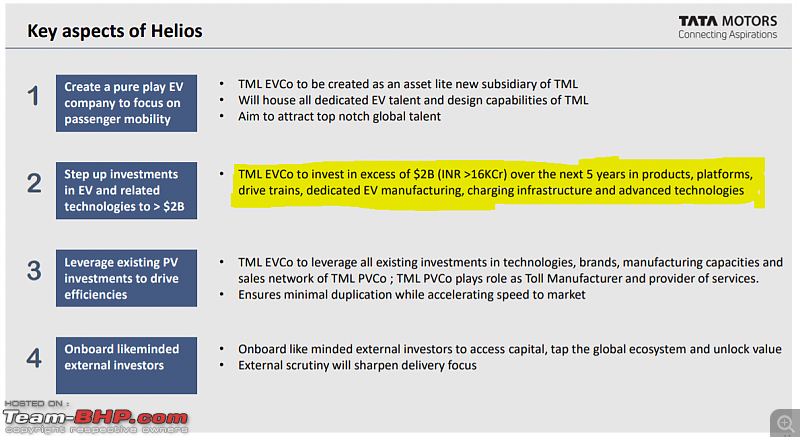

The new company will leverage all existing investments and capabilities of Tata Motors Ltd. The company will channelize the future investments into electric vehicles, dedicated BEV platforms and advanced automotive technologies. It will also make strides to develop charging infrastructure and battery technologies.

Tata's new EV subsidiary will launch 10 EVs over the next 5 years. The company will collaborate with Tata Power Ltd. to set up charging infrastructure to facilitate rapid EV adoption in India.

The first round of capital infusion is expected to be completed by March 2022, and the entire fund will be infused by the end of next year.

In August this year more than 10% of all new car sales in UK was electric, despite big waiting periods and short supply. This growth was rapid in comparison with the 1-2% market share till the not too long ago.

I think most Indian manufacturers are underestimating this trend and I fear the biggest beneficiary in the not too distant future will be the chinese like MG, BYD etc. The current crisis between the two nations must be the only reason in them being circumspect in going gung-ho into the Indian EV space.

Tata Motors is trying to be the Tesla of India, making electric cars that will sell in huge numbers unlike more niche offerings like the MG ZS or Hyundai Kona.

The market is also indicating that people trust TaMo to be the number 1 EV player for the next decade. If Tata establishes a larger EV Charging network, I can see India going 40% electric by 2030. Hope this occurs, and I would like to see Indian Automakers succeed.

Major takeaways from the press release:

- I think the most important announcement from this fundraising is Tata Motors will invest > $2B (Rs 15,0000 crores) specifically for EV development. I don't remember any such huge amounts in such as short period of time in India. Kia spent $1.1 billion (Rs ~7,700 crores) for a 3 lakh capacity greenfield plant.

- Tata is developing 10 EVs with different body styles and driving ranges by FY2026. For comparison, their existing ICE lineup has 7 models.

- Tata will develop a new modular platform for EVs instead of current ICE conversions like Nexon and Tigor.

I am glad that Tata is proactive in investing heavily in EVs. As mentioned by @shortbread, many Chinese companies have multiple EVs like ZS already in production and selling in huge quantities in their lineup and the current border crisis is only preventing them from investing heavily in India. Otherwise, the automobile market will become similar to the smartphone market dominated by Chinese companeis very quickly.

10 EV vehicles by FY26 would certainly include 2-3 CV's. Even if we assume this to be as high as 4 (unlikely), we can expect 6 PV EV's from Tata in the coming years.

They already have the Nexon and Tigor. Assuming they launch BEV versions of the Tiago (entry into Tata UniEVerse as they say), Altroz and Punch, that is still only 5 BEV's.

I am hoping they bring back the Nano as the entry BEV. Offer a lower range, brand it as the City EV to have, and this thing will sell.

Assuming they don't bring the Nano back, and assuming the 10 EV's mean 10 separate vehicles instead of multiple battery packs across say, 5-6 vehicles, we may expect an EV version of the Sedan Tata is so interested in building, or even the Sierra (as the most expensive EV in their portfolio).

We know OLA has signalled its intent to move on to 4 wheel EV's in 2-3 years; several Chinese players have significant production experience and a willingness to invest in India; M&M has stated they want to concentrate on EV's now; and that Hyundai and MG already have EV's in India.

I foresee BEV's being available from 8L to 20L ex showroom from multiple manufacturers with multiple battery ranges in the next 5-7 years. Good times ahead for the consumer.

That's what you get for believing in your products, investing in EVs when there was a slowdown in the Indian automobile sales and other companies where trying to play it safe and taking on the challenge of pushing and educating customers in EVs. TAMO has also invested in charging networks and home-charging solutions.

Unlike Maruti, who couldn't be even bothered to launch the Wagon-R EV. Maruti has been giving me a lot of Bajaj vibes these days in their stubborn-ness when it comes to strategy.

Kudos to Tata. Your hard work is paying off. A well rounded product and first to market advantage is helping them greatly. Will be interesting to see the other 5-6 launches.

Mahindra - That billion Dolares $$$ could have been yours but alas. I will book an electric Thar, no questions asked.

Maruti - Like mentioned above, they do sound like bajaj getting out of Scooters. Would need a couple of MIA in senior management to realise that they are missing the bus and are still waiting.

Maddy

Quote:

Originally Posted by maddy42

(Post 5172463)

Mahindra - That billion Dolares $$$ could have been yours but alas. I will book an electric Thar, no questions asked.

|

Going by Mr Anand's tweet to Elon back in 2017, Mahindra should have been an established EV player in India by now. Don't understand what was special about Verito and E20 that got his confidence so high.

And people say Elon should get off twitter.

This is how market responded to the deal - I think Tata has a good plan on EVs. I have seen Nexon EVs in the far flung villages of Bihar - which is really a good sign of product getting accepted. I would go so far to say that Tata Motors stocks could be a good investment in long term.

Reading into share price fluctuations is a bad way to gauge this. My guess would be Tata will eventually hive off the EV arm and there will be an eventual IPO for that and TPG may look to cash in then. This could be a 3 year horizon.

| All times are GMT +5.5. The time now is 21:52. | |