Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by adithya.kp

(Post 3921791)

On question on loan against FD. If i am not wrong, the amount will come to my account and then i will pay the dealer

|

Quote:

Originally Posted by Lobogris

(Post 3921938)

If it is legal money then why do you need to worry?

|

Hey Adityha, a late reply but nevertheless - as Lobogris had pointed, when you are clear about the genuineness of the source, then why bother?

Secondly, even if a question arises on the source of such fund, it can always be answered as your bank account would definitely be having your PAN details and the loan details would have automatically got linked to the PAN.

So to make this work with low FD rates today, I should open a FD with a bank having the least interest rate for 5 years. Assuming 2% additional charge, a 6.5% interest FD with Citibank will cost be 8.5%. I say way cheaper than any car loan.

Hi guys,

I am planning to take a loan against my FD.

Loan amount is 10L.

FD amount is 10L.

I am being offered a loan at 1% above what I am earning for my FD.

My question is whether this is a good option or should I opt to keep FD interest(compounded) and get a regular car loan?

Also, in a scenario where I pay back some of the principal amount, say 5L out of 10L within a year. Would my interest for the amount be less?

Thanks

Quote:

Originally Posted by renownedalmond

(Post 4126665)

Hi guys,

I am planning to take a loan against my FD.

Loan amount is 10L.

FD amount is 10L.

I am being offered a loan at 1% above what I am earning for my FD.

My question is whether this is a good option or should I opt to keep FD interest(compounded) and get a regular car loan?

Also, in a scenario where I pay back some of the principal amount, say 5L out of 10L within a year. Would my interest for the amount be less?

Thanks

|

Hello Renownedalmond,

All valid questions raised. Did you manage to get answers from the banks, etc.

Please share with the forum members and also if you went ahead or took some other option.

Thanks a lot

Quote:

Originally Posted by nikhil_pon

(Post 4260687)

Hello Renownedalmond,

All valid questions raised. Did you manage to get answers from the banks, etc.

Please share with the forum members and also if you went ahead or took some other option.

Thanks a lot

|

Hello Nikhil,

I had to opt for the FD loan option as the car loan option would have needed a lot of paperwork and time(according to the bank manager). And since there was only one car remaining in the showroom with the color that I wanted, I had to move fast.:D

But my two cents on the dilemma is that if you already have an existing FD(which I had) and would not need the money or the term of loan, then opt for the FD loan. If, on the other hand, you might require to use the money, then go for a normal car loan. Though the interest rates would definitely be higher than the 'FD option'.

Also, the loan allotted in the FD option would be 90% of the FD amount.

So, if you have an FD of 10L, then the loan amount would be 9L.

Does this still hold, say in private banks like HDFC? I spoke to someone in the bank who deals with car loans and he flatly said that they didn't have this option (of taking a home loan against a fixed deposit). Has anyone availed this recently (say 2020 onwards)?

Thanks!

Quote:

Originally Posted by blr_se

(Post 5150181)

Does this still hold, say in private banks like HDFC? I spoke to someone in the bank who deals with car loans and he flatly said that they didn't have this option (of taking a home loan against a fixed deposit). Has anyone availed this recently (say 2020 onwards)?

|

Home loan is already a collateralized loan (ie, your house is a collateral against the loan) so it does not make sense to do a home loan against a FD.

Just ask them to give you a loan against a FD.

Quote:

Originally Posted by itspb

(Post 5162575)

Home loan is already a collateralized loan (ie, your house is a collateral against the loan) so it does not make sense to do a home loan against a FD.

Just ask them to give you a loan against a FD.

|

I apologize. I meant to say car loan. But yes, I did get the bank to offer a loan against FD.

Quick question regarding car loan finance.

in todays lower roi regime is it better to take loan against fd to take a car or better to take fixed car loan please ?

SBI offer car loan at 7.5 fixed for 5yr

Loan against security sbi FD rate (4.5) + 1% as OD for 5 yr

looking forward to groups insight.

Quote:

Originally Posted by roadjourno

(Post 5250887)

Quick question regarding car loan finance.

in todays lower roi regime is it better to take loan against fd to take a car or better to take fixed car loan please ?

SBI offer car loan at 7.5 fixed for 5yr

Loan against security sbi FD rate (4.5) + 1% as OD for 5 yr

looking forward to groups insight.

|

This loan against an FD generally makes little sense. You are paying more to use your own money and you lose the liquidity anyway while the loan is pending. It can only make sense if there is some temporary shortfall and the person doesn't want to liquidate the FD to avoid a penalty.

Coming to the second point, the loan would be at a 1% surcharge on the rate of the FD. If the FD is old and getting an interest rate of say 7% then the rate of the loan would be 8%.

Quote:

Originally Posted by roadjourno

(Post 5250887)

Quick question regarding car loan finance.

in todays lower roi regime is it better to take loan against fd to take a car or better to take fixed car loan please ?

SBI offer car loan at 7.5 fixed for 5yr

Loan against security sbi FD rate (4.5) + 1% as OD for 5 yr

looking forward to groups insight.

|

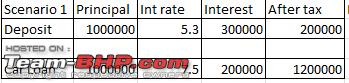

Please look at these calculations. I assume the Principal is 10,00,000 INR and 5 years as tenure for both FD and Car Lon.

Below is the calculation

Scenario 1:

You take a car loan at 7.5% Fixed rate. Currently no processing charges as per SBI website. Also, the loan is reducing balance method.

At the same time, you have money available 10,00,000 INR and open an FD for 5 years. You fall under 30% Income tax bracket. Current interest rate is 5.3% and FD is quarterly cumulative and given back at maturity.

Essentially, at the end of 5 years you will be left with 2,00,000 interest (after tax) and a car. Essentially you got the car at 0% interest.

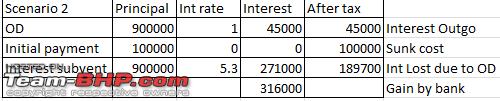

Scenario 2:

You open the same FD at the same rate but opt for OD Loan against FD. You will be given only 9,00,000 loan and 1% will be your interest outgo. I believe bank will calculate interest at 5.3% (FD) + 1% (OD) during calculations. For the same car, you will pay 45,000 INR extra in 5 years as interest and will forego 2,71,000 interest (or 1,89,000 after Income tax) if you have put in FD separately. So at the end of 5 years, you will be left with no interest gain and the same car.

OD loan against FD is highly skewed in favor of Banks. Since they will get

1. A FD without any liability to be paid at maturity

2. OD loan provided without risk

3. Instead of getting a 2,00,000 interest, in the books it will be shown as 3,16,000 INR out of which 45,000 INR will come as interest and avoidance of 2,71,000 INR as savings which they can lend further.

OD loan is beneficial for customers only in cases like MaxGain Home loans.

Correct me if I my calculations are wrong.

| All times are GMT +5.5. The time now is 18:09. | |