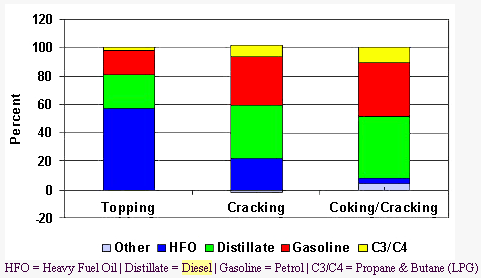

@Anarchy, I agree that whatever the case, producing diesel will cost less energy than producing petrol from crude. The graph you have provided is very informative, and nicely illustrates what I said in my

previous post.

I think what ukderebail means is that crude coming out of India is the light variety which produces more petrol than the heavy ones.

Agreed, the biggest oil field in India, the Bombay High, produces light sweet crude. And even the KG basin (which is mostly gas) gives light crude. But the second highest reserves of India which are in Rajasthan (Thar desert) gives extremely heavy crude, and so does the Digboi oilfield in Assam. Trying to refine more petrol from these would mean wastage of so much energy in the cracking and coking processes.

Even in the Bombay High crude which is light, the percentage of diesel obtained is higher than that of petrol. With these facts, how can you say:

Quote:

Originally Posted by ukderebail  India has petrol rich crude and therefore in its own interest should encourage Petrol driven vehicles. I would recommend zero tax and minimum life time tax on Petrol driven vehicles and no tolls on petrol driven vehicles in India. This would ensure that more petrol driven vehicles are sold for private sector and diesel vehicles reserved for public transport vehicles. The difference of Rs 25 to Rs 30 currently on diesel vs petrol will get negated. The govt will earn huge revenues from Sale of Petrol. It would be win win situation. |

It's not true! By encouraging more petrol vehicles you are taking efficiency out of the system. I proposed doing the exact opposite thing in my

previous post. Why do you think ships run on furnace oil and not petrol or CNG? It is simply the most efficient fuel for transportation! Of course road transport vehicles simply cannot accommodate the huge furnaces needed to burn FO, so they use (should use) the next best thing: diesel.

The reason why petrol ever became popular is because in the days when refineries were first being installed around the world, diesel engine technology was very much undeveloped. Plagued by performance issues such as poor acceleration and low top speed, wear-and-tear issues affecting the life of the engines, and the inability to curb engine vibration which led to loosening of body parts of the car before they should, they were restricted to commercial usage and nobody in their right minds would have wanted to drive a diesel as a personal vehicle. So refiners modified their refineries to produce lots of gasoline.

Thanks to the millions of $$ invested in R&D and the subsequent leap in diesel engine tech, we can now enjoy what people couldn't earlier: diesel that costs less to refine providing (very nearly) the same performance of petrol! Wear-and-tear has been addressed by the lubricants industry which have developed specialized diesel engine oils of higher quality than ever before. We have learned to control the vibration by making the engines heavier (of course the increase in power enabling it to pull its own heavier load).

Even if we stop considering the low refining costs of diesel for a moment, diesel has more joules per liter than petrol does (well all of us Indians already knew that; diesel gives more mileage than petrol). But for your information diesel engines are more efficient at converting the chemical energy into heat energy and then kinetic energy. An estimated 50% percentage of the inherent energy in diesel can be converted for usage. Compare this to a petrol engine, which has its efficiency at only 25-30%!!

So basically you're spending more to buy lighter crudes, investing heavily on refinery modules to get more petrol, spending energy on these modules on a daily basis, laying a public distribution system for two fuels which reduces efficiency... all for a fuel which has lower calories for a given volume, PLUS only 30% of these calories is usable!!

-------

Regarding the other subject: cigarettes... Well, I don't care two hoots if the government imposes 500% taxes on it or 5000%. I'd rather they just ban the stuff, it's not helping anybody in any way.

Or wait... Sales of cigarettes contribute towards the GDP of India. And it also directly contributes towards the supply of patients to hospitals for various ailments. More patients means more money spent on the hospitals, which also contributes towards GDP. Not to mention the manufacturing of all those cancer equipment required by the hospital management, the production of all those medicines, construction of more hospitals to accommodate more patients, which all contribute to a higher GDP! So the government should blindly double/triple/quadruple the supply of cigarettes in the country, and start permitting their ads again to witness a shoot in GDP growth and a booming healthcare industry. Plus more tax revenue from cigarettes at existing tax rates means they can give tax rebates on fuel! Win-win-win!!

P.S. I hope no politician reads this bit.

(2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks

(5)

Thanks

(5)

Thanks

(5)

Thanks

(5)

Thanks

(4)

Thanks

(4)

Thanks

(1)

Thanks

(1)

Thanks

and

and