The Movers & Shakers

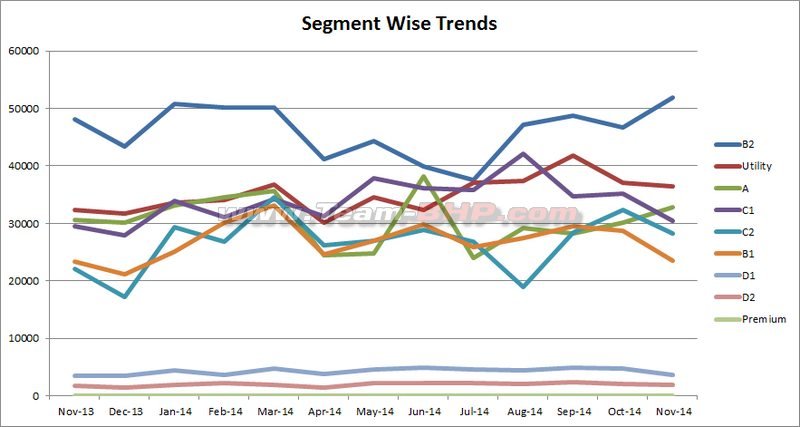

November 2014 was a mixed bag of sorts. The total sales tally of 2.09 lakhs is ~10% higher than the 1.91 lakhs of Nov' 13. It was also a lot brighter than how the financial year started off (

especially April, May & July). 5 of the top 6 manufacturers have recorded YOY gains, but the bottom 7 have all bled! Clearly, when the going gets tough, the tough gets going. Or perhaps, the strong get stronger and the weak...weaker.

The Government extended the excise benefits that were rolled out earlier. However, there's no clarity whether it's going to remain in place till the next budget. Thus, take these November numbers with a pinch of salt. Some manufacturers ramped up production a bit and pushed inventory out the door while these excise benefits last.

Conversely, the end of the year also means inventory corrections, with dealers hesitant to take cars that will be 'a year old' in 2 months. A couple of brands chose to trim the pipeline as the festive season wasn't too good for them, and dealers still have cars lying around in the stockyard. Expect discounts in December...customers prefer buying cars in the new year and hold their bookings till Jan.

Maruti climbs back into the 6-figure zone (by merely 19 units!), something it didn't manage last month nor in Nov' 13. Big push of the refreshed Swift & new Alto K10 is evident, both models recording superb numbers. The Dzire sees its lowest dispatches of 2014, but I think it's because the updated Swift's production was prioritised over it. Still, 14K is no mean feat. For a 10 lakh Maruti, the Ciaz has started off on a strong note, 2nd only to the formidable Honda City in the segment. Amazing how Maruti explores new growth opportunities; 5.2K units is double of what the SX4 managed in the

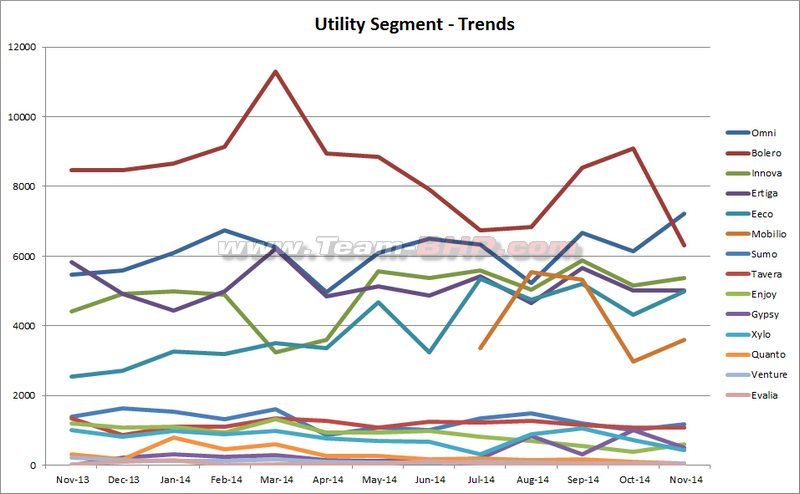

entire year (Sept '13 - Aug '14)! The WagonR & Ertiga push out what's been their sales average for the last 6 months, although the Celerio is showing a consistent slide over the last 3 months. It stands to lose its USP - the AMT automatic - with the launch of the Alto K10 AMT. Things are looking up in the commercial vehicle sector, with the Omni & Eeco both reflecting that sentiment. Believe it or not, from its range of regular cars, the long-in-the-tooth Ritz is now Maruti's worst performer @ 2.5K units. Expect Gypsy numbers to climb with the Army's recent 4000 piece order (

related news).

Just like Maruti, Hyundai rolled out an aggressive product onslaught over the last 3 years, with one new launch after another. The November tally of 35,000 cars is 2K higher than last year, but a 2.5K fall compared to Oct '14. The premium i20 is Hyundai's best selling product for the 3rd month in a row! In November, it sold over 10,000 units. No better testament to the quality & all-roundedness of the car. The Grand i10 is next in line with over 8,000 shipments. While the number is respectable, the Grand i10 & ol' i10 (

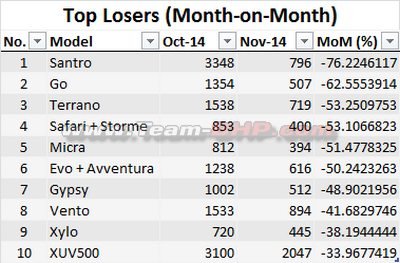

combined) sell just about as much as the i10 used to in its hey days (2011, for example). The Eon does its usual numbers, while the sharp dip in Santro sales seems to confirm its rumoured demise. Neither the Eon nor the old i10 have gained from the Santro's exit, but of course, it's early days to confirm that. I'm surprised to see the Xcent's fall to 3,900 units. For a well-priced high-quality compact sedan, that's nothing to write home about. The Xcent is ahead of the Amaze, but this is the lowest since full production started in April 2014. The Verna's 1600 sales indicate that production is being moved to the facelift version whose launch is just around the corner. The Elantra sees its worst month in history with merely 207 copies moved off factory floors. And it's not facing the heat from the dominating new Corolla alone; fact is, the Elantra's average of 2014 is 30% lower than its 2013 volume. A poor month for the Santa Fe too, while the Sonata remains embarrassed with its single-digit sales.

At position no.3 on the podium with a score card reading 15,000 is Honda : a single engine (1.5L i-DTEC diesel) has turned around the fortunes of this Japanese giant. The City brings home a whopping 7,200 sales in November! After losing the lead to the Ciaz last month, the City convincingly grabs it back. The Mobilio behaves like a yo-yo; 5.3K in September, 2.9K in October and 3.5K in November. In the 5 months from introduction, Honda's 7-seater has an average tally of 4,159. Not sure if it'll maintain this 4K average in the longer term with the current pricing & economy interiors / build. Not a good month for the Amaze with its lowest sales ever. 3.3K is nothing for a cheap Honda sedan with a diesel engine, though I have a feeling that Honda stuffed dealer channels in August (9,200 Amaze' dispatched then). The Brio's poor performance, and the inconsistent yo-yo swings of the other models, tells me that Honda needs to step up its marketing & sales function. It doesn't have the experience of pushing multiple cars in the volume segment.

An awful month for Mahindra - it sees some corrections after stuffing the pipeline in October for the festive season. Mahindra lost 5,000 units on the MOM chart and 3,000 on the YOY! A third wiped out from its numbers (from the previous month), the Bolero had 6,300 dispatches. I looked at stats all the way back to 2011 and still didn't catch a smaller figure for India's favourite UV. It's the same story with the Scorpio & XUV500. I'm eager to watch the much improved 2014 Scorpio's run over the coming quarters. The XUV500's 2K is lacklustre. Another month or two of data should give us a clearer picture, but the XUV500 needs some kind of updates now...it's been 3+ years since launch. A 15 lakh car needs to remain 'fresh', and there's no sign of the automatic either (premium customers love their Diesel ATs). Further, Mahindra needs to focus and trim its product line. Truth is, it has more flops (Xylo, Quanto, Verito, Vibe) than hits. Why waste time on non-performers? Presence in a segment for the heck of it creates too much of a distraction within the organisation. See how Maruti got rid of slow-movers like the A-Star, Estilo, 800, Kizashi, Grand Vitara etc.

For Toyota, the Innova & Fortuner's sales are proving as reliable as their mechanicals

. Status quo on both. What's truly remarkable is the new Corolla Altis' 4 digit performance....for the 2nd month in a row!! The Corolla has outsold all of its competitors

combined. Clearly, it's hit the bulls eye in the D1 segment. These celebrations aside, numbers of the Liva & Etios are as lacklustre as their drab interiors. Toyota has learned its lesson: don't sell cheap & outdated products in India. Even the mighty "T" badge can't save them.

Tata's latest compact sedan brings some Zest to its sales! The company sees a little improvement on both, the MOM & YOY charts. 3,800 is an average start, yet the number is showing a consistent climb since the car was introduced. Let's just hope Tata's marketing machinery doesn't let this sedan down, as it's been a traditional weak point within the company. Every other model from Tata's stable is a failure....from the Nano to the Aria and everything in between. Business Standard reported that the Manza's monthly tally is a shocking 130 pieces...what a devastating blow for an otherwise competent sedan. Even the Linea sells more than that! Clearly, it's the old Indigo that is bringing in orders from the taxi segment. Equally ironic is how rumours are floating around of the 2nd-generation car's (Manza) death, and not the 1st-gen (Indigo). Taxi business is also keeping the Indica numbers at 2.5K. The Safari + Storme see over 50% of the MOM numbers shaved off.

Ford loses numbers on the MOM as well as YOY comparos. Historically, at any given point in time, Ford India has had 1 product bringing in a majority of its sales. First, it was the old Fiesta, then the Figo, and now the EcoSport. For a competent well-priced car that generated so much hype & interest, I find it appalling that the EcoSport hovers between the 4,000 - 5,000 mark. What's more, only once in its lifetime (Sept '13) did the EcoSport cross the 6K level. The unusually long waiting period, price hikes & feature deletions show that initial interest was shoddily handled. The new Fiesta - as improved as its styling is - has bombed, and the ol' Fiesta isn't getting anywhere either. The ageing Figo is down to half of what it garnered in Nov '13. The new Figo & Endeavour (expected in 2015) couldn't arrive a moment too soon. Last month, Ford actually exported more than it sold locally -

related thread.

Chevrolet? Things are looking as directionless as they've always been. They're sleeping at the wheel! Of SEVEN cars in the sub-10 lakh segments, merely two sell over a 1,000...and only just. The Americans have lost a third of sales compared to Nov' 13, which were dismal to begin with. Just like we commented on the Santro, the Spark also appears to be on its way out as production levels are shrinking. Cruze - a favourite with many BHPians - falls hard & sees its poorest numbers in history. The company is keeping itself busy with mysterious engine changes when the customer hasn't even asked for one :

related thread.

Despite VW's strong brand pull, an aging model range & no new mass market cars are seriously hitting it. I'm pleasantly surprised to see the Polo near the 3000 mark though, as its average performance in the first 6 months of the year was 2,000 / month. The Polo is a well-rounded hatchback and now has good engines too. If only this 1.5L diesel was offered at the time of its Indian entry (instead of the notorious 1.2L diesel). The Vento's supplies are highly irregular, with 500 in one month, 1500 in another and then, 900 (in November). Seems to indicate that dealers are sitting on a pile of inventory and demand is poor. A forgettable month for the Jetta with 106 dispatches. Ignore the Passat's numbers. It's discontinued and what you see is the invoicing of old cars.

I'm just wondering which dimwit told Renault-Nissan that you have two struggling brands in India - Start with a THIRD!!! It's among the cheapest cars on sale, and still, the Datsun Go can't hold onto a bare minimum 1,000 sales. The tri-brand group has 11 cars in Indian showrooms, of which a single model has sold in the 4 digits (i.e. Duster). Everything else deserves to be put up in the hall of shame, that's how shoddily they were handled. YOY, the Duster loses a thousand sales. Compared to its monthly average in the year 2013 (4284 cars), 2014 (3322) sees it moving 960 units lesser each month. In comparison, the Terrano (monthly average = 1800) isn't able to hold a candle to its mechanically-identical sibling. Wondering what will happen to this group once the big boys (Maruti, Hyundai etc.) launch their compact SUVs.

Skoda is yet another sob story. After spending 13 years in India, and possessing a brand that many aspire to, Skoda sells less than 1,200 cars in India. Only saving grace is the new engine + DSG giving the refreshed Rapid some boost. I can't figure out the Octavia story: On the one hand, numbers are so poor, on the other, dealers claim long waiting periods for some variants. Is there actually a shortage of supplies, or is the company simply building small numbers? It's over a year since the car was launched, hence I'm not buying the 'imported kits & Indian allocations are limited' rubbish. Even if that was the case, why would the Octavia fall below a 100? On the other hand, relative to its segment, the Superb is doing alright. It's the only D2-sedan you can buy with a diesel.

Avventura came & went, so did the Linea Classic. The Punto & Linea - both - see a dip in their YOY stats. MOM, the Punto loses 50% volume. Don't expect any changes until fresh products arrive. Meanwhile, Fiat India is happy making 80% of its $$$ from supplying engines to others :

related post.

(36)

Thanks

(36)

Thanks

(45)

Thanks

(45)

Thanks

(27)

Thanks

(27)

Thanks

(18)

Thanks

(18)

Thanks

(36)

Thanks

(36)

Thanks

(2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks

(5)

Thanks

(5)

Thanks

(4)

Thanks

(4)

Thanks

. Status quo on both. What's truly remarkable is the new Corolla Altis' 4 digit performance....for the 2nd month in a row!! The Corolla has outsold all of its competitors combined. Clearly, it's hit the bulls eye in the D1 segment. These celebrations aside, numbers of the Liva & Etios are as lacklustre as their drab interiors. Toyota has learned its lesson: don't sell cheap & outdated products in India. Even the mighty "T" badge can't save them.

. Status quo on both. What's truly remarkable is the new Corolla Altis' 4 digit performance....for the 2nd month in a row!! The Corolla has outsold all of its competitors combined. Clearly, it's hit the bulls eye in the D1 segment. These celebrations aside, numbers of the Liva & Etios are as lacklustre as their drab interiors. Toyota has learned its lesson: don't sell cheap & outdated products in India. Even the mighty "T" badge can't save them.