Team-BHP

(

https://www.team-bhp.com/forum/)

NOTES:

1: Thanks to the team at

Management Punditz for sharing these sales numbers with us!

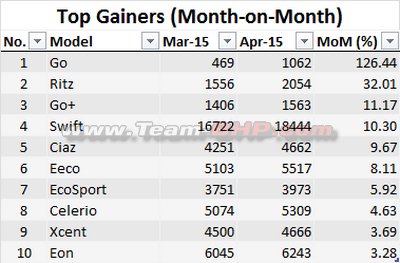

2: Only cars that sell 500+ units (and thus, the relevant ones) have been included in the gainers & losers chart.

3. These manufacturer-reported sales numbers are factory dispatches to dealerships. They are NOT retail sales figures to end customers.

Movers & Shakers

April - the first month of the new financial year - usually sees a dip in volume, because there is a flurry of activity in March from depreciation-seeking businessmen & companies. Still, 2.14 lakh dispatches is pretty good. Just look at last April and you'll see a near 20% year-on-year (YOY) jump. Things have definitely improved compared to 2014 which was an especially weak year. In terms of manufacturers, about half of them have recorded YOY growth (the ones that haven't are plain complacent).

There is no doubt that the big guys are getting increasingly aggressive with time. Collectively, the top 3 manufacturers control almost 75% of the market. The top 6 car makers (from Maruti to Tata) have a whopping 90% of the market between themselves. The remaining 9 brands (including global majors like GM, Ford, VW, Renault-Nissan) have to fight it out for the crumbs. Despite all their money, talent & products, 8 manufacturers have less than 2% market-share! I can tell you these underperformers are biting their fingernails when they're headed to global headquarters for annual presentations & reviews.

Going forward, Auto CEOs are a bit cautious, as the rural outlook isn't bright. 2-wheeler sales are the best indicator of the rural market, and they've been nothing to write home about in April.

Maruti gains a whopping 22,000 sales YOY - it has actually increased its market-share to 47% of the passenger car market. What's interesting is that, a majority of that growth has NOT come from the Alto which hasn't been able to sustain the mid-20 thousand levels (again, an indicator of poor rural sentiment). The Swift & Dzire continue their menacing hold over the market, and their sales are within an arms length of the far cheaper Alto. The old faithful WagonR closes the month with nearly 14,000 sales, while the petrol-only Omni & Eeco bring in a combined 12,000 (better YOY demand from commercial operators). On the other hand, the Ertiga has its lowest sales since Sept '13, albeit I think it's because of the upcoming facelift (production shift-over and customers waiting for the newer version). 7 months since launch and the Ciaz is doing rather well for itself. This is Maruti's first big sedan to taste success; it's holding on to the no. 2 spot in the C2 segment. Other than the AMT, the Celerio has nothing to make it stand out from the crowd. It's a conservative

neither-here-nor-there car. Keeping that in mind, 5,300 sales is respectable. The Alto AMT doesn't appear to have affected its sales too much. Don't forget, the Celerio diesel begins its dispatches this month. I'll be keenly watching the performance of Maruti's cheapest diesel car, and the only one without a Fiat diesel engine. A BHPian got his hands on one -

related post.

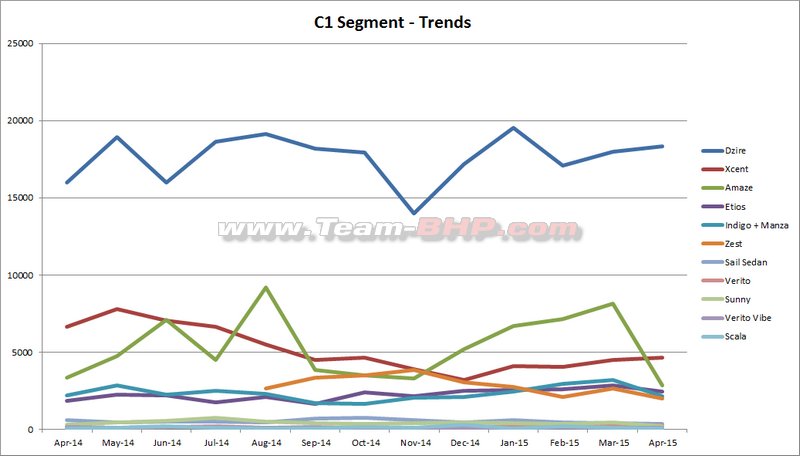

Buoyed by a fresh product range, Hyundai consistently sells between 37,000 - 39,000 cars / month now. It won't take much longer for the Koreans to cross the 40k mark. YOY growth comes in at 18%. Hyundai's most expensive hatchback is also its best selling product in India. Says a lot about the sheer competence of the Elite i20, and how engineers got the product absolutely spot-on. Over 12,000 sales for the 2nd month in a row surpasses Hyundai's own predictions! The Grand i10 delivers its usual 8,000 odd tally, while the Eon & old i10 chug along at 6k & 3k respectively. The Xcent sees its best numbers in 8 months, outselling the Honda Amaze, but 4,700 dispatches isn't impressive for a well-priced compact sedan backed by Hyundai's powerful marketing machinery. The Elantra witnesses a bump up in volumes due to a push of the 2015 updated version (Team-BHP report will be up soon). If we consider the last 12 months' sales, it's obvious that the Elantra has lost customers to the popular new Corolla. The Verna has gotten old. Its sales average of 2,336 / month (for the last 6 months) is a far cry from the 4,500 - 5,500 units it used to once manage easily. Product freshness is crucial in the C2 segment, and buyers see the Verna as long in the tooth (facelift notwithstanding). The Santa Fe is another weak performer. This SUV is one of my favourites, but it's not easy to make an Indian customer pay 35 big ones for the slanted-H badge.

Mahindra & Honda keep fighting over the final podium position. Mahindra takes it back in April, and by a big margin! That said, I doubt anyone is celebrating over at Mahindra headquarters. The company is facing two major threats: a weak rural market (where it derives a lot of its UV sales), and competition from the new breed of monocoque MPVs (Ertiga, Lodgy etc.) & SUVs (Duster, EcoSport etc.). Where Maruti & Hyundai have recorded a nearly 20% increase in YOY sales, Mahindra's numbers are identical. No growth, in a market that has gone up in size. The best-selling Bolero is flat year on year (9k is still admirable for such an old UV). The Scorpio remains a reliable performer, winning 4,700 customers in April. The XUV500 facelift couldn't be coming anytime too soon (

scoop pictures). Mahindra desperately needs it to make the XUV500 a consistent 3,000+ / month product again. Other than these 3 cars, Mahindra's portfolio only has failures....and there are 5 of them (Verito, Vibe, Quanto, Xylo & Rexton)! Mahindra realises that its over-dependence on two old vehicles (Bolero, Scorpio) is risky. Expect a minimum of 2 new UVs (including the compact S101) to be launched soon.

Not a good month for Honda. The Japanese company logs its lowest month in a year; clearly, Honda was stuffing dealer channels recently and it was time for some inventory clipping. YOY growth is merely 1,600 cars, and the MOM dip is a massive 10,000 cars. It's hard to put a finger on Honda's wild sales fluctuations. The City is the star performer, ending April with 8,200 dispatches. The Amaze goes through a steep decline to merely 2,862 units! April was its worst month in history. You'll see a lot of Amaze ads around, so clearly dealers are sitting on inventory pileup, which they want out the door before taking in new cars from the factory. Can't Honda ever plan its production in line with actual demand? Another one to see its worst sales ever, is the overpriced Mobilio. I insist this MPV had no right to be priced at such a premium over the Ertiga. 689 shipments means the Mobilio is now on ventilator support. The Brio remains the flop it always was. Not only customers, Honda itself gives the Brio a cold shoulder. Despite its new strategy of focussing on the sub-10 lakh segment, Honda must be feeling a sense of déjà vu... just like it was for the last decade, the City is the only car bringing in significant volumes. Period.

Toyota adds nearly 5k units YOY, but that's because it was just recovering from a lockout in April 2014. It's business as usual = 12,000 dispatches is about the average we've seen from the big T in the last 12 months. There is no stopping the Innova & Fortuner which rake in the moolah like no expensive UVs do. The Fortuner now costs between 25 - 33 lakhs on the road. 1,600 units? Wow. The new Corolla is no. 1 in the D1 segment by a mile, selling more than double of its closest rival. Some correction is being seen though, as it's the 2nd time in 3 months that sales have been in the 700 range. Not much to talk about with the Etios & Liva. They'll remain the laggards they are until the next-generation cars replace them. The Camry facelift has been launched and this time with better features & safety kit. Most likely, it'll settle down to the 60 - 70 average we saw last year. The Land Cruiser 200's price has inexplicably climbed to 1.5 crores on-road! People sure are buying a lot of them recently, I see 24 dispatches in March and another 13 in April. We've never seen these kind of numbers for the Land Cruiser. Perhaps, a hotel order under the EPCG scheme?

As our official reviews indicate, the Tata Zest & Bolt are a step in the right direction. Ever since the Zest was launched, Tata's numbers have been in the 5 digits. YOY, Tata sees a 38% increase in sales. That said, it's clearly not enough and no one should be expecting any miracles overnight. The journey to rebuilding Tata Motors will be long & arduous. Tata has a wide range of 9 products which cumulatively bring in 10,200 sales. Viewed independently, it's a different story, especially if you remember that the Indica + Vista sisters used to sell 10,000 a month (alone) at one time! The Zest has slipped below the 2,000 mark and sustaining the earlier 3k level doesn't look likely. The Bolt falls to a shocking 600 units, a victim of its over-optimistic pricing (

where is the Mayank Pareek magic?). If that continues, it's going to be branded as a flop in <6 months of launch. With the inconsistent quality, reliability & dealer network, Tata cut the branch it was sitting on. Once your brand name is damaged in India, a recovery is painful, if at all possible. Even though its products have improved, the brand simply doesn't make it to the consideration list of shoppers. Get this, the old Indigo + Manza outsell the new Zest, while the old Indica + Vista outsell the new Bolt! The Safari & Nano, both, see a further drop from their already weak sales, due to facelifts rolling out. Aria is going from dud to D-U-D.

At position no.7 is Ford. Whenever I see their numbers, the term 'missed opportunity' rings in my head. YOY, the American giant lost 1,600 sales. Damn, if you can't sell more than 3,973 EcoSports in a month, there is seriously something wrong with you. If this superb compact SUV had the backing of a Maruti or Hyundai, our roads would be seeing over 10,000 new EcoSports each month... effortlessly. Forget growing year on year, the EcoSport actually lost 40 sales. Every other Ford is a flop. As has been the case all through its Indian stint, Ford can only sell one product at a time (first the Escort, then the Ikon, Fiesta, Figo & now EcoSport). I shudder to think what'll happen to the compact SUV once the Figo Aspire is introduced.

Renault has increased its YOY sales by 20%. Reason is the Lodgy which starts off with 2,000 dispatches to dealers (this includes display cars). The Duster goes through a curious fall to 1,707 units (from its usual 3k level). Can't think of anything else, but the production line being altered for the Lodgy. Next month will provide a clearer picture. Hopefully, the Lodgy takes the

one-trick-pony stamp away from the French automaker. Each & every one of its other products is a fail. Just wondering why they bother making the Scala, when it can't even sell in the 3 digits.

VW increases its sales by 500 units YOY. I'm surprised at how they're able to keep the Polo above the 2,000 point, although it's a far cry from the 2,900 average managed in Q4 of 2014. Vento sales fell below the psychological 4-digit number for 5 months of 2014, and I have no doubt we'll see a repeat this year too. Both these products are too long in the tooth, no matter how timeless their styling may be. With lack of significant investments coming in from VW Germany, the short to mid-term future isn't bright. The Jetta walks along, unable to battle with the (resurgent) Octavia, Elantra & Corolla.

How do you go from a weak position to a weaker one? Just ask Chevrolet. But WAIT! You'll have to wake them up first :D. YOY, the Americans lose 35% in volume! After spending 20 years on Indian soil, and with 8 cars on sale, is this the best you can do? Each GM car in India is a failure. I'm just wondering how its dealerships manage to survive. GM India isn't making money either. It's one loss-making year after another.

Datsun outsells Nissan! The GO+ is seeing a consistent rise in sales, with April's 1,563 tally being its best ever. Who would've thought?! Additionally, the GO hatchback crosses 1,000 units for the first time in 6 months. It's still a flop, but interesting to see some renewed interest around the cheap hatchback. At Nissan, life must be simple. Slap your badge onto a Renault / Dacia and sell it as your own product (the Terrano). You'll get nearly 1,100 customers ready at the showroom. What about their own cars, the Micra, Sunny & Evalia? Time to RIP. Yes, I really mean it.

1.5 years after the Octavia's launch, Skoda finally decides to start supplying them to the market in adequate numbers. 300 is a nice number, the Octavia has never seen this, other than the time right after its introduction. The car is competent, so just as well. The Rapid suffers a fate similar to the Vento. In the D2 segment, there are only two cars left: The Superb & the Camry. A long 6 years since launch and the Superb still gets over a 100 customers each month, outselling the fresher Camry.

Fiat & HM-Mitsubishi? The former should stick with selling engines only, since it's clear that they haven't got a clue of how to move cars. I'm pleasantly surprised that the latter is able to sell over 200 expensive Mitsubishi Pajeros each month. The SUV must have a loyal following! It doesn't have a parent in India as such, yet outsells the likes of the Santa Fe, Rexton & Captiva. Heck, the Pajero Sport sells more than Maruti's Grand Vitara ever did.

Datsun Go+ is getting more sales than the Datsun Go! So buyers find the Go+ to be more value for money! People are actually considering those ridiculous third row seats or they are removing those seats for more boot space! May be for four adults and two kids the Go+ makes some sense. :)

Whats wrong with the Tata Bolt? Just 633 units for such a deserving car! :eek: Plus the number of Tata zest's sold is roughly 1900 where as with the same engine and less features Maruti managed to sell nearly 19,000 Dzire's! It clearly proves brand name matters a lot! Its more like buying a Maruti over a Tata rather than buying a Dzire over a Zest.

Thanks for this GTO. We're seeing your comments on the sales trend after a long time. Very interesting to read!

Honda never gets it right. Dealers are confused of what to expect and when. Seems the company has a mind of their own for pumping in the inventory! No wonder their dispatch figures are like a Yo-Yo, Up and down!

GM *sigh*, What are they doing? Better if the American HQ decides to donate money pumped into their Indian venture to some charitable institution. They willl earn some brand recognition then! :uncontrol

VW and Skoda: I don't totally agree that the products are only at fault. Improve your aftersales service by a huge leap, be transparent about your service and spare costs, give higher warranty on your overly complex products and see your cars flying out of the showroom!

Oh well, I won't write more. The opening posts says it all! :D

Great thread with the Analysis is a welcome change.

MSIL has again proved that why they are the leader in the Indian market. AMT, the Mild facelifts, C segment, MPV all seem to be doing good. Next will be the CUV's, the premium hatch,new turbo petrol engines re-powering their cars will be their grand plan to better the market share.

Hyundai is doing well with Grand i10, Elite, Xcent and now with Elantra.

Mahindra seems to be going good with Bolero, Scorpio and Thar. XUV numbers seem down

Fiat : It feels very sad to see sales figure of car like Linea moving down MoM. No mass segment car to excite the market. Maybe a JV with Suzuki will be a win-win situation.

Ford : It seems they are making business from past few months only on Ecosport and not at all interested in selling there other models. Aspire's success will depend on an aggressive pricing or else will go the Fiesta way.

Honda :Sudden increase in Mobilio and Brio last month is a clear indication of Honda clearing their inventory to the dealers - year end effect?"Brio and Mobilio seem to be duds. City clearly the leader in the C segment.

Renault : Nice to see Lodgy numbers, but i guess these must be shipped to showroom as a display unit.

Tata : Zest and Bolt are struggling for sales. Bolt seem 'dead on arrival' - too close a pricing to the segment leader -Swift

Datsun : Not bad in numbers for the negative publicity that was created in safety ratings

Skoda/VW: Will need to redefine their strategy - Sub compact sedan if it is a

notch-back could generate some volumes as pricing is expected to be premium and could create a new sub-segment. VW- All cars seem down MOM.

Guess Honda's resurgence was only for the previous month with sales plunging this time. Popular estimations of Honda taking over Hyundai's spot in a few years look more impossible than ever thanks to newer Hyundai models like i10 & i20.

Fiat is still among the last even after refreshed product launches. Will the turbo-Punto help? Given the increase in price for the bigger engine I'd say maybe just barely 10-20% more. New more exciting products needed.

Surprise pulled out by VW/Skoda who are playing to their strengths in the 8-15 lakh market even with mostly outdated products.

Suzuki has milked WagonR, Alto, Swift and Desire to their limits and it seems there is no sign of stopping them even now.

HM - going by the sales I really don't know how they are surviving.

Nissan/Renault the badge twins surviving mainly due to MUV segment.

Ford - true sales trajectory will be clear after launch of new Figo and Figo sedan.

Toyota - great products & reliability but design-wise not quite there yet, not to mention lack of features compared to competition.

Awesome analysis as always and a delight to read. Thank you ! :)

I am worried about GM now, not that I love the brand, but because as I own a Chevrolet Beat. I can vouch for the Beat being a good city car with its compact dimensions, good interiors, styling and mileage.

I can't fathom how the GM India folks show up in office each day with the steeply declining sales trends.

Personally, should I now start thinking about selling my Beat ? I am hoping Chevrolet Brand doesn't do an Opel and kill the already low resale value :Frustrati

The most-awaited monthly thread returns and with a fantastic GTO-special analysis in tow, after a long, long gap!

One HUGE fact standing out in the graphs - the Ciaz is head-on with the mighty Scorpio! Says a lot about the Maruti-Suzuki premium sedan, whose practicality and the MSIL badge has finally clicked with the buyers. Also, being 2nd in a very competitive C2-sedan segment is no mean feat, outshining the feature-rich Verna and the more competent European offerings. MSIL deserves a pat in the back.

Fluctuations in the Amaze numbers is worrying. Either the City is getting prioritised in the production lines (more profit margins might be at the fore here), or the lines are being freed for the upcoming Jazz. Honda needs to treat the Amaze a bit better - after all, it was THE car which propelled Honda's sales in India, specially because it was introduced with the wonderful i-DTEC mill.

Very happy to see Hyundai going strength-from-strength. The car company which exudes premium in all it's offerings is finally getting the market attention it deserves. The Elite i20 is a superb all-round product and that can be seen in the sales it commands - this despite Hyundai dealerships in fewer comparable numbers than Maruti-Suzuki. I won't be surprised if the Elite i20 (+ Active) numbers go past the Swift's numbers in the coming months!

Need an idea for a new thread? How about this - Renault and Ford milking their one-horse-ponies to the extent of being exorbitantly overpriced! Remember the launch prices of the Duster & the EcoSport? Compare them with today's prices, and you will realise how overpriced they have become, specially when compared to the competition. The segment will be wide open once the ACross and the ix25 enter the scene. Will be interesting to see if the Ford and the Renault compact SUVs be able to retain their monthly numbers once those two are launched.

Happy times ahead, despite car prices going northwards. I have a hunch this fiscal year will see more sales than last year, despite the removal of the excise cut. Major beneficiaries would be Hyundai (ix25 + i20), Honda (Jazz + City), Maruti (ACross + Celerio diesel), Mahindra (new UVs) and probably Ford (Aspire + new Figo) - pricing being the key.

Rated thread a fully, completely, highly deserving 5-stars!

1 question GTO.

Isn't an average of 2500 nos a respectable sales number for Etios? I mean other sub 4 sedans at better styling and cheaper price sell 3k to 4 k per month.

Agree that most of them here are cabs.

TATA has no one to blame other than their design team. It was too costly a mistake to bring out all new cars which bears similarity to older generation. However good Zest and Bolt be, in another 6 months both will become flops. I can't believe that energies are spent on making Scala, Evalia, Spark et al. Why bother with the stress! It would be interesting to hear what the top management brings out in defence of poor sales at annual meetings.

Such a detailed insight into the April sales with the analysis of contributing factors such as rural economy, 2 wheeler sales etc. Thanks for the big bang entry GTO! Loved reading your post!!

Elite i20 is a run away success!! Hyundai will now surely be proud to run 'almost' shoulder to shoulder against Maruti Swift!

Zest is such a beauty of a car! Wondering what else is required for the masses to take the plunge? The upcoming Ford Aspire compact sedan is a potential threat to Zest, Xcent and Amaze!

The Top 20 has cars from Maruti (nine entries) and Hyundai (five entries) in the prime positions. Its like The Beatles having four songs in the Top Ten Pop Music charts at the same time in the 1960's, in the U.K., USA and other western countries.:)

The Swift sometimes beats the DZire to peak at # 2 and the vice versa. Its sibling rivalry (metallic). The Maruti Ciaz has been accepted by the market and may repeat the success of its Esteem. They had missed the bus in the C segment since more than a decade. A large chunk of the Eeco's (with the Omni) sales come from the Mumbai taxi market and so also from other taxi markets.

The Hyundai Elite i 20 has become their best seller. Proves that re-packaging an existing product with chic looks pays.

Honda with its City and Amaze are too here perhaps for a long time to come. Only positions may change.

Sadly, Mahindra has only two entries - its proven Bolero and Scorpio.Both are old and RUGGED war horses. All its newer launches are out of the Top 20. The Xylo and the XUV 500 used to be here sometime back, but now thats history.

Toyota has only one entry with its Innova. The Innova is sustaining TKIL which would have otherwise become sick by now. The Fortuner and the new Corolla are no doubt successful, but its volumes are too low to be here in the Top 20. In fact, the Fortuner and the Corolla may not be in till India becomes a developed country. A poor image of the world's largest car maker, who are unable to introduce any acceptable B or C segment car in our market.

Ford struggles with its Ecosport here and this is keeping the company afloat. Their B and C segment cars are passe now. The Escort, Ikon and Fiesta in their prime years were favourites of many buyers. Somehow Ford has missed the bus in the B and C segment. Poor planning, strategies and marketing have played traunt.

Can we use the past tense for Tata Motors ? Its a great surprise that our homegrown Tata Motors do not have even a single entry in the Top 20. It is the sixth largest car maker in India but has no entries in the Top 20. Its like some political party getting a huge chunk of votes all over the country, but having very less winning candidates. Very poor showing by Tata ....

Another surprise exit is the Renault Duster. It sold well during its initial years but is now OUT of the Top 20.

| All times are GMT +5.5. The time now is 16:32. | |