| re: Residual Value Analysis of the luxury car segment (IBB report)

Quote:

Originally Posted by smartcat

Highlights:

1) Although luxury sales constitute 1% of total new car sales, searches are 7% of total volume - implying that luxury car buyers do significant amount of research online before buying

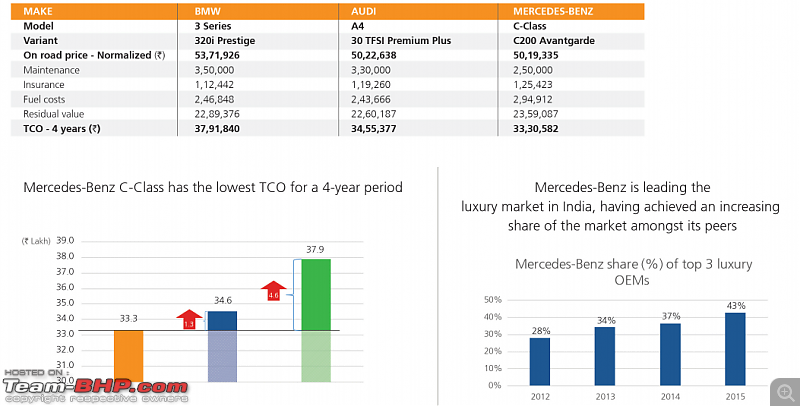

3) Mercedes 4 year service contract is 24% and 29% cheaper than Audi and BMW.

5) All three brands have roughly the same total cost of ownership (Mercedes lowest, Audi 1.3% higher than Merc, BMW 4.6% higher than Merc)

6) Mercedes marketshare has risen from 28% in 2012 to 43% in 2015.

|

Would be interesting to see, in %age terms how much the depreciation and maintenance would differ as compared to the more mass market cars.

Their TCO seems to be greatly impacted by the vehicle's residual values, of which BMW seems to be losing the most (but to be fair, their discounts are the highest too!)

Re the highlights:

1) This doesn't come as a surprise as these people are very well educated, and are keener on conducting research before spending so much money, as opposed to going on word-of-mouth.

3 & 5) This is a surprise - From our personal experience, and the situation a couple of years ago: the BMW is the cheapest to maintain, followed by the Mercedes, and then the Audi (E60 5 series, v/s w211 E Class, v/s current A6). However, number's don't lie - according to the website, Mercedes' C220d premium maintenance package works out to 2.xx L for 5 years including wear and tear items and consumables. Quite affordable if you ask me (5% of total OTR cost over 5 years).

BMW's position in this aspect is disappointing as they pioneered the maintenance package scheme in this segment with the BSI program (at a time when Mercedes didn't even offer extended warranty!)

6) Not surprising! BMW's have become the most expensive vehicles to buy (the E90 320D CE was the cheapest in it's segment post-discounts, and significantly so!), and don't have the looks or ride quality to match Audi and Mercedes. Plus, Mercedes has the charm to draw in a lot of buyers - ask any senior citizen and they will not even look at an Audi or BMW!

EDIT: Just thinking out loud how these new lighter Mercs/Audis/BMWs would fare were it not for the maintenance package. Our new c220d with 800kms on the odo is already rattling, and the passenger seatbelt sensor is a little wonky. Similarly, for our A6 (5 years and 35Kkm) - Audi wants us to pay INR 1.1L for the rear windshield blind motor which is making squeaking noises, and the car also had work carried out on the air suspension under warranty. BMW @ 8 years and 60KKm is still going strong with mainly wear and tear items needing replacement.

Last edited by lamborghini : 25th November 2016 at 12:40.

|

(11)

Thanks

(11)

Thanks

(6)

Thanks

(6)

Thanks

(3)

Thanks

(3)

Thanks

(5)

Thanks

(5)

Thanks