Team-BHP

(

https://www.team-bhp.com/forum/)

We have an email today from our company car lease team that we would be paying more. Eg: for a car with an engine that is more than 1200CC, the increase in monthly lease payment is close to 25%. They have given us the option to exit the lease.

Quote:

Originally Posted by quadmaniac

(Post 4214427)

|

Quote:

Originally Posted by quadmaniac

(Post 4222226)

|

There is no reply yet from the government on the plea by Lease plan companies on the transition of VAT to GST for existing lease.

Lets wait for government's reply/reaction - until then one need not worry i think. about double taxation.

Quote:

Originally Posted by DCEite

(Post 4222457)

There is no reply yet from the government on the plea by Lease plan companies on the transition of VAT to GST for existing lease.

Lets wait for government's reply/reaction - until then one need not worry i think. about double taxation.

|

I think it's not so simple. The GST rules apply from July 1st. And this government has decided to meet the lease companies on June 30th

:Frustrati

Which means that if they do not agree to input tax credit, it will be too late for foreclosure. Reason: foreclosing today attracts 14.5% VAT. Foreclosing on July 1st will attract 43% GST (for my class of vehicle).

If this is not :deadhorse I don't know what is.

Quote:

Originally Posted by vsrivatsa

(Post 4222797)

|

Shared it internally in my organisation. There is a lot of shock and disbelief among the folks who have opted for the lease program. I can feel their pain as for some EMIs have shot up like anything! Some are even going ahead with foreclosure.

But if this tax rate continues, will this be the end of car lease programs in private companies? Maybe the ruling class doesn't want an iota of benefit to the common man, and this was a pre-planned exercise.

Quote:

Originally Posted by Dry Ice

(Post 4225215)

Shared it internally in my organisation. There is a lot of shock and disbelief among the folks who have opted for the lease program. I can feel their pain as for some EMIs have shot up like anything! Some are even going ahead with foreclosure.

But if this tax rate continues, will this be the end of car lease programs in private companies? Maybe the ruling class doesn't want an iota of benefit to the common man, and this was a pre-planned exercise.

|

I did checked from my company lease providers -

three categories - and revised rates post GST -

small car + petrol = 28% + 1%

small car + diesel = 28% + 5%

SUV/Big Sedans = 43%

Its a big big impact on middle class. For higher income bracket, this would probably make no difference.

Quote:

Originally Posted by ptaneja

(Post 4225250)

I did checked from my company lease providers -

three categories - and revised rates post GST -

small car + petrol = 28% + 1%

small car + diesel = 28% + 5%

SUV/Big Sedans = 43%

Its a big big impact on middle class. For higher income bracket, this would probably make no difference.

|

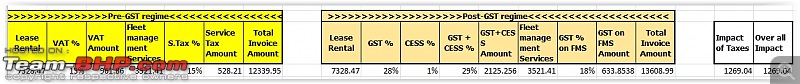

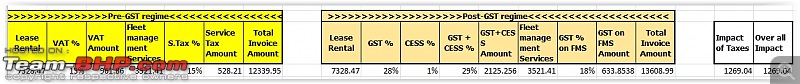

Here is what I got for my Celerio ZXI AMT -

I'm one of those running around to mobilize funds to foreclose today. I got to know from my company just this morning (the last date of pre-GST era) and was given an option to foreclose at existing ST rates. I own an SUV, and the GST rate is a ridiculous 43% tax on base rentals. From 14.5%, to 43%. Long live GST !!!

Most of my colleagues are in disbelief and really put in spot. Worst case, we have to bite the bullet and end up paying a ridiculous 43% tax on a depreciating asset.

To rub salt in the wound - The Leasing agency has sent a 'marketing' email to my company that with GST, the tax benefits on leasing car will increase since the overall EMI will increase !!! :Frustrati

Quote:

Originally Posted by harishpr

(Post 4226225)

I'm one of those running around to mobilize funds to foreclose today. I got to know from my company just this morning (the last date of pre-GST era) and was given an option to foreclose at existing ST rates. I own an SUV, and the GST rate is a ridiculous 43% tax on base rentals. From 14.5%, to 43%. Long live GST !!!

|

I am in same situation as yours. My car is 3 months old. It will attract 43% tax now. I was intimated on 29th June. I was not given any option of foreclosing the lease by my employer while intimating the change. I was just told that my EMI will increase.

I personally feel, rather than wasting energy with employer or leasing company, people should appeal government. The petition is a god start. I am personally raising a grievance with PMO. There is no news in media on rumored 30th June meeting. Hope that we are given a relief by the government.

Guys,

This is another major category where Corporate executives are rushing in their droves to foreclose existing car leases fearing a substantial increase in monthly payments once the goods and services tax (GST) is in place on July 1 due to the absence of any transition mechanism.

Major Cost impacts -

1. No transition credit for vehicles leased pre-GST

2. Cost of lease to go up by 30% due to GST and VAT difference

3. Industry demands for credit on excise duty paid

The Leasing companies are flooded with requests to foreclose the Car leasing contracts and have moved to either loans or purchased the cars outright.

Link -

http://economictimes.indiatimes.com/...w/59315191.cms PS: Mods, please merge this thread if found similar to any other

Cheers,

Amey

But looks like the cut-off for the fore-closure was 30-June, before the GST came into effect. They can still do it now, but the fore-closure amount will also be higher now. If they dont fore-close, they need to pay higher amount each month.

( A colleague is having to pay 3k more a month, for a Baleno ! )

Quote:

Originally Posted by condor

(Post 4228068)

But looks like the cut-off for the fore-closure was 30-June, before the GST came into effect. They can still do it now, but the fore-closure amount will also be higher now. If they dont fore-close, they need to pay higher amount each month.

|

True! The foreclosure date was 30th June' 2017.

Basically the Residual value plays an important role in the lease working and has the maximum effect on the 30% cost difference.

Anything old lease foreclosed after 30th June' 2017 will have a cost impact.

Cheers,

Amey

Quote:

Originally Posted by VaibhaoT

(Post 4227641)

There is no news in media on rumored 30th June meeting. Hope that we are given a relief by the government.

|

No point talking about foreclosure now that we are in the GST Era. I dont believe this topic was discussed on 30 June. The Leasing companies have requested for either a waiver or alignment to 18% which would be the nearest GST slab. The ask seems reasonable and would avoid the excessive 43% on existing Leases for SUVs and Large Cars.

It is still a wait and watch as of now but as per rules the Lease companies have to legally starting applying GST from July itself.

| All times are GMT +5.5. The time now is 19:49. | |