2019 by far, has been worst year for PV industry.

At the later part of 2018 the industry had seen the signs of a downward trend but that was considered due to the uncertainty in the political scenario owing to elections. But post that the spiraling downward trend even worsened towing to to several headwinds, like, fuel price hike, interest rate hike, insurance price hike, etc.

What is more serious is there is no clue when the downturn is going to end.

The Upcoming Emission norms was also cited as one of the reasons to slowdown but then we see MG Hector with a BSIV Portfolio shows no signs of slowdown.

Quote:

|

Despite having BS4 engine, every month, MG is able to sell more Hectors. It is largely due to very aggressive pricing, making it a great value for money offering. So new entrant instead of expanding the segment size, has eaten into competitor’s pie.

|

Reason of slowdown:

Quote:

|

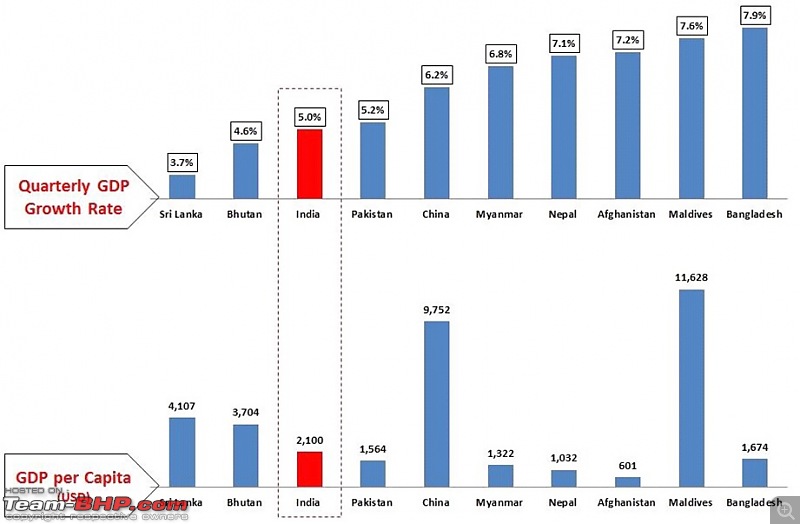

Indian economy is largely struggling with overall consumption-demand slowdown. This is clearly reflecting in quarterly GDP growth rate, which has nosedived since Q2 2018. Below illustration shows how PV growth rate follows the cues from GDP growth rate

|

Amidst a slowdown in economy, consumers are spending on need-based purchase and are mostly holding back on discretionary spending.

Quote:

|

Given the current state of manufacturing sector, Q3 GDP growth data will not be that good either. Recent Corporate tax rate cut may help companies to grow their bottom-line (profit) but may not help much with top-line (revenue).

|

Quote:

|

What is more worrying, is India losing its status of fast growing major economy. Global factors and trade-war has impacted many other global economies, but Indian economy is facing worse, than one can imagine.

|

2019 -the worst year for the PV industry

2019 -the worst year for the PV industry

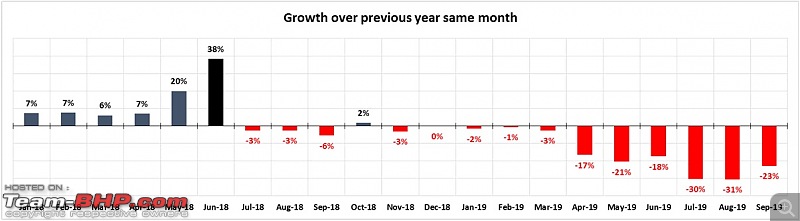

Growth Over Previous Years

Compare to Q1 & Q2, Q3 usually remains a lean season owing to monsoon. But due to financial and lending sector crisis, Q3 2019 has been in terrible shape.

All the progress made by the industry since 2014 has been completely reversed, for now.

Manufacturers:

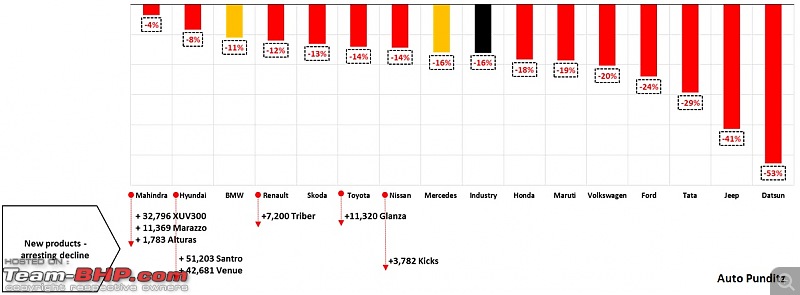

Manufacturers: All manufacturers are affected due to downturn, including luxury car makers. it is relative as some have to undergo little less pain, due to new product launches lined up for launch in 2019.

Body style:

Body style:

MUV : has shown some growth in otherwise struggling market condition

SUV : off- late it is also struggling

Hatchback : worse than industry

Sedan : unarguably in worse situation

MUV segment is growing :

MUV segment is growing :

Bigger, next-gen Eritga, with more powerful engine, has a very strong value proposition

What is also helping Ertiga and XL6, is clever price positioning in sedan’s territory

Link

Link

(5)

Thanks

(5)

Thanks

(5)

Thanks

(5)

Thanks