|

|

Originally Posted by dZired

(Post 5604870)

I have successfully paid for the next 2 years for my 22BH Nexon without any issues. Tax on my vehicle is now valid till 2026. Following are the steps for making the payment: |

|

Originally Posted by Fx14

(Post 5604927)

Is there no field seeking details of the current state where you / your workplace and the vehicle are now based? If so, the logic of the 2 year tax being passed to the State where the vehicle is transferred does not hold. |

|

Originally Posted by Axe77

(Post 5606621)

Did you have to resubmit any documents that demonstrate your current proof of eligibility for continued registration under BH? |

|

Originally Posted by Bhodrolok

(Post 5606777)

And then people wonder why some states are reluctant to allow private employees get BH registration? :disappointed |

|

Originally Posted by casnov

(Post 5609993)

But with BH registration if I am keeping the car for > 15 years for example, wonít I be paying more tax throughout the life of the vehicle? In the long run if I am not moving out of my state, then the current system of paying the life time tax even in a state like Karnataka where the tax is higher works out cheaper, isnít it? Or am I missing some nuance here? |

|

Originally Posted by casnov

(Post 5609993)

I have a question regarding paying the tax every 2 years. Currently when I pay life time tax in Karnataka, I am done paying tax for the rest of the life of the vehicle. But with BH registration if I am keeping the car for > 15 years for example, wonít I be paying more tax throughout the life of the vehicle? In the long run if I am not moving out of my state, then the current system of paying the life time tax even in a state like Karnataka where the tax is higher works out cheaper, isnít it? Or am I missing some nuance here? |

|

Originally Posted by casnov

(Post 5609993)

I have a question regarding paying the tax every 2 years. Currently when I pay life time tax in Karnataka, I am done paying tax for the rest of the life of the vehicle. But with BH registration if I am keeping the car for > 15 years for example, wonít I be paying more tax throughout the life of the vehicle? In the long run if I am not moving out of my state, then the current system of paying the life time tax even in a state like Karnataka where the tax is higher works out cheaper, isnít it? Or am I missing some nuance here? |

|

Originally Posted by casnov

(Post 5609993)

But with BH registration if I am keeping the car for > 15 years for example, wonít I be paying more tax throughout the life of the vehicle? In the long run if I am not moving out of my state, then the current system of paying the life time tax even in a state like Karnataka where the tax is higher works out cheaper, isnít it? |

|

Originally Posted by rakesh_r

(Post 5609998)

Road taxes are for 15 years, post which it would be green tax which one needs to pay while getting the fitness or registration renewed. |

|

Originally Posted by shantanumishra

(Post 5610005)

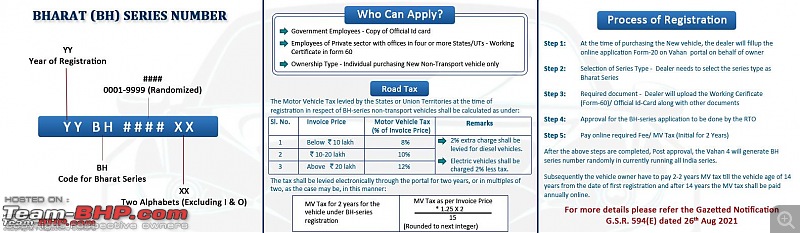

The BH tax slabs are different from state tax and its a fixed amount every 2 years. |

|

Originally Posted by dijkstraind

(Post 5610023)

Person A is saving more than 1.1 L in road tax and if you add inflation adjustment, then person A is saving a lot more. |

|

Originally Posted by ashwin.terminat

(Post 5610024)

For the XUV7OO - BH series for 2 years is Rs.26000. In Karnataka, the lifetime road tax was 4.5L. Hypothetically, if BH series needs you to maintain the same payment cycle even after 15 years, you will need to go 36 years before it finally becomes more expensive than KA road tax. :) |

|

Originally Posted by ashwin.terminat

(Post 5610024)

For the XUV7OO - BH series for 2 years is Rs.26000. |

|

Originally Posted by casnov

(Post 5610875)

How do I figure out this tax amount for any vehicle? Every dealer is still providing a price list with the lifetime tax. If I have to calculate this for any vehicle, how do I do that? |

|

Originally Posted by casnov

(Post 5610875)

How do I figure out this tax amount for any vehicle? Every dealer is still providing a price list with the lifetime tax. If I have to calculate this for any vehicle, how do I do that? |

|

Originally Posted by casnov

(Post 5610875)

Thank you guys for clearing that up. If you guys don't mind indulging me some more. I have a follow up question as below: How do I figure out this tax amount for any vehicle? Every dealer is still providing a price list with the lifetime tax. If I have to calculate this for any vehicle, how do I do that? |

|

Originally Posted by Travel Bright

(Post 5611148)

Using the portal link discussed above, once you select Delhi, it goes to Delhi transport website instead of path to pay BH vehicle tax. |

| All times are GMT +5.5. The time now is 02:57. |