| |||||||

| Search Forums |

| Advanced Search |

| Go to Page... |

|

| Search this Thread |  29,384 views |

| | #1 |

| BANNED Join Date: Oct 2011 Location: Hyderabad

Posts: 12,350

Thanked: 21,411 Times

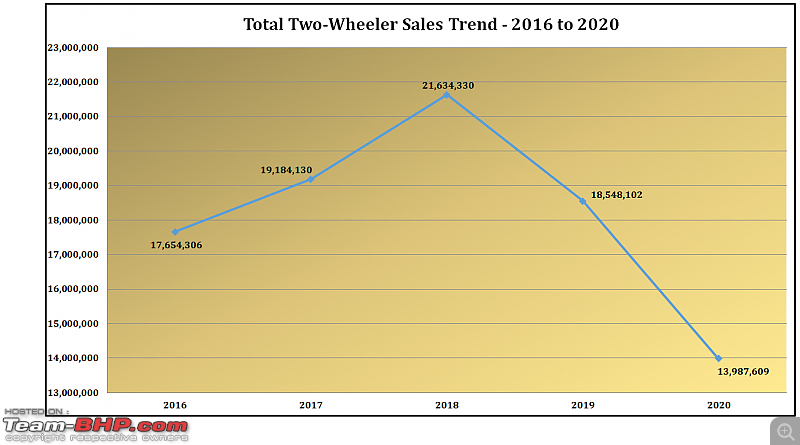

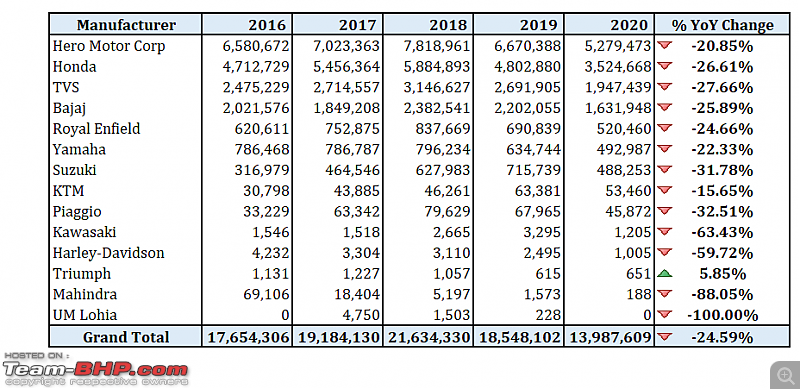

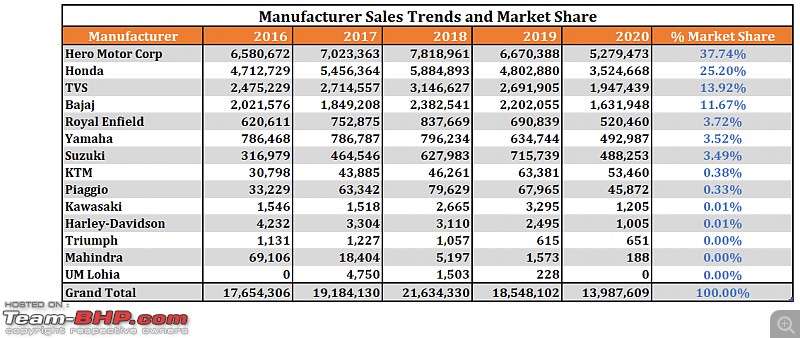

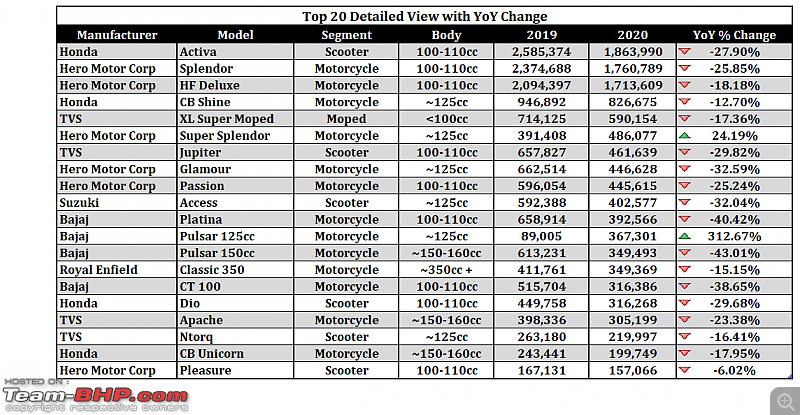

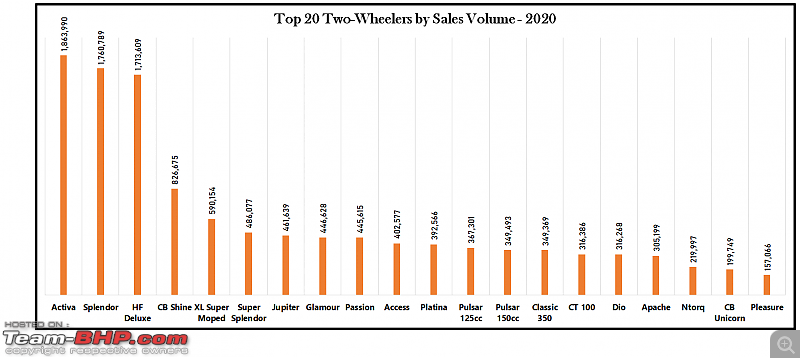

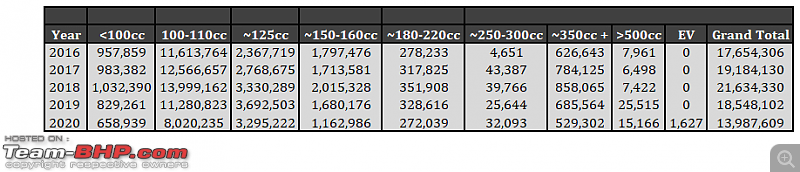

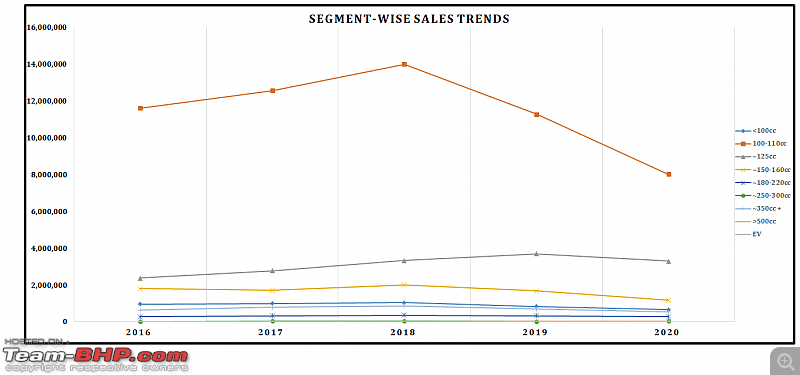

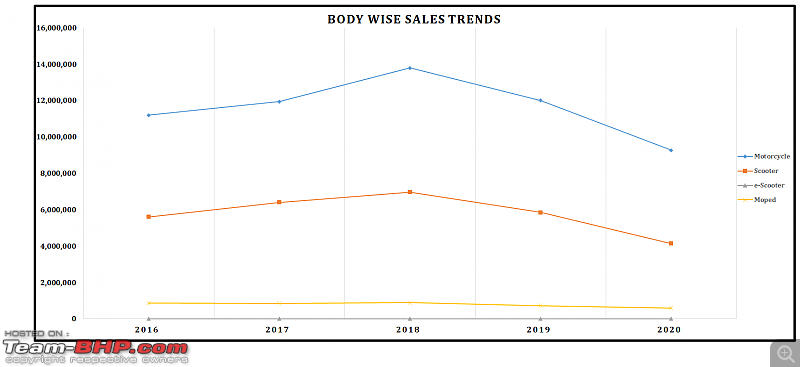

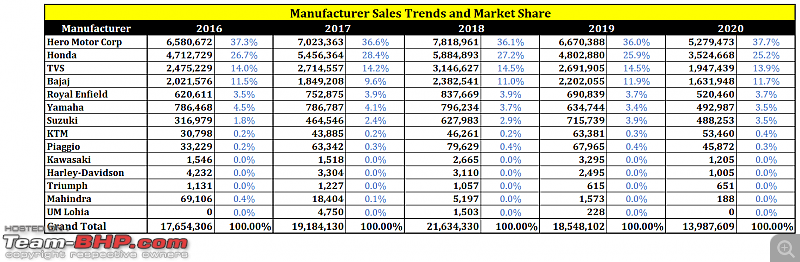

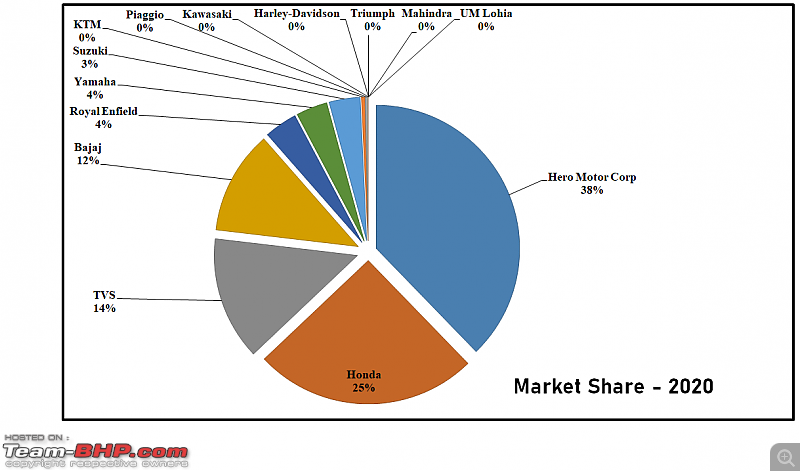

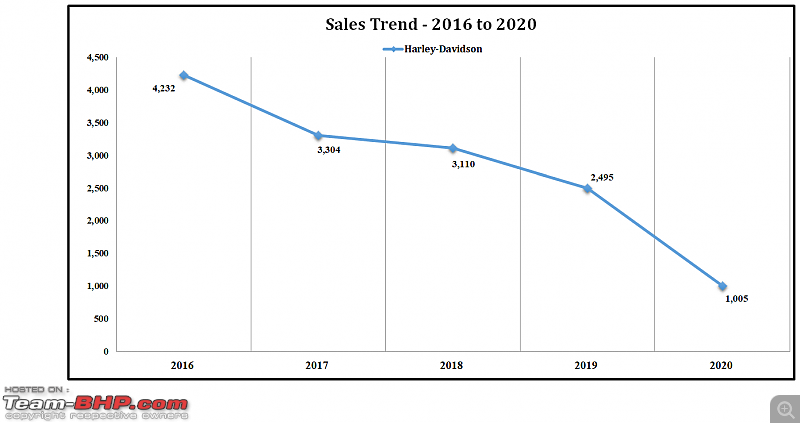

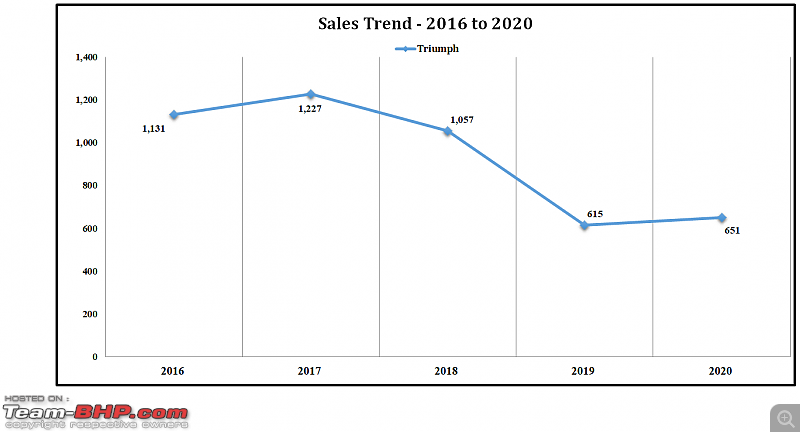

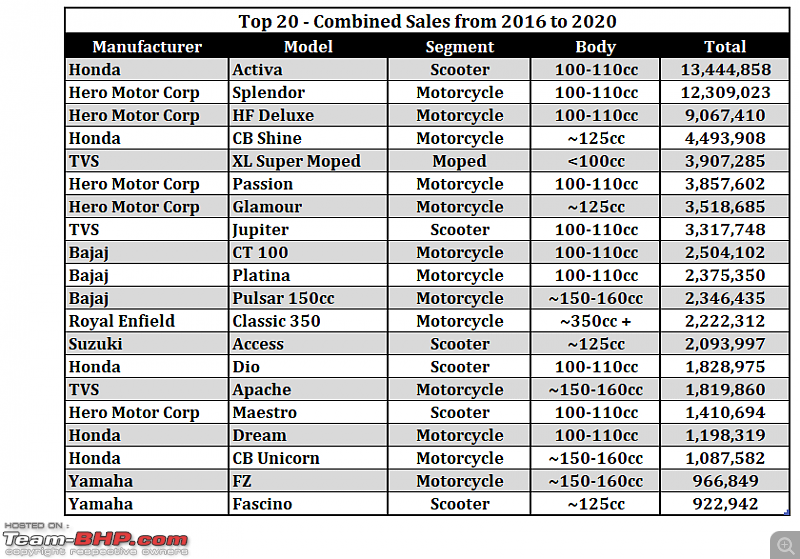

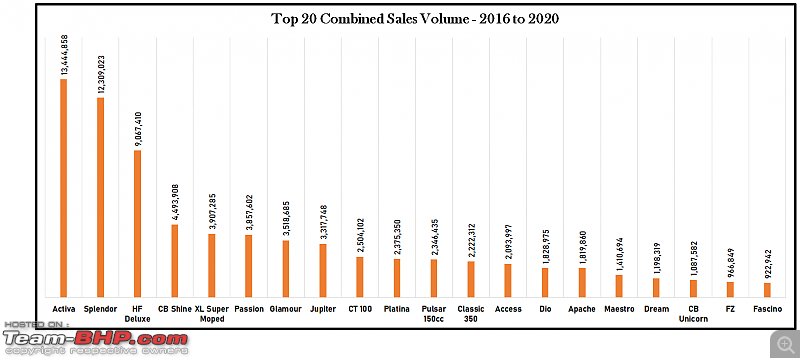

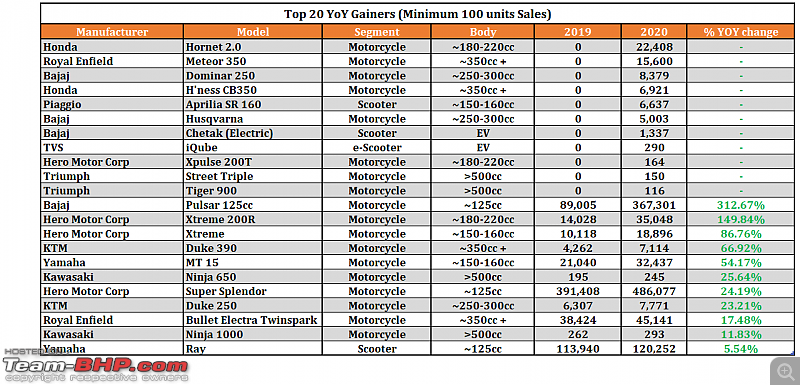

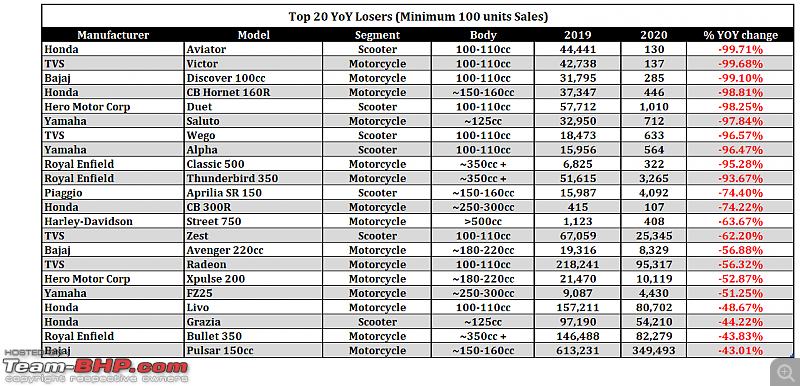

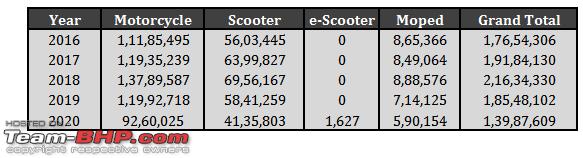

| 2020 Report Card - Annual Indian Two Wheeler Sales & Analysis! A consecutive drop in total sales since 2018 is similar to the trend shown by the four-wheeler sales too. From the year 2018 to 2109 the drop in sales was ~14% whereas from year 2019 to 2020 it was ~24%. Except for Triumph, the rest have witnessed a drop in YoY%. Honda Activa and Hero Splendor rule the charts as always. Bestsellers for their respective manufacturers helping them maintain the market share. Absolutely mind-boggling numbers YoY by both these vehicles which speaks of how reliable they are and have become the "first vehicle" in every household. Top 20 Combined Sales - 2016 to 2020 Table  Top 20 Combined Sales - 2016 to 2020 Chart  Top 20 Y-o-Y Gainers - 2020  Top 20 Y-o-Y Losers - 2020  PS:

Last edited by GTO : 15th March 2021 at 18:41. Reason: Adding link to https://www.autopunditz.com/ |

| |  (9)

Thanks (9)

Thanks

|

| The following 9 BHPians Thank a4anurag for this useful post: | AutoIndian, chinmaypillay, GTO, InControl, mh09ad5578, Researcher, sajaijayan, Slick, tchsvy |

| |

| | #2 |

| BANNED Join Date: Oct 2011 Location: Hyderabad

Posts: 12,350

Thanked: 21,411 Times

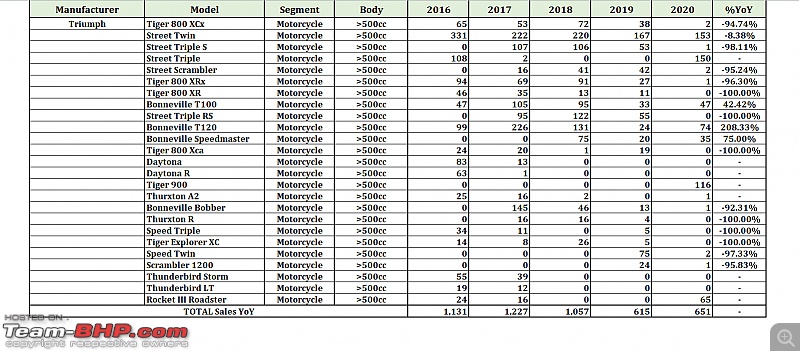

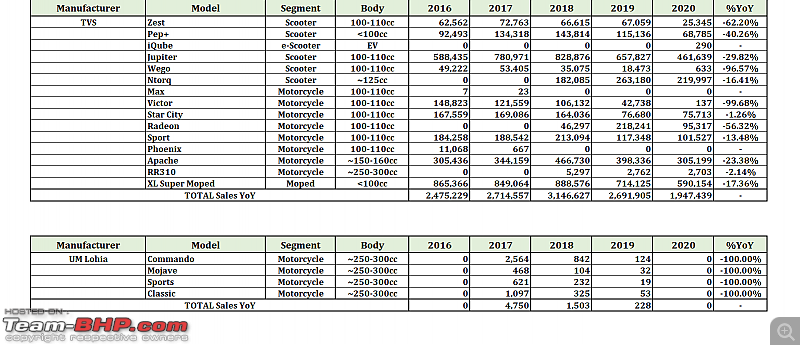

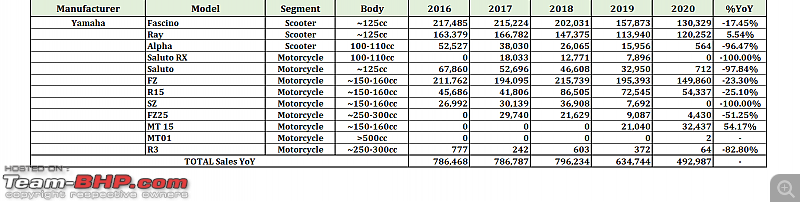

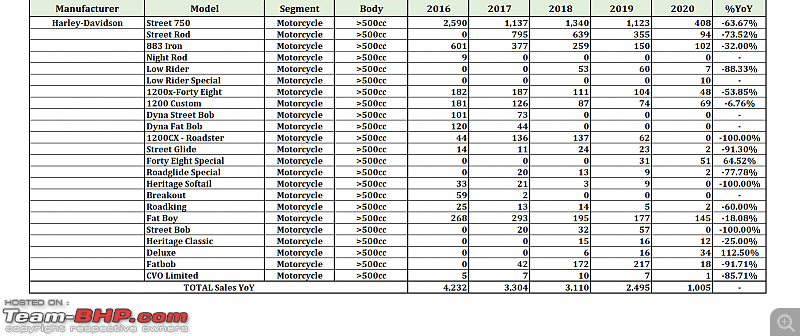

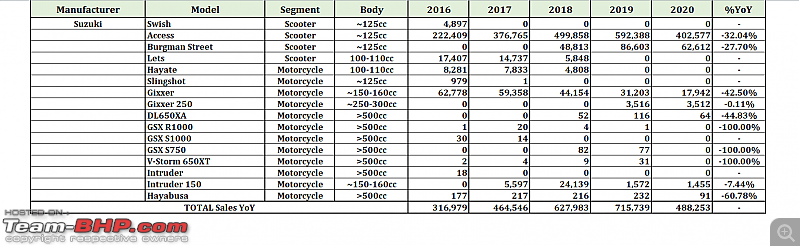

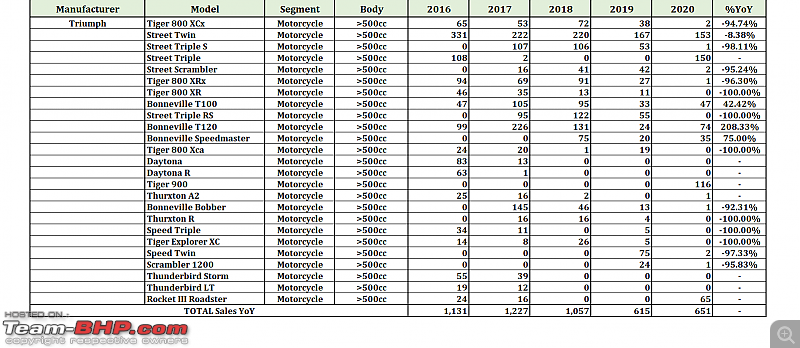

| re: 2020 Report Card - Annual Indian Two Wheeler Sales & Analysis! Here's how they fare individually (model-wise) Year-on-Year!Last edited by a4anurag : 13th March 2021 at 10:34. |

| |  (6)

Thanks (6)

Thanks

|

| The following 6 BHPians Thank a4anurag for this useful post: | GTO, InControl, Researcher, sajaijayan, Slick, tchsvy |

| | #3 |

| BANNED Join Date: Oct 2011 Location: Hyderabad

Posts: 12,350

Thanked: 21,411 Times

| re: 2020 Report Card - Annual Indian Two Wheeler Sales & Analysis!

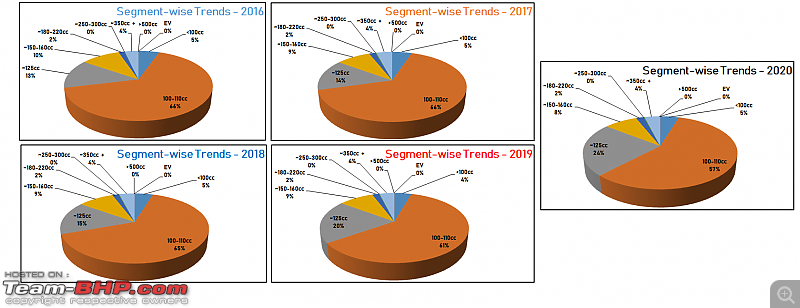

From 2016 till 2020, the top 3 contributors in the 100-110cc are well known to everyone i.e. Honda Activa, Hero Splendor and Hero HF Deluxe. In the ~125cc, it is held by Honda CB Shine, Hero Glamour and Suzuki Access. In the ~150-160cc segment top 3 are held by Bajaj Pulsar 150cc, TVS Apache and Honda CB Unicorn. In the ~180-220cc segment, Bajaj/KTM dominate the scene since in the first place it is Pulsar 180+200NS next comes Pulsar 220cc and then it is KTM Duke 200. In the 350cc segment, RE takes the win with a large margin having Classic 350 in the first place, Bullet 350 in second and Bullet Electra in third. In the ~500c+ segment, RE 650 Twins are the first place followed by Harley Davidson Street 750 and then Harley Davidson Street Rod. ---x---x--- Body-wise Trend Table  Last edited by a4anurag : 13th March 2021 at 00:07. |

| |  (5)

Thanks (5)

Thanks

|

| The following 5 BHPians Thank a4anurag for this useful post: | GTO, Researcher, sajaijayan, Slick, tchsvy |

| | #4 |

| BANNED Join Date: Oct 2011 Location: Hyderabad

Posts: 12,350

Thanked: 21,411 Times

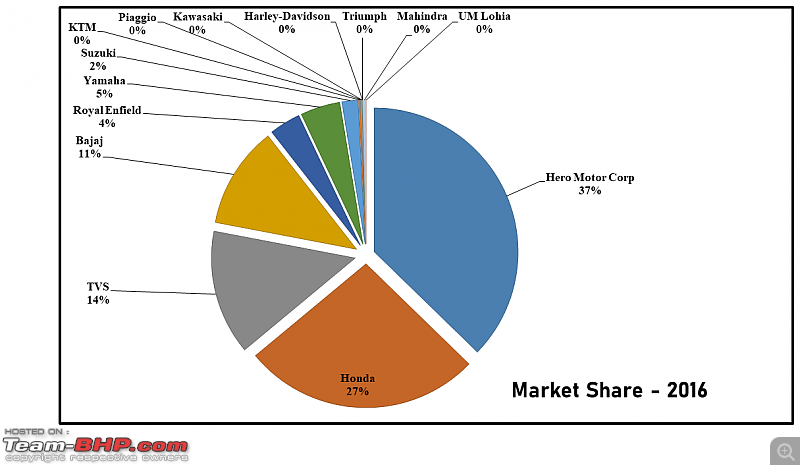

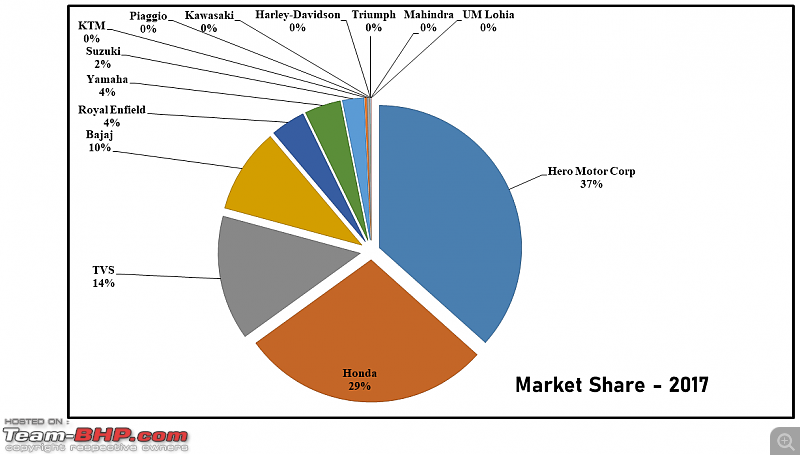

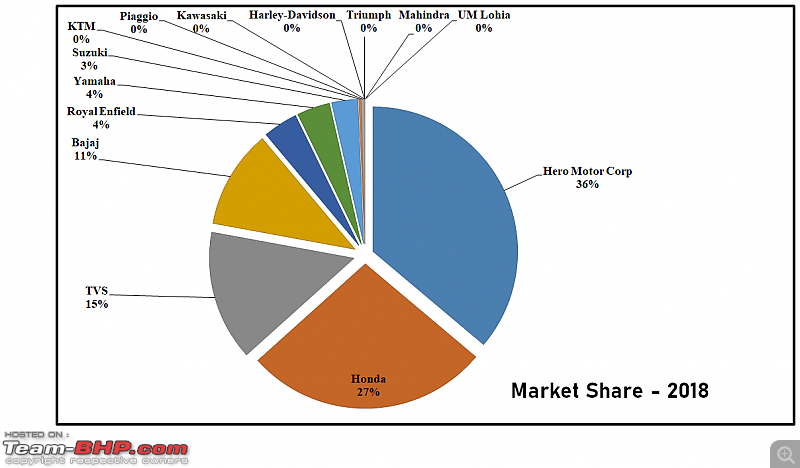

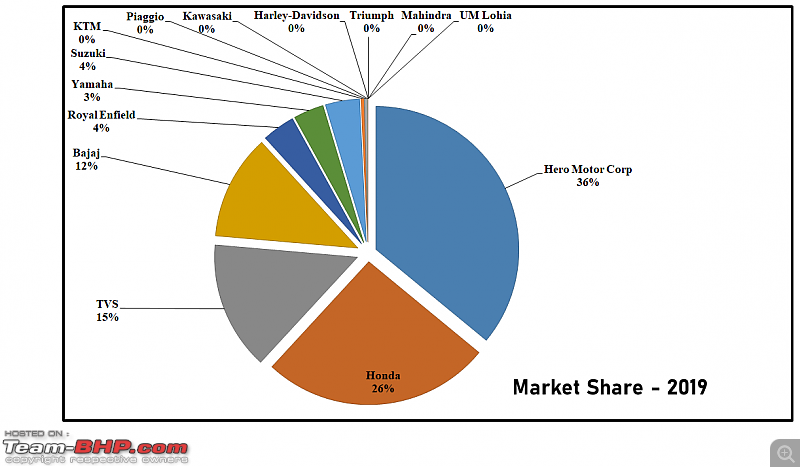

| re: 2020 Report Card - Annual Indian Two Wheeler Sales & Analysis! Looking at these numbers I can relate each of them with their comparable 4-wheeler manufacturer counterpart in terms of market share % held YoY (just for fun!).

Last edited by a4anurag : 9th March 2021 at 11:45. |

| |  (4)

Thanks (4)

Thanks

|

| The following 4 BHPians Thank a4anurag for this useful post: | GTO, Researcher, sajaijayan, tchsvy |

| | #5 |

| BANNED Join Date: Oct 2011 Location: Hyderabad

Posts: 12,350

Thanked: 21,411 Times

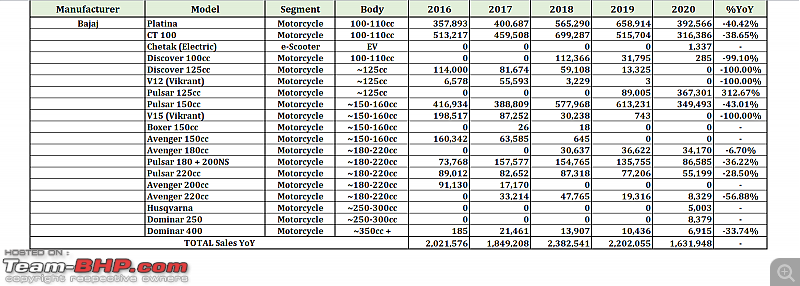

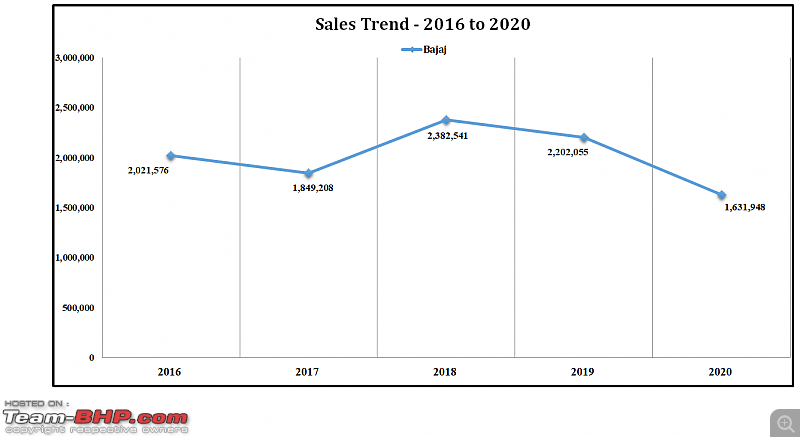

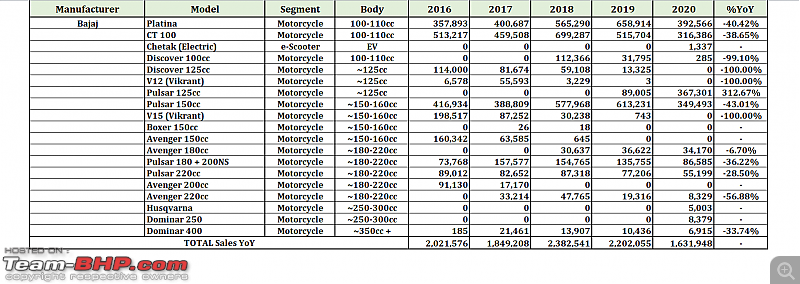

| re: 2020 Report Card - Annual Indian Two Wheeler Sales & Analysis! Placed at No.: 4 on the Top 10 list, Bajaj has closed the year 2020 with a total of 16.3 lakh units witnessing a drop by ~25% from 2019 numbers that were at 22 lakh units. Consistently YoY Bajaj is on position 4 from 2016 (data available from 2016) sitting below TVS. I feel Bajaj should stop the habit of releasing so many sub-variants of the same motorcycle and concentrate on getting one single bike proper in each segment and support the same at least for 3-5 years. A simple case of Dominar 400, an under-rated offering that just doesn't feel that it has been designed and manufactured by Bajaj. After the launch of the facelift, that bike has been hardly selling and to be honest Bajaj is the least bothered about the low sales - Peak sales were in 2017 (21.5K units) wherein in 2020 it is just 6.9K units. Platina (3.9 lakh units), CT 100 (3.2 lakh units), Pulsar 125 (3.7 lakh units) and Pulsar 150 (3.5 lakh units) were the top performers for Bajaj in 2020 getting the numbers in and maintaining that market share. Pulsar 180+200NS and Pulsar 220 were decent performers in their respective segments. Platina/CT 100 - The two bikes that Bajaj is dependent on plus it is in the segment which has the fiercest competition too i.e. from Hero Splendor, Hero HF Deluxe, Hero Passion and Honda Activa. I feel these bikes haven't been able to create that 'connect' with the masses that Splendor/Passion could manage. What could be the reason for this?! Platina contributes 24% to the sales Bajaj manages whereas CT 100 contributes 19%. Pulsar - This brand name is managing to pull the hearts of many even after so many years of launch and so many sub-variants of that bike. Pulsar 150cc has been a leader in sales in the 150-160cc with 3.5 lakh units in total in 2020 where the nearest competition is from TVS Apache (3 lakh units). So many variants on sale! For every 100cc there is one Pulsar available in their dealership. Overall the Pulsar range has a 52% share in sales in 2020 with a major contribution by Pulsar 125cc (22%) and 150cc (21%). Avenger - 4 models that I know of - Avenger 150, 180, 200, 220 with sub-variants in each like Street etc. None of them has been a terrific seller for Bajaj for long and just lingering on YoY. The Avenger 180cc has been managing 33,000 units on average YoY whereas the 220 variant is 27,000 units. The year 2020 saw 34,000 units of sale for the Avenger 180 and 8,300 units for the Avenger 220. Avenger range has a contribution of 2.6% in 2020 sales that Bajaj could do. Dominar - Their premium offering is ignored by the manufacturer itself. Priced pretty well (especially the 400) and loaded with features too. I still find it hard as to why people are NOT accepting this machine. Rides well and also adequate on power and FE too. Had RE not launched the 650 Twins, the Dominar 400 was the only option on my list. I don't have a liking towards Bajaj since long for their bikes due to poor quality and long-term ownership experience but the Dominar 400 was the bike that changed my attitude towards Bajaj. Spares are available and priced-well too but somehow it is barely selling MoM. Just shy of 7,000 units sale in 2020 for the Dominar 400, shameful! Just 0.9% is the contribution by the Dominar range (250 & 400) in Bajaj's sales. Had Bajaj focused its energy on marketing the Dominar without trying to play the 'Haathi mat paalo" logic with Royal Enfield, the Dominar could have got a decent run YoY for what it is capable of! I feel it is the number of sub-variants that Bajaj manages to launch is that dilutes the overall portfolio i.e. one new bike for every 100cc increment is not worth IMO and I pity the salesmen there at the dealerships to remember everything.  With my experience in dealing with 4 dealership's in Hyderabad when I had gone for the Dominar 400, 3 of them were lacklustre! No TD's available, cramped space, the SA's were least interested just happy selling CT 100 & Pulsar's to walk-in customers. Bajaj seriously needs to focus on maintaining the overall atmosphere at their respective dealership's and try to have a separate focus on the premium side too (just like how Honda is doing). Last edited by a4anurag : 13th March 2021 at 12:17. |

| |  (7)

Thanks (7)

Thanks

|

| The following 7 BHPians Thank a4anurag for this useful post: | GTO, InControl, mh09ad5578, Researcher, sainyamk95, Slick, tchsvy |

| | #6 |

| BANNED Join Date: Oct 2011 Location: Hyderabad

Posts: 12,350

Thanked: 21,411 Times

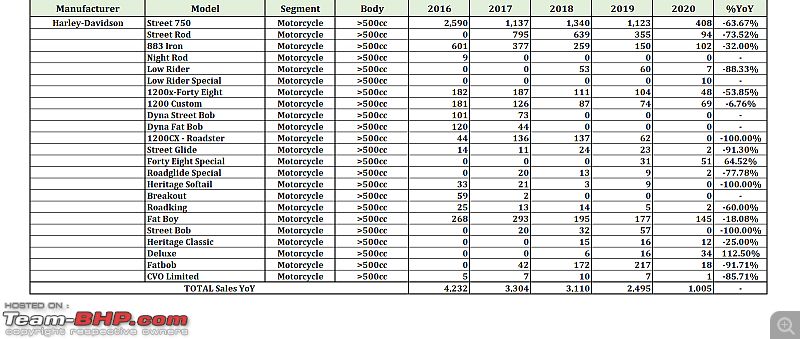

| re: 2020 Report Card - Annual Indian Two Wheeler Sales & Analysis! Last edited by a4anurag : 13th March 2021 at 01:08. |

| |  (4)

Thanks (4)

Thanks

|

| The following 4 BHPians Thank a4anurag for this useful post: | GTO, mh09ad5578, Researcher, tchsvy |

| | #7 |

| BANNED Join Date: Oct 2011 Location: Hyderabad

Posts: 12,350

Thanked: 21,411 Times

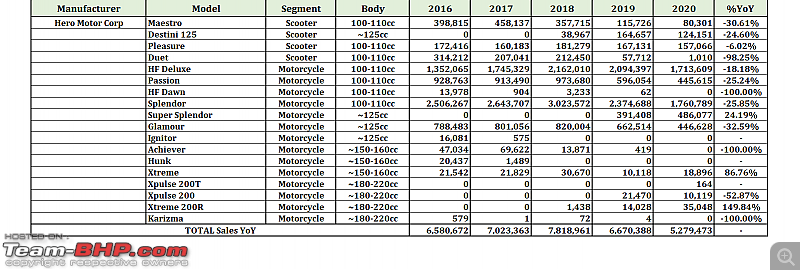

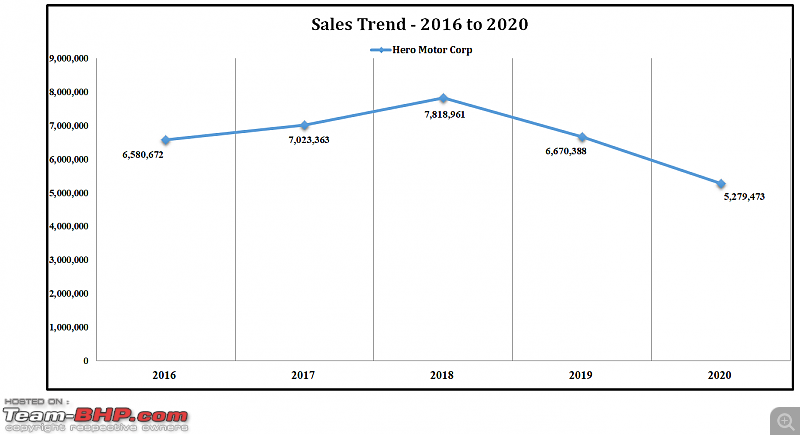

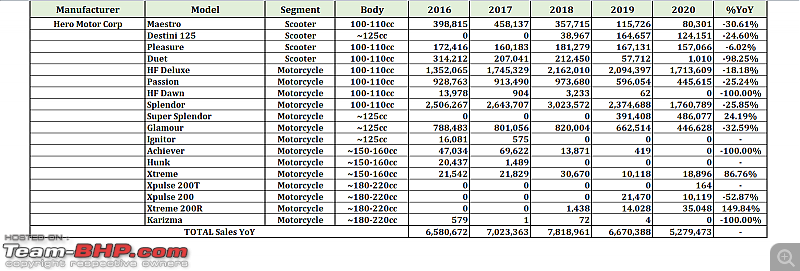

| re: 2020 Report Card - Annual Indian Two Wheeler Sales & Analysis!  The Maruti Suzuki of the two-wheeler industry (Sales number-wise!). The sheer numbers this manufacturer manages is literally every other manufacturer's dream - 52.8 lakh units in 2020 which is ~38% market share. Hero HF Deluxe's total sales in 2020 (17.1 lakh units) = Bajaj's total sales (16.3 lakh units) of all models put together, fascinating. I haven't brought in the rest to the list yet.  Motorcycles are Hero's forte without a doubt and that shows in the numbers too - 93% contribution whereas it is just 7% from scooters. Motorcycles are Hero's forte without a doubt and that shows in the numbers too - 93% contribution whereas it is just 7% from scooters. I personally thought, post-split from Honda, Hero will drop consistently YoY and find it difficult to survive in the market but I was wrong. Thanks to Splendor, Passion and HF Deluxe models in the lineup, Hero is soldiering well YoY. Hats off to the sales team who manage to churn out such numbers along with the manufacturing team who can keep up with the demand MoM. Even though numbers have dropped from 2019 but the market share has gone up actually by 1.78% thanks to many households running to dealership's to get one for themselves in this COVID-19 situation where public transport isn't preferred by many. Splendor - 100-110cc segment king and no other model comes close to this one from Hero. Riding the legendary success for a long time, this super-reliable, fuel-efficient, light, city-friendly motorcycle is every person's go-to name when looking for a 'first bike' at home or a commuter requirement. Shipping around 17.6 lakh units in 2020, Splendor has a 33.4% share in total sales that Hero managed in 2020 (12.6% contribution in the total two-wheeler sales in 2020). With the available data from 2016 till date Hero has managed to push out 1.23 crore units of the Splendor - unbelievable! This is the case even when the Splendor has witnessed a 25% drop in numbers compared to what it did in 2019 (23.7 lakh units). Super Splendor - It is their premium offering from the 'splendor line-up' range positioned in the 125cc segment competing with the likes of Honda CB Shine majorly. This model managed to reach 4.9 lakh units sale in 2020 contributing to 9% of the sales. One of the few models in the Hero line-up that managed to show a positive growth (up by 24%) compared to 2019. HF Deluxe - Another motorcycle that just sells happily MoM without any hiccups helping Hero in maintaining the market share. Priced slightly lower than the Splendor, this bike I feel is the king in the rural markets. With 17.1 lakh units in 2020, this models contribution is 32% in sales for Hero. Compared to 2019 numbers, a drop of 18% was observed. From 2016 till date total sales for this model has been in the tune of 91 lakh units. Passion - Priced slightly higher than the Splendor is the premium offering in the 110cc range holding an 8.4% share in sales by Hero. Not as fierce as the Splendor in terms of sales but performs well for the asking price in its segment. 4.5 lakh units sale in 2020 which means there is a drop in numbers by 25% compared to 2019. A commuter by heart but slightly polished and upmarket in nature. People who want a little bling can look towards the Passion where ones looking to merge into the crowd will go after the Splendor. Glamour - The 125cc segment companion with Super Splendor selling in similar numbers manged by Super Splendor. 4.5 lakh units in 2020 showing a 32% drop in numbers compared to 2019 numbers. Glamour is a pretty good bike for city use since it has an excellent low-end torque helping rider chug along in the city without heavy loss to FE numbers. Fells better built than Super Splendor and it comes equipped with Fuel injection (PGM-Fi). Xtreme - Hero's started off as a 150cc offering using the engine from Honda Unicorn could manage decent sales for its period but slowly lost grip when the competition went a lot ahead. Hero then went and launched a 200cc version of the Xtreme which has helped gain some numbers for Hero MotorCorp in 2020. The highest positive growth recorded in 2020 for Hero was for the Xtreme 200R at 149% selling 35,000 units for the whole year. Xpluse - Catering to the customer who prefers to go off-road etc Hero's offering has been accepted well by the targeted masses. The nearest competition is from Royal Enfield Himalayan. YoY is on the negative side at the loss of 52% over 2019 sales numbers. Karizma - Once a hot seller for Hero is now a dead model. It was both a city-usable one or to be used as a tourer. I have had one from 2009 till 2016 (26,000 kms) and still love when I get to ride it. That was IMHO the best offering in the 200+cc category when the bike was on sale having competition mainly from Bajaj Pulsar 220cc which sold a lot more than what Hero could manage in the later years. Karizma ZMR was not accepted well by the masses as they had for the Karizma and the Karizma R variants. Maestro/Pleasure/Destini 125 - Sort of a weak zone for Hero in the two-wheeler market. When it comes to scooter's it is Honda Activa that comes first on anyone mind. In all scooter sales in 2020, Maestro could manage 80,000 units, Pleasure did 1.6 lakh units and Destini 125 did 1.25 lakh units. 1.5%, 3% and 2.4% is their individual contribution to the numbers performed in 2020 by Hero. Last edited by a4anurag : 13th March 2021 at 12:16. |

| |  (6)

Thanks (6)

Thanks

|

| The following 6 BHPians Thank a4anurag for this useful post: | chinmaypillay, GTO, mh09ad5578, Researcher, sainyamk95, tchsvy |

| | #8 |

| BANNED Join Date: Oct 2011 Location: Hyderabad

Posts: 12,350

Thanked: 21,411 Times

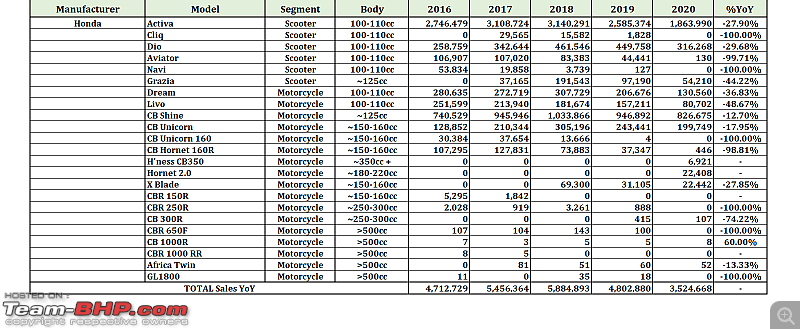

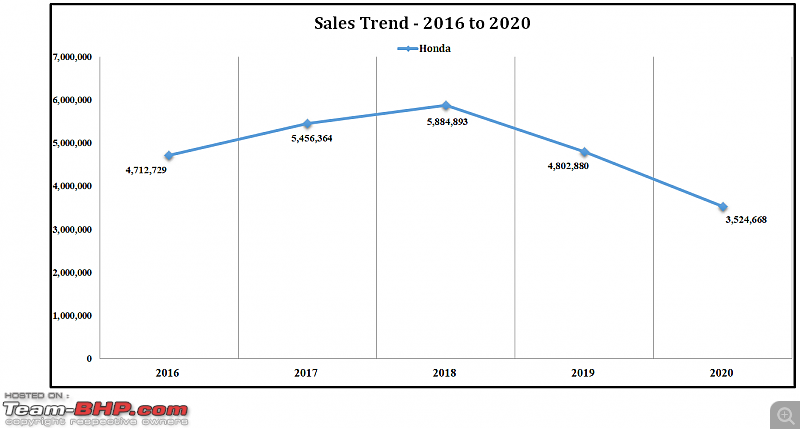

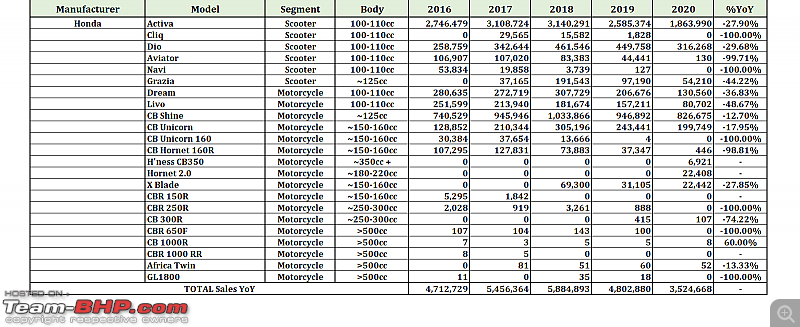

| re: 2020 Report Card - Annual Indian Two Wheeler Sales & Analysis!  The Hyundai of the two-wheeler industry (Sales number-wise!) Drop-in numbers by almost 12 lakh units compared to 2019, the market share drop was around 0.7%. Standing in 2nd position always below Hero MotorCorp, I relate it to Hyundai of the two-wheeler market (sales number wise). Crazy numbers as always and all that is made possible by two main models that help Honda to survive in India i.e. Activa and CB Shine. None of the models in their complete line-up has shown positive growth YoY compared to 2019. Honda literally survives in the commuter segment handled by the Activa and CB Shine in the premium commuter segment (125cc). Even the dealers are least bothered in customer treatment as they know these models will sell anyway so a lot of effort isn't required and their target customers know what they want hence enter the showroom with a firm mindset of booking the vehicle. Sheer numbers that Honda has been managing is mind-boggling and to match their selling pace is their manufacturing facility including their suppliers who must be the happiest MoM. I can see 10 models that are active in sales (excluding their premium offering) that helps Honda maintain that market share. With the recent launch of the BigWing concept where it is catering to customers of the premium segment in that separate showroom, their recent launch i.e. H'ness CB350 is doing well for its segment and time shall tell how well it maintains it's the position in the market. Activa - Highest selling two-wheeler in the Indian market AFAIK and is unbeatable YoY. Total numbers from 2016 till 2020 by Activa alone is a staggering 1.35 crore units. Every household name for a 'scooter' is Activa. Effortless, the fairer sex is happy to use one, easy for everyone to learn and use for errands plus keeping in mind current traffic conditions, gear-less scooters are a better choice than using a four-wheeler. 110cc is reliable and runs fine with regular services. The 125cc BS-4 version was a PITA and as expected it hardly moved off the showroom floors but off-late I am observing the BS-6 variant refresh of the 125cc variant is getting some attention. So many 'G' versions of the Activa have come up, it is a pain when visiting the spares market, the seller remembers thing by the 'G' version rather than the year.  Dio - Underpinnings from the Activa albeit different style of panels mainly targeting the youth. Pretty decent seller for its segment since the numbers are more or less consistent YoY. Dio contributes 9% of the total sales done in 2020 standing at 3.16 lakh units. Since everything underneath is similar to the Activa, there are no issues related to reliability or any such thing. Priced slightly more than the Activa and the funky body panels doesn't attract the crowd which Activa manages to. Navi - Mini-sized scooter that didn't do well for Honda. Sold lakh units in 2016 and 2017 but then onwards a steep drop in numbers losing YoY sales by 99%. In 2020, Honda managed to move 130 units. Had the engine from Activa again! Grazia - Upmarket 125cc scooter competing with the likes of TVS NTorq, Hero Destini 125, Suzuki Access, Burgman Street and Vespa. Not a great seller for Honda since the competition just dismisses this out of the list. To give an example in the 125cc scooter segment, the Access has managed 4 lakh units whereas the Grazia could do 54,000 units. 2018 and 2019 were great for this model as it managed 1.9 lakh & 97,000 units in those two years respectively. The year 2020 saw a 44% drop in numbers totaling the sales to 54,000 units. Honda couldn't manage to get that connection with the masses in this segment for the Grazia. Dream & Livo - Offerings in the 100cc commuter segment from Honda. The Dream Yuga has been discontinued in 2020 (IIRC) and I think the replacement was the Livo. Dream used to sell an average of 2.4 lakh units a year closing the tally for 2020 with 1.3 lakh units where the Livo averages 1.8 lakh units with closing the 2020 year with 80 units. Since this is in the same category as the Splendor/Passion/HF Deluxe, it is difficult for any other model to garner sales. I feel it is decent that Honda still manages to pull these numbers in this segment. CB Shine - 125cc motorcycle segment killer with large margin. Reliable, Fuel-efficient and easy to potter around in the city. Customers upgrading from scooters or 100cc segment who are looking for commuter-style bikes, pick the CB Shine. Loosing 12% sales over 2019 is still the leader in the segment at 8.2 lakh units for 2020. It contributes to the total sales for Honda in 2020 by 23%. Total sales since 2016 have been 45 lakh units. To put things in perspective, where the Shine managed 8.2 lakh units, Super Splendor was the next best-seller at 4.9 lakh units in 2020 - that's almost 50% difference. Unicorn - Honda's best offering in the 150cc segment that was a good seller since launch thanks to that smooth engine and gearbox delivery good FE and power on tap. Had a comfortable commuter-ish riding stance which was accepted well by the masses. Pulsar 150cc was its main competition other than the Hero CBZ/Xtreme. Off late, the bike has lost numbers since the overall design and features didn't keep up with the competition. Somewhere in 2019 (IIRC), Honda decided to launch a variant named CB Unicorn 160 replacing the 150cc with a 160cc one. Even after this change, not many takers were found for the Unicorn since competition is miles ahead and it was just not worth the price Honda was asking for the Unicorn 160. It closed the year 2020 with ~2.0 lakh units observing a drop by 18% compared to 2019. This bike contributes 5.7% of the sales Honda managed in 2020 averaging 2.1 lakh units a year. CB Hornet 160R/2.0 - Another decent seller for Honda in the 160-200cc segment. Competing with the likes of Yamaha FZ-S and Suzuki Gixxer, sales were pretty decent in 2016 and 2017 averaging 1.2 lakh units per year. After that the drop was consistent and in quarter 3 of 2020, Honda decided to launch the upgrade of the Hornet 160R naming it the Honda hornet 2.0 which got an upgraded engine i.e. 180cc and a host of other improvements. Only time will tell how well the masses have accepted this bike in its latest iteration. XBlade - Based on the Unicorn 160 underpinnings, it is a newer avatar with the same engine as well. Sold well in 2018 (69,000 units) but numbers have dropped to 22,000 units in the year 2020. After the BS6 version launch, the bike has been averaging 4,000 units a month. CB 300R - Launched in 2019, this is the street-naked bike was placed to compete with the likes of KTM Duke 390, BMW G310R, Yamaha FZ25 and Dominar 400. Didn't do well as expected as I think and was priced ~₹2.4 lakhs even though it was a CKD bike. For the asking price, people went for the Duke or RE 650 Twins. It managed 415 units in 2019 and 107 units in 2020. H'ness CB350 - Placed in a segment that is ruled by Royal Enfield with the Classic 350, this bike has been introduced to disrupt and take some market share from Royal Enfield. Launched in Q3 of 2020, so far has managed to sell ~7,000 units. A major competitor other than the Classic 350 is the newly launched Meteor 350. I can see one downside for this capable bike compared to the competition is the reach this two-wheeler has. Placed in the newly launched BigWing showrooms in the country, not many cities have a dedicated on ready yet to showcase the bike and start sales. Honda should have kept this bike in the regular showroom till the new BigWing showrooms get ready in all major cities so the customer is aware. Honda also launched the RS version of the CB350 recently. The coming months will tell how well the bikes has been received and will it sustain the numbers or not. For more information related to Super bikes and imported offerings from Honda, check the link for details - Link to the post. Last edited by a4anurag : 13th March 2021 at 12:16. |

| |  (6)

Thanks (6)

Thanks

|

| The following 6 BHPians Thank a4anurag for this useful post: | AutoIndian, GTO, mh09ad5578, Researcher, Slick, tchsvy |

| | #9 |

| BANNED Join Date: Oct 2011 Location: Hyderabad

Posts: 12,350

Thanked: 21,411 Times

| re: 2020 Report Card - Annual Indian Two Wheeler Sales & Analysis! Last edited by a4anurag : 13th March 2021 at 01:08. |

| |  (4)

Thanks (4)

Thanks

|

| The following 4 BHPians Thank a4anurag for this useful post: | GTO, mh09ad5578, Researcher, tchsvy |

| | #10 |

| BANNED Join Date: Oct 2011 Location: Hyderabad

Posts: 12,350

Thanked: 21,411 Times

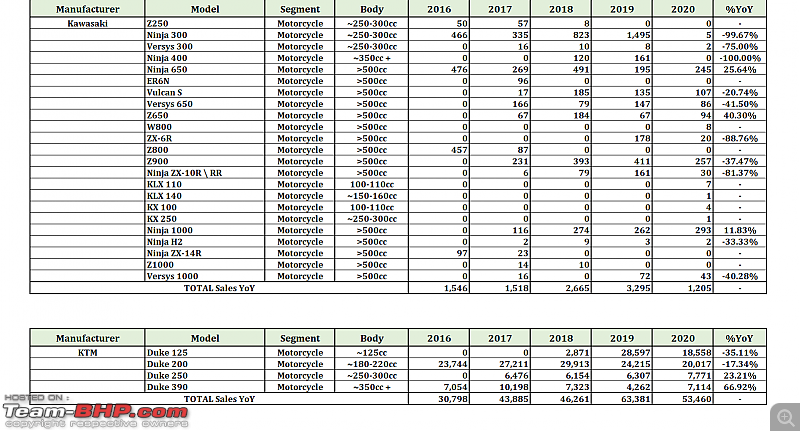

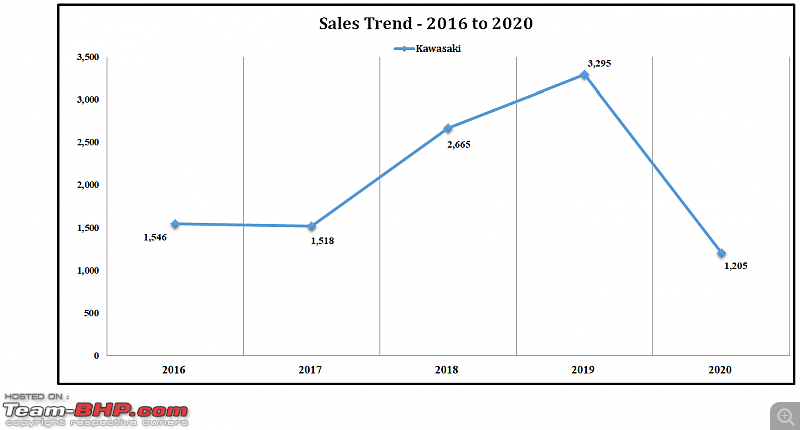

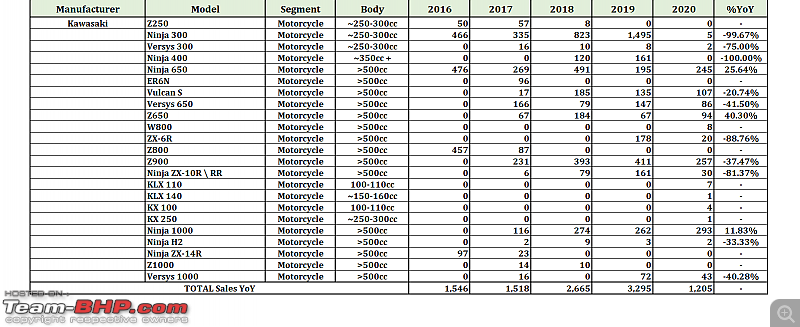

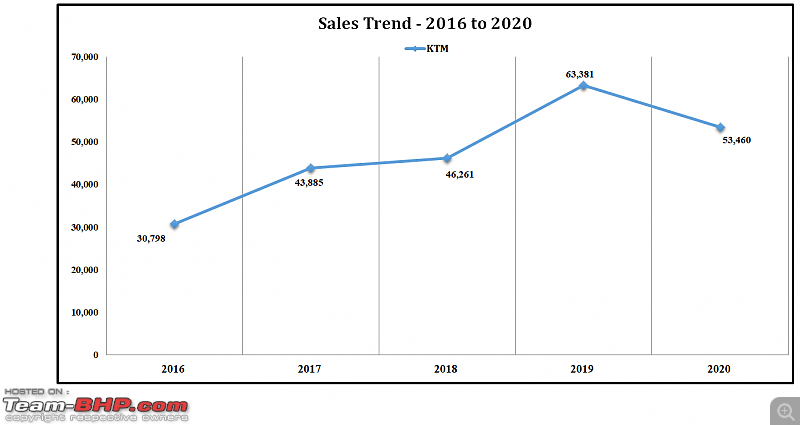

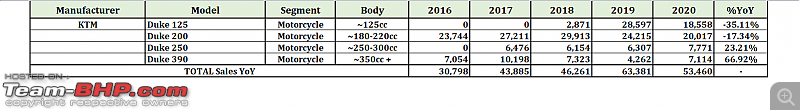

| re: 2020 Report Card - Annual Indian Two Wheeler Sales & Analysis! One successful brand that has a lot of following especially the younger crowd who mainly look for performance and handling as major attributes. Four engine options - 125cc, 200cc, 250cc and 390cc. Managed by Bajaj with separate showrooms placed near the regular Bajaj showrooms, the masses have loved their offering for the crazy power, speed and precise handling characteristics. I can say these bikes are benchmarks when it comes to power and handling. Sound and styling are two other factors that many bike owners try and imitate. Duke 125 - Majorly dominated by the commuter oriented motorcycles in the 125cc segment, the KTM Duke 125 feels premium and more focused on performance than FE and it does stand up to it without a doubt. Not a great seller in that segment but people who want performance and handling in this category and CANNOT increase their budget will go for the Duke 125 whereas motorists conscious of FE will look at CB Shine or Super Splendor. Closing the year 2020 with 18,000 units, this model has lost 35% sales over 2019. Duke 200 - Premium performance offering in the 200cc segment where sales have consistent YoY averaging 25,000 units a year. Though there was a drop in numbers by 17%, the tally for this model was 20,000 units in 2020. It is an important model for KTM since it contributes 37% of the sales obtained by KTM. Duke 250 - Competes with the Yamaha FZ25, Suzuki Gixxer 250, Dominar 250. It is a great bike for a buyer who wants the 390 but can't extend their budget to get the 390. Looks great, performs well and has similar characteristics to the 390. I can say this model is like a gap-filler between Duke 200 and Duke 390. In 2020 this bike managed a total sales of 7,700 units which says that there is a jump of 23% over the numbers in 2019 contributing 14% of the sales captured by KTM. Duke 390 - It was this bike that gave the masses a taste of what true performance with sharp handling was. A decent seller and one of the few bikes that have witnessed positive growth % YoY. Numbers grew by 66% compared to 2019 finishing the year with 7,100 units this year. The Duke 390 has a 13% share in the sales managed by KTM in 2020. Competitors that I can think of are - the Dominar 400, Himalayan, CB350 PS: I have kept this manufacturer separate from Bajaj so comparison/tracking is easier. Also regarding the numerous iterations i.e. the RC-series and the Adventure-series apart from the Duke-series, sales data isn't available except for the ones given in the table below hence all the above points etc are based on the available data from Autopunditz. Last edited by a4anurag : 13th March 2021 at 00:52. |

| |  (6)

Thanks (6)

Thanks

|

| The following 6 BHPians Thank a4anurag for this useful post: | GTO, mh09ad5578, Researcher, Slick, surjaonwheelz, tchsvy |

| | #11 |

| BANNED Join Date: Oct 2011 Location: Hyderabad

Posts: 12,350

Thanked: 21,411 Times

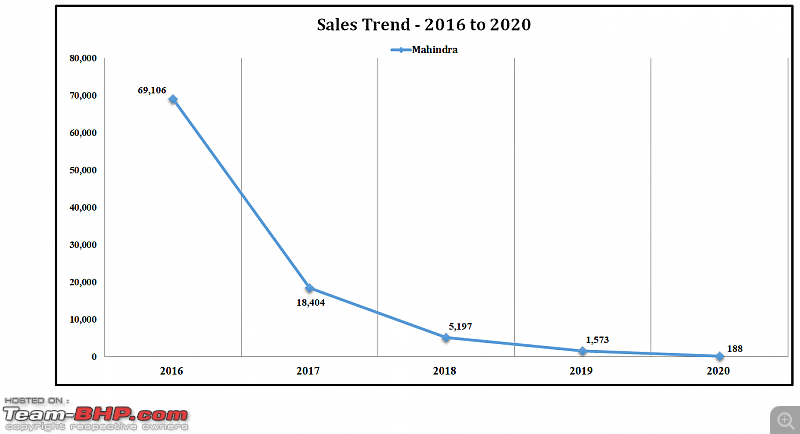

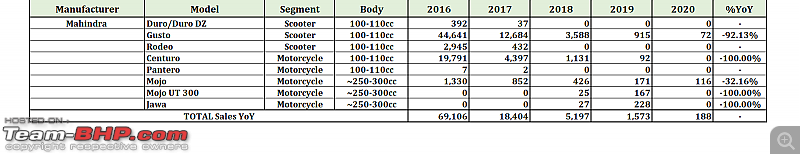

| re: 2020 Report Card - Annual Indian Two Wheeler Sales & Analysis! Nothing much to write here. Almost every model is 0. Not sure why Mahindra is not releasing numbers for the Jawa MoM. What is that they have to hide so much?! I see a lot of them on the road but MoM sales numbers are always '0'. Last edited by a4anurag : 13th March 2021 at 12:15. |

| |  (5)

Thanks (5)

Thanks

|

| The following 5 BHPians Thank a4anurag for this useful post: | GTO, mh09ad5578, Researcher, sainyamk95, tchsvy |

| |

| | #12 |

| BANNED Join Date: Oct 2011 Location: Hyderabad

Posts: 12,350

Thanked: 21,411 Times

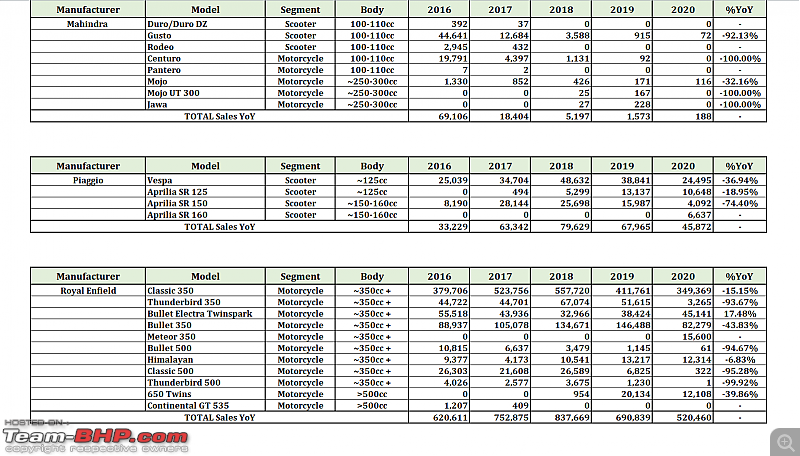

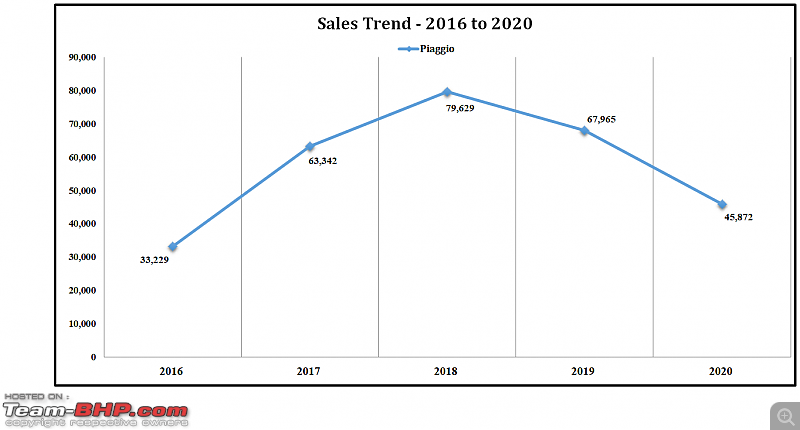

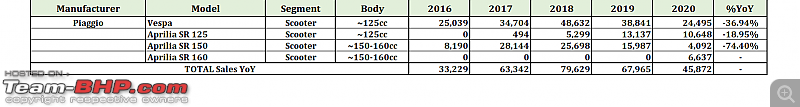

| re: 2020 Report Card - Annual Indian Two Wheeler Sales & Analysis! Scooter-only offering having Vespa on one end and the other is occupied by Aprilia. Most of them have been consistent sellers and the graph is almost on the positive side (i.e. climbing). This manufacturer has lost a total of 10,000 units compared to the total numbers obtained in 2019. If the average is taken from 2016 till 2020, it is around 58,000 units a year which is great since their offerings are on the premium end where prices are premium too. Neither is the Vespa cheap nor the Aprilia scooters. Vespa - Named on the legendary brand owned by Piaggio, LML was roped in after Bajaj gave up on the JV, LML manufactured the Vespa scooter. The sales ended in 1999 and the scooter was discontinued. However, in 2012, Piaggio relaunched this brand again in numerous variants in 125cc and 150cc segment. They start near the ~₹95,000 range going up to ₹1.36 lakh too. Looking at the price tag it is understood that the takers for these scooters will be on the lower side anyway. 25,000 units in 2020 which is a drop by 37% over 2019 numbers. Vespa contributes 54% sales of Piaggio in 2020. Aprilia SR-125, 150 & 160 - Performance-oriented scooters with large wheels, tight suspension tune, sharp styling and bold livery (graphics) is what all these three scooters display when one looks at them. SR 150 variant has seen the highest drop of 74% compared to 2019 numbers whereas the SR 125 witnessed a 19% drop closing the year at 11,000 units and 4,000 units for the SR 150 model. All three models combined contribute to 46% of the sales. Last edited by a4anurag : 13th March 2021 at 12:15. |

| |  (5)

Thanks (5)

Thanks

|

| The following 5 BHPians Thank a4anurag for this useful post: | GTO, mh09ad5578, Researcher, Slick, tchsvy |

| | #13 |

| BANNED Join Date: Oct 2011 Location: Hyderabad

Posts: 12,350

Thanked: 21,411 Times

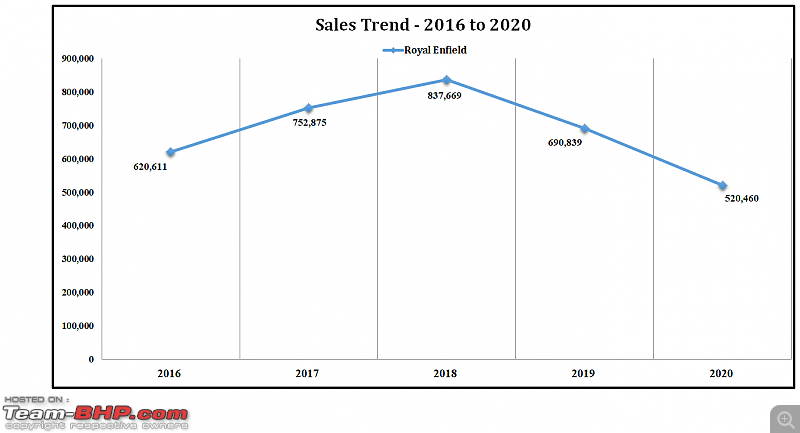

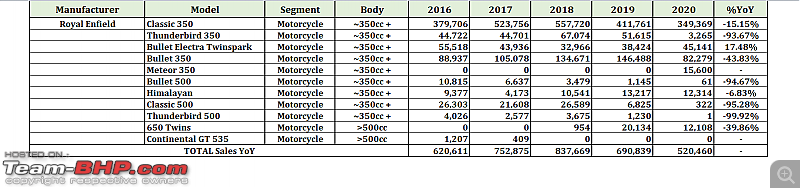

| re: 2020 Report Card - Annual Indian Two Wheeler Sales & Analysis!  At the 5th position in the chart of Market share % occupying 3.72%, it has been consistent for RE for 3 years but the sales number is on the negative side from 2019. Loosing 1.7 lakh units of total sales in 2020 compared to 2019, Royal Enfield needs to do something to remain afloat and hold on to that market share. New models are on the way and hopefully should do good for them in the coming months/years. Royal Enfield has discontinued the entire 500cc line comprising of Bullet 500, Classic 500 and Thunderbird 500 from the year 2020. So they currently have the regular 350cc engine along with the 650cc being in the Interceptor and GT. In the competition to Honda's CB350, Royal Enfield has offered the segment a new motorcycle called the Meteor 350, which looks similar to the Thunderbird series with a LOT of improvements. Classic 350/Bullet Electra/Bullet 350 - The cash cow for RE that sells a lot in its segment. No other vehicle in this segment comes close to the numbers this bike manages MoM. Closing the year 2020 with 3.5 lakh units sale has witnessed a YoY drop by 15% and has a contribution of 67% in the sales done by RE for the year 2020. It is the word of mouth and brand image that this bike enjoys making sales not much of an effort for the dealerships. It is the first upgrade people do from the 100-125cc segment once they have enough saving to splurge on. Silencer change is done as soon as delivery happens along with some minor accessories and the owner is the happiest of the lot. The Electra model has gained numbers from 2019 witnessing a positive YoY of 18% closing the year at 45,000 units. Bullet 350 has seen a total sales of 83,000 units in 2020 with a drop in numbers by 18%. Bullet 500, Classic 500 & Thunderbird 500 - Similar body and styling compared to the Classic/Bullet 350 albeit a powerful engine i.e. 500cc that sold pretty decent for that asking price. Out of the three, Classic 500 sold the highest YoY averaging 16,000 units per year. Since all these models have been discontinued, the numbers by the end of this year were 61 units, 322 units and 1 unit respectively. 650 Twins - Best offering from RE that just feels like it has been developed and manufactured by RE. Smooth, refined and a complete VFM in the performance category that other manufacturers are finding difficult to crack and sustain the sales. Both the models in this lineup i.e. Interceptor and GT have their own fans but overall the share is with Interceptor since it has a commuter-ish riding stance whereas the GT has a sports bike kind of lean that not many owners prefer. For ~3 lakh rupees the performance, ride quality, touring abilities are unmatched by any of the competition. Yes, power figures are on the lower side for this parallel twin but that is made by the ample torque that is available from the low-end RPM range making city driving or cruising on the highway pretty effortless. Meteor 350 - Latest kid on the block competing straight with the Honda H'ness CB350. This motorcycle can be called as the replacement for the Thunderbird 350 but the Meteor has a lot of changes done for the good be it in the chassis department or the engine. Improvements are visible and appreciated since it can cruise a lot better at the 90-110 kph range without vibrating all your bones and handling wise also has taken a turn for the good. Advertised as a cruiser and commuter for daily usage, it does fill in the shoes pretty well. Launched in the month of November 2020, the data captured in excel is just for two months and it has sold 15,600 units which are a lot higher than what the Honda's CB350 could. Remember the negative point that I had highlighted for the CB350, this is what I was trying to point out. Due to the limited number of showrooms available for the CB350, customers aren't able to lay hands on them whereas the Meteor 350 has a lot of more reach hence the sales too are on the higher side even though waiting periods are longer than usual. Last edited by a4anurag : 13th March 2021 at 12:15. |

| |  (6)

Thanks (6)

Thanks

|

| The following 6 BHPians Thank a4anurag for this useful post: | GTO, mh09ad5578, Researcher, sainyamk95, surjaonwheelz, tchsvy |

| | #14 |

| BANNED Join Date: Oct 2011 Location: Hyderabad

Posts: 12,350

Thanked: 21,411 Times

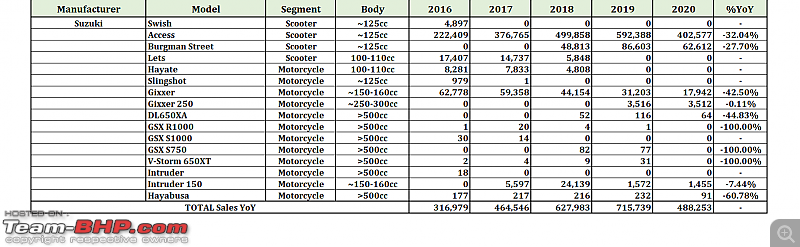

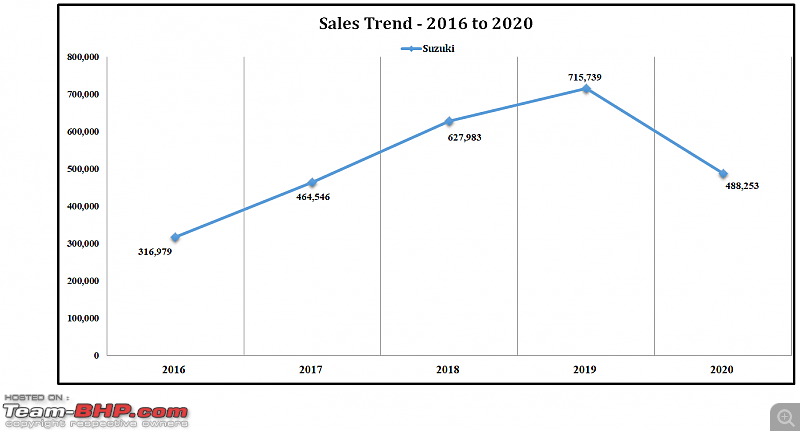

| re: 2020 Report Card - Annual Indian Two Wheeler Sales & Analysis! In the Top 10 list, Suzuki manages to be in the 7th position totalling sales to 4.9 lakh units in 2020. The graph has been on the rise from 2016 till 2019 but a drop in 2020 is alarming. Loss in numbers compared to 2019, is in the tune of almost ~2.3 lakh units. Suzuki needs to do something to stay afloat in the market else it is shut shop for them in India. Hardly two options in the market that sell well for them i.e. Access 125 in the scooter segment whereas Gixxer in the motorcycle segment. Rest all mediocre in terms of numbers. Neither the commuter segment sells well nor their premium offerings. Access 125 - Bestseller in the segment by a large margin. 4.1 lakh units in 2020 is the highest in this segment where the nearest competition given by TVS NTorq is at 2.2 lakh units which are 50% lagging in numbers. Rated as the best scooter in the 125cc segment, nothing really comes close to this in any attribute. Simple styling, well-tuned engine and suspension keep all kind of riders happy. A frugal engine delivers performance and FE without any issues. Build quality or materials used to build the scooter are of high quality excluding premium feel and doesn't degrade over time. I have seen many who are happy with the Access over the regular selling scooter i.e. the Honda Activa. Even the fairer sex is happy with this scooter since it has a slightly larger foot-board and under-seat storage compared to the competition. Access contributes 83% of the sales done by Suzuki in 2020. Burgman Street - With a different body but the same underpinnings from the Access 125, this scooter has been inspired by the 'Maxi-Scooter' styling. Angled foot-board, makes it a bit spacious for the rider to place his/her legs comfortably making everyday riding easier. Based on the Burgman 400/600, this scooter sells decently in its segment. At ~63,000 units, this model has witnessed a drop of 27% over 2019. Since the engine, suspension, chassis are the same as the Access, reliability or driveability has never been an issue. Even though the 125cc engine feels small for this body size, it doesn't struggle when on the move. Gixxer 150 & Gixxer 250 - Seeing the success of Yamaha's FZ series, Suzuki decided to capture some market share in this segment by launching the Gixxer 150 and Gixxer 250. Combined they sold ~22,000 units in 2020 contributing to 4.4% of the total sales for Suzuki. A comfortable riding stance, good handling and a peppy 150cc engine makes the Gixxer 150 a great scooter in its segment but isn't a fierce seller. The Gixxer 250 was their offering in the 250cc segment dominated by Duke 200 & Duke 250, Dominar 250 and TVS Apache RTR 200. Gixxer 250 managed 3,500 units in the whole of 2020 witnessing a drop of 0.1% over 2019.

Last edited by a4anurag : 13th March 2021 at 12:14. |

| |  (4)

Thanks (4)

Thanks

|

| The following 4 BHPians Thank a4anurag for this useful post: | GTO, mh09ad5578, Researcher, tchsvy |

| | #15 |

| BANNED Join Date: Oct 2011 Location: Hyderabad

Posts: 12,350

Thanked: 21,411 Times

| re: 2020 Report Card - Annual Indian Two Wheeler Sales & Analysis! Last edited by a4anurag : 13th March 2021 at 01:09. |

| |  (7)

Thanks (7)

Thanks

|

| The following 7 BHPians Thank a4anurag for this useful post: | GTO, mh09ad5578, Researcher, sajaijayan, Slick, tchsvy, tsk1979 |

|