Team-BHP

(

https://www.team-bhp.com/forum/)

Hello Experts,

Is there any way I can switch my regular mutual funds to direct mutual funds without considering it as a sell and buy order so as to save a tax on gains?

Quote:

Originally Posted by SmartCat

(Post 5018755)

Historically, overnight funds have returned 6.5% pa over a long term.

|

Thanks SmartCat for the response. When speaking specifically of overnight funds, what is considered normal duration to park the funds? Is it data/weeks/months/years?

When you say “long term” what duration are you talking about?

Also, can you please give me the names of such funds that have returned 6.x% for my research purposes?

Quote:

Originally Posted by pandey.jai

(Post 5018802)

Thanks SmartCat for the response. When speaking specifically of overnight funds, what is considered normal duration to park the funds? Is it data/weeks/months/years?

|

It's up to you actually. You can hold for for a month or you can hold it for 10 years. Depends on the purpose of parking funds there. For eg: if you are looking for absolute safety, you can keep funds here forever. If you want slightly higher returns, you can ignore overnight funds altogether and invest in liquid funds instead. Historically, liquid funds have returned 0.5 to 1% pa higher returns than overnight funds.

Quote:

When you say “long term” what duration are you talking about?

|

Last 10 year returns from overnight funds are 6.5% pa. But this is the past. Future might be different, depending on interest rate scenario.

Quote:

Also, can you please give me the names of such funds that have returned 6.x% for my research purposes?

|

List of overnight funds:

https://www.valueresearchonline.com/...r&tab=snapshot

HDFC/SBI/UTI overnight funds have been around for almost 20 years. Look up its historical/since inception returns.

Quote:

Originally Posted by sushantr5

(Post 5018788)

Hello Experts,

Is there any way I can switch my regular mutual funds to direct mutual funds without considering it as a sell and buy order so as to save a tax on gains?

|

Hey Sushant,

There is no way to do what you have suggested. The only way is to sell and repurchase as the scheme plans would be different. Also bear in mind that you would be charged stamp duty on the repurchase if you go ahead with it.

My dad invested quite a bit of his retirement corpus in ICICI equity & debt fund, HDFC balanced advantage fund, DSP equity and bond fund and UTI hybrid equity fund. All of these were regular, monthly dividend schemes and not doing well with almost 7 lakhs lost from principal. But now most of it has been recovered due to the current bullish market.

I see that some of these funds are not performing well and have been rated low. Should my dad exit some funds and invest somewhere else? Moreover, is it a good strategy for a 65 year old retiree to invest in aggressive hybrid monthly dividend schemes for regular monthly income?

Quote:

Originally Posted by Maverick Avi

(Post 5019369)

Moreover, is it a good strategy for a 65 year old retiree to invest in aggressive hybrid monthly dividend schemes for regular monthly income?

|

This is a very subjective question and the answer will vary depending on many factors like size of corpus, risk appetite etc.

For example, if the corpus is big enough to have a big chunk of funds in debt funds that can cover the expenses for the next 5 or 6 years, he could invest a small portion in equity which would perform well in the long term of 5 to 7 years.

On the other hand, if he is risk averse, it would be better to exit all equity and invest in only debt instruments.

This is just my thought. Experts like SmartCat can provide better inputs.

Quote:

Originally Posted by sushantr5

(Post 5018788)

Hello Experts,

Is there any way I can switch my regular mutual funds to direct mutual funds without considering it as a sell and buy order so as to save a tax on gains?

|

Paytm money has a switch option from Regular to Direct fund in their platform. I have not tried it, but sure have come across the option while doing some SIPs. Check this before you do it hard way. Otherwise hold the current funds and do new investments in the direct funds through the same folio.

https://www.zeebiz.com/companies/new...vestors-112554

PS: This also involves redeeming and reinvesting but with one click.

Quote:

Originally Posted by Maverick Avi

(Post 5019369)

I see that some of these funds are not performing well and have been rated low. Should my dad exit some funds and invest somewhere else? Moreover, is it a good strategy for a 65 year old retiree to invest in aggressive hybrid monthly dividend schemes for regular monthly income?

|

Monthly Income Plans were a rage many years ago, because they offered some kind of tax advantage (since income was in the form of dividends). But that loophole was plugged and since then, MIPs have lost their popularity.

Instead of investing in balanced/MIP/hybrid funds, you can achieve the same equity/debt mix by investing in a handful of equity & debt mutual funds. Advantages:

- You can tweak the percentage of equity/debt in your portfolio based on your risk profile

- Debt MF portfolio is likely to be in profit all the time. If your dad needs some cash, he can withdraw from debt MF portfolio anytime. But your MIP/Balanced/Hybrid fund investment is likely to be in loss during bear market. If your dad wants to withdraw money from his investments, he has to book losses.

Quote:

Originally Posted by SmartCat

(Post 5018816)

Last 10 year returns from overnight funds are 6.5% pa. But this is the past. Future might be different, depending on interest rate scenario.

List of overnight funds: https://www.valueresearchonline.com/...r&tab=snapshot

HDFC/SBI/UTI overnight funds have been around for almost 20 years. Look up its historical/since inception returns.

|

Overnight funds as a category got introduced in 2018 only. SBI/HDFC/UTI overnight funds were in other categories before they got re-categorized as overnight funds, since SEBI rules doesn't allow for AMCs to offer multiple funds in same category. So to look at historical returns it is recommended to look only from 2018, since the mandate of these funds were different before re-categorization.

Quote:

Originally Posted by DigitalOne

(Post 5019432)

Overnight funds as a category got introduced in 2018 only. SBI/HDFC/UTI overnight funds were in other categories before they got re-categorized as overnight funds, since SEBI rules doesn't allow for AMCs to offer multiple funds in same category. So to look at historical returns it is recommended to look only from 2018, since the mandate of these funds were different before re-categorization.

|

Yeah, they were called 'cash management' or 'insta cash' or something like that before. But such funds used to invest in 1 day maturity overnight securities even before 2018. That was their stated mandate. So historical returns of SBI/HDFC/UTI are valid.

Looks like we came within hair's distance of yet another debt fund disaster.

Recently SEBI issued a circular stating that the maturity of perpetual bonds ( like AT-1 ) will be treated as 100 years. This would cause the bond price of AT-1 to be impacted negatively. Investors would start redeeming MFs folding such bonds (e.g HDFC Banking and PSU debt fund) causing a stampede and value erosion.

Fortunately the finance ministry stepped in and has asked SEBI to

withdraw this rule.

Quote:

Originally Posted by JediKnight

(Post 5020411)

Looks like we came within hair's distance of yet another debt fund disaster. Fortunately the finance ministry stepped in and has asked SEBI to withdraw this rule.

|

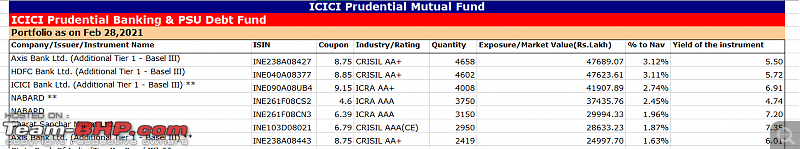

I would consider this as a warning signal. It is time to scan through the portfolio to ensure which funds have exposure to perpetual bonds and take corrective actions as required. Yes, both HDFC Banking and PSU fund as well as SBI Banking and PSU funds have exposure. Not all fund houses disclose these details properly in their portfolio disclosure fact sheet. SEBI should standardize the format and introduce a maturity date column.

Quote:

Originally Posted by Simhi

(Post 5020555)

I would consider this as a warning signal. It is time to scan through the portfolio to ensure which funds have exposure to perpetual bonds and take corrective actions as required. Yes, both HDFC Banking and PSU fund as well as SBI Banking and PSU funds have exposure. Not all fund houses disclose these details properly in their portfolio disclosure fact sheet. SEBI should standardize the format and introduce a maturity date column.

|

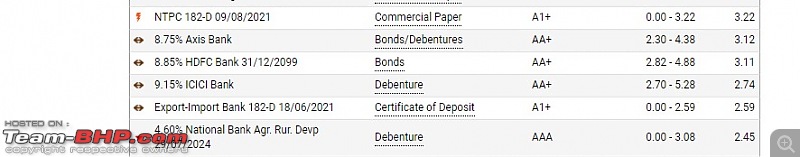

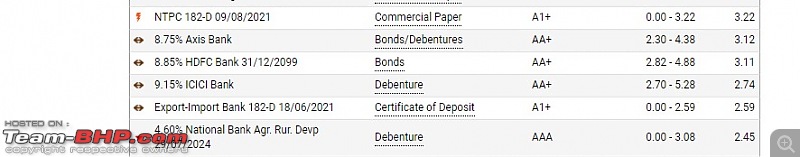

Should be easy enough to spot when you look at the 'top holdings' column of a debt mutual fund - perpetual bonds will not have a maturity date in the instrument name. Eg:

https://www.valueresearchonline.com/...-psu-debt-fund

In this mini-screenshot -

8.75% Axis Bank

8.85% HDFC Bank 31/12/2099

9.15% ICICI Bank

are perpetual bonds, since they don't have maturity date in the name. 8.85% HDFC Bank security has a maturity date of 80 years (which also means it is a perpetual bond)

Quote:

Originally Posted by JediKnight

(Post 5020411)

Recently SEBI issued a circular stating that the maturity of perpetual bonds ( like AT-1 ) will be treated as 100 years. This would cause the bond price of AT-1 to be impacted negatively. Investors would start redeeming MFs folding such bonds (e.g HDFC Banking and PSU debt fund) causing a stampede and value erosion.

|

Thanks for this info. I am invested big in HDFC Banking and PSU fund. I read the SEBI circular but didn't understand the impact. That would have been a disaster for me; I am still reeling under the FT fiasco.

Quote:

Originally Posted by SmartCat

(Post 5020565)

|

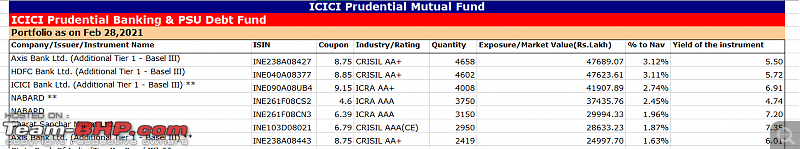

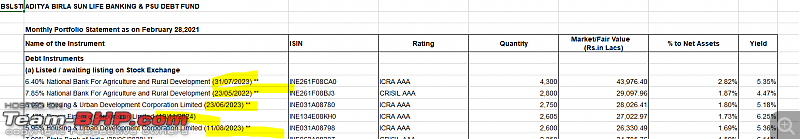

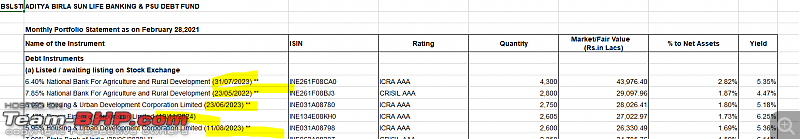

Problem with VR is that it gives details of only the top holdings and I think it pulls maturity date based on ISIN details. I rely more on the disclosure from the fund house who are forced to provide all holding details.

Here are the two snapshots. One for the fund you have referred to i.e. ICICI Banking and PSU and the other for ABSL Banking and PSU. ICICI discloses that it is Tier 1 - Base III but it does not disclose maturity date for any of its holdings. Whereas ABSL displays maturity date for all its holdings. Hence, I mentioned that SEBI should standardize the format.

ICICI Banking and PSU snapshot

ABSL Banking and PSU snapshot

| All times are GMT +5.5. The time now is 03:45. | |