Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by sushantr5

(Post 4501616)

Please guide me in readjusting my portfolio. I am looking for longer term; 7-10 years. The portfolio will be continuously increasing with SIPs. Please recommend me ideal debt/equity ratio. Right now I try to maintain it around 50:50. I would prefer Low risk and I want to target 8 to 10 % returns.

DEBT: Axis Liquid Fund 13.50%

DEBT: Franklin India Low Duration Fund 34%

EQUITY: HDFC Small Cap Fund 3.70%

EQUITY: L&T Emerging Businesses Fund 11.20%

EQUITY: SBI Blue Chip Fund 18.30%

HYBRID: SBI Equity Hybrid Fund 19.30%

|

MY 2 cents on your portfolio.

1) I don't see the point of investing in two small cap funds. A low risk investor should not be investing in small caps at all. you should add a multicap fund if you want to take low risk and moderate 8-10 percent returns.

2) Two of your funds are from the sbi stable. you should diversify and find another fund house in either aggressive hybrid or large cap category. One should not have two funds from the same fund house.

3) In my experience it is prudent to diversify your debt holdings as well. you have seen how many fund houses were hit with the ilfs fiasco. A third of your money is in franklin low duration fund. You should tone down your exposure to this fund and add either a short term fund, corporate bond fund or a credit risk fund that takes moderate risk. I am assuming your holding period will be more than 3 years.

Quote:

Originally Posted by bullrun87

(Post 4501812)

MY 2 cents on your portfolio.

1) I don't see the point of investing in two small cap funds. A low risk investor should not be investing in small caps at all. you should add a multicap fund if you want to take low risk and moderate 8-10 percent returns.

2) Two of your funds are from the sbi stable. you should diversify and find another fund house in either aggressive hybrid or large cap category. One should not have two funds from the same fund house.

3) In my experience it is prudent to diversify your debt holdings as well. you have seen how many fund houses were hit with the ilfs fiasco. A third of your money is in franklin low duration fund. You should tone down your exposure to this fund and add either a short term fund, corporate bond fund or a credit risk fund that takes moderate risk. I am assuming your holding period will be more than 3 years.

|

Thank you for your inputs. I wanted to diversify Franklin India and SBI. If you/anybody could suggest me some funds then this will help me a lot in selection of new funds. I will study them and slowly start diverting to those funds.

Quote:

Originally Posted by sushantr5

(Post 4501832)

Thank you for your inputs. I wanted to diversify Franklin India and SBI. If you/anybody could suggest me some funds then this will help me a lot in selection of new funds. I will study them and slowly start diverting to those funds.

|

DEBT: Axis Liquid Fund keep it

DEBT: Franklin India Low Duration Fund

I would suggest you reduce your exposure here and add a high quality short term/ corporate bond fund like ABSL corporate bond fund or ICICI short term.

You can also add a credit risk fund like UTI credit risk or ICICI credit risk. Have a horizon of atleast 3 years.

EQUITY: HDFC Small Cap Fund

3.70%

EQUITY: L&T Emerging Businesses Fund

11.20%

Since you have clearly stated that you are a low risk investor, you should exit these and invest in a multicap or a large & midcap fund. I would recommend ppfas long term, mirae emerging bluechip or absl equity

EQUITY: SBI Blue Chip Fund

18.30%

you should switch to reliance large cap, axis bluechip or mirae india equity.

HYBRID: SBI Equity Hybrid Fund

19.30%

After the IL&FS and other fiascos, why would you invest in Franklin India Low Duration Fund that has only 3.19% in AAA rated instruments and more than 46% in less than A rated instruments?

The whole point of investing in debt is safety. I don't see the point in chasing returns in debt by sacrificing on credit rating.

I am not recommending this fund, but as an example, HDFC Short Term Debt Fund offers much lesser returns but has 88% of its portfolio in AAA rated instruments. Franklin India Low Duration provides a return of 7.45% vs. HDFC Short Term Debt Fund with a return of 6%. It depends on your priorities -- returns or safety.

Pradeep

For those looking for a safe option in Liquid Mutual Funds, i suggest to take a look at Quantum Liquid Fund. They invest only in Treasury bills and PSU debt. So their returns will also be a bit lower.

https://www.quantumamc.com/Schemes/Q...quid-Fund.html

Disclosure: I have a significant portion of my portfolio in Quantum Mutual Funds.

Quote:

Originally Posted by smartcat

(Post 4501027)

I would not invest in this fund. Just look at its portfolio: https://www.valueresearchonline.com/...chemecode=6489

Note that this is not the complete portfolio. Even then, most of the securities in the portfolio are:

1) Unlisted companies (Eg: piramal realty)

2) Unknown companies (Eg: Northern Arc Capital)

I no longer trust the credit rating assigned to these securities. The credit worthiness of these companies are a suspect.

|

I have some exposure to this fund and after reading your post did some research to reach the same conclusion. I dont recall the portfolio to contain these obscure names when I had invested in it almost two years back. However, morningstar goes onto recommend this fund and even gives a 'High' rating to its credit quality!

https://www.morningstar.in/mutualfun...-research.aspx

The analysis dates back to Dec 2017 though and things may have slid since then. The risk rating is still moderate however and return rating high for obvious reasons.

Morningstar is a reputed research site. Wonder who does one trust!

Quote:

Originally Posted by hothatchaway

(Post 4502154)

However, morningstar goes onto recommend this fund and even gives a 'High' rating to its credit quality! The analysis dates back to Dec 2017 though and things may have slid since then. The risk rating is still moderate however and return rating high for obvious reasons. Morningstar is a reputed research site. Wonder who does one trust!

|

Both morningstar and valueresearchonline refer to ratings assigned by credit agencies like ICRA or CRISIL. And these agencies are corrupt because the companies that they rate are their clients. If a bond fund has 80% holdings on A+ securities (assigned by corrupt credit rating firms), then it will mark it as 'High credit quality' fund - because it is based on quantitative analysis.

Thanks to IL&FS fiasco, we as investors need to do 'qualitative analysis' of the portfolio. Avoid funds with unknown names in the holdings portfolio. How can these funds invest crores of rupees (our money) in companies

that don't even have a website?

As long as music is playing, they will keep running around the chairs. When the music stops (major financial crisis), I fear things will blow up in debt mutual fund industry.

I think most investors in the Franklin short term fund, myself included, were suffering from a false sense of security by seeing no direct exposure to IL&FS in its portfolio. What came as a rude shock to me, was the indirect exposure to it via Yes Bank.

Yes Bank has lent a good bit of money to IL&FS and must be feeling the heat from its decision. Now, what is worse is that Yes Bank has its own mess to handle, specifically mess arising from questionable accounting practices and other shenanigans of its promoter Rana Kapoor.

All of this taken together makes an investment in Franklin India Ultra Short Bond Fund, which at least on paper, is marketed as an equivalent to a savings account, extremely risky at the moment.

More details.

We believe debt funds are generally risk free, but that is not true. Only debt funds investing 100% in sovereign debt (government guaranteed) are risk free. Any debt fund generating a return more than the risk free return rate (ex. 1 year government bond return) of 7% has an element of risk. Higher the risk, higher the returns. Credit Risk funds give the highest returns, with some having YTM of 11%+ currently. The nature of the fund can found in the fund style box and in the fund's investment objective, where they state the type of debt instruments (AAA, AA) they invest in. One should not purely go by Value Research or Morningstar ratings. The high ratings may be because the fund that has managed the risk well over an extended period of time.

Quote:

Originally Posted by rovingeye

(Post 4502216)

Yes Bank has lent a good bit of money to IL&FS and must be feeling the heat from its decision. Now, what is worse is that Yes Bank has its own mess to handle, specifically mess arising from questionable accounting practices and other shenanigans of its promoter Rana Kapoor

All of this taken together makes an investment in Franklin India Ultra Short Bond Fund, which at least on paper, is marketed as an equivalent to a savings account, extremely risky at the moment. More details.

|

Most Franklin debt funds and some absl debt funds are investing in dhfl promoters' holding company papers along similar lines as Morgan capital and yes capital owned by reliance mutual fund and Franklin Templeton respectively.

idbi liquid fund is also investing in this dhfl promoters' holding company.

One must be wary of what debt funds are holding, even liquid funds arent safe anymore. Some credit risk funds have YTM as high as 13%!

https://www.moneylife.in/article/mut...oor/55811.html

I had all along been thinking Yes Bank is very well managed and have my primary NRE account and some FDs with it. In fact I was lured by their higher interest rates especially for savings account. So it's now a wake up call for me. On the mutual funds side, my debt exposure is limited to these debt component of Hybrid Funds (Aggressive), but since I'm planning to retire after three years was seriously thinking of slowing down on equities and increasing the debt component. Any suggestions for me would be most welcome.

A suggestion - overnight funds have a tight mandate. And interestingly a lot of AMCs are launching these funds. This can be a cleaner option.

Quote:

Originally Posted by srsrini

(Post 4502686)

A suggestion - overnight funds have a tight mandate. And interestingly a lot of AMCs are launching these funds. This can be a cleaner option.

|

Oh boy, I love Overnight funds. Smartcat had suggested them to me somewhere in the 'sifting gears' section and so I plonked some money with SBI overnight fund. It returns a clean 6.5% on an annual basis, no drama. If you hold this for 3+ years, with indexation, this is better than FDs from a LTCG perspective. It's better than the 4% savings account rate.

Since it can be liquefied quickly if needed, this fund holds my emergency money in case something goes seriously wrong with any of my 3 vehicles. I'll similarly create another emergency fund for health emergencies.

Quote:

Originally Posted by srsrini

(Post 4502686)

A suggestion - overnight funds have a tight mandate. And interestingly a lot of AMCs are launching these funds. This can be a cleaner option.

|

I tried to post the above message from a mobile browser and it was too brief. Here is a bit more info taken from a post in my nascent blog:

https://srinivesh.in/blog/gen/346

"Overnight funds is a less popular category of debt funds. These invest in debt instruments that have maturity of 1 day, yes 1 day. At this resolution, little effect would be seen because of interest rate changes, credit downgrades, etc. The only significant risk in this fund is if the issuer of the debt vanishes overnight.

This article in freefincal.com has a detailed explanation of Overnight funds:

Worried about risk? Use Overnight mutual funds"

Believe it or not, 8 AMCs have plans to launch overnight funds - may be as a reaction to the negative vibes on liquid funds. Biggies like ABSL and ICICI are quite close to the NFO.

MF Experts,

Request some help here.

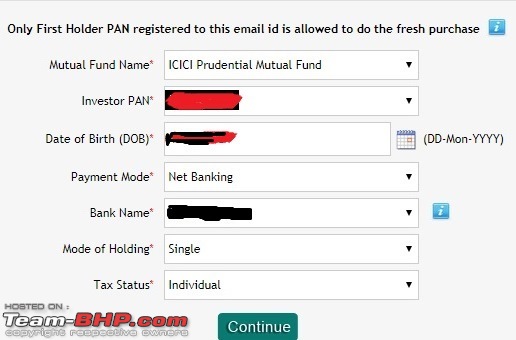

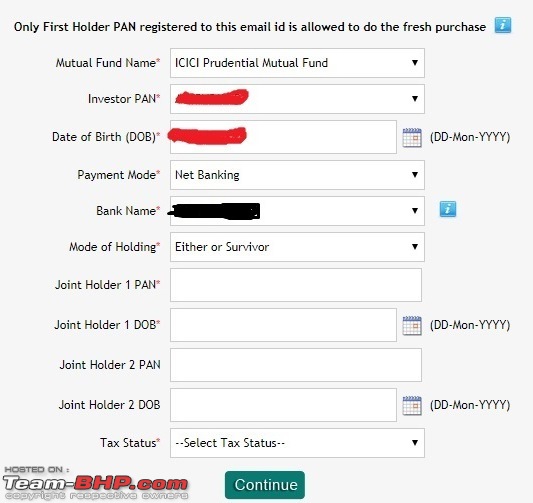

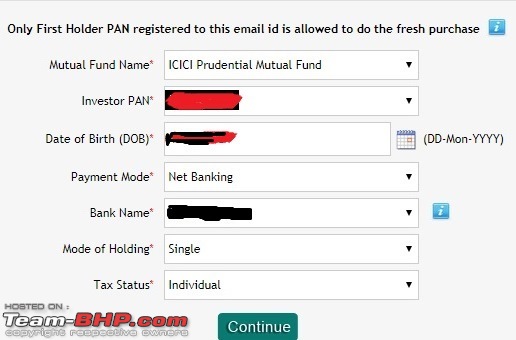

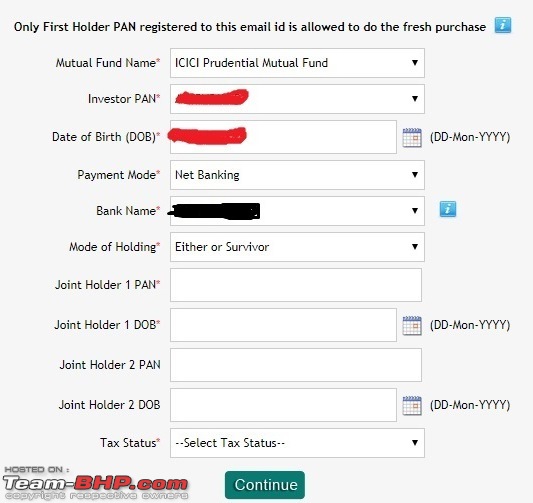

In Camsonline, while we do a fresh transaction, we get the option to select the

'Mode of holding'. I believe, this relates to the mode of holding the Mutual fund that we are investing in and is not related to the mode of our bank-account holding.

In both the cases, there is only one tax status option -

'Single'.

In my case, I have an

'Either or Survivor' account with my wife in a bank. However, since I have been investing in MFs in my name (with wife as nominee), I have always been selecting the

'Mode of holding' as

'Single'.

Thanks in advance!

| All times are GMT +5.5. The time now is 02:10. | |