Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by audioholic

(Post 4551263)

SIP is a method of investment. Mutual fund is one of the places you invest. By converting an RD into SIP, did you want to move the installments to SIP alone or move the current amount invested as a one time investment to an MF and then the installments as SIP to the same fund?

|

Thanks, @Audioholic. I was thinking to move the accured amount + installments to SIP. Please advice

Quote:

Originally Posted by condor

(Post 4551260)

A noob question

Is a SIP a type of Mutual Fund ?

I think the two are different products

I was at SBI today, asking to convert one RD to SIP. The "officer" asks SIP MF ?

|

SIP means Systematic Investment Plan, wherein you invest in an security instrument, a particular amount at a particular frequency for a particular period. For example investing say Rs.5000 per month for a period of 60 months.

This is exactly like what you have done - RD, Recurring Deposit. One difference is that RD is done with a bank or a post office whereas SIP is done with a mutual fund house or with a share trading platform where you can keep buying a particular company shares periodically.

Another difference is that RD gives you a fixed bank interest without any volatility risk, whereas Investing in shares and mutual funds prone to volatility of the market depending on many external factors - take the upcoming general elections or the ongoing foreign policy aberrations.

Now as far as your RD is concerned - assuming the RD has matured and you are not pre-maturely withdrawing it thereby loosing some interest accrued, you can invest the maturity amount in some mutual fund schemes and the keep investing in the same schemes by way of SIP every month for a long period.

The amount of investment in equity market again will depend on your age, goals and all that also taking into the account that you are residing in the speed-breaker city.

Hope this helps.

From my MF investments, among the ELSS, I see Axis LT fund has withstood the crash that happened in the last 6-12 months where as BOI AXA, IDFC & DSP Black suffered big losses. So, am skipping everything else and concentrating only on Axis LT from the new FY. Thanks to all who had suggested the same. Learning never stops in investments.

I hope all corrections happen now and the market / fund picks up pace from here. My 2005 MF investment in HDFC was going strong and then crashed around the maturity period wiping out major gains. However, I still managed decent returns via dividend payout in those 3-4 years, so net net a worthy investment.

I have tiny investment in L&T Business Cycles Fund and have noticed a peculiar behaviour from this fund. Peculiar since I have spread my investments across 5-6 funds and the frequent expense ratio change of this fund beats possibly all the funds put together. L&T Business Cycles Fund has had it expense ratio revised 8 times since Jan 15, that's 8 revisions in less than 2 months. In fact, since June 2018, there have been 26 revisions in expense ratio.

I wonder why this particular fund sees so frequent revisions while other funds see much lesser activity. Also, is it possible to have such frequent changes in fund management expenses that the fund house needs to revise expense ratio every week?

Quote:

Originally Posted by ksameer1234

(Post 4558657)

I have tiny investment in L&T Business Cycles Fund and have noticed a peculiar behaviour from this fund. Peculiar since I have spread my investments across 5-6 funds and the frequent expense ratio change of this fund beats possibly all the funds put together. L&T Business Cycles Fund has had it expense ratio revised 8 times since Jan 15, that's 8 revisions in less than 2 months. In fact, since June 2018, there have been 26 revisions in expense ratio.

I wonder why this particular fund sees so frequent revisions while other funds see much lesser activity. Also, is it possible to have such frequent changes in fund management expenses that the fund house needs to revise expense ratio every week?

|

May be they are churning up the portfolio too often - it may be indicated on scrutiny of their monthly portfolio.

Setting aside a sum for bulk car expenses - in Overnight funds

On this thread, Smartcat had earlier advised me to try investing in overnight funds at a time when i was looking to park funds in Liquid funds. My idea was to set aside a sum of money to cover any probable planned and unplanned expenditures with any of my vehicles. So I plonked 2 lakhs into SBI overnight funds and it keeps returning 6.5% on an annualized basis; there have been no downs, only a steady 0.02% accrual everyday for the past 6 months.

Overnight funds are safer because there is a collateral element involved; my money and other investors' money gets pooled and entities such as the government borrow it for a day and return it with a 0.02% interest payout; they qualify to borrow only if they submit some collateral amount to the CBLO (Collateralized Borrowing and Lending Org).

Long story short - I reckon that the accrual will help pay for 5 new tyres for my TUV 300 5 years down the line. And the Principal itself can be withdrawn anytime by me, if my older used car should develop a major fault; there are no exit loads.

The sad story with liquid funds

Thankfully I had diverted my funds away from liquid funds; so many liquid funds had invested in IIFL and other weak, credit-unworthy organizations. Those fund NAVs have been taking a pummeling for a long time. And now the RBI has further tightened the screws with new rules designed to prevent a repeat of the IIFL-liquid fund saga.

Quote:

Originally Posted by locusjag

(Post 4559054)

So I plonked 2 lakhs into SBI overnight funds and it keeps returning 6.5% on an annualized basis; there have been no downs, only a steady 0.02% accrual everyday for the past 6 months.

|

We can roughly pencil in 0.25 to 0.5% lower returns than liquid funds, with significantly lower risk because mostly banks borrow from the overnight market. And yeah, the holding period is just 1 day (overnight) and hence the name.

Fund houses line up to launch overnight funds, an alternative to liquid funds https://cafemutual.com/news/industry...o-liquid-funds

Quote:

Originally Posted by SmartCat

(Post 4559066)

|

Thank you Smartcat :)

I read the article you shared now, by the way. It seems the exchange is no longer the CBLO, since last October. It's being done at the behest of the CCIL (the Credit Corp of India Ltd, I presume).

I have a very newbie question for mutual fund / investment veterans. Maybe you might have heard this naiive question from others.

So basically I am thinking:- If I put my whole 100% portfolio divided between a Sensex index fund a Nifty index fund, I get:

- Worry-free from any particular company's performance

- As long as India is doing well in the long run, my portfolio will keep up and have stable growth

- Still a much higher return rate (long run - thinking in decades) compared to FD

- My "unscientific research" (basically pulling data from the interwebs and crunching numbers in an excel) shows that over the years, a 11% return rate is expectable and 7.5% inflation year over year

- So splitting the portfolio between these two index funds minimizes my risk (for equity funds), while my SWP at 2.5% (keeping 7.5% for inflation and another 1% as buffer) is a fairly "safe" (if I may dare use that word) investment that requires no thought and no maintenance.

- And my LCTG would still be just 10% on that SWP.

So.. how terrible is this idea as a non-savvy investor? I know it is all eggs in one basket, but considering it is a pretty wide basket, by not diversifying would I be increasing my risk? Or would I just be missing out on better returns?

Quote:

Originally Posted by rajushank84

(Post 4559554)

I have a very newbie question for mutual fund / investment veterans. Maybe you might have heard this naiive question from others.

So basically I am thinking:- If I put my whole 100% portfolio divided between a Sensex index fund a Nifty index fund, I get: - Worry-free from any particular company's performance

- As long as India is doing well in the long run, my portfolio will keep up and have stable growth

- Still a much higher return rate (long run - thinking in decades) compared to FD

- My "unscientific research" (basically pulling data from the interwebs and crunching numbers in an excel) shows that over the years, a 11% return rate is expectable and 7.5% inflation year over year

- So splitting the portfolio between these two index funds minimizes my risk (for equity funds), while my SWP at 2.5% (keeping 7.5% for inflation and another 1% as buffer) is a fairly "safe" (if I may dare use that word) investment that requires no thought and no maintenance.

- And my LCTG would still be just 10% on that SWP.

So.. how terrible is this idea as a non-savvy investor? I know it is all eggs in one basket, but considering it is a pretty wide basket, by not diversifying would I be increasing my risk? Or would I just be missing out on better returns?

|

Not an expert in this field, but I believe it is never a good idea to put 100% of your money in equity. Make some allocation in debt where your money is more more secure, albeit with lesser returns. And within equity too you can diversify into some well managed multicap, midcap and small cap schemes. Over a long period you have a good chance of beating the index with these.

Quote:

Originally Posted by rajushank84

(Post 4559554)

So basically I am thinking:- If I put my whole 100% portfolio divided between a Sensex index fund a Nifty index fund. how terrible is this idea as a non-savvy investor? I know it is all eggs in one basket, but considering it is a pretty wide basket, by not diversifying would I be increasing my risk? Or would I just be missing out on better returns?

|

Quote:

Originally Posted by Santoshbhat

(Post 4559559)

Not an expert in this field, but I believe it is never a good idea to put 100% of your money in equity. Make some allocation in debt where your money is more more secure, albeit with lesser returns. And within equity too you can diversify into some well managed multicap, midcap and small cap schemes. Over a long period you have a good chance of beating the index with these.

|

By 100% of portfolio, do you mean all your savings in index funds? As Santosh suggests, that is a bad idea. Conservative but safe investment strategy would be to put 50% portfolio in Index funds and 50% portfolio in Gilt funds (government bonds with sovereign guarantee).

Whenever there is a big crash (like in 2000 or 2008), Gilt funds can give up to 30% returns per year because money rushes into safe assets. So having a stocks + bonds portfolio, you can get higher than FD returns with very low volatility (up and down movement of portfolio value).

Quote:

Originally Posted by SmartCat

(Post 4559704)

By 100% of portfolio, do you mean all your savings in index funds? As Santosh suggests, that is a bad idea. Conservative but safe investment strategy would be to put 50% portfolio in Index funds and 50% portfolio in Gilt funds (government bonds with sovereign guarantee).

Whenever there is a big crash (like in 2000 or 2008), Gilt funds can give up to 30% returns per year because money rushes into safe assets. So having a stocks + bonds portfolio, you can get higher than FD returns with very low volatility (up and down movement of portfolio value).

|

Could it be a good idea to spread across 2-3 gilt funds or 1 is enough ?

I have bonus money e.g. 5lacs to invest to add for my future house buying plans.

While browsing i came across these funds

1. Reliance Gilt Securities Fund - Direct Plan (Lumpsum)

2. SBI Magnum Gilt Fund - Direct Plan (Lumpsum)

3. Franklin India Ultra Short Bond Fund - Super Institutional Plan - Direct Plan (Lumpsum)

4. UTI Nifty Next 50 Direct Plan (SIP)

Quote:

Originally Posted by roadjourno

(Post 4562688)

Could it be a good idea to spread across 2-3 gilt funds or 1 is enough ? 1. Reliance Gilt Securities Fund - Direct Plan (Lumpsum) 2. SBI Magnum Gilt Fund - Direct Plan (Lumpsum)

|

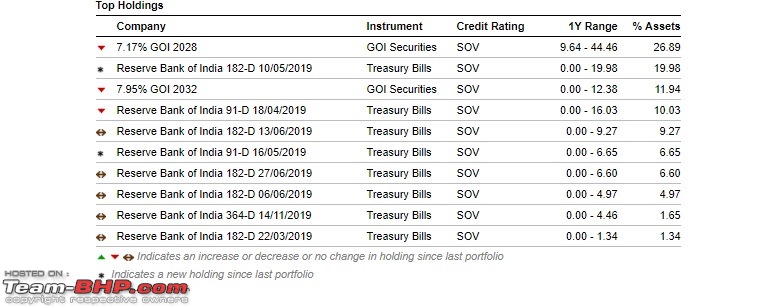

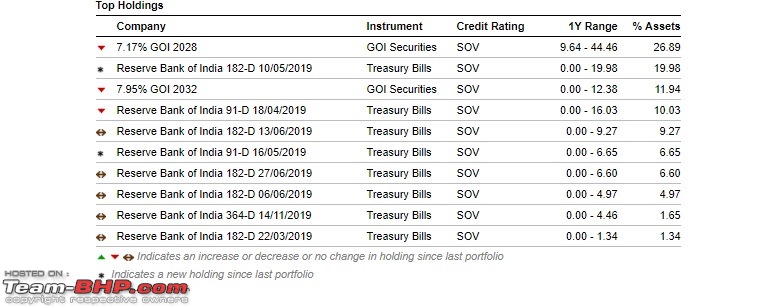

Go for gilt funds that own both treasury bills and government bonds. This ensures that the fund is not affected too much by interest rate hikes. Treasury bills have just 3 to 12 months duration. Of the two, I prefer SBI Magnum Gilt fund. It has approximately 40% exposure to long term bonds and 60% exposure to short term bills

1 gilt fund is enough if amount to be invested is < 5 Lakhs.

Quote:

I have bonus money e.g. 5lacs to invest to add for my future house buying plans. While browsing i came across these funds. UTI Nifty Next 50 Direct Plan (SIP)

|

Perhaps a regular large cap or multicap fund is better (safer) than Nifty Next 50 fund?

So its that time of the year again which is quickly approaching, and I have to do some tax saving investments pronto.

These are the options provided by my banker:

1. ELSS in MUTUAL FUNDS is an equity exposed fund which will give you a tax benefit under Section 80 C but LTCG (long term capital gain) tax is applicable at the time of withdrawal.

2. TRADITIONAL PLANS will give you tax benefits under Section 80 C for long term assuring a guaranteed return of minimum 220% of your total invested amount and will be same mentioned on the bond as this tax benefit investment doesn’t have a market exposure so there is no risk of losing any capital and returns will also become absolutely tax free at the time of maturity under Section 10(10)D of Income Tax.

3. ULIP PLANS will be unit linked which will have both market exposure just like ELSS in mutual funds and government bonds as well considering this will also be giving you Tax benefit under 80 C as well as tax free returns at the time of maturity under Section 10(10)D of Income Tax.

Questions:

1. I need to invest 1.5L to gain maximum tax savings. How should I diversify it amongst the above? Or should I diversify at all?

2. Which funds do I invest in considering the options at present? What are your recommendations?

I will also do some quick catching up. Stayed away from the financial markets since 1997 (don't ask me why I'm getting back in now :)

I have a unique question:

My breakup for 2018-19

Principal - 689403 (repaid)

Interest - 90007

My office has deducted (projected) a huge chunk of tax already, can I look at investing in any schemes so as to save this 'scary' deduction in my March 2019 salary in the next 5 days?

Let me know the best viable option (MF or otherwise) urgently.

| All times are GMT +5.5. The time now is 11:45. | |