Team-BHP

(

https://www.team-bhp.com/forum/)

I see a decent recovery, markets are back at yesterday's level at least.

Post office returns are taxable as per the taxable slab. Debt funds over three years provide indexation benefits. That makes a big difference. I do understand your concern about debt funds.

Quote:

Originally Posted by carboy

(Post 4768422)

Annual return comes to 7.2% which is better than many of the super safe debt funds.

|

Quote:

Originally Posted by pradkumar

(Post 4769388)

Post office returns are taxable as per the taxable slab. Debt funds over three years provide indexation benefits. That makes a big difference. I do understand your concern about debt funds.

|

I never said I had any concerns.

How do you guys deal with portfolio overlap? Whenever I zero in on a few funds that look decent, on closer inspection I find that half the companies in one fund are almost always present in one or more of the other funds on my list.

Hence, I have decided to keep it simple. One Bluechip, one Multicap and one Gilt fund.

1. Axis Bluechip - 25% (a small but really good collection of 26 Bluechip stocks)

2. PPFAS Long Term Equity - 25% (again a small collection of 24 good stocks, gives international exposure too)

3. SBI Gilt - 50% (for long term debt investment)

Is this ideal for a 41 year old who is just starting out on some real long term investment? I refrained from it so far as I had a huge home loan hanging over my head, which I managed to close just last week.

Quote:

Originally Posted by Oxy

(Post 4769459)

How do you guys deal with portfolio overlap? Whenever I zero in on a few funds that look decent, on closer inspection I find that half the companies in one fund are almost always present in one or more of the other funds on my list.

|

Stocks overlap is not an issue. It means multiple fund managers are bullish on a particular stock. This might not be the case 12 months from now.

Quote:

Hence, I have decided to keep it simple. One Bluechip, one Multicap and one Gilt fund. Is this ideal for a 41 year old who is just starting out on some real long term investment?

|

I like the 50% gilt and 50% equity portfolio. Going by history, you will get equity-like returns with low volatility. That's because whenever there is a major dip in equities, gilt funds will shoot up in value.

But I think you should diversify across funds. Add 2 more multicap funds and 3 more gilt funds (do NOT pick constant maturity gilt funds). The SIP amount for all funds should be equal.

Quote:

Originally Posted by SmartCat

(Post 4769470)

But I think you should diversify across funds. Add 2 more multicap funds and 3 more gilt funds (do NOT pick constant maturity gilt funds). The SIP amount for all funds should be equal.

|

Thanks for the valuable inputs SmartCat. Just a couple of questions:

1. What is the point of 4 Gilt funds? I thought all of them invest in government securities so picking any one from the lot would suffice.

2. Do you reckon SIP is the right approach or would I be better off implementing this idea of yours which sounds quite brilliant?

https://www.team-bhp.com/forum/shift...ml#post4760086

Quote:

Originally Posted by Oxy

(Post 4769477)

|

Sadly, this is not MY "brilliant" idea. :D It is a reasonably popular investment strategy called "Strategic Asset Allocation Strategy" (do a Google search). If you think you have the discipline and patience to implement it, go ahead. This is way better than SIP - because you automatically buy assets (equities & bonds) at low prices and stop buying when prices are high. Gilt funds usually perform the best when equity funds are NOT doing well (there is logic behind this too).

That's why an asset allocation strategy has the best "risk adjusted returns" - meaning highest possible returns at the lowest possible risk.

Quote:

1. What is the point of 4 Gilt funds? I thought all of them invest in government securities so picking any one from the lot would suffice.

|

- Gilt funds go up and down in value, depending on expected future interest rates. What is the logic behind this? I will explain later if anybody is "interested".

- Over a longer term (5 yr+), gilt funds are guaranteed to return the coupon rate of the bonds (7% pa, 8% pa and so on). So there is zero risk (unlike in equity funds)

- But in the short term, fund managers have some "control" over how much a gilt fund rises in value and how much it falls. It depends on a fund manager's talent in predicting future interest rates.

- Good fund managers move into long term govt bonds (5 yr, 7 yr, 10 yr etc) if they expect interest rates to fall. And they move into short term govt bonds (3 months, 6 months, 1 yr duration etc) if they expect interest rates to rise.

That's why it makes sense to pick 3 or 4 different gilt funds and gilt fund managers. Same rules -> largest AUM, good brand name, long history, 3/4/5 star rating on valueresearch.

A question for SmartCat:

In December, the RBI purchased Rs 10,000 crore worth of long-term government securities and sold Rs 6,825 crore of four short-term securities through the special open market operations (OMOs).

How does this affect gilt funds if they do it more often? I guess this operation affects gilt funds more than other categories of debt funds. Does it affect investors like us?

https://m.economictimes.com/markets/...w/72943825.cms

Thanks,

Pradeep

Quote:

Originally Posted by SmartCat

(Post 4769512)

That's why it makes sense to pick 3 or 4 different gilt funds and gilt fund managers.

|

Quote:

Originally Posted by Oxy

(Post 4768371)

I somehow find the government backed recurring deposits very attractive in the current market scenario. Here's an example:

|

If one looks at PPF also as a long term FD after factoring the tax benefit (80C and no tax on interest earned), it would beat debt MFs by a margin. But, this is capped to 1.5Lakh p.a. So, we need to figure out an alternate beyond that value and of course the liquidity of the same is constrained due to the lock in of 15 years.

Quote:

Originally Posted by carboy

(Post 4768422)

It's pointless calculating total returns. You need to look at annual returns if you want to compare different kinds of instruments. Annual return comes to 7.2% which is better than many of the super safe debt funds.

|

If taxation is factored in at the 30%+ slabs, then with indexation, the returns on a liquid MF would be probably be better (assuming the returns of a liquid MF to be in the ball park of 7%).

Quote:

Originally Posted by SmartCat

(Post 4769512)

- Gilt funds go up and down in value, depending on expected future interest rates. What is the logic behind this? I will explain later if anybody is "interested".

|

SmartCat, would be useful if you could give your educative writeups on this!

Recently (before Corona became a epidemic) I started a SIP on a 2 Gilt funds. Also, based on the current situation and the expectation that there will be rate cuts, does it make sense to pause investment in Gilt funds?

Quote:

Originally Posted by pradkumar

(Post 4769577)

In December, the RBI purchased Rs 10,000 crore worth of long-term government securities and sold Rs 6,825 crore of four short-term securities through the special open market operations (OMOs). How does this affect gilt funds if they do it more often?

|

When a heavyweight like LIC buys Rs. 10,000 crores worth of TCS shares and sells Rs. 6,825 crores worth of Infosys shares, what is likely to happen? TCS shares will go up in value and Infy shares will fall in value. Ditto with your RBI example - long term gsecs will go up value and short term gsecs will go down in value.

It might or might not affect your gilt fund. Depends on the fund's holding percentage between long and short term gsecs.

Quote:

Originally Posted by whitewing

(Post 4769584)

Also, based on the current situation and the expectation that there will be rate cuts, does it make sense to pause investment in Gilt funds?

|

Rate cuts are good for gilt funds. NAV will shoot up.

Quote:

SmartCat, would be useful if you could give your educative writeups on this!

|

Let me try to simplify how gilt funds work.

- In January 2020, let's assume that you invested Rs. 1 Lakh in 5 year bank FD at 8% interest pa. The terminal value of this fixed deposit is Rs. 1.5 Lakhs (total returns after 5 years, in 2025)

- Worst case scenario, Coronavirus is raging all across the world. Demand drops and world is in a recession. Crude oil falls to $15 per barrel. Inflation in India is zero because prices of everything has dropped. RBI will slash interest rates drastically, every 3 months.

- Let's assume that in Jan 2021, 4 year bank FD offers 4% interest pa. If I deposit Rs. 1 Lakh in the year 2021, I will only get Rs. 1.16 Lakhs in 2025 (terminal value).

- But your FD is locked in at 8% interest pa, and has a much larger terminal value in 2025 (Rs. 1.36 Lakhs to be exact, after 4 years)

- Let's assume fixed deposits are tradeable. I will approach you and offer to buy the fixed deposit from you, since returns offered are double. If I buy it from you, I will get Rs. 36,000 as interest instead of Rs. 16,000.

- You will sell your fixed deposit to me only if I offer a nice premium. But since it is a tradeable market, you will get lot more offers. You will eventually sell your fixed deposit, at say Rs. 1.25 Lakhs. So now, because of the fall in interest rates, you earned 25% returns in just one year.

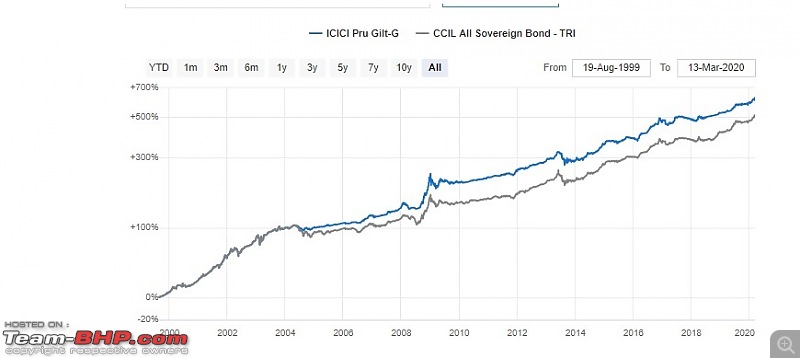

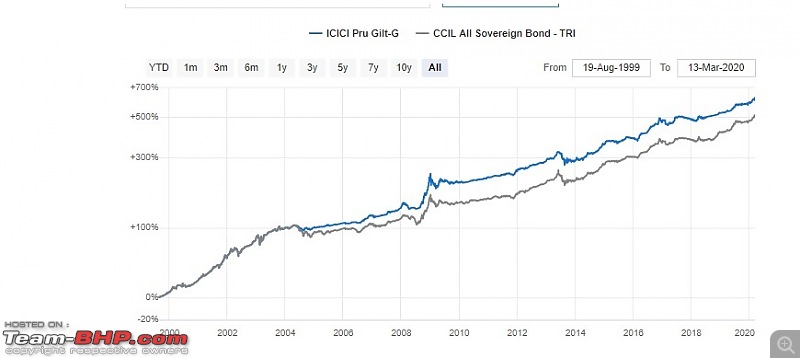

That's exactly how bonds go up in value when interest rates fall. And vice versa. Bond value crashes when interest rates rise. Gilt funds returned up to 50% returns in year 2009. But then, it crashed 30% the next year, when things returned to normalcy. :) So before getting into this gilt fund investment business, it is best to understand what you are getting into.

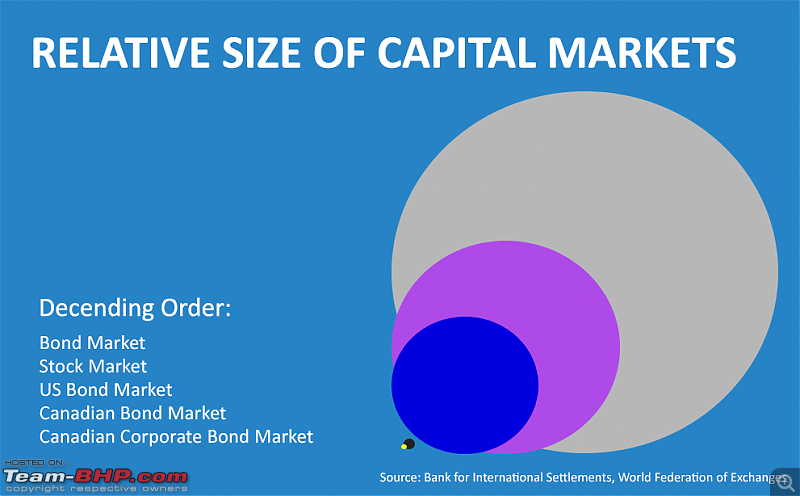

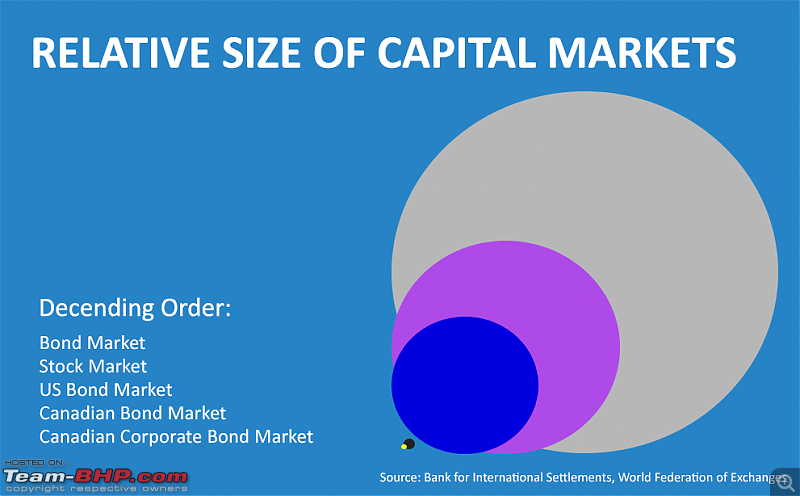

But hold gilt funds for long duration, you are guaranteed the returns (coupon rate) when it is due. Just like fixed deposits. It's just that there is a mini-roller coaster ride in between. Globally, bond market size is approximately 2x larger than stock market:

Here is an example of indexation benefits calculation. I have kept the FD rates and Debt fund rates same for the purpose of this comparison.

This calculation is taken from a video made by Yadnya Investment on YouTube. All credit to them. My only contribution is putting the data in a spreadsheet.

Thanks,

Pradeep

Quote:

Originally Posted by SmartCat

(Post 4769601)

But hold gilt funds for long duration, you are guaranteed the returns (coupon rate) when it is due. Just like fixed deposits. It's just that there is a mini-roller coaster ride in between. Globally, bond market size is approximately 2x larger than stock market:

|

Thank you for this incredibly informative post SmartCat. This demystifies Gilt Funds. Also the very interesting strategic asset allocation approach.

Would you pick Gilt Funds over Dynamic Bond funds if the outlook is for a medium to long term horizon? Or do you need both in your debt portfolio? This is assuming that funds are parked in Liquid funds for short term needs.

If you read this article, you probably would veer towards gilt funds.

https://edition.cnn.com/2020/03/14/i...rus/index.html Quote:

Originally Posted by ranjitnair77

(Post 4769642)

Would you pick Gilt Funds over Dynamic Bond funds if the outlook is for a medium to long term horizon? Or do you need both in your debt portfolio? This is assuming that funds are parked in Liquid funds for short term needs.

|

Quote:

Originally Posted by ranjitnair77

(Post 4769642)

Would you pick Gilt Funds over Dynamic Bond funds if the outlook is for a medium to long term horizon?

|

Quote:

Originally Posted by pradkumar

(Post 4769661)

If you read this article, you probably would veer towards gilt funds.

|

Correct. Dynamic bond funds have corporate bond holdings, and hence carry both interest rate risk (sensitivity to changes in interest rate) and credit risk (sensitivity to corporate defaults). Theoretically, they are supposed to offer higher returns than gilt funds. But actually, gilt funds have outperformed every other type of long term debt fund. Stay away from dynamic bond, corporate bond and credit risk funds.

Gilt funds cheat sheet:

- Long term investment. You need to have a mindset of fixed deposit investor (5+ yr holding period) and equity investor (NAV dances around everyday).

- When interest rates are expected to increase, NAV will go down. When interest rates are expected to go down, NAV will go up.

- Risk free investment over long term. Safer than bank fixed deposits. Because Govt cannot/will not default.

- Actively managed gilt funds have returned 8 to 10% per annum during the past 10 or 20 years.

- Should ideally be used in conjunction with an equity fund portfolio. Whenever there is a global economic or financial or geopolitical crisis, your equity funds will be losing money but your gilt funds NAV will be going up in value.

- A simple 50:50 SIP in gilt fund and equity fund portfolio every month works well.

- But if you are tactical about it and adopt "strategic asset allocation", you will generate even superior returns (because you are automatically timing the markets - buying low, and not buying high). However, this strategy is not for the faint-hearted because it forces you to buy when NAV of equity/gilt fund is falling.

For further reading: Do a Google search for these keywords -

- Stocks Bonds Portfolio

- Asset Allocation

Quote:

Originally Posted by SmartCat

(Post 4769470)

But I think you should diversify across funds. Add 2 more multicap funds and 3 more gilt funds (do NOT pick constant maturity gilt funds). The SIP amount for all funds should be equal.

|

Can you expand more on this point? I thought constant maturity gilt funds are better for the long term, as they usually hold more percent of govt. securities compared to normal Gilt funds.

| All times are GMT +5.5. The time now is 07:06. | |