Team-BHP

(

https://www.team-bhp.com/forum/)

Thanks Smartcat. Btw I meant to say a few companies invest in dynamic bonds. ( not gilt). Have seen it in a few annual reports. You are right. Liquid (till now) is the most preferred fund for companies.

Btw I have seen you talking about PSU and Banking debt funds. If you look at the underlying portfolio, its scary. They hold private banks and a lot of subsidiary companies. A few funds had defaults due to an IL&FS subsidiary project. So in my opinion, only overnight and gilt are worth looking at.

Also, I was studying the correlation between gsec yield and stock market. There seems to be a clear correlation in the US. But not in India. 10 yr yield went up even when the equity is down big. Probably because in India, the FIIs selling bonds too. So I think the only major trigger would be a rate cut.

Quote:

Originally Posted by SmartCat

(Post 4771428)

Retail will not invest in gilt funds primarily because of its complexity and counter-intuitiveness. If interest rates go up, it is good for FD investors. But it is bad for bond investors. If interest rates go down, it is bad for FD investors. But it is good for bond investors. :)

Companies don't invest in gilt funds because of interest rate sensitivity. Treasury operations of a company is supposed to generate predictable interest income - that's why liquid funds is the preferred route.

Almost all the govt securities trading in India is done by banks. 25% to 30% of a bank's income is from treasury operations (which is basically trading of govt securities). That's why whenever RBI reduces interest rates, bank stocks shoot up in value. That's because it straight away adds Rs. 100 cr or Rs. 500 cr to profits, because of rise in value of govt bonds that they hold.

|

Quote:

Originally Posted by JMaruru

(Post 4772954)

What's the advantage of 'Coin Platform' over 'MF Utilities'? Are there any costs involved, per transaction OR per period?

|

I do not have much idea about MFUtilites. In Zerodha Coin, there are no transaction costs or annual charges. Since you have to open a brokerage account at Zerodha to use Coin, they hope that you will eventually starting trading stocks or derivatives on their platform. That's their business model.

Quote:

Originally Posted by carboy

(Post 4773614)

What kind of debt fund is Aditya Birla Sun Life Regular Savings Fund? How much is the risk here? Have there been any writedowns in this? I have some money in this. Should I redeem or carry on?

|

Used to belong to "Monthly Income Plans" or MIP category. Now this category is called "Hybrid Conservative" fund, investing up to 80% in debt and 20% in equities. I don't recommend investing in Hybrid or Balanced funds. Instead, create your own hybrid or balanced portfolio by picking individual equity and debt funds.

If I look at the debt portfolio of ABSL Regular Savings Fund, I see lots of unknown or lesser known names:

https://www.valueresearchonline.com/...r-savings-fund

SP Imperial Star

Fullerton India Credit

HDB Financial Services

First Business Receivable Trust

Essel Lucknow Raebareli Toll Roads

Valueresearchonline is listing only 25 out of the 60 bonds this fund holds. We don't know what else this fund has in its portfolio. Another red flag: the average maturity of bond portfolio is almost 5 years. This means the debt portfolio is a corporate bond portfolio (see previous post for disadvantages)

Quote:

Originally Posted by adithya.kp

(Post 4773654)

Btw I have seen you talking about PSU and Banking debt funds. If you look at the underlying portfolio, its scary. They hold private banks and a lot of subsidiary companies. A few funds had defaults due to an IL&FS subsidiary project. So in my opinion, only overnight and gilt are worth looking at.

|

Fund managers made a mistake of categorizing IL&FS as PSU. They had no business investing in IL&FS. Rest of the portfolio is good enough. This is the second time RBI/Govt is demonstrating to the public that they will not allow depositors in private banks to lose money. Global Trust Bank in early 2000s, and now Yes Bank.

Quote:

Also, I was studying the correlation between gsec yield and stock market. There seems to be a clear correlation in the US. But not in India. 10 yr yield went up even when the equity is down big. Probably because in India, the FIIs selling bonds too. So I think the only major trigger would be a rate cut.

|

True. The correlation between Indians stocks and Indian g-secs is not so consistent as the correlation between US Stocks and US 10 Yr treasury bonds.

Quote:

Originally Posted by SmartCat

(Post 4773657)

Used to belong to "Monthly Income Plans" or MIP category. Now this category is called "Hybrid Conservative" fund, investing up to 80% in debt and 20% in equities. I don't recommend investing in Hybrid or Balanced funds. Instead, create your own hybrid or balanced portfolio by picking individual equity and debt funds.

|

It actually is a merger of 5-6 different ABSL funds, I think I am pretty sure I never invested in any hybrid fund - I also have the same philosophy towards hybrid funds. I probably just didn't notice the change when it happened. Anyway sent a redemption now - it seemed to have done 7.5% CAGR during the time I held it, so not bad.

I have a question.

What's the ideal strategy on the liquid funds at this point ? Assuming we are in for a high volatility year or two ahead, does it make sense to exit liquid fund and hold it as liquid cash or FD through out the turbulence ? I used these especially for a scenario like now with a few months' pay saved in there.

Or is it simply based on how good the particular fund is ?

Quote:

Originally Posted by ashokrajagopal

(Post 4773879)

What's the ideal strategy on the liquid funds at this point ? Assuming we are in for a high volatility year or two ahead, does it make sense to exit liquid fund and hold it as liquid cash or FD through out the turbulence ? I used these especially for a scenario like now with a few months' pay saved in there. Or is it simply based on how good the particular fund is ?

|

I have some money in large AUM liquid funds which I'm not touching. These funds will get into trouble only if there is some kind of financial Armageddon. If that's the case, FDs might not be safe either. The financial system is all interlinked. One major fail will have a domino effect. So planning for such eventualities is like planning for Nuclear Armageddon - it is mostly futile. RBI will do whatever it takes protect the entire financial system.

RBI's coronavirus contingency plan: Keep it going from a secret location https://www.business-standard.com/ar...2100060_1.html Quote:

As the country goes on a self-imposed lockdown to fight the coronavirus contagion, a crack team of 150 people, in hazmat suits, is keeping India’s financial system up and running since March 19 from an unknown location in a completely quarantined environment.

These 150 people, including 37 officials from critical departments of the Reserve Bank of India (RBI), such as debt management, reserve management and monetary operations, and third-party service providers, are now in charge of the business continuity plan of the central bank, designed in a way that could help create a benchmark for such exigencies in the future as well.

|

Cash in savings account, BHIM app and some currency notes in wallet is good enough.

Quote:

Originally Posted by adithya.kp

(Post 4773654)

Also, I was studying the correlation between gsec yield and stock market. There seems to be a clear correlation in the US. But not in India. 10 yr yield went up even when the equity is down big. Probably because in India, the FIIs selling bonds too. So I think the only major trigger would be a rate cut.

|

Quote:

Originally Posted by SmartCat

(Post 4773657)

The correlation between Indians stocks and Indian g-secs is not so consistent as the correlation between US Stocks and US 10 Yr treasury bonds.

|

It may sound like a trivial request but please share the information about correlation between US stock market and 10 year yield for knowledge's sake.

Quote:

Originally Posted by huntrz

(Post 4774634)

It may sound like a trivial request but please share the information about correlation between US stock market and 10 year yield for knowledge's sake.

|

I have created a graph of S&P500 and 10 Yr US Treasury bond ETF on

www.tradingview.com

- This shows 15 year data. From 2005 to 2020.

- S&P 500 is the blue line and 10 Yr Treasury bond is the green line

- Between 2005 and 2008, S&P500 (blue line) was rising but 10 Yr Bond (green line) was falling

- Between 2008 and 2009, S&P500 crashed. But 10 Yr Treasury Bond shot up in value.

- Between 2009 and 2010, the reverse happened. S&P 500 recovered and 10 Yr Bond value crashed

- Between 2010 and 2018, there is no clear correlation between S&P 500 and 10 Yr Treasury Bond. Both are rising in value, but at different pace.

- In 2019-20 period, S&P 500 crashed but 10 Yr Bond shot up in value.

Structurally equities and bonds are positively correlated. This is because P/E ratio tends to be higher when yields are lower. When fixed income assets offer a low yield one is ready to pay a higher price for the same earnings.

However cyclically fixed income assets and equities have a negative correlation. This is because when GDP is lower investors prefer the certainty of the fixed interest while earnings are expected to be lower than expected.

When it comes to emerging markets this correlation fails because foreign investors expect a higher yield to compensate for the weaker currency that one expects in a downturn. Also while extremely unlikely that a sovereign nation defaults on debt denominated in its own currency some investors fear that as well.

Quote:

Originally Posted by SmartCat

(Post 4773904)

I have some money in large AUM liquid funds which I'm not touching.

|

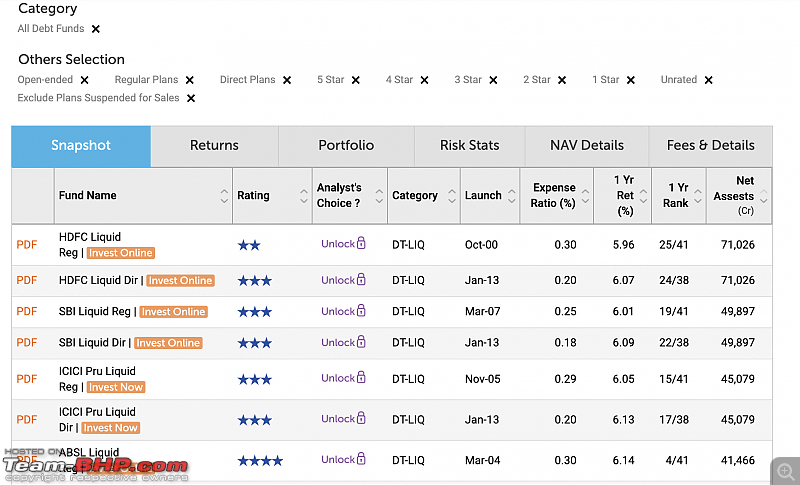

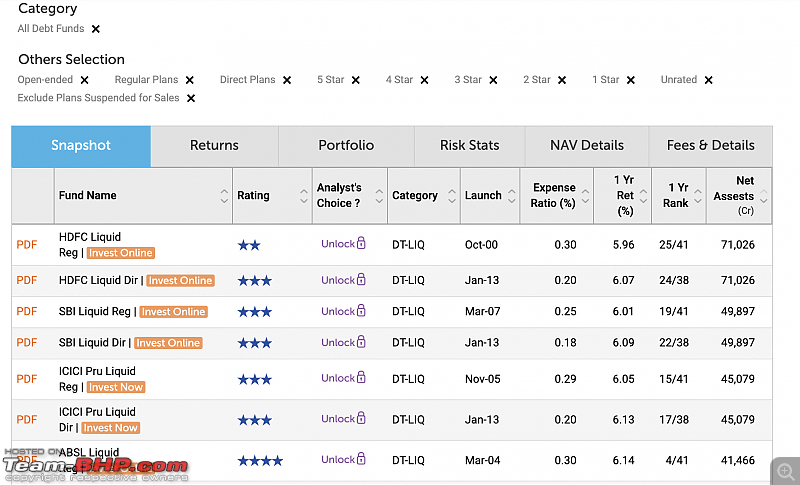

Could not find a way to sort Liquid funds by Aum on Valueresearchonline. Is there any other site which helps find largest Aum funds of a particular categories?

Trading halted in markets after hitting the circuit breaker. If entire states and countries can be in lock down, why not the markets? This mayhem is not going to end soon.

Quote:

Originally Posted by SmartCat

(Post 4773904)

I have some money in large AUM liquid funds which I'm not touching.

|

From the list of funds it appears HDFC Liquid has the highest AUM. Is that right? Last few days, some of the liquid funds NAV came down marginally (HDFC Liquid, ICICI Liquid etc). Is this a cause for concern? Sign of things to come?

Quote:

Originally Posted by carboy

(Post 4774653)

Could not find a way to sort Liquid funds by Aum on Valueresearchonline. Is there any other site which helps find largest Aum funds of a particular categories?

|

I think it's labeled as 'Net Assets' in the list of funds, see last column.

Quote:

Originally Posted by anandhsub

(Post 4774650)

When it comes to emerging markets this correlation fails because foreign investors expect a higher yield to compensate for the weaker currency that one expects in a downturn. Also while extremely unlikely that a sovereign nation defaults on debt denominated in its own currency some investors fear that as well.

|

Japanese and US treasury bonds experience a phenomenon called

flight to quality. That's why these bonds have better negative correlation to their respective indices during economic crisis.

Indian govt bonds do pretty well too, during economic crisis and there is pretty good reason for that. The first thing that RBI/Govt does is to slash interest rates during every financial crisis. And that is positive for bonds. Slashing interest rates during financial crisis is not a problem because crude usually crashes, eliminating inflation risk.

Quote:

Originally Posted by poloman

(Post 4774809)

Trading halted in markets after hitting the circuit breaker. If entire states and countries can be in lock down, why not the markets? This mayhem is not going to end soon.

|

Stock market is interlinked with the banking system and debt markets. If you shutdown stock market for a long time (say 6 months), it can have unintended consequences. Eg: Banks lend to promoters and retail shareholders keeping stocks are collateral.

Quote:

Originally Posted by SilentEngine

(Post 4774930)

From the list of funds it appears HDFC Liquid has the highest AUM. Is that right? Last few days, some of the liquid funds NAV came down marginally (HDFC Liquid, ICICI Liquid etc). Is this a cause for concern? Sign of things to come?

|

Just saw a news flash on CNBC today. Apparently, liquid funds are seeing withdrawals by corporates (because their revenues are being hit, and they need funds to run operations). Now mutual fund houses are appealing to RBI/Govt to offer them a liquidity window, to take care of large withdrawals.

Quote:

Originally Posted by SmartCat

(Post 4774940)

Stock market is interlinked with the banking system and debt markets. If you shutdown stock market for a long time (say 6 months), it can have unintended consequences. Eg: Banks lend to promoters and retail shareholders keeping stocks are collateral.

Just saw a news flash on CNBC today. Apparently, liquid funds are seeing withdrawals by corporates (because their revenues are being hit, and they need funds to run operations). Now mutual fund houses are appealing to RBI/Govt to offer them a liquidity window, to take care of large withdrawals.

|

When the entire economy is in ICU what is the point in keeping markets open. Govt may do well if they announce some kind of moratorium on financial activities rather than allowing everything go on a tailspin.

Quote:

Originally Posted by poloman

(Post 4774950)

When the entire economy is in ICU what is the point in keeping markets open

|

What is the point in keeping it closed?

Quote:

Originally Posted by SmartCat

(Post 4773904)

I have some money in large AUM liquid funds which I'm not touching.

|

I was reading some reviews of liquid funds. Is AuM a good metric for safety of the fund. The liquid funds which have max percentage of Govt Securities (much larger percentage than other others) seem to be Parag Parekh Liquid Fund & Quantum Liquid fund & both of them are very small AuM funds.

So what is the reason for looking at AuM for liquid funds?

| All times are GMT +5.5. The time now is 14:05. | |