Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by poloman

(Post 4796195)

The money would have been safer if you just kept it under your cot rather than handing over to this suited and booted experts.

|

This also possibly highlights the distinctions between a Santosh Kamath and a Parag Parkih - may he rest is peace.

Nothing personal against Santosh, he must have had his reasons for the nature of his fund management, but I never really liked his philosophy.

Although I am invested in FT's equity funds, I will continue for a while and re-asses in 2/3 weeks as the corona induced market volatility gets a little better understood.

I’ve posted a few times on this thread about Franklin funds specifically which have been now wound up. These debt funds from Franklin have been giving around a percent above the industry average in similar category schemes. That must alone had been the greatest indicator for the investors. I’ll repeat the old wise line: greater risk, greater returns and vice versa. Lower credit rated papers which obviously carry higher risk and higher returns have been Franklin’s investment philosophy for long. And it has bitten Franklin in this sudden turn of times for which it could not prepare due to long maturity time of its underlying papers. Unfortunately, most investors and some advisors overlooked the same for too long and have now to repay with their hard earned money and the underlying uncertainty. Hope the investors are paid back in full and within reasonable time.

Quote:

Originally Posted by hondafanboy

(Post 4796183)

I am invested in the following two funds from FT

Franklin India Focused Equity-Direct growth

Franklin India Prima- Direct growth

I am considering getting out it ( though the issue is related to their debt portfolio).

Anyone thinking on these lines or are you continuing your equity investments in FT?

|

Don't think there is an issue with the equity funds. I myself have units of Prima direct.

Essential that folks assess risk instead of panicking and losing money in the bargain.

Disclosure- I had redeemed my holding in FT USB more than a year ago. A through look at the underlying securities convinced me. Retail investors have no business in subscribing to funds which invest in unknown entities.

Quote:

Originally Posted by saket77

(Post 4796262)

I’ll repeat the old wise line: greater risk, greater returns and vice versa.

|

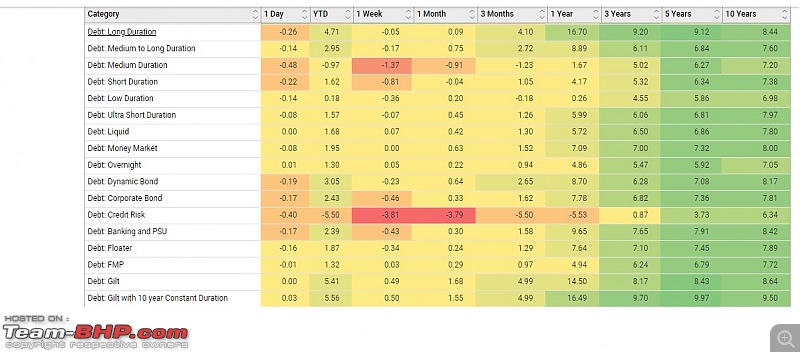

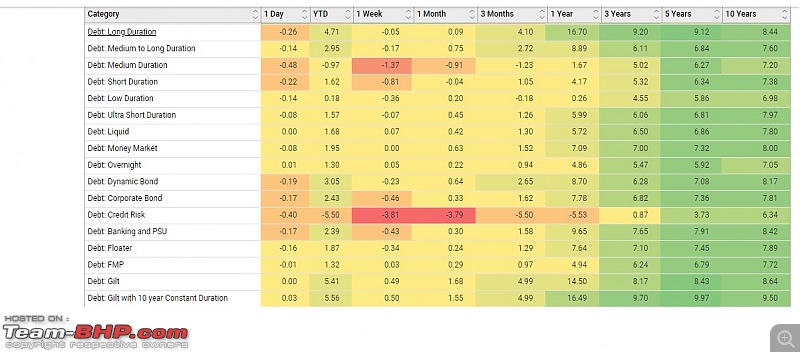

Ironically, the debt fund category with zero credit risk (gilt funds) has given the highest returns across multiple time periods - 10 years, 5 years, 3 years, 1 year, year to date and so on.

Note

Note:

1) Click on pic to see a clearer image

2) "Debt Long Duration" category contains up to 80% long term government securities. Remaining will be AAA bonds.

3) "Debt Gilt" category contains both short term and long term government securities

4) "Debt Gilt constant maturity" category contains only long term government securities.

Quote:

Originally Posted by JediKnight

(Post 4796320)

|

It's behind a paywall.

Could you summarise what is the gist of that article?

Quote:

Originally Posted by DigitalOne

(Post 4795787)

FT has published a FAQ including Cash Flow projections for the 6 wound up schemes.

|

Quote:

Originally Posted by rjainv

(Post 4796361)

Could you summarise what is the gist of that article?

|

FT has published a detailed FAQ (linked in my earlier post). This must be a summary of the FAQ.

Quote:

Originally Posted by hothatchaway

(Post 4796285)

Don't think there is an issue with the equity funds. I myself have units of Prima direct.

Essential that folks assess risk instead of panicking and losing money in the bargain.

Disclosure- I had redeemed my holding in FT USB more than a year ago. A through look at the underlying securities convinced me. Retail investors have no business in subscribing to funds which invest in unknown entities.

|

I am stopping SIPs into those two funds ( India Focused Equrity and Prima fund) but wont redeem for now as I am already in loss ( approx. 10% down) .

I have some small investments in US feeder fund. I don't really want to redeem because i will face STCG, and this fund is one of the very few which are in the green in my portfolio.

https://www.valueresearchonline.com/...rtunities-fund

Is there any larger issue that I am ignoring if I continue to hold on to it?

Since it's a feeder fund, most of the investment is controlled by the actual US Opportunities fund in the US, so the local Indian fund manager doesn't have much to do other than channeling the funds across, is that right?

Quote:

Originally Posted by SilentEngine

(Post 4796859)

I have some small investments in US feeder fund. I don't really want to redeem because i will face STCG, and this fund is one of the very few which are in the green in my portfolio. https://www.valueresearchonline.com/...rtunities-fund

Is there any larger issue that I am ignoring if I continue to hold on to it?

Since it's a feeder fund, most of the investment is controlled by the actual US Opportunities fund in the US, so the local Indian fund manager doesn't have much to do other than channeling the funds across, is that right?

|

The data on the underlying securities isn't available on value research. What does this fund invest in?

Quote:

Originally Posted by SmartCat

(Post 4796289)

Ironically, the debt fund category with zero credit risk (gilt funds) has given the highest returns across multiple time periods - 10 years, 5 years, 3 years, 1 year, year to date and so on.

|

Thanks Smartcat. This is a good data point.

One question on the AUM. The size of Gilt funds is significantly smaller than other Liquid, Banking PSU debt funds. Any particular reason for this?

Smartcat can give a better answer.

Three reasons I can think of

1. Retail category doesn't dominate debt category. Its the corporate. Usually they prefer liquid funds.

3. Even today, mutual funds are mostly push type of products. The so called relationship managers/wealth advisors etc usually push credit risk kind of categories under debt category.

3. Usually people dont want to see short term notional loss in debt products. It can happen in gilt due to interest rate movement.

But I too am surprised at the total AUM size. Its very low even considering the above three points.

Quote:

Originally Posted by C300

(Post 4798266)

Thanks Smartcat. This is a good data point.

One question on the AUM. The size of Gilt funds is significantly smaller than other Liquid, Banking PSU debt funds. Any particular reason for this?

|

Quote:

Originally Posted by C300

(Post 4798266)

One question on the AUM. The size of Gilt funds is significantly smaller than other Liquid, Banking PSU debt funds. Any particular reason for this?

|

I think the biggest reason is the wrong assumption that g-sec funds will offer the lowest returns. People who invest want higher than benchmark returns. The reason for high returns for g-sec funds is that the gap between risk free interest rate (g-secs) and AAA/AA/A/junk bonds is

NOT enough.

That is, in my

opinion, if 10 year g-secs offer 6% pa:

AAA should offer 8% pa

AA should offer 10% pa

A should offer 12% pa

Junk bonds should offer 15% pa

Only then, it makes sense to invest in other categories of debt funds. That's because it costs the fund house (hence high expense ratio) to check the credit risk. The fund also sees lower returns because of minor defaults too.

But instead of

large spread between corporate bonds and g-secs, we have:

AAA bonds offering 6.5% pa

AA bonds offering 7.5% pa

A rated bonds offering 9% pa

Junk bonds offering 10% pa.

This yield spread between g-secs and corporate bonds is simply not enough to cover for the extra risk and costs.

Quote:

Originally Posted by adithya.kp

(Post 4798280)

1. Retail category doesn't dominate debt category. Its the corporate. Usually they prefer liquid funds.

|

Correct. Corporates prefer steady returns that liquid funds offer. But other categories of debt with longer maturity periods (credit risk, corporate bond etc) have huge AUMs too. Perhaps HNIs invest in them.

Quote:

Even today, mutual funds are mostly push type of products. The so called relationship managers/wealth advisors etc usually push credit risk kind of categories under debt category.

|

Possible. Commission to distributors for g-sec funds is probably lower than other categories of debt funds. G-sec funds have a very low expense ratio too - so I'm guessing this category is funds is not too profitable for fund houses.

Quote:

Usually people dont want to see short term notional loss in debt products. It can happen in gilt due to interest rate movement.

|

This cannot be the reason. All longer maturity debt funds have high volatility (because of interest rate sensitivity).

Quote:

Originally Posted by SmartCat

(Post 4798315)

All longer maturity debt funds have high volatility (because of interest rate sensitivity).

|

Banking and PSU Funds (BPF) vs Gilt Funds

When I did research using annual returns of funds in VR.com, I am seeing following trends

1. Credit Quality - Gilt funds (All SOV papers + cash) are safer than BPF (many funds in these categories have AA papers even though percentage allocation is more in AAA/A1+/SOV papers)

2. Average return of Gilt Funds is better than BPF over 5 years period

3. BPF funds returns are better than Gilt Funds when interest rate increases (in some years, when Gilt funds returned 2%, BPF have returned 4 to 5%)

Assuming that in next few years, we might witness increase of interest rate and expect volatility in both the categories,

1. How should the allocation be between the two categories if I am looking at investment horizon of 3 to 5 years? I am leaning towards 100% in Gilt Funds. Should I allocate some percentage to BPF category too? (Note: I have taken care of investing in other categories like overnight/liquid funds etc)

2. How do Gilt funds manage their allocation during increasing interest rate regime? Do they increase their allocation to T-Bills?

| All times are GMT +5.5. The time now is 09:24. | |