Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by sandeepmohan

(Post 4793530)

The DSP Mid Cap Fund is a bit all over the place.

|

If you are looking for Midcap exposure, check out the Axis MidCap Fund as well.

Quote:

Originally Posted by sandeepmohan

(Post 4793530)

Thinking of starting a couple of new SIP's and wanted feedback on the following funds.

Axis BluChip Fund (Growth)

|

I am a bit of a noob who relies on Moneycontrol & ValueResearch to make informed picks.

I would advise you to read up about along with your other choices.

1. Axis Blue Chip Fund Direct Growth

2. Axis Long Term Equity Fund Direct Growth

In the current scenario, if you have cash just sitting, you could do a lumpsum for next few months over various dips till markets begin doing their thing and then go the SIP route. This way, you may be able to pick up more number of units for the same cost.

Would be interesting to see how the market reacts once the curve flattens and investors mood/sentiments change. I for one suspect a sharp V-recovery as soon as the economy is up and running. Reason being, many of the top bluechip companies do not justify the sharp fall (~25-35%) having strong liquidity and balance sheet to weather this situation.

Quote:

Originally Posted by Sumeru97

(Post 4793301)

4. 3-5 years is a good time horizon. You are going to be a rich guy, if you are not one already :D

|

Haha, thanks man. Not quite there yet, but hope to make the most of this slump market to reap benefits later!

Quote:

Originally Posted by Striker

(Post 4793787)

I for one suspect a sharp V-recovery as soon as the economy is up and running.

|

Some economists are expecting a Nike logo shaped recovery (No kidding!): :)

A ‘U,’ a ‘V’ or maybe a Nike swoosh? Economists try to predict what a recovery will look like https://www.cnbc.com/2020/04/22/a-u-...look-like.html

A ‘U,’ a ‘V’ or maybe a Nike swoosh? Economists try to predict what a recovery will look like https://www.cnbc.com/2020/04/22/a-u-...look-like.html

my portfolio has gone by approx 23% since Jan-2020, where as NIFTY has gone down by around 30% in the same time frame.

I am still holding on to all the funds and have not stopped any SIPs. I hope I am doing the right thing. Experts comments please.

Quote:

Originally Posted by SmartCat

(Post 4794146)

Some economists are expecting a Nike logo shaped recovery (No kidding!): :)

|

So that is faster than U and nearly as aggressive as a V. The proponent of that model is clear there will be no depression and a quick ish recovery.

Which formation are you personally expecting?

So I am one of the unfortunate ones who has quite a lot of money parked in Franklin Templeton Ultra Short Debt Fund.

Just keeping my fingers crossed that I get my entire corpus back. Banks collapsing, MFs collapsing, these are stressful times.

Quote:

Originally Posted by puneetakhouri

(Post 4794218)

So I am one of the unfortunate ones who has quite a lot of money parked in Franklin Templeton Ultra Short Debt Fund.

Just keeping my fingers crossed that I get my entire corpus back. Banks collapsing, MFs collapsing, these are stressful times.

|

I am sailing in the same boat and I hope I would get atleast my principle amount back in the near future.

In addition I went ahead and redeemed all my other investments in duration funds, credit risk funds and savings funds across other fund houses on Friday. I am continuing my investments in liquid funds, banking/PSU funds, gilt funds and a couple of dynamic bond funds (80% plus portfolio invested in government backed instruments). I am sure that I would have lost quite a bit in terms of exit load and short term capital gain tax liability, but I don’t want to take any more chances with my hard earned money from now.

Quote:

Originally Posted by Simhi

(Post 4794402)

|

I am worried about what will happen to Franklin's equity funds now. I have SIP running in FIT (ELSS). I am aware of the lockin for 3 years but what to do now? Stop SIP or continue? Performance has been as for other ELSS funds. Nothing to write about.

Any suggestions?

Quote:

Originally Posted by Simhi

(Post 4794402)

|

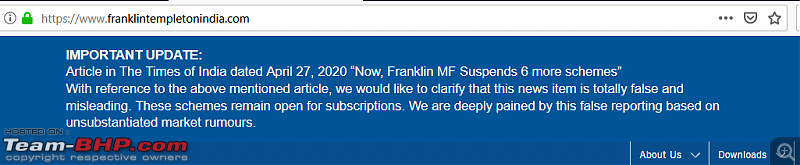

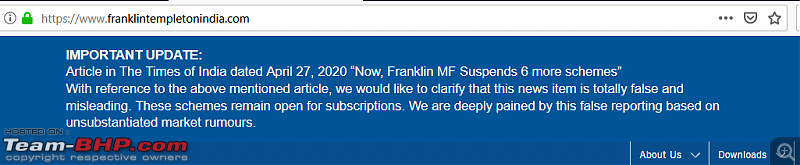

Clarification from FT

Quote:

Originally Posted by digitalnirvana

(Post 4794200)

Which formation are you personally expecting?

|

Frankly, no clue. We are seeing articles that suggest we countries might go through a series of lockdowns and lifting of restrictions. If that turns out of be true, full recovery will take a couple of years.

Quote:

Originally Posted by sunilch

(Post 4794410)

I am worried about what will happen to Franklin's equity funds now. I have SIP running in FIT (ELSS). I am aware of the lockin for 3 years but what to do now? Stop SIP or continue? Performance has been as for other ELSS funds. Nothing to write about. Any suggestions?

|

Different fund manager, different strategies. Franklin India Taxshield's portfolio looks like any other equity fund - I don't smell a rat here at all. But if you are not comfortable, stop SIP here and start investing in another ELSS.

https://www.valueresearchonline.com/...taxshield-fund Quote:

Originally Posted by Simhi

(Post 4794402)

Now, Franklin MF suspends 6 more schemes

|

Quote:

Originally Posted by Simhi

(Post 4794456)

Clarification from FT

|

TOI has changed the title from "suspends" to "marks down".

The NAV of L&T hybrid fund is 22.97 for this month, whereas it was 20 something last month.

I am wondering has the market improved my head says otherwise. What could be going on here?

Quote:

Originally Posted by SideView

(Post 4795488)

The NAV of L&T hybrid fund is 22.97 for this month, whereas it was 20 something last month.

I am wondering has the market improved my head says otherwise. What could be going on here?

|

On 23rd March, BSE was around 26000. Today, it is at 32000. That is a 23% recovery in a month. That is the reason for the NAV of the hybrid fund appreciating in the past month.

Quote:

Originally Posted by graaja

(Post 4793559)

If you are looking for Midcap exposure, check out the Axis MidCap Fund as well.

|

Could you elaborate on what Midcap exposure means, or, how does this fund operate, please.

| All times are GMT +5.5. The time now is 11:02. | |