| | #3061 |

| BHPian Join Date: Sep 2011 Location: Bangalore

Posts: 224

Thanked: 501 Times

| |

| |

| |

| | #3062 |

| BHPian Join Date: Oct 2004 Location: Pune

Posts: 322

Thanked: 175 Times

| |

| |

| | #3063 |

| BANNED Join Date: Mar 2007 Location: Kolhapur

Posts: 1,717

Thanked: 1,901 Times

| |

| |

| | #3064 |

| BHPian Join Date: Sep 2011 Location: Bangalore

Posts: 224

Thanked: 501 Times

| |

| |

| | #3065 |

| Team-BHP Support  | |

| |  (1)

Thanks (1)

Thanks

|

| | #3066 |

| BHPian Join Date: Sep 2011 Location: Bangalore

Posts: 224

Thanked: 501 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #3067 |

| Team-BHP Support  | |

| |  (1)

Thanks (1)

Thanks

|

| | #3068 |

| BHPian Join Date: Oct 2004 Location: Pune

Posts: 322

Thanked: 175 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #3069 |

| BHPian Join Date: Oct 2012 Location: Bangalore

Posts: 561

Thanked: 1,592 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #3070 |

| Team-BHP Support  | |

| |  (2)

Thanks (2)

Thanks

|

| | #3071 |

| BHPian Join Date: Oct 2004 Location: Pune

Posts: 322

Thanked: 175 Times

| |

| |

| |

| | #3072 |

| BHPian Join Date: Mar 2010 Location: Pune

Posts: 289

Thanked: 1,640 Times

| |

| |

| | #3073 |

| BHPian Join Date: Oct 2004 Location: Pune

Posts: 322

Thanked: 175 Times

| |

| |

| | #3074 |

| Team-BHP Support  | |

| |  (2)

Thanks (2)

Thanks

|

| | #3075 |

| BHPian Join Date: Sep 2019 Location: City

Posts: 101

Thanked: 189 Times

| |

| |

|

Most Viewed

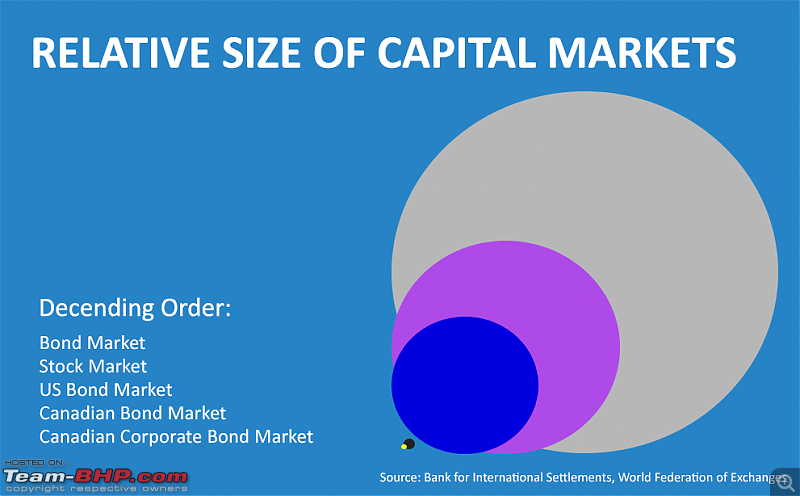

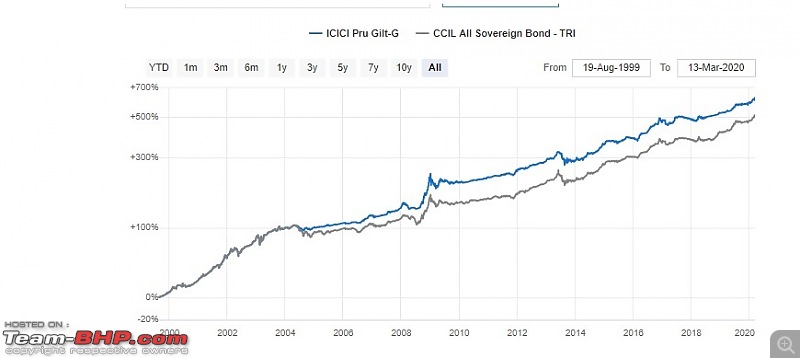

It is a reasonably popular investment strategy called "Strategic Asset Allocation Strategy" (do a Google search). If you think you have the discipline and patience to implement it, go ahead. This is way better than SIP - because you automatically buy assets (equities & bonds) at low prices and stop buying when prices are high. Gilt funds usually perform the best when equity funds are NOT doing well (there is logic behind this too).

It is a reasonably popular investment strategy called "Strategic Asset Allocation Strategy" (do a Google search). If you think you have the discipline and patience to implement it, go ahead. This is way better than SIP - because you automatically buy assets (equities & bonds) at low prices and stop buying when prices are high. Gilt funds usually perform the best when equity funds are NOT doing well (there is logic behind this too).

So before getting into this gilt fund investment business, it is best to understand what you are getting into.

So before getting into this gilt fund investment business, it is best to understand what you are getting into.