| | #3196 |

| BHPian Join Date: Jun 2019 Location: BLR - PKD

Posts: 160

Thanked: 813 Times

| |

| |

| |

| | #3197 |

| BHPian Join Date: Jun 2005 Location: Coimbatore

Posts: 524

Thanked: 349 Times

| |

| |  (2)

Thanks (2)

Thanks

|

| | #3198 |

| Team-BHP Support  | |

| |  (7)

Thanks (7)

Thanks

|

| | #3199 |

| BHPian Join Date: Jun 2005 Location: Coimbatore

Posts: 524

Thanked: 349 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #3200 |

| Distinguished - BHPian  Join Date: Dec 2012 Location: Ranchi

Posts: 4,396

Thanked: 12,046 Times

| |

| |  (3)

Thanks (3)

Thanks

|

| | #3201 |

| Team-BHP Support  | |

| |  (7)

Thanks (7)

Thanks

|

| | #3202 |

| BHPian Join Date: Jun 2005 Location: Coimbatore

Posts: 524

Thanked: 349 Times

| |

| |

| | #3203 |

| Team-BHP Support  | |

| |  (5)

Thanks (5)

Thanks

|

| | #3204 |

| BHPian Join Date: Nov 2006 Location: Bombay

Posts: 77

Thanked: 43 Times

| |

| |

| | #3205 |

| Team-BHP Support  | |

| |  (4)

Thanks (4)

Thanks

|

| | #3206 |

| BHPian Join Date: Aug 2007 Location: Banaglore

Posts: 647

Thanked: 2,139 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| |

| | #3207 |

| BHPian Join Date: Jun 2005 Location: Coimbatore

Posts: 524

Thanked: 349 Times

| |

| |

| | #3208 |

| Team-BHP Support  Join Date: Nov 2013 Location: Coimbatore

Posts: 3,223

Thanked: 20,742 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #3209 |

| BHPian Join Date: Aug 2012 Location: Kolkata

Posts: 761

Thanked: 1,665 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #3210 |

| BHPian Join Date: Sep 2015 Location: Bangalore

Posts: 164

Thanked: 224 Times

| |

| |  (1)

Thanks (1)

Thanks

|

|

Most Viewed

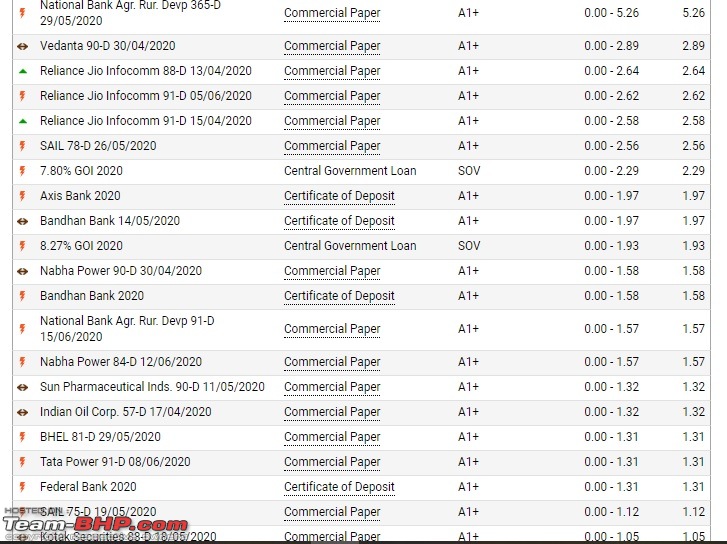

I believe this has never happened in Indian history before. I was an investor in one of the schemes. And that too a big percentage of my portfolio. But i redeemed a few days back. I thank my stars.

I believe this has never happened in Indian history before. I was an investor in one of the schemes. And that too a big percentage of my portfolio. But i redeemed a few days back. I thank my stars.