Quote:

Originally Posted by Saanil  Hi Guys,

....So what is the point of the Central Bank officially coming out with a statement? Should we view the statement from the Central Bank to mean that “Ok, so we are in trouble. Get used to Naira being 180”. What is the point of giving a range of 165-170 when the market rate is already at 180?

Can someone please tell me what happens when a country devalues its currency? Also, what do we mean by a country devaluing its own currency? The market rate already reflects the devaluation so why the statement “Nigeria has devalued its currency”. It is not that Nigeria is doing it – it is just that market dynamics are such that the currency is trading in that range. |

I am not aware of the developments around Nigeria's currency, that you refer to. I quickly tried to refer to some news article. It appears there is quite a gap between the Naira-USD peg set by the central bank of Nigeria. the reason for the gap could be lack of efficient markets / blackmarketeering of Naira-USD,etc - someone with better understanding of Nigeria's economy would have insights. But the 'devaluation' refers to the fact that the central bank of Nigeria's official Naira-USD peg has been re-adjusted( I understand earlier it was arounf 153 Naira to 1 USD with a +/- 3% cushion. Post the announcement, I guess this is around 160 Naira to 1 USD with a +/- 5% cushion.) One way of looking at this is - prior to the announcement, it would have been

theoretically possible to exchange Naira/USD's at the old rate., although

practically more Naira's would have been needed to get a USD. And, post the announcement,

theoretically it is possible to exchange Naira's for USD's at the latest rate set by central bank of Nigeria, but

practically that may not happen for various reasons. This kind of a blackmarket for currency is usually prevalent during any instability /strife - internal or external/ loss of faith in the government of the day.

In a way, Nigeria's economy being heavily dependent on oil exports, this can be, in a way, seen as a side-effect of the imposed petro-dollar denominated trade in crude oil.

Quote:

Originally Posted by Saanil  Hi Guys,

.......

Can someone please tell me what happens when a country devalues its currency? Also, what do we mean by a country devaluing its own currency? ... |

The citizens holding those

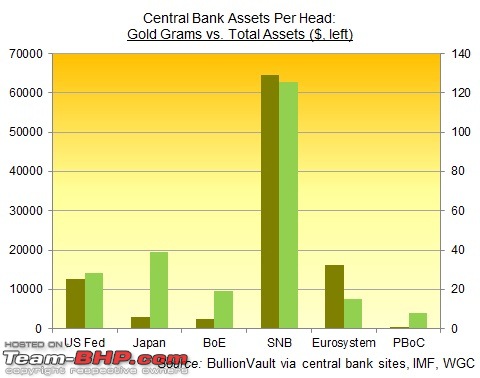

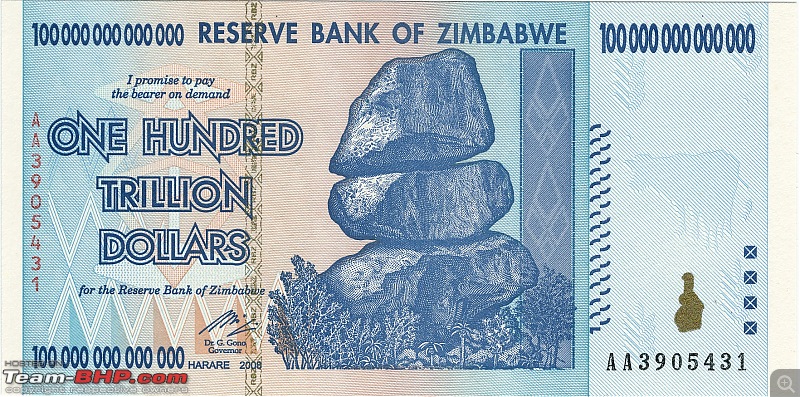

devalued currency see a noticeable erosion in purchasing power, to put it lightly.You could refer to Weimar hyperinflation - 1920's / devaluation of INR during 1991 / the recent Zimbabwe hyperinflation for the details. Amongst others, I believe Argentina / Sweden also have gone through periods of noticeable devaluation in the past 2-3 decades. Although a slightly more complex situation, I believe Japan's currency since the mid-1980s also is a good case of currency devaluation( but in this case, I guess some years in between, there were 1-2 years of deflation - the opposite of inflation, which makes this example a bit more complicated. I could be a bit wrong here). Russia too has seen some devaluation relative to the USD last couple of months. I think the EUR too is seeing some devaluation with respect to the USD, markedly more since last week's SNB tsunami on the financial markets.

Quite interestingly, the USD has seen some devaluation with respect to the Swiss franc since last week!

In reality, as long as a government is able to devalue its currency in a

controlled fashion, it is not necessarily a bad thing

for that country. If not controlled, it can

very quickly spiral into hyperinflation, which can have relatively disastrous consequences.

On a lighter sense, in the case of a significant devaluation of a major currency, you could probably expect a 99%+ possibility of war!

( Hope that helped up clear more points, than it helped to further complicate!

)

I don't know what to say or how to react to this.

I don't know what to say or how to react to this.

)

)