Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by avira_tk

(Post 4990239)

Warren doesn't seem to know that stock market shenanigans don't affect day to day company operations. The reason there is a short squeeze is because the new investors are in it for the long haul, and the free float is reduced.

|

Still waiting to understand who her backers are, whom she's speaking up for.

Also, if not the Post and CNN, who, according to you, are good sources of news?

Quote:

Originally Posted by Jeroen

(Post 4990279)

do you want to benefit from somebody else downfall and misfortune? It is not illegal, but should you participate in such behaviour?

|

Almost all major stocks in US will have short positions - including insanely profitable companies like Microsoft or Google. And just because somebody is shorting these stocks, it does not mean Microsoft or Google is facing a "downfall". Short positions are taken even if somebody feels a particular company is overvalued at that point of time.

Short selling is just one of the price discovery mechanisms. Many investors look at percentage shorts in a stock as an important indicator of undervaluation or overvaluation.

Also, as mentioned before, making profits out of shorts is tough. It is not as simple as identifying a list of companies that are about to go bankrupt and going short in them. It is a sureshot way of going to the poor-house. That's because there might be a bunch of other investors who will buy up all the stocks that short sellers sell, since they find value in that stock at that particular price.

Quote:

Originally Posted by avira_tk

(Post 4990239)

No it's not a hoax, she was listed as Native American on the Harvard law school directory between 1986 and 1995.

|

Yes, I know she was listed as native. How did that help her? Harvard recruited her because of her brilliant work and not to fill some diversity quota.

Quote:

Originally Posted by avira_tk

(Post 4990239)

She won, with obama campaigning for her, in Massachusetts, ground zero of voter fraud. The oppression Olympics just doesn't end.

Washington Post, the same guys who settled with Nick Sandmann over another native American elder? They are really trustworthy, just behind CNN on the Babylon bee doublethink features.

|

Sorry, I don't have much stomach for alternative facts.

Quote:

Originally Posted by SmartCat

(Post 4990290)

Short selling is just one of the price discovery mechanisms. Many investors look at percentage shorts in a stock as an important indicator of undervaluation or overvaluation..

|

Absolutely, and I was counting on you to point that out. Never the less, there might be those cases where folks go short because they believe the company is going south too.

Morality is not absolute. It is always in the eye of the beholder. I know folks who believe playing the stock market is evil and immoral no matter what.

I have been the managing director of a private investment company for over 15 years and I have been investing privately for about double that period. As an MD I need to be able to explain my actions to my shareholders and board. But even then I would never ever cross my own borders when it comes to what I would consider morally right or wrong. That is my call, not the board, not the share holders, not the public at large, just my own conscious.

They can sack me, compliment me, condemn me or applaud me. I am indifferent as long as I feel I do things in an appropriate matter.

No matter what, when you ran into folks whose moral compass has a different calibration from yours, no debate is going to help. Best leave and move on.

Jeroen

Question for the better informed: how sure can investors be that the big hedge funds are still holding on to their short positions? Is there a way to find this information? Because, IMO, the entire thing hinges on this stock being over-shorted. The way I see it, if Melvin and Citadel haven't closed their short positions, just holding makes a lot of sense. If they have, woe for most of the recent retail investors.

Quote:

Originally Posted by lordtottuu

(Post 4990374)

Question for the better informed: how sure can investors be that the big hedge funds are still holding on to their short positions? Is there a way to find this information?

|

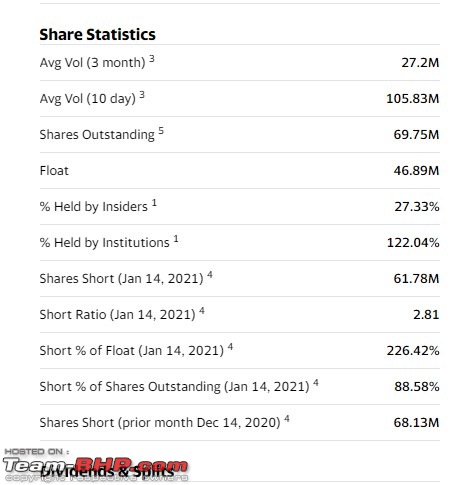

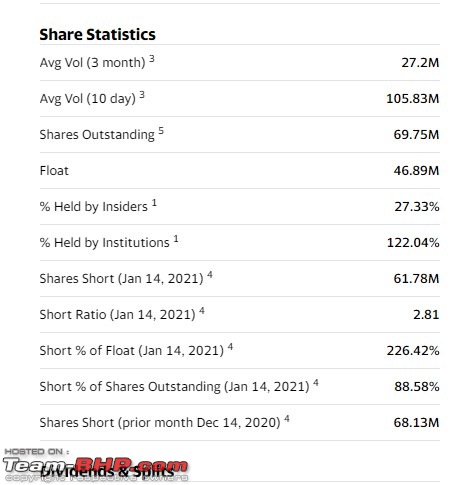

Just Google

<Stock short interest ratio>. Eg: "GameStop Short Interest Ratio"

https://finance.yahoo.com/quote/GME/key-statistics/

There were 68 million short shares last month and 62 million now. So only about 10% of shorts have covered. Short ratio of 2.81 means it will take 2.81 days to cover all shorts if short sellers (theoretically) buy up all the shares traded that day. Such high ratio means short squeeze could continue.

Quote:

Because, IMO, the entire thing hinges on this stock being over-shorted. The way I see it, if Melvin and Citadel haven't closed their short positions, just holding makes a lot of sense. If they have, woe for most of the recent retail investors.

|

As long as there is no change in business prospects & financials of GameStop, the hedge funds will continue to hold - provided they have the muscle power to manage the "

mark to market" losses.

GameStop short sellers are still not surrendering despite nearly $20 billion in losses this month https://www.cnbc.com/2021/01/29/game...this-year.html

Such losses can be managed by:

- Bringing in fresh capital from other large investors who believe retail will eventually fold and give up

- Taking positions in derivatives (that make money if GameStop goes up, but does not lose much when it goes down. Eg: call option)

- Selling shares in other stocks they own to raise capital

One possible endgame in which retail will win and hedge funds will lose is GameStop taking advantage of this stock surge and raising fresh equity at these prices. If successful, it means there has been a fundamental and long term change in financials of this company for the better. AMC Entertainment is already mulling such a move:

AMC Entertainment explores raising new capital as its stock surges, sources say https://www.cnbc.com/2021/01/29/amc-...urces-say.html

On a lighter note, this is what comes to mind!

P. S. That's u/DFV

I hope DFV does not get prosecuted after all this. I know there is nothing illegal he has done here, but people with money can easily find something to hurt him if they want to. Especially if he does something that makes him to be perceived as the leader of the pack. At this point, he should lay low as much as possible and should not try to take the credit for leading this pack. If WSB stays as a leader less bunch of degenerates as they claim, there is nothing SEC or the hedge fund money can do here.

I went through all his posts right from 2019 and felt he did not foresee this short squeeze either till about mid 2020. He was in this only because he felt GME had a valuable business that had the potential for profit during the time of console refresh. The short squeeze angle came much later.

Keeping politics aside, the subreddit is pretty clear that many aren't motivated by profit making, but by pure revenge and hatred towards the many Wall Street biggies. Over the last week, the open manipulation done by wallstreet biggies (restricting buying of $gme, using media, etc) popular posts have come up, rallying the users under the banner of this being a revolution against wallstreet and paying them back for 2008.

It is interesting and also has a lot of legitimacy, as unlike many other financial industries around the world, wallstreet received bail out packages and was left unregulated.

I'm not a big fan of SEBI, but at least we can say SEBI has learnt from our previous scams and mistakes (the most popular being the Harshad Mehta scam). I'm linking a Twitter thread which shows the difference between Indian and American financial markets, and how unregulated it is. This is one of the prime reason why retailers are mad at the biggies, they got away almost scott free for their actions. The other being obviously, the greed of wallstreet (they shorted 120%+ of the total stocks of GME, which caused the squeeze in the first place).

Twitter link -

https://twitter.com/Nithin0dha/statu...152952325?s=20

Interesting update.

One of those zero commission brokerages has announced they will stop selling order flow to these big HFTs and instead will introduce "tipping" for making a trade.

Didnt quite realise how big this Retail vs Hedge fund story is going to become.

Quote:

Originally Posted by koyomi_araragi

(Post 4990704)

Keeping politics aside, the subreddit is pretty clear that many aren't motivated by profit making, but by pure revenge and hatred towards the many Wall Street biggies. Over the last week, the open manipulation done by wallstreet biggies (restricting buying of $gme, using media, etc) popular posts have come up, rallying the users under the banner of this being a revolution against wallstreet and paying them back for 2008. 0

|

I agree, many put in money to teach the Suits a lessons, some specially recalled them sipping Champagne and laughing during the occupy wall street protests.

More entertainment folks.

Media misinformation ramps up and Silver makes a grand entry.

Just do a google search on "GME stock news" and you will see articles spruiking silver to the Redditors. However as they say on WSB, we may be retarded but we are not stupid.

Silver is being sold by the hedge funds to pay for the GME. Citadel has majority share of Silver and Citadel owns RH. Basically you buy silver you are allowing Citadel to continue the fight on GME. (Everything is from Reddit and take it with a bag of salt.)

As long as the "few" share gang is there I don't think WSB will easy to crack.

There have been more ladder attacks and there is no sign of entertainment waning.

Will the Congress use this chance to regulate Wall St? I do not think so. It was Democrats only who let the Wall St guys walk off without any consequence.

David Vs Goliath story applied to stock markets. All the users who bought the shares of GameStop liked the company and wanted it to remain the same way much to the chagrin of ruthless wall street pundits like Melvin capital who held short positions to profit from the expected fall.

The question of ethical practices does not rise since the actions of both parties were, IMO, within the law. Its now only a question of who blinks first. The first round, obviously has gone to the Robinhood army. Such practices should come as a wakeup call to pundits who just see business as a sheet of paper with some numbers in it unlike users who see it as part of their life.

Quote:

Originally Posted by how_you_doing

(Post 4988113)

GME is certainly going to be in $500-$600 range as now lot of institutions are also buying this stock.

|

GME is actually at $90 now.

I am glad I don't invest in stocks as I can easily lose my hard earn money chasing trends :D

Quote:

Originally Posted by how_you_doing

(Post 4992909)

GME is actually at $90 now.

I am glad I don't invest in stocks as I can easily lose my hard earn money chasing trends :D

|

The stock was expected to come down sooner or later. The only question was how long it would hold the price. Frankly, I expected it to hold a little more considering the buzz it made all over the world.

| All times are GMT +5.5. The time now is 15:11. | |