Team-BHP

(

https://www.team-bhp.com/forum/)

We can call this a DRAW, rather than an outright victory for either short sellers or the Reddit gang. GameStop has crashed 75% from $396 to $95 in the past few days, resulting in huge losses for those who joined the party late. Meanwhile, hedge funds have exited (at a loss) some of the shorts they held for a long time (since Jan, when its price was in $15 to $25 range).

GameStop Short Interest Plunges in Sign Traders Are Covering https://finance.yahoo.com/news/games...145226052.html Quote:

Short interest in the video-game retailer plummeted to 39% of free-floating shares, from 114% in mid-January, according to IHS Markit Ltd. data. Data from S3 Partners, another market intelligence firm, showed a similar pattern, with GameStop’s short sales having fallen to about 50% of its total stock available to trade, down from a high of roughly 140% reached earlier this year.

|

Quote:

Originally Posted by SmartCat

(Post 4993262)

We can call this a DRAW, rather than an outright victory for either short sellers or the Reddit gang.

|

It is a loss for common investors on the street. People like us who do the due deligence and what not. And what we are up against? A system so thoroughly rigged against us. WSB just exposed how deep the rot goes.

SEC is now investigating the social media posts which drove up the prices of GameStop.

Yellen who was paid around 810K by Citadel (for giving a talk) got an Ethics Waiver to lead the regulator meeting on GameStop saga.

And who is investigating how Robinhood effectively stopped people from buying GME while institutational houses were given a free hand to play with the stock?

So much for the theory of Markets being efficient. :disappointed

Quote:

Originally Posted by download2live

(Post 4993347)

And who is investigating how Robinhood effectively stopped people from buying GME while institutational houses were given a free hand to play with the stock?

So much for the theory of Markets being efficient. :disappointed

|

Have not followed this full thread and will not comment on specific stocks. But Robinhood had no choice but to stop trades which required it to put up more capital than it had with the clearing corporation. People don’t have a God given right to borrow to buy stock. And hyper growth without capital is not possible in financial services.

As tor market efficiency, it does not mean that there can be no anomalies in prices of individual stocks or even of a particular market as a whole - it just means that aggregate prices reflect all the information available with the market at a point in time.

Here is something pretty shocking... Tom Rogers on Newsweek compares the Redditors to insurrectionists who stormed the Capital Hill last month.

He says...

Quote:

While it might seem a bit outlandish to compare the insurgent rioters that stormed Capitol Hill on January 6, to a mob of small investors who overwhelmed short sellers betting against the stock price of the store chain GameStop, there are some striking similarities. Both the window-breaking Capitol Hill rioters, and the norm-breaking GameStop investor "insurgents," were organized based on calls to action exchanged on social media

|

When retailer investors try to play the same game hedge funds play, they are compared to traitors and criminals. He keeps repeating they are very different, but keeps comparing anyway.

https://www.newsweek.com/mob-that-st...pinion-1565456

Wow... and MSNBC gives air and even agrees with his assessment.

Jump video position 7:30

https://youtu.be/KWe61MA8WT0?t=450

What the Redditt army set out to do :

Quote:

Originally Posted by SmartCat

(Post 4993262)

Meanwhile, hedge funds have exited (at a loss) some of the shorts they held for a long time (since Jan, when its price was in $15 to $25 range).

|

Time to move on.

Quote:

Originally Posted by SmartCat

(Post 4993262)

GameStop has crashed 75% from $396 to $95 in the past few days, resulting in huge losses for those who joined the party late.

|

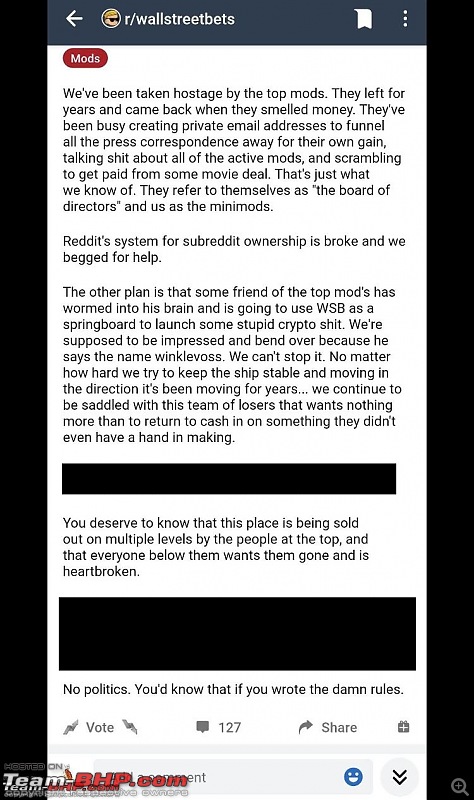

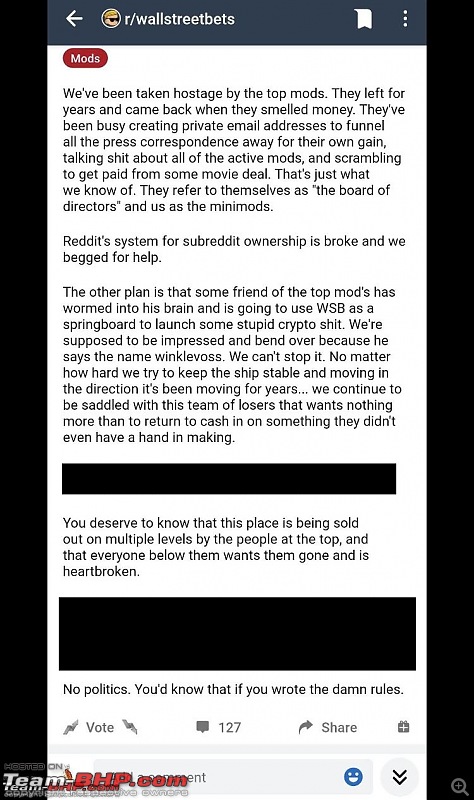

The Sub reddit has gone wild. The top mods kicked out the ones doing the main work and now signing up book / movie deals. Idiots still posting memes saying they'll hold to the grave and others blindly following while losing their savings.

It started off well but then became a good case study of how easily people can be influenced using 'hype' and 'memes'. I'll try editing this from my phone so I can post screenshots of some depressing drama on the Sub today, people still believe the squeeze is yet to come.

https://qz.com/1527974/the-internet-...s-information/

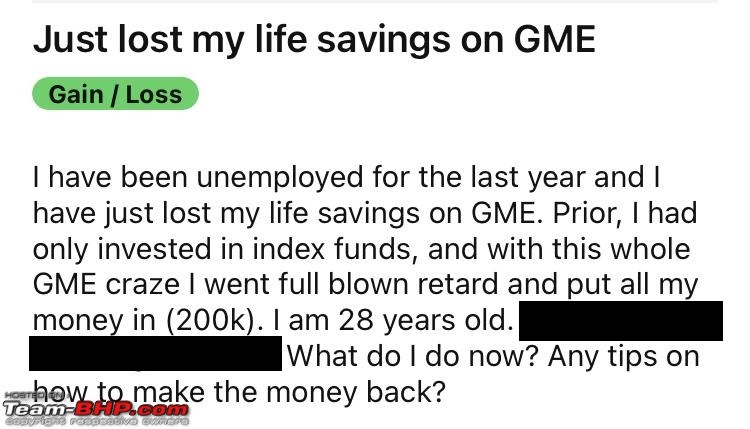

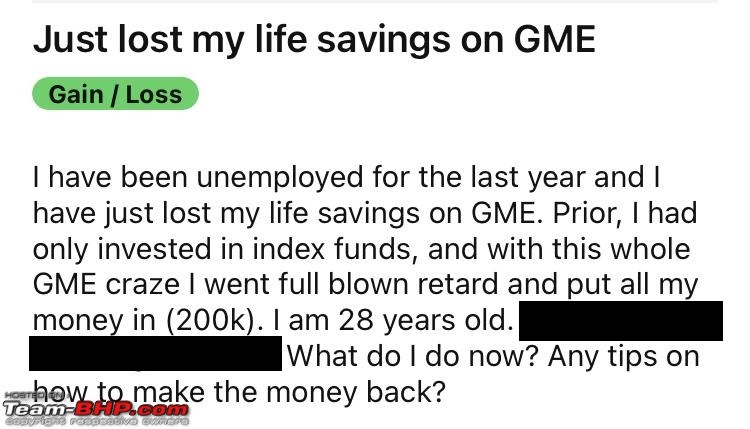

I don’t think the title is justified now. Some redditors made a lot of money. Most are now left holding an empty bag. People who knew when to exit or timed their exit well were the ones who made millions. Other people owing to their greed or buying into the hype of teaching Wall St a lesson or just being plain dumb, have lost a whole lot of money.

People who invested their savings, their retirement and if one Reddit post is to be believed, took a credit at 70% APR and bought GME are the ones who are likely to be in a very bad financial state.

Quote:

Originally Posted by Samurai

(Post 4993398)

Here is something pretty shocking... Tom Rogers on Newsweek compares the Redditors to insurrectionists who stormed the Capital Hill last month.

He says...

...

When retailer investors try to play the same game hedge funds play, they are compared to traitors and criminals. He keeps repeating they are very different, but keeps comparing anyway.

Wow... and MSNBC gives air and even agrees with his assessment.

|

How is this shocking or untrue? the media have been saying this from when the story broke. The capitol hill insurrectionists are in the same boat, they refused to buy the fact that Joe Biden won in the biggest landslide in history. They rioted , tried to burn down the capitol and kill AOC. The reddit crowd buy into some crazed conspiracy theory that wall street doesn't play by the rules as the little guy, they got burnt when the stock collapsed, unless you have a put option, falling stock prices usually lead to a loss, actual or on paper.

MSNBC is a major network, they must have realised that the reddit crazies were trying to destabilise the system, the equivalent of shouting "Fire" in a crowded theatre. The regulators moved in to prevent retail traders from causing any more chaos and getting the stock back to its fundamental value. There are major barricades and troop deployments around the capitol now, to prevent anything like the coup that happened in Burma/Myanmar. I am not sure what the network should do? encourage more mayhem, who will watch out for the pensioners and small investors?

Quote:

Originally Posted by avira_tk

(Post 4993805)

They rioted , tried to burn down the capitol and kill AOC. The reddit crowd buy into some crazed conspiracy theory that wall street doesn't play by the rules as the little guy, they got burnt when the stock collapsed, unless you have a put option, falling stock prices usually lead to a loss, actual or on paper.

|

One group was not breaking the law. They didn't try to kill anyone either. They saw that a hedge fund was trying to destroy a company by shorting 100%. They saw a chance to make huge profit at the cost of the hedge fund, which was rescued by other firms from going bankrupt. All totally legal. If you can't see the difference between them and criminals who unlawfully attacked the capital hill and killed/injured the police, I don't know what to say.

Quote:

Originally Posted by ashokrajagopal

(Post 4987526)

As are other stories in 21st century finance, this will also look like one large pyramid.

|

Quote:

Originally Posted by SmartCat

(Post 4987535)

Yes, this is going to end badly for majority of retail folks who are getting in now. Because they won't know when to get out.

|

Some of us called it a week ago, but I was honestly hoping it fizzles out after a couple of weeks, not so quick.

What DFV should do is hire bodyguards or move to Liechtenstein --- the top guys may be hounded.

Quote:

Originally Posted by Hayek

(Post 4993366)

But Robinhood had no choice but to stop trades which required it to put up more capital than it had with the clearing corporation. People don’t have a God given right to borrow to buy stock. And hyper growth without capital is not possible in financial services.

|

No offence, but this is exactly the kind of Finance-speak that riles up every small trader out there.

Robinhood operates in a market and it needs to follow rules. At one point RH stopped users from buying, but allowed selling of these select stocks.

IMHO, the argument above is fine if RH shut down or the SEC stopped all trading in GME.

Quote:

Originally Posted by Samurai

(Post 4993934)

One group was not breaking the law. They didn't try to kill anyone either. They saw that a hedge fund was trying to destroy a company by shorting 100%. They saw a chance to make huge profit at the cost of the hedge fund, which was rescued by other firms from going bankrupt. All totally legal. If you can't see the difference between them and criminals who unlawfully attacked the capital hill and killed/injured the police, I don't know what to say.

|

The consequences of destabilizing the market will be much more widespread than the attempted insurrection, the new regime barely had control of law enforcement. That's the trusted sources version, the narrative as they call it. You were pushing CNN as a trusted source, they pointed out the evil intentions of the reddit group long ago, why be so selective with outrage?

The capitol hill protestors didn't do anything resembling an insurrection, they stood around, took selfies and were let in by the security. AOC just had a police officer opening her office for and asking her if everything was all right. The attempted murder nonsense was just her usual attention seeking antics. She did nothing when wall street moved in with the establishment to crush the little guys. Perhaps, a fake photo shoot is in the works.

The reddit action was just atomised individuals taking on an organised racket, they exposed it for the fraud that it was, the MSNBC clip you shared just shows you how brazen the scam artists are. The profit and loss figures don't mean anything when currency can be printed to cook the books, a fifth of the usd in circulation was created in 2020.

I don't get your opposition to MSNBC, are they pushing alternative facts according to you?

Quote:

Originally Posted by avira_tk

(Post 4994008)

The capitol hill protestors didn't do anything resembling an insurrection, they stood around, took selfies and were let in by the security.

|

You do realize that multiple people (5 last I remember) passed away in that protest. Either you believe that people died while taking selfies or your news source is too limited (basically they took for a ride) and conveniently forgot to mention this death toll.

Edit: The role of some security officials into helping those insurrectionists is still being looked into. Besides, it seems you were only shown the footage of people milling around in the capitol halls and not the barricaded doors that were being guarded by armed personnel who were forced to fire shots at lunatics attempting to murder elected officials.

Great post. I couldn't agree more. It must be happening in all markets and even in quality stocks. ( May not be at this level)

Its easy to say, price will follow earnings in the long term. (Which is actually true). But these kind of irrational events in the short term, does affect a long term/fundamental based investor. And people will try justify it with theories like, market is forward looking, no other alternative invest, high earnings multiples in a low interest environment etc.

Quote:

Originally Posted by download2live

(Post 4993347)

It is a loss for common investors on the street. People like us who do the due deligence and what not. And what we are up against? A system so thoroughly rigged against us. WSB just exposed how deep the rot goes.

So much for the theory of Markets being efficient. :disappointed

|

Quote:

Originally Posted by avira_tk

(Post 4993805)

The reddit crowd buy into some crazed conspiracy theory that wall street doesn't play by the rules as the little guy, they got burnt when the stock collapsed,

|

I am also that Reddit crowd. The ways of hedge funds is not a conspiracy theory, having followed the frustration of Elon Musk with short sellers. I learnt about "loss porn" only on WSB, and I never once thought I would make a dime on this stock buy. I bought these in solidarity with the folks on WSB, and also because I do not use Robinhood, but others who did not have any restrictions. Outrage against short sellers, and hedge funds is for real, and that is based on real happenings. I see no conspiracy theory here.

Quote:

Originally Posted by avira_tk

(Post 4994008)

The consequences of destabilizing the market will be much more widespread than the attempted insurrection,

The capitol hill protestors didn't do anything resembling an insurrection, they stood around, took selfies and were let in by the security.

..

She did nothing when wall street moved in with the establishment to crush the little guys. Perhaps, a fake photo shoot is in the works.

|

I’m sorry I don't understand - what are you referring to as “destabilizing the market”? Are these not just “market forces at play”? DFV and Burry saw the shorts and put their money against the big Hedge funds. DFV posted on Reddit and everyone else followed. How is that different from say a Rakesh Jhunjhunwala (for example) or an analyst on TV suggesting that a certain stock is good? Will these people also be labeled as trying to “destabilize the market”?

Re- second paragraph- They just stood around taking selfies? I don’t know if you’ve taken a tour of the Capitol building but there are specific areas where pre-registered tourists can visit and take picture. What we saw was hundreds of people, some of whom were armed, going around the building flouting rules. Whether AOC did a publicity stunt or not is secondary. The primary crime was committed by those who went there without permission, flouting rules (at the minimum).

Re - third paragraph- What was AOC expected to do?

| All times are GMT +5.5. The time now is 21:46. | |