Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

The Central Consumer Protection Authority (CCPA) has issued guidelines terming the service charge levied by restaurants as unfair trade practice.

According to the Ministry of Consumer Affairs, the rates for food and beverages served in hotels or restaurants already include the charge for food and service.

|

Quote:

As per the guidelines, "No hotels or restaurants shall add service charge automatically or by default in the bill."

Restaurants and hotels generally levy a service charge of 10 per cent on the food bill.

The guidelines said there should not be any collection of service charge by any other name.

|

Quote:

No hotel or restaurant can force a consumer to pay a service charge. They have to clearly inform the consumer that the service charge is voluntary, optional and at the consumer's discretion.

"No restriction on entry or provision of services based on collection of service charge shall be imposed on consumers," the guideline added.

|

Quote:

Further, service charges cannot be collected by adding them along with the food bill and levying GST on the total amount.

If any consumer finds that a hotel or restaurant is levying a service charge in violation of the guidelines, s/he can request the concerned establishment to remove it from the bill amount.

|

Quote:

Consumers can also lodge a complaint on the National Consumer Helpline (NCH), which works as an alternate dispute redressal mechanism at the pre-litigation level, by calling 1915 or through the NCH mobile app.

They can also file complaints with the Consumer Commission. The complaint can be filed electronically through the e-Daakhil portal for its speedy and effective redressal.

|

Source:

Economic Times

What about the unfair trade practices of the Central and State Govt's arbitrarily increasing taxes on fuel, does one get to appeal on that too through the e portal?

Next, they should repeal the parking charges levied at malls and hospitals.

All the restaurants that charge this will increase the menu prices by 5-10% percent. Usually the premium restaurants do this, and to be fair, they try to justify it with very good service.

And here we are paying taxes after taxes with very little results to show but the former is banned and the latter is enforced.

I don't know whether service charge is good or bad but was charged 5% as service charge for a dinner buffet at Radisson Blu Water edge cafe at Mahabalipuram last Sunday.

I was wondering what 'service' is qualified for the charge where you have to take food and eat on your own.

Irrespective of the above, GST was not levied on Service charge, so probably government wants either not to collect it or will try to include it in the tax ambit to safeguard their own interests and shown as consumer friendly initiative.

An excellent decision by the CCPA. I hope it is implemented strictly. The service charges make no sense. If you want everybody to pay 10% extra, why not increase the prices by 10% and pay the staff using that amount. I find it offensive to find some amount on the menu and another amount on the bill. Sometimes, when I have had too much to drink, I have even left a tip without noticing the service charge which was automatically added.

Please note that I usually tip 10-15% of the bill depending on how the staff interacts with the people with me, but I get uncomfortable when somebody adds it without checking with me. I have made sure that the unethically added service charges are removed. So, I think this might be a blessing in disguise for the staff also.

I have been to restaurants in Delhi NCR wherein I politely requested for the removal of service charge. The Manager walked over and asked me to share my mobile number. When I refused, he said the service charge will only be removed after I share my mobile number. I wonder whether anyone has faced such a scenario in Delhi NCR or elsewhere.

Quote:

Originally Posted by Durango Dude

(Post 5351390)

What about the unfair trade practices of the Central and State Govt's arbitrarily increasing taxes on fuel, does one get to appeal on that too through the e portal?

|

No one is stopping you from trying it out. Maybe you will be a trailblazer.

Quote:

Originally Posted by drift87

(Post 5351406)

Next, they should repeal the parking charges levied at malls and hospitals.

|

The corporation here is pretty strict and such charges are banned. Even at Lulu Mall one of the largest. But they collect parking charges for parking at their designated zones on the road.

Quote:

Originally Posted by kushagra452

(Post 5351425)

I wonder whether anyone has faced such a scenario in Delhi NCR or elsewhere.

|

Just a stalling tactic i guess.

My opinion is that if the charges are mentioned upfront then it should be ok but then the onus on taking care of the restaurant's employees should be on the owner and not on the customer.

Quote:

Originally Posted by deathwalkr

(Post 5351429)

My opinion is that if the charges are mentioned upfront then it should be ok but then the onus on taking care of the restaurant's employees should be on the owner and not on the customer.

|

As a customer we have no means of knowing whether the business is actually using the service charge to pay its staff OR simply pocketing that money. As a customer I will tip a decent amount if the service provided by the staff is worth it.

I 100% agree that this is a good decision and must be implemented.

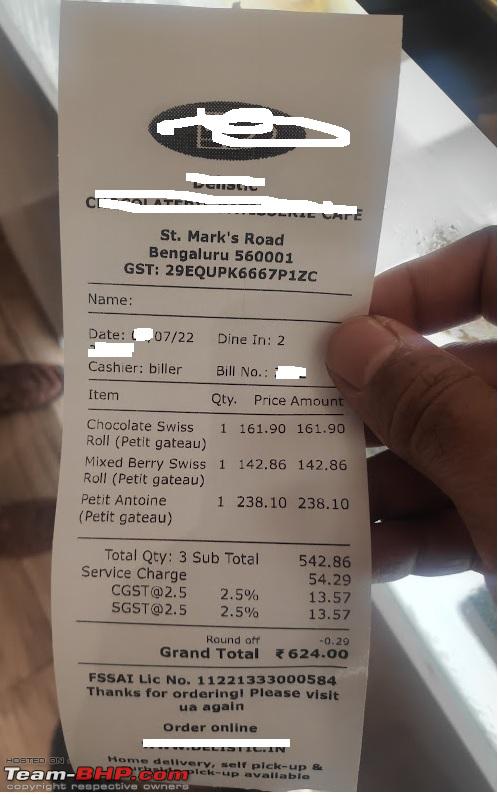

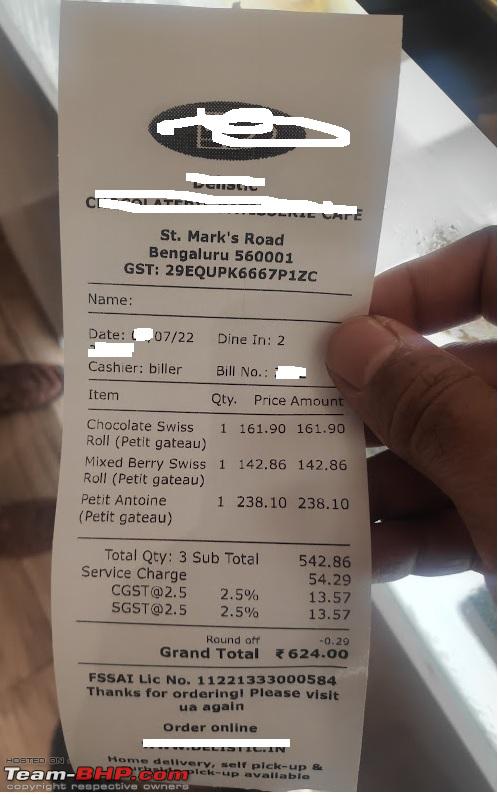

A fancy place in Bangalore changed us service charge and then GST on that!

Is this allowed?

Quote:

Originally Posted by Captain Slow

(Post 5351524)

A fancy place in Bangalore changed us service charge and then GST on that!

Is this allowed?

|

No they have not. If you read the bill carefully, the 5% GST is on food price of Rs 542 only which does not include service charge. That 10% is untaxed money going to their account.

I believe there is no HSN code defined separately in GST at restaurants for the service. This is the reason government contends GST is for both goods and the service associated with it in restaurants. This seems fair to me and I won't rule out tax evasion on the service charges collected.

May be restaurant owners can tell how they account this collection in their books.

I actually prefer having a service charge on the bill, makes it easy for me, not having to figure out how much to tip. And unless the service has been atrocious (which I can't ever remember it being at any restaurant I've been to), I always tip, so this makes it easy.

It would be great if restaurants displayed their policy on service charge up front, not just on the menu and also on their websites/to customers when they book. That way customers can decide whether to go or not. What would be even better is if restaurants disclose how they distribute what they collect. I like the idea of pooling tips and sharing it between staff. But there should be some provision to tip exceptional staff service a little higher too.

Quote:

Originally Posted by kushagra452

(Post 5351425)

I have been to restaurants in Delhi NCR wherein I politely requested for the removal of service charge. The Manager walked over and asked me to share my mobile number. When I refused, he said the service charge will only be removed after I share my mobile number. I wonder whether anyone has faced such a scenario in Delhi NCR or elsewhere.

|

A very disgraceful practice. I'd give him a fake number and then report him to the appropriate consumer protection authority.

Service charge is a sneaky way of converting staff salary from a fixed cost to a variable cost. Many establishments indulge in this practice. They pay a smaller fixed salary and add a variable component which depends on the service charge earned. If little business, then little service charge and therefore little salary outgo. Not ethical. Hospitality industry is anyways a poor pay master. The lowest paid employees in our country need to have a certain predictability about their earnings. A billion dollar company's CEO earning 50% of his salary as variable is a different matter.

On the point of restaurant being a "service" business, there is nothing unique about it. Hundreds of service businesses are there. Should they all adopt this model? Charge as per your costs. I know removing service charge will lead to increase in menu prices but so be it. It is money taken from one pocket and put into another pocket. Therefore this is not so much a matter about the customer as it is about the staff.

Quote:

Originally Posted by am1m

(Post 5351556)

I actually prefer having a service charge on the bill, makes it easy for me, not having to figure out how much to tip.......

It would be great if restaurants displayed their policy on service charge up front, not just on the menu and also on their websites/to customers when they book. ....

|

Indeed, that should have the regulation by the government instead of abolishing service charge. Like the warnings on cigarette packets, the government should regulate on how to display the service charge (Font/Language/size etc) and leave the rest to the restaurant and customers to make informed decisions.

Quote:

Originally Posted by Captain Slow

(Post 5351524)

A fancy place in Bangalore changed us service charge and then GST on that!

Is this allowed?

|

Quote:

Originally Posted by thanixravindran

(Post 5351549)

.... That 10% is untaxed money going to their account.

....This seems fair to me and I won't rule out tax evasion on the service charges collected.

May be restaurant owners can tell how they account this collection in their books.

|

There is clear tax-evasion fraud going on here. 5% GST has to calculated on base price + service charge.

| All times are GMT +5.5. The time now is 06:50. | |