| | #31 |

| Distinguished - BHPian  | |

| |

| |

| | #32 |

| BANNED Join Date: Apr 2015 Location: Kochi

Posts: 924

Thanked: 7,279 Times

| |

| |  (2)

Thanks (2)

Thanks

|

| | #33 |

| BHPian Join Date: Jun 2009 Location: Chennai

Posts: 437

Thanked: 641 Times

| |

| |  (2)

Thanks (2)

Thanks

|

| | #34 |

| BHPian Join Date: May 2010 Location: Frankfurt

Posts: 245

Thanked: 72 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #35 |

| Team-BHP Support  Join Date: Apr 2007 Location: Delhi

Posts: 9,388

Thanked: 13,305 Times

| |

| |  (5)

Thanks (5)

Thanks

|

| | #36 |

| BHPian Join Date: Jul 2008 Location: HYD

Posts: 543

Thanked: 1,206 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #37 |

| Senior - BHPian | |

| |  (1)

Thanks (1)

Thanks

|

| | #38 |

| BHPian Join Date: Jun 2017 Location: Jaipur

Posts: 54

Thanked: 71 Times

| |

| |

| | #39 |

| Team-BHP Support  | |

| |  (12)

Thanks (12)

Thanks

|

| | #40 |

| Newbie Join Date: Nov 2022 Location: Kolkata

Posts: 8

Thanked: 186 Times

| |

| |

| | #41 |

| BHPian Join Date: Jan 2014 Location: Kolkata - Pune

Posts: 726

Thanked: 2,799 Times

| |

| |  (2)

Thanks (2)

Thanks

|

| |

| | #42 |

| Senior - BHPian Join Date: Dec 2007 Location: CNN/BLR

Posts: 4,243

Thanked: 10,091 Times

| |

| |

| | #43 |

| BHPian Join Date: Feb 2008 Location: YYZ,AP(India)

Posts: 105

Thanked: 266 Times

| |

| |

| | #44 |

| BHPian Join Date: Mar 2018 Location: Thane - MH04

Posts: 594

Thanked: 2,284 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #45 |

| BHPian Join Date: Jun 2019 Location: Patna

Posts: 416

Thanked: 2,245 Times

| |

| |  (2)

Thanks (2)

Thanks

|

|

Most Viewed

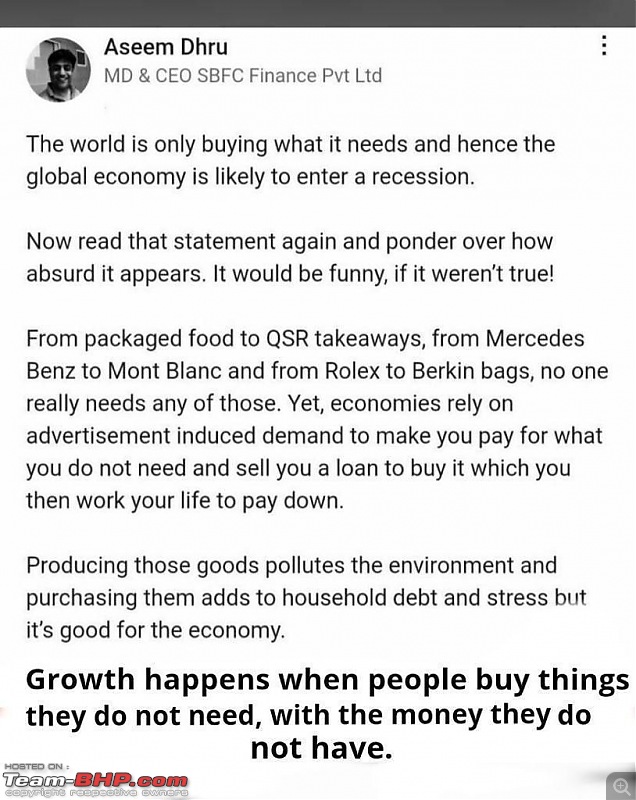

. Over the years, the efforts I've spent on wealth creation + asset management have got me a lot more money than the efforts on spending lesser / cost cutting. In terms of bandwidth, I spend 90% of my financial bandwidth on making money & 10% on ways to curtail expenditure.

. Over the years, the efforts I've spent on wealth creation + asset management have got me a lot more money than the efforts on spending lesser / cost cutting. In terms of bandwidth, I spend 90% of my financial bandwidth on making money & 10% on ways to curtail expenditure.