Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by deathwalkr

(Post 5549372)

I am sorry to hear about this untoward incident. But won't not paying credit card bill have the bank enforce recovery procedures?

As for calls for high transactions, what is "high" transaction? Will vary from customer to customer right?

Sorry state of affairs, all these scams :(

|

Yes they would enforce recovery procedures but we do have the case pending with the cyber crime police who suggested to hold the payment till the FIR is closed. Not received any calls from the bank yet.

Regarding high transaction values, just an example: we usually get an alert saying you're sending an unusually high amount and do you want to proceed. It's on Google pay I believe not sure. A similar mechanism is in ICICI where I get an automated call for a few transactions that are usually more than 10k (not sure what the limit is though to trigger the call). We're expected to confirm on the call as well.

Quote:

Originally Posted by SideView

(Post 5549461)

You are able to block the transactions if reported quickly. Atleast with certain bank they share a link together the message of debit asking to report if it is not. Citibank has it. So was it of no help?

In my case without sharing any otps or installing any apps amounts got deducted that too from debit account. Filing a police report helped get back all the amount.(ps i reported the issue to customer care within 1 hour)

|

You do get an SMS with a link to report the transaction in case not done by you. However that's either for POS transactions or someother kind I believe. Never received one for OTPs. No idea how Citibank handles it though.

Regarding your scenario, as per what the police said, it's easier to track and reverse transactions from a savings account and almost impossible for credit card transactions. Also since amount was deducted without OTPs, am sure you'll get back the amounts from the bank but with a little bit of to and fro.

Quote:

Originally Posted by abhi7013

(Post 5549281)

As my dad's now retired and CIBIL doesn't matter to him, I've told him to not pay anything towards the credit card. As the transaction happened via OTP, it's a fair transaction as per the bank. However, there should have been other security measures for transactions with higher amounts like having an automated call to confirm the payment, over and above the OTP, like how some other banks do (this was Citibank BTW).

|

If it is a Mastercard/ Visa credit card call the customer care and initiate a chargeback. It does not matter if the OTP was entered as it was a phishing site. Many Indians are not aware of this but chargebacks are very common and supported by Mastercard and visa. You just have to be very insistent with the CC that a chargeback request be initiated.

Quote:

Originally Posted by abhi7013

(Post 5549281)

As my dad's now retired and CIBIL doesn't matter to him, I've told him to not pay anything towards the credit card. As the transaction happened via OTP, it's a fair transaction as per the bank. However, there should have been other security measures for transactions with higher amounts like having an automated call to confirm the payment, over and above the OTP, like how some other banks do (this was Citibank BTW).

|

Did you inform the credit card company immediately and raise a dispute? What was their response?

Usually, they would initiate a temporary charge back so that you need not pay the amount till their investigation is complete. It does not matter whether the transaction was fair or not, as long as you can provide evidence that the website was malicious. I have successfully done this with Citibank.

Quote:

Originally Posted by abhi7013

(Post 5549473)

You do get an SMS with a link to report the transaction in case not done by you. However that's either for POS transactions or some other kind I believe. Never received one for OTPs. No idea how Citibank handles it though.

Regarding your scenario, as per what the police said, it's easier to track and reverse transactions from a savings account and almost impossible for credit card transactions. Also since amount was deducted without OTPs, am sure you'll get back the amounts from the bank but with a little bit of to and fro.

|

You are being misled. In fact, getting the transaction reversed for a credit card is much easier than a savings account. Since it is the bank's money, the bank is more proactive in investigating when it comes to CC fraud.

I have a sudden rise in donation related scam calls. I have been telling them not to call me ever again but I guess a scammer wont bother. I had recently grown so irriated from it that I complained to 1909 (Jio).

They told me that if its a personal number and not a telemarketing number, they can not do anything. Moreover, my number was not “fully blocked” which is a surprise diacovery since my number has always been fully blocked (telecom companies cooperating with these spammers and changing settings?).

Anyway, I know I have to live with this so have stopped boiling my blood. Most of the unknown numbers end up being scams/spams and I block them on Truecaller. The only issue is that unlike Android, iOS does not let truecaller work its magic. So best not to pick unknown call till you identify the number. We can always call back if its a genuine number.

Quote:

Originally Posted by PaddleShifter

(Post 5549590)

I have a sudden rise in donation related scam calls. I have been telling them not to call me ever again but I guess a scammer wont bother. I had recently grown so irriated from it that I complained to 1909 (Jio).

|

My connection is on Full DND (Vi) and even then I regularly get spam calls for donations, investments etc.

I don't engage with them and just cut the call and block/report on my google phone dialer app.

I don't use truecaller and never have.

What I observed recently is, I did not get any spam calls for a week when I was travelling up north on a vacation. As soon as I landed in BLR, I get spam call within 10 minutes. I feel, via some means the scam callers know where the person is! This really spooked me!

Quote:

Originally Posted by deepak_misra

(Post 5548627)

I remember reading about it somewhere in the group but would like to share how I got scammed this month. .

|

It is not nice to respond to your own post but continious emails to CEO helped and some dept head phoned me sometime back and sent someone with the money so case closed.

Idid advise the head that if he responded to emails, the CEO would not need to be an associate help desk member and could concentrate on running the company

Yes, initiating a chargeback is the best way to go about scams done on credit cards. It can be done by filling Cardholder Dispute Form, along with the FIR copy.

Quote:

Originally Posted by Bluengel180

(Post 5549539)

If it is a Mastercard/ Visa credit card call the customer care and initiate a chargeback. It does not matter if the OTP was entered as it was a phishing site. Many Indians are not aware of this but chargebacks are very common and supported by Mastercard and visa. You just have to be very insistent with the CC that a chargeback request be initiated.

|

I have been getting calls from people claiming to be representatives of some insurance company telling me that I have a life insurance from them that needs to be renewed.

I never purchased insurance from the company they were claiming to represent so I just let them know I did not buy the said insurance.

I am not sure if this is a scam of some sort and what their playbook is. Anyone else here get such calls?

Quote:

Originally Posted by abhi7013

(Post 5549281)

As my dad's now retired and CIBIL doesn't matter to him, I've told him to not pay anything towards the credit card. As the transaction happened via OTP, it's a fair transaction as per the bank. However, there should have been other security measures for transactions with higher amounts like having an automated call to confirm the payment, over and above the OTP, like how some other banks do (this was Citibank BTW).

|

The exact thing happened to my Maasi (aunt) 6-7 months back. We immediately informed the credit card issuing bank (ICICI) & the relationship manager. We also wrote to them in an email and a registered letter too. Bascially covered all modes of communication to raise a dispute.

She has not been asked to pay the amount till now, so we are hoping it worked. I suggest you do the same, else your dad may have to deal with bank recovery agents etc. That is a bigger headache than CIBIL.

Quote:

Originally Posted by Bluengel180

(Post 5549539)

If it is a Mastercard/ Visa credit card call the customer care and initiate a chargeback. It does not matter if the OTP was entered as it was a phishing site.

|

Chargeback wasn't initiated even though we reported it immediately and raised a dispute with the bank. What you said is right, but it was not a phishing site. It was BESCOM's official website. This along with the use of OTP, plus the scam happening via a paytm transaction are the reasons cited by the bank for considering this as a "fair transaction". We have all the proofs of the mails that we've sent to the bank along with screenshots of the SMS and the FIR copy, but still, going by their book, they say there's no dispute and they have closed the ticket.. Am unsure how to proceed further other than wait for the call from the recovery team and explain the situation to them. This is what cyber crime suggested.

Quote:

Originally Posted by Jaguar

(Post 5549543)

Did you inform the credit card company immediately and raise a dispute? What was their response?

|

Dispute was raised immediately. The thing is that we know the scammer used paytm to debit the card and there was no malicious website in picture. From the bank's point of view, everything has happened legally on paytm along with OTPs. It is this argument of their's that am not able to refute. Apart from the fact that a screen-mirror app was downloaded and the OTP was not explicitly shared with anyone, rather taken without our knowledge.

Quote:

Originally Posted by Jaguar

(Post 5549543)

You are being misled. In fact, getting the transaction reversed for a credit card is much easier than a savings account. Since it is the bank's money, the bank is more proactive in investigating when it comes to CC fraud.

|

Since there is no transaction ID generated immediately for credit card payments, there's no way to track it. By the time the merchant submits the transaction, and an ID is generated, which usually takes more than 24 hours, the amount would have moved elsewhere.

Quote:

Originally Posted by Eddy

(Post 5550417)

She has not been asked to pay the amount till now, so we are hoping it worked. I suggest you do the same, else your dad may have to deal with bank recovery agents etc. That is a bigger headache than CIBIL.

|

We have everything on record, right from the day this happened. The thing is, recovery team takes 6-8 months to get in touch with you and we're waiting for the same to clearly deny making the payment (forget paying the interest that's accumulated all these months!).

Quote:

Originally Posted by pandey.jai

(Post 5550243)

I have been getting calls from people claiming to be representatives of some insurance company telling me that I have a life insurance from them that needs to be renewed.

I never purchased insurance from the company they were claiming to represent so I just let them know I did not buy the said insurance.

I am not sure if this is a scam of some sort and what their playbook is. Anyone else here get such calls?

|

This is a scam.. The goal is to get you to pay something so that they can release a policy that does not exist.. if you have time, lead them on for some time and waste their time so that they cannot cheat someone else who is more gullible.

Bajaj Allianz calls me more than my family members. OLX Auto too. I have finally resorted to another way to get to them. When Bajaj Allianz calls, I pose as OLX Auto and try to sell them cars and when OLX Auto calls, I sell them Bajaj Allianz insurance. result is, calls have reduced big time. Most of the time I notice them seeing my number from truecaller and calling. Many people here must have noticed that calls usually come after someone views your profile on true caller. I have a strong feeling they sell the database. I yet block and mark these numbers as spam on true caller immediately and if I get the time and energy, I even report this on the Vodafone app. They block these numbers through TRAI

Quote:

Originally Posted by suryaj1990

(Post 5550937)

Many people here must have noticed that calls usually come after someone views your profile on true caller. I have a strong feeling they sell the database.....

|

You still only have a "strong feeling"? I think you didn't read my earlier post. How about I confirm this?

I had a female friend from college who disappeared after some rumours spread about her in 2007. Her phone went off and then "doesn't exist".

There was no way of contacting her. Social media wasn't so much there too.

Eventually, I paid Rs. 75 to Truecaller in my office's common phone and found our her number, from just her name... Is this proof enough that Truecaller sells your data? (The data TC itself got for free, from some trusted person's phone).

I confess I once installed Truecaller in the Nokia Symbian era, and once I got to know the cancer it was, I uninstalled it.

Read this link more to know more about how Truecaller promotes SPAM:

https://www.indiatoday.in/technology...275-2016-12-30

------

EVERYONE, requesting your attention:

Use this link to DELIST your number from Truecaller forever:

https://www.truecaller.com/unlisting

NOTE: You have to delete your account and uninstall the app first, do that too. Plus, you won't be able to list your number again.

Also, for information, please read the India today link I posted above.

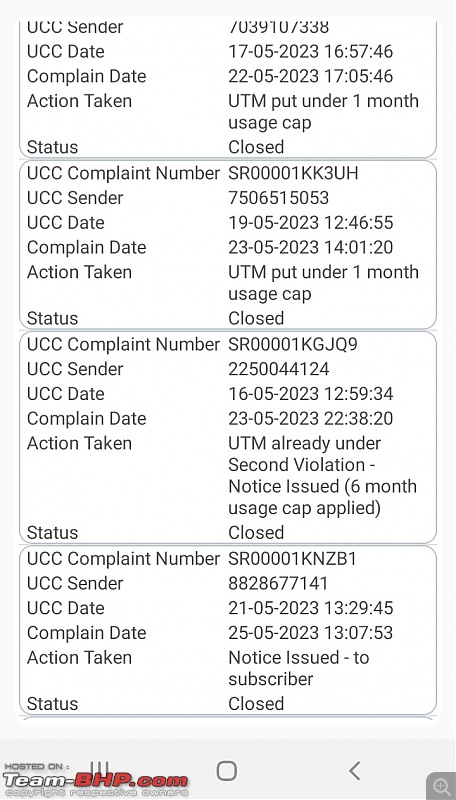

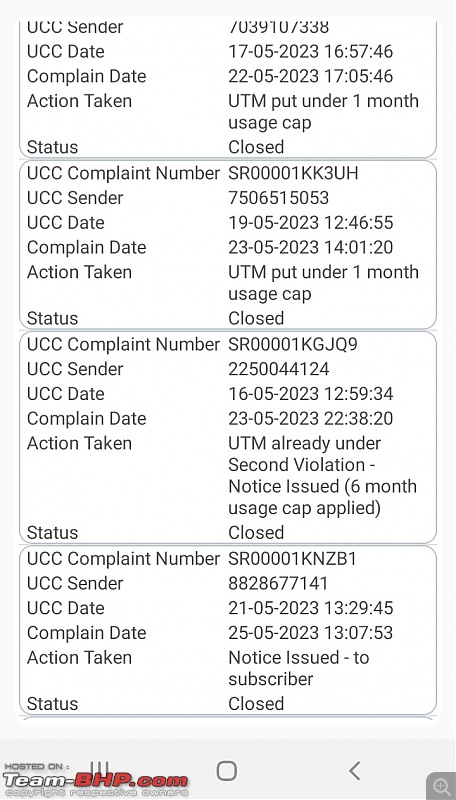

I've installed the TRAI DND app after reading about it on this thread. Its a glitchy app, but it works. Hardly any spam calls now instead of 5-10 per day. On registering complaint, there is action taken as shown below-

I've had Truecaller, but this works quite well in addition.

| All times are GMT +5.5. The time now is 02:28. | |