Team-BHP

(

https://www.team-bhp.com/forum/)

I had Citibank Credit card points redeemed to cash sometime back.

And it felt nice.

Quote:

Originally Posted by simply_sunny001

(Post 1478223)

I had Citibank Credit card points redeemed to cash sometime back.

And it felt nice.

|

How did you do it?

I would like to do the same with my citibank card.

Quote:

Originally Posted by harry10

(Post 1478233)

How did you do it?

I would like to do the same with my citibank card.

|

I am not aware of conversion to cash. But at designated shops like Shoppers' stop, West side etc., you can buy anything you want and tell the guy at the billing counter to adjust your reward points against the purchase. And he will.

Quote:

Originally Posted by karankapoor

(Post 1477726)

In your case one thing is pretty funny, As you said you are using this silver car for years now and the you have 40000 rewards points that means you must have purchased stuff worth Rs.8000000/- (eighty lac's) (1 rewards per 200/- spent) and still bank has not upgraded your card this is one thing i can't digest.

I too use a HDFC BANK Card recently they upgraded my car to Platinum Plus card with enhanced limit (almost 3 times of my previous car titanium), Check with your local HDFC Credit Card department why haven't they did this with you.

|

Oh My God, i didn't knew so many people would come up for my question, I am little down with fever since 2-3 days, so didn't checked this thread since last night.

thanks guys for your expert opinions and ideas, will try my luck.

Yes I've spent hell lot of money through this card, and i know in last 4 years i've not paid a single rupee as late fee, Payments have been always on time, but its always on revolve one after another, cause i use the card for business use (sending payments to US/Indian providers)

Card has limit of 35k only, and sometimes I've to use it like prepaid card, pay 25k, and then make payments....top up as soon payment is captured and then use, top up again.....

In my business i need at least 1.0Lac of plastic money a month, so sometimes i am just stuck with this stupid card.

Its shocking that HDFC never enhanced my card limit, i've spent one large amount of my life by standing in

QUEUE at bank, cause my primary banking (business banking) is with ICICI Bank but i've credit card only from HDFC, so have to draw cash from ICICI and dump it to HDFC.

I've learn never pay credit card bill through cheque if you want to work fast, that's a different story though.

ICICI doesn't show any care for my business and has never offered me a credit card, they say, my city is not eligible for new credit card issuance.

Today also i called ICICI Care and was told, "we are not offering any credit card all across India till further notice)

Lastly, this card has recently been renewed, but now it doesn't works with paypal, doesn't works at few prominent gateways in USA.

customer care tells me to generate a Netsafe card and use it at paypal, which doesn't works well in my requirement as I am subscribed to lot of payments at paypal. now the customer care has a ticket for this issue since a 15 days, but no solution yet.

I 've been registered for VBV/MC securecode for years, but suddenly after that 1AUG PANIC created by RBI, the card is no longer International,

I think Indian credit cards are now totally Indian, you can't shop at international store for some unknown reason.

Bang your head with customer care and you get a CANNED reply in 3-4 days.

I also have an merchant account at ccavenue, and since 15-20 days, at-least 20-30 of my customers who had HDFC card, called me that even after having balance, their card is declined at ccavenue/paypal, and ultimately they had to take pains to drop a cheque for payments, some paid through their wife's card which was from other bank.

I've not been such a bad customer at HDFC, but now I am FRUSTRATED to a limit which is just close to getting MAD.

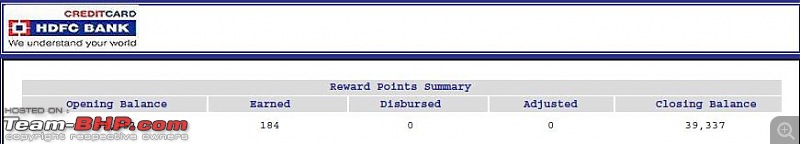

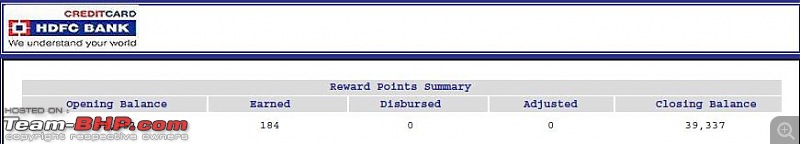

Screen-shot from a recent statement showing close to 40k points.

I am not Enjoying it....

Gansan

Gansan

most banks don't allow conversion of rewards points to cash, Iam sure about hdfc cause i read that faq, last night itself.

Quote:

Originally Posted by harry10

(Post 1478233)

How did you do it?

I would like to do the same with my citibank card.

|

just give them a call and they will deduct the same from the amount outstanding.

cheers

I have a Jet Airways citibank mastercard. The reward points are Jet Airways JPMiles. I have used this card for years, have flown for free a couple of times, and I now have 85000 miles, enough for a free flight to the states and then some. I think this (or some other credit card which uses the airmiles of some airline as reward points) is the best kind of card to go for.

Quote:

Originally Posted by johnjacob

(Post 1479629)

I have a Jet Airways citibank mastercard. The reward points are Jet Airways JPMiles. I have used this card for years, have flown for free a couple of times, and I now have 85000 miles, enough for a free flight to the states and then some. I think this (or some other credit card which uses the airmiles of some airline as reward points) is the best kind of card to go for.

|

Yep.

I have the American Express KF First card. I've been using it since Jan 09 and have accumulated close to 27k points. And being an Amex, it maintains some exclusivity too.. and also the "Saar no Amex" replies from some merchants :D

Well I have a HSBC Gold Card. Usually convert my points to KF air miles, allows me to rake up free flights :)

Quote:

Originally Posted by simply_sunny001

(Post 1478794)

just give them a call and they will deduct the same from the amount outstanding.

cheers

|

Citibank Cashback Cards - The accumulated points are basically nothing but the cashback amount earned. Call the helpline and they will credit the money to ur card account against which you can make purchases anywhere or adjust against any debit balance in the card. The most simplest and best choice I've ever seen:thumbs up

Citibank Gold - Points can used to make purchases at Landmark directly i.e 1 Reward Point is worth 50 paise. Make a purchase and inform that you want to make it against your Citibank reward points and the Billing counter will do the needful.

SCB - Have a big list of reward gifts but I've redeemed them only for Lifestyle Gift Vouchers.

I have a IndianOil Citibank Credit Card.....I convert points into free petrol vouchers (1 Re. Petrol for every point)

I have Vodafone co-branded Citibank Credit card. The points earned are redeemed for talk time. Believe me I haven't paid my mobile bill for past 5 years or so !

Last week I got a letter from Citibank that tie-up between Vodafone & Citibank will end and my card will expire. So I have to get a credit card now. Most likely, I will go for IndianOil Citibank Titanium Credit Card.

Quote:

Originally Posted by msdivy

(Post 2018424)

Last week I got a letter from Citibank that tie-up between Vodafone & Citibank will end and my card will expire. So I have to get a credit card now. Most likely, I will go for IndianOil Citibank Titanium Credit Card.

|

I got the letter too! I had already requested them to cancel my vodafone card and put me into Indian Oil card. However, my request was denied.

I usually buy some articles which I normally will not have the heart to pay for - Reebok / Adidas shoes and floaters, for instance - from points accumulated on my HDFC Bank platinum card! The bank will send me the gift vouchers upon request.

With Citibank Platinum card, it gets even better. Buy whatever you want, call up the bank to adjust your points towards the dues, and pay the balance if any!:thumbs up

I have Citi Platinum and uses the reward points at Shoppers Stop or Westside for further shopping!

The thing with booking your tickets via miles is that you need to book well in advance. I had few points to convert and hence called up the flight cc. They told that for every flight, there is a limited %age of seats which can be booked via miles & looks like the %age is in single digit. Seats were not even available for next week from the date which i wanted the tickets for. So be careful folks.

| All times are GMT +5.5. The time now is 02:01. | |