Team-BHP

(

https://www.team-bhp.com/forum/)

Folks, I have a query regarding an SBI credit card which I got recently.

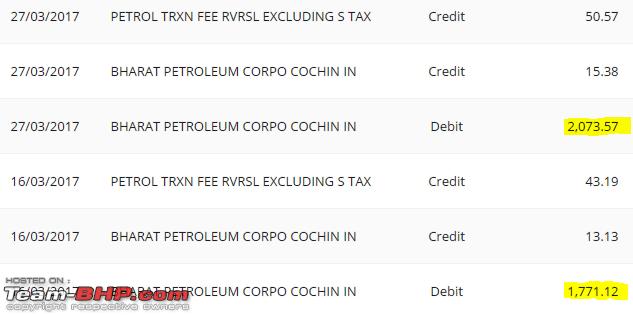

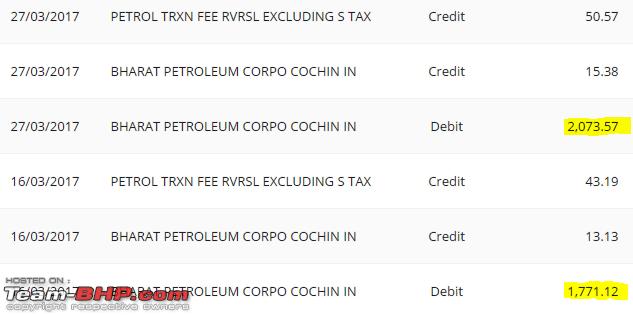

Below is a snapshot of the two fuel purchases made using the card:

The actual transaction amounts (debit) on 16th March & 27th March are Rs. 1751 & Rs. 2050 respectively. However, as can be seen, the card statement shows a higher amount. On the day of transaction, the amount shown is usually the exact amount. But it increases by 1.15% when the surcharge & cashback is credited back (which takes approx 5-6 days from the transaction date). Any idea what is the logic behind this increase in actual transaction value?

The surcharge (2.46%) & cashback (0.75%) amounts are getting credited correctly though.

Quote:

Originally Posted by raghu.t.k

(Post 4176493)

For those looking for a fresh life-time free card, HSBC is providing one. .

|

Is it the HSBC Visa Platinum card?

http://www.hsbc.co.in/1/2/personal/credit-cards

The first card in this link? Do you have any mail / reference? Please forward to me on PM. This is for my daughter, who has just joined her first job.

Quote:

Originally Posted by Navneet

(Post 4176767)

|

They are the ones. I went through Bank Bazar. They have additional offers. Just ensure that you don't apply for too many cards as each is considered as separate request and would have a separate credit check.

What are the implications of moving an expense to easy-pay option ?

Assuming I dont miss any payments on the converted part ?

Quote:

Originally Posted by condor

(Post 4179818)

What are the implications of moving an expense to easy-pay option ?

|

What is easy-pay option?

Quote:

Originally Posted by binand

(Post 4179821)

What is easy-pay option?

|

Convert to installments

Quote:

Originally Posted by BigBrad

(Post 4176764)

Folks, I have a query regarding an SBI credit card which I got recently.

Below is a snapshot of the two fuel purchases made using the card: Attachment 1626584

The actual transaction amounts (debit) on 16th March & 27th March are Rs. 1751 & Rs. 2050 respectively. However, as can be seen, the card statement shows a higher amount. On the day of transaction, the amount shown is usually the exact amount. But it increases by 1.15% when the surcharge & cashback is credited back (which takes approx 5-6 days from the transaction date). Any idea what is the logic behind this increase in actual transaction value?

The surcharge (2.46%) & cashback (0.75%) amounts are getting credited correctly though.

|

The surcharge refund and cashback offered by the companies usually has a window amount. For example my sbi platinum card has a window of Rs 500 to 3000, if my fuel amount falls between these 2, I get a refund otherwise I will have to bear the surcharge.

The refund process takes time because every transaction, when done, is registered in the head of 'transaction under settlement'. During the settlement they add the surcharge amount to the transaction amount. For SBI cards you can log on to their user portel and get the details. Its just like the IRCTC service charges which used to be debited after 2-3 weeks from the date of transaction. Once their settlement accounts are reconciled, they refund the surcharge. The info might (not) be 100% correct but it was provided by a GE-SBI CARDS Employee.

P.S. : feel free to correct if I am wrong.please:

Quote:

Originally Posted by condor

(Post 4179818)

What are the implications of moving an expense to easy-pay option ?

|

Got it. I thought it was the bill-pay option. It is called SmartEMI in HDFC Bank. :-)

Gotchas/fine print of this scheme are:

1. This EMI thingy charges interest from the day of conversion.

2. There is most likely a processing fee (plus service tax on it).

3. There is often a pre-payment fees as well, if you wish to do so.

4. Purchases converted to EMI do not earn reward points.

5. You cannot buy gold as bullion or jewellery or any other form (RBI requirement). There might be other prohibited categories too.

6. Closing the card account, not paying sufficient money etc. will result in higher penalties than without these EMIs.

I had done this once - bought an expensive fridge on a six-month EMI. The next six months were somewhat of a tightrope walk as the EMI wouldn't show up on the online statement during the month; it will appear only on the day the monthly statement is generated. All financial planning would go haywire. Decided never to do this again; instead I now do it the other way - open Recurring Deposits and once I have accumulated sufficient money, only then buy high-value items. I pay off all credit card debt in full every month.

On the other hand, if you have already made the purchase or are committed to the purchase, then this scheme can alleviate the liquidity problem somewhat. Your call.

Quote:

Originally Posted by Ry_der

(Post 4180009)

The surcharge refund and cashback offered...

|

Thanks!

My query is actually regarding the transaction amount shown in the SBI card statement. For fuel purchases, the amount shown is 1.15% more than actual. For eg., I had filled diesel for Rs. 2050, but when I check the card statement online, it shows Rs. 2073.57 (2050 + 1.15% = 2073.57). I'm wondering why is there such an increase in actual transaction amount. Isn't this effectively reducing my net savings? 2.5% + 0.75% - 1.15% = 2.1% is what I get back.

P.S: I'm new to the credit card world, so maybe I'm missing something. Also, this happens only with fuel purchases, all other transactions show exact amount.

Quote:

Originally Posted by BigBrad

(Post 4180103)

My query is actually regarding the transaction amount shown in the SBI card statement.

|

Which specific card is this (so that I could take a look at the T&C regarding the fuel surcharge refund and also the cashback offer)?

Also, please confirm the fill numbers - 1751 & 2050?

Note that fuel surcharge is usually 2.5% across all cards and fuel brands.

Quote:

Originally Posted by condor

(Post 4179961)

Convert to installments

|

Keep in mind, the interest component of all such EMI's will attract service tax of 15%.

Thanks binand.

Quote:

Originally Posted by binand

(Post 4180117)

Which specific card is this (so that I could take a look at the T&C regarding the fuel surcharge refund and also the cashback offer)?

|

This one.

Quote:

Also, please confirm the fill numbers - 1751 & 2050?

|

Yes, correct.

Quote:

Originally Posted by binand

(Post 4180055)

Gotchas/fine print of this scheme are:

|

Quote:

Originally Posted by condor

(Post 4179818)

What are the implications of moving an expense to easy-pay option ?

|

And the credit limit on your card will reduce to the extent of amount converted into EMIs. Cash loan on card is preferred option these days, the interest is low as compared to easy-pay option and credit limit also remains intact.

@binand & @Moto Hill, Thanks for the inputs.

Assuming credit limits are not a constraint, Does it make sense to do a balance transfer instead ?

Quote:

Originally Posted by condor

(Post 4181460)

@binand & @Moto Hill, Thanks for the inputs.

Assuming credit limits are not a constraint, Does it make sense to do a balance transfer instead ?

|

Just sharing a hack.

Suppose you have a credit card with a limit of 1.0 lacs. You have utilised 20000 Rs during the month. You still have 0.8 lacs in your card. For paying this 20000 amount you have generally 2 choices.

1. Pay the minimum bill amount and pay monthly interest on the balance.

2. Convert it into EMI and still pay some premium for converting as well as interest.

But there is another way of getting out of this without paying any interest or charges.:Shockked:

Step.1 Topup your PAYTM wallet using Rs. 20K from your CC.

Step2. Transfer the amount to your bank account from PAYTM.

Step3. Pay your credit card bill from your bank account.

So basically you will be repaying the bill from the card itself. You can reduce the amount by a fraction in each cycle. That will be your EMI without any interest or premium. clap:

You can also withdraw cash by this route rather withdrawing from your credit card and paying a cash premium.

You can show the withdrawl amount as an unsecured/secured loan(depends upon your credit card type) in your balance sheet.

Thanks.

| All times are GMT +5.5. The time now is 22:41. | |