Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by pratyush6

(Post 4145457)

|

Thanks for the link. Just checked my cibil score. I had applied for AMEX card in december 2016. I could get the score information from AMEX. I am supposed to lose some points for the hard pull of my cibil score by AMEX. Isn't it so. But the current score is more than what it was in December 2016.

Another query for experts here, the CIBIL lists my old rented residential address ( vacated almost 11 years back) along with current one. How to get the old address removed form their system?

Quote:

Originally Posted by rkg

(Post 4145839)

Thanks for the link. Just checked my cibil score. I had applied for AMEX card in december 2016. I could get the score information from AMEX. Iam supposed to loose some points for the hard pull of my cibil score by AMEX. Isn't it so. But the current score is more than what it was in December 2016.

Another query for experts here, the CIBIL lists my old rented residential address ( vacated almost 11 years back) along with current one. How to get the old address removed form their system?

|

You are partially correct in that the hard pull does affect score by around 3-5 points.

However, if you subsequently get approved, then your credit utilization ratio decreases assuming your spending habits don't change.

This lowering of credit utilization ratio affects the score in a more positive way so as to negate the hard pull.

35% of score is determined by credit utilization ratio, so getting more credit will almost always better your score despite the enquiry.

I've never seen addresses removed by request, you can only add a new address upon KYC completion. I guess they keep old ones around to safeguard their credit in the very unlikely event that you could be found on your old address. :)

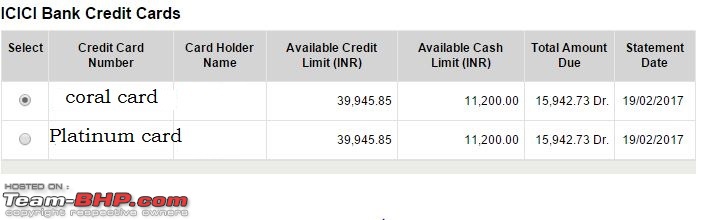

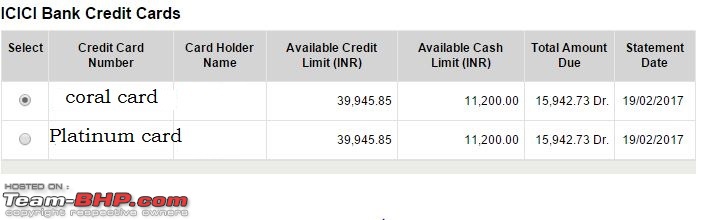

I have 2 credit cards from ICICI Bank - Platinum & Coral.

When I check the status of these cards on my icici net banking portal, I see the same amount of expenditure, total balance and credit limit is same for both cards even if I have made payment from one of the two cards.

For Example - If I have paid Rs. 1000 bill from my Platinum card, the same amount will be deducted from Coral effective balance as well?

Am I missing something or unable to understand how ICICI cards works?

Quote:

Originally Posted by bluevolt

(Post 4149332)

When I check the status of these cards on my icici net banking portal, I see the same amount of expenditure, total balance and credit limit is same for both cards even if I have made payment from one of the two cards.

Am I missing something or unable to understand how ICICI cards works?

|

Is it the same account ?

How do the expenses tally ? combined ?

Quote:

Originally Posted by condor

(Post 4149353)

Is it the same account ?

How do the expenses tally ? combined ?

|

Yes both card shows same expenses, even if I have used only one. Though If I make payment to one, the other card's figures also resets.

For ex - please see the sample illustration as on the portal.

Now I have made payments of Rs. 15,942 using Coral card, but it is showing in Platinum as well. If I do payment using Platinum, it reflects in Coral again!

When I pay the credit card bill of the card, both of them resets to initial amount.

So looks like the payment & expenses are shown for your account as a whole - irrespective of which card is used.

Quote:

Originally Posted by condor

(Post 4149367)

So looks like the payment & expenses are shown for your account as a whole - irrespective of which card is used.

|

Exactly.

So is this normal? Is it like this only? Or I should contact the bank?

Guys any idea on the SBI simplysave card ? Thus would be my first credit card ever. So just wanted to know views on it.

Regards

Dieseltuned

Quote:

Originally Posted by bluevolt

(Post 4149398)

Exactly.

So is this normal? Is it like this only? Or I should contact the bank?

|

With ICICI bank, your first credit card# is also your CC account#, and it stays the same no matter how many cards you upgrade, and your credit limit is cumulative.

I moved from Gold>Platinum>Coral cancelling the previous card with each upgrade (they offered to let me keep them if I chose to).

Some account level transactions (annual fee waivers, reward points redemptions etc.) are still shown under a separate section that bears my original Gold card# on my CC statement.

If you aren't getting two separate accounts and credit limits, what's the point retaining both cards? Why not cancel the Platinum and use the Coral? If you prefer multiple credit cards for redundancy, get one from another provider.

Quote:

Originally Posted by Pancham

(Post 4144046)

I have an excellent history. Never ever delayed my payment in the last 3years. Let's see then.

Another query: I applied for a SCB card and the bank rep asked me to send the credit card statement and card front side photo for faster approval of any other card I have . Is it advisable to send such details over mail or even in person.?

|

Guys, HDFC has finally reversed the charges. I had sent them a mail for the 2nd time and they seemed to acknowledge the fact that my payment history is good. I sent the mail to

customerservices.cards@hdfcbank.com and it seemed to work. So for now I am not cancelling the card.

So my friend in Canada just woke up to see his card being used in Kerala thrice to withdraw cash!

He has not visited Kerala after he got this card. 30K in three 10k lots. He's speaking to the bank and the bank is investigating and my friend is figuring out where and how his card could have been skimmed.

:(

Thats sad to hear. Has he got any resolution from the bank yet?

Today i got a message from ICICI saying the my "credit card is proactively blocked due alter from network partner to prevent misuse...and a new card will reach to me within couple of days". When i called the call center, they said, it is blocked by the issuer (master card) as there are possible duplication of cards created by miscreants which is detected by them ...".

Is anyone got similar incidents in the past and recently? It is a Rubyx card.

Quote:

Originally Posted by r_devakumar

(Post 4176444)

Today i got a message from ICICI saying the my "credit card is proactively blocked due alter from network partner to prevent misuse...and a new card will reach to me within couple of days". When i called the call center, they said, it is blocked by the issuer (master card) as there are possible duplication of cards created by miscreants which is detected by them ...".

Is anyone got similar incidents in the past and recently? It is a Rubyx card.

|

Got similar message on CityBank in Jan. But they did not block instead left option with me to get it blocked or not.

For those looking for a fresh life-time free card, HSBC is providing one. I do not know how good or bad this card is, and this is the 1st time I am applying for a HSBC card.

I have a few life-time free cards from other banks with whom the relationship exceeds a decade, and the credit limit also been increased. So I wanted a card which would be used in the Kirana shops, and other small expense areas. Hence after all searching found the HSBC is lifetime free while a few other banks/cards waive off the first year fees, with the fine print stating that, from second year there would be annual charges.

I am in no way related to HSBC, and putting the same, as it took some effort to figure out which is a lifetime free card. Also would like to know if there is anything I need to be careful regarding HSBC or their cards...

| All times are GMT +5.5. The time now is 07:31. | |