Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by archat68

(Post 5426491)

What's the best way to spend monthly Rs 4x1500 for the Amex MRCC card for bonus 1000 points. Earlier paytm/amazon pay cash load used to work. But these now now are chargeable.

|

You can buy Amazon gift card for 1500 and load it to your own account. This works exactly like amazon pay but with a validity of 1 year. You can buy gift cards for Flipkart also and use it for yourself.

Hello everyone,

I would like recommendations on a new credit card. I have a banking relationship with HDFC who have been trying to cross sell their millenia cards, but the benefits don't seem to be that huge and they have criteria to waive off the yearly fee. I am confident I can clear this criteria but would prefer if there was a lifetime free card. My credit score is 740.

Can my score be improved with just a credit card? If yes, please do provide card suggestions.

I need the benefits and the improvement in credit score that these cards offer than the amount of credit itself. (Not that it hurts)

I have also described how my credit score went to this low number and the only reason I'm doing so is because I don't want anyone else to be as gullible as me.

Flipkart Pay Later:

I used the flipkart pay later scheme in 2018-19 mostly for the ease of use rather than the credit. I was 19 years old. I had a basic idea about credit scores, but didn't realise this would reflect as an unsecured loan on my report. I should have read the T & C more carefully. I have never been late on payments and credit utilization was kept to a minimum. I had stopped using the account sometime in 2019 and asked flipkart to close the account which was done and assumed the credit line would have closed too. How wrong I was...

1 year later, I download my first CIBIL report and I was shocked to see the line still active and utilization of the full amount even though my actual transactions weren't so high and my score in the 760-780 range. I mailed IDFC and got the credit line closed. I also didn't use any other credit line for over a year, however no improvement in my credit score.

Slice Super Card:

Finally bit the bullet and got myself a slice super card last year. Was approved for a 20k limit which in a few months got upgraded to 25k. Once again, no delayed payments, no part payments etc, but the utilization hovered at around 60-70%. Assumed my score would have improved and checked it recently but once again shockingly found it to be 740 now. This was my only line of credit and I had applied only to Zomato One Card for it's benefits and the metal design, which was rejected which prompted me to download the report which showed my abysmal score. However, atleast this time the report only consisted of my actual credit utilization. Slice card also reflects as an unsecured personal loan on the report.

I have since continued using the card, but the utilisation is now at around 20 -30%. I have managed to rack up around 4L spends in a year not including fuel(because of surcharge, lack of points and my usage of HP Pay). However, slice has recently decided to change their operating methods and no longer give you a credit line but an on demand credit which will be credited into the wallet for a small flat fee which no longer makes the card useful to me since the flat fee will make the cost of ownership higher and the main reason being my credit score not improving.

Thank you.

alphamike_1612

Quote:

Originally Posted by alphamike_1612

(Post 5431888)

Hello everyone,

I would like recommendations on a new credit card.

|

Hi Alpha,

First of all you should get rid of Slice and Pay Later accounts as soon as possible. They will affect your credit score.

Credit score increases when you consume very less percentage of your credit limit. So your target should be to increase credit limits on your cards and utilize less than 10% or there abouts. Some cards which I use and feel give immense benefits.

ICICI Amazon Pay Card : 5% flat cash back on buying products from Amazon. 2% flat cash back on paying bills or buying flight/train tickets through Amazon. Also 1% cash back everywhere else other than fuel payments. Cashback credited as Amazon Pay every month so it's as good as cash. No upper limit or redemption charges like many other cards. Plus they keep on giving additional cashbacks on Amazon time to time. No fuel surcharge. Life time free card with no minimum spend.

IDFC First Select : Complicated points system but if your spend above 25k per month it multiplies. Also spends done on your birthday has multiplication of points. Have started redemption fees of ₹99 + taxes so redemption should be done after accumulating lots of points. The best thing about this card is that it gives 3 airport lounge accesses per quarter. Life time free card with no minimum spend.

You can also look at Flipkart Axis card if you shop a lot from Flipkart. It gives 5% cash back on Flipkart spends and 1.5% on spends outside. However there is an annual charge of ₹.1000. Since I don't do much shopping on Flipkart, don't find it right for me.

It looks like we can no longer buy the gift cards from Amazon by paying through credit card. I checked with my account and in my wife’s account. Surprisingly, it worked on 31st night. May be, they have disabled it from 1st of November? Can someone please confirm this?

Quote:

Originally Posted by kavensri

(Post 5432187)

It looks like we can no longer buy the gift cards from Amazon by paying through credit card. I checked with my account and in my wife’s account. Surprisingly, it worked on 31st night. May be, they have disabled it from 1st of November? Can someone please confirm this?

|

I tried to purchase Amazon gift card and it allows me to pay through the Amazon pay card and also my saved SBI CC. Do not think they have disabled it. Maybe check in a laptop and if already on laptop retry after clearing cache.

Quote:

Originally Posted by TorqueyTechie

(Post 5432197)

I tried to purchase Amazon gift card and it allows me to pay through the Amazon pay card and also my saved SBI CC. Do not think they have disabled it. Maybe check in a laptop and if already on laptop retry after clearing cache.

|

Tried that. But I am still getting the same alert message, "The card will not be available for use for this purpose"

Quote:

Originally Posted by kavensri

(Post 5432204)

Tried that. But I am still getting the same alert message, "The card will not be available for use for this purpose"

|

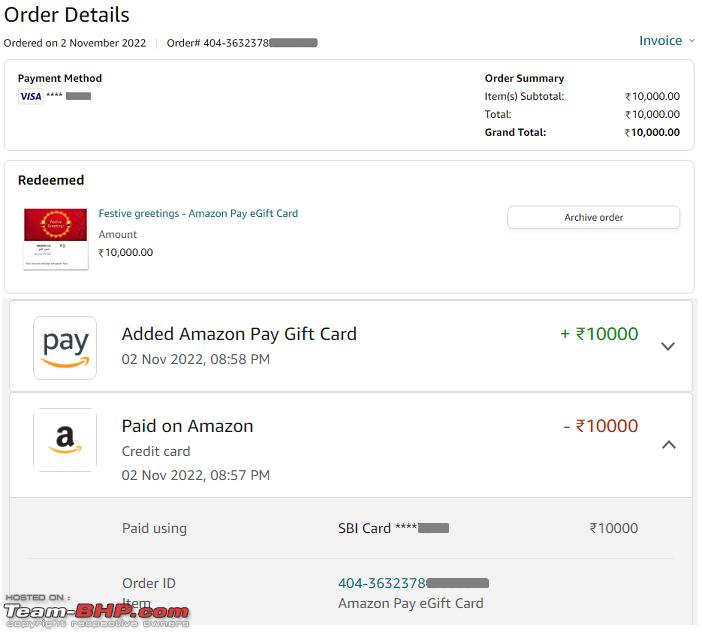

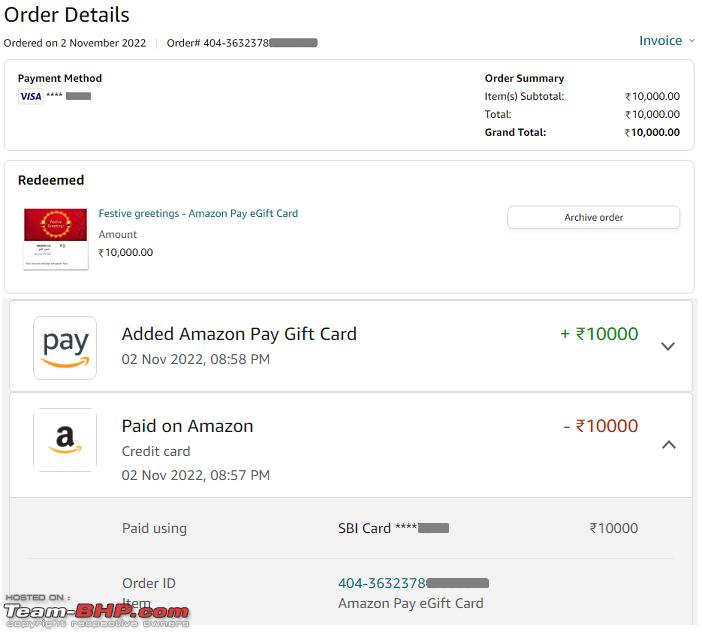

Just bought a 10K GC using my SBI CC after seeing your message and it went through fine and I loaded the GC balance to my Amazon account already. Try removing your added cards and re-add them and enable the token authorization for the card(s) that you frequently use on Amazon. I have saved my SBI CC using the new Tokenization method on Amazon and I did not face any issues so far with any transaction.

Quote:

Originally Posted by kavensri

(Post 5432187)

It looks like we can no longer buy the gift cards from Amazon by paying through credit card. I checked with my account and in my wife’s account. Surprisingly, it worked on 31st night. May be, they have disabled it from 1st of November? Can someone please confirm this?

|

I just tried in the app and it shows my saved HDFC DCB credit card as the best option to buy. In the terms, it seems only corporate credit cards cannot be used. Hope you are using your personal credit card.

Quote:

Originally Posted by Funny

(Post 5432223)

JTry removing your added cards and re-add them and enable the token authorization for the card(s) that you frequently use on Amazon. I have saved my SBI CC using the new Tokenization method on Amazon and I did not face any issues so far with any transaction.

|

I am trying through SBI CC and Amazon Pay ICICI CC. And even I tried removing the card and adding it again. Still no luck.

Quote:

Originally Posted by thanixravindran

(Post 5432224)

I just tried in the app and it shows my saved HDFC DCB credit card as the best option to buy. In the terms, it seems only corporate credit cards cannot be used. Hope you are using your personal credit card.

|

I have tried with two cards and both are personal.

Quote:

Originally Posted by kavensri

(Post 5432230)

I am trying through SBI CC and Amazon Pay ICICI CC. And even I tried removing the card and adding it again. Still no luck.

|

Could be something to do with KYC? Better to get in touch with Amazon support and get clarification since other users are able to pay using CC except for you.

Quote:

Originally Posted by Funny

(Post 5432233)

Could be something to do with KYC? Better to get in touch with Amazon support and get clarification since other users are able to pay using CC except for you.

|

Just to clarify, I am able to use both the CC for any other purchases from Amazon, except for gift cards. And even for gift cards, it worked till 31st (when i brought gift card of worth 25k). So, I am just wondering if there is any monthly limit or something like that exists?

Quote:

Originally Posted by fiat_tarun

(Post 5425604)

I recently used the dispute feature on my HDFC Regalia credit card and had a very good experience.

I made a purchase on this site www.insaraf.com (STAY AWAY!) for a furniture item and paid via credit card. Long story short, the vendor didn't ship the item, wasn't responding to emails regarding cancellation and hence I raised a dispute with HDF.

|

I too had a very bitter experience with them. A piece of furniture meant to be delivered at Kolkata never materialised. Since they have a showroom in Hyderabad, I went there and made a ruckus. Still they used many dilatory tactics like a DD was couriered etc. I went to the showroom a second time and didn't budge until the money was transferred.

Quote:

Originally Posted by lejhoom

(Post 5432805)

I too had a very bitter experience with them. A piece of furniture meant to be delivered at Kolkata never materialised. Since they have a showroom in Hyderabad, I went there and made a ruckus. Still they used many dilatory tactics like a DD was couriered etc. I went to the showroom a second time and didn't budge until the money was transferred.

|

One question on raising customer dispute for Credit card. As per my recent experience from Kotak cards, they asked me to pay the entire disputed amount or else risk the interest being levied in case the dispute is not resolved in my favor. This is contrary to may past experience with HSBC and Amex cards. Thankfuly the amount was 5k and i just paid up. IMagine if it was > 20k Would have been very difficult situation. Any other experiences in this regard.

I am using SBI Cashback card for the last 2 months with a pathetic limit of 20K. This is my first card. Whether I can add money and thus increase my limit? Say I add 5K, will I be able to spend 25K? Secondly, will I get cashback on the extra money spent?

Customer care of SBI Card never gets connected.��

Quote:

Originally Posted by alexgv

(Post 5433247)

One question on raising customer dispute for Credit card. As per my recent experience from Kotak cards, they asked me to pay the entire disputed amount or else risk the interest being levied in case the dispute is not resolved in my favor. This is contrary to may past experience with HSBC and Amex cards. Thankfuly the amount was 5k and i just paid up. IMagine if it was > 20k Would have been very difficult situation. Any other experiences in this regard.

|

Most cards have similar view. Pay up and if the dispute is resolved you get the amount credited.

With AMEX you have an insurance against fraudulent and/or disputed charges, hence as a customer you are covered and as a merchant so are they. In general worldwide AMEX is extremely customer friendly. If you loose a card, a replacement is delivered withing a day where ever you may be (as long as it can be delivered). Similarly any msiuse of card after loss is taken care of without any hassle.

| All times are GMT +5.5. The time now is 07:26. | |