Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by Aroy

(Post 5434052)

Most cards have similar view. Pay up and if the dispute is resolved you get the amount credited.

|

Not Citi. They do a provisional reversal of the disputed transaction soon after the dispute is raised.

Quote:

Originally Posted by binand

(Post 5434056)

Not Citi. They do a provisional reversal of the disputed transaction soon after the dispute is raised.

|

Similar experience with HDFC. They reversed the amount and then started investigation on disputed transaction.

Quote:

Originally Posted by darkfantasy

(Post 5431354)

You can buy Amazon gift card for 1500 and load it to your own account. This works exactly like amazon pay but with a validity of 1 year. You can buy gift cards for Flipkart also and use it for yourself.

|

Just a correction, the validity of 1yr is only applicable on gift cards that are not used (i.e., not added to any a/c), The balance once added to an a/c has no expiry. I confirmed this with Amazon customer service and they said that even for the expired gift cards, we can always reach back to them and get them revalidated.

Quote:

Originally Posted by vinu_h

(Post 5434478)

|

They are trying to complete with well established Amazon pay ICICI card. Amazon pay balance is anyday more useful compared to Flipkart coins, so not sure if this is attractive deal.

Quote:

Originally Posted by kavensri

(Post 5432239)

Just to clarify, I am able to use both the CC for any other purchases from Amazon, except for gift cards. And even for gift cards, it worked till 31st (when i brought gift card of worth 25k). So, I am just wondering if there is any monthly limit or something like that exists?

|

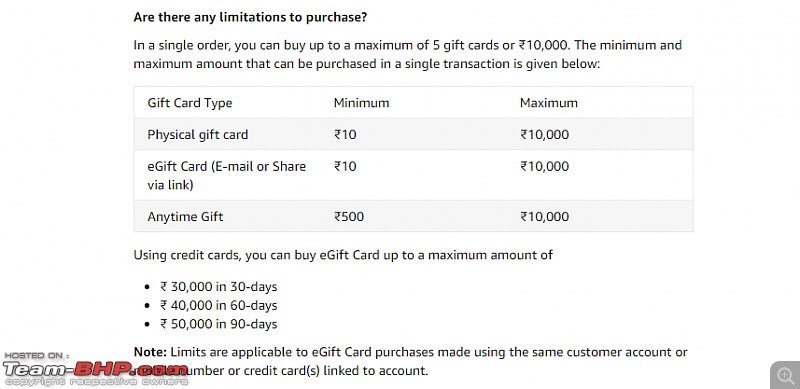

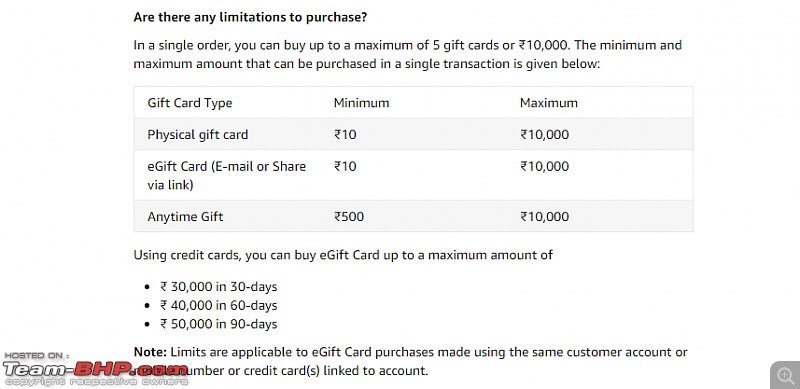

I bought GC worth 30K in this month and couldn't purchase more using CC same like you. So did some digging and found out that there is a limit on buying GC using CC on Amazon. Source and relevant details below.

Source:

Link

Quote:

Originally Posted by Everlearner

(Post 5434665)

They are trying to complete with well established Amazon pay ICICI card. Amazon pay balance is anyday more useful compared to Flipkart coins, so not sure if this is attractive deal.

|

The normal Flipkart Axis credit card offered direct statement credit. If that's still on, would recommend that.

Quote:

Originally Posted by AZT

(Post 5434726)

The normal Flipkart Axis credit card offered direct statement credit. If that's still on, would recommend that.

|

Other option is HDFC millennia card which offers flat 5% cash back on all major online retailers with lounge access included and 1% cashback on all other transactions.

https://www.hdfcbank.com/personal/pa...llennia-cc-new

On another topic, Seems like Zomato RBL card have lost it's value preposition. Since Sept 2022, Only those transactions are eligible for 5 % cash back which are done via zomato pay or for orders place via zomato for delivery. It doesn't help that restraunts are refusing any payments via Zomato pay and there is no recourse. In my case, to cirumvent zomato's pressure on zomato pay, restraunt added the lowest cost item in my bill as discounted and claimed to zomato that they cannot pass on multiple discounts as per T & C. Offcourse, I was neither consulted not informed. Will not be using Zomato for dine in anymore with this experience.

Learned it hard way yesterday.

Quote:

Originally Posted by Funny

(Post 5434717)

I bought GC worth 30K in this month and couldn't purchase more using CC same like you. So did some digging and found out that there is a limit on buying GC using CC on Amazon. Source and relevant details below.

|

Thank you so much for extracting this information. Even I had a feeling that some kind of limit must have been there, but I just could not find that information from the web.

Silly doubt,

If I add the amazon icici card on Samsung pay and pay at shops using Samsung pay, will I get points/rewards from both Samsung and Amazon?

Quote:

Originally Posted by JithinR

(Post 5368877)

Seem to have missed this card. From what I understand Axis bank no longer wants additional people pulled into this card so they have made it difficult to obtain it.

I guess the only way left is to apply for the Flipkart Axis CC and then after a few months request and upgrade to ACE.

|

if you know a manager or rm in axis, they can help you get one.

thats how my partner got this card.

Quote:

Originally Posted by deathwalkr

(Post 5434801)

Silly doubt, If I add the amazon icici card on Samsung pay and pay at shops using Samsung pay, will I get points/rewards from both Samsung and Amazon?

|

Yes.

-For you, Samsung Pay becomes an NFC mechanism for payment.

-For Samsung, you become a user for their ecosystem due to convenience.

-For Amazon/ICICI, you are continuing to be an active customer.

It is a win-win situation for everybody involved. clap:

Quote:

Originally Posted by .sushilkumar

(Post 5434736)

Other option is HDFC millennia card which offers flat 5% cash back on all major online retailers with lounge access included and 1% cashback on all other transactions.

|

The reason I avoid using my Millennia card is because of the 99 rs redemption fee to redeem the points. This is an archaic system and for some reason HDFC still clings to it.

I got the HDFC Millenia card issued last month. It then went on a little journey visiting places in Bengaluru because genius me forgot to update the communication address while going through the process.

I had asked whether the card was being issued as LTF multiple times during the process. This was confirmed by a RM and someone from the Credit card department who helped me complete the process.

After finally receiving the card last week, I have also got it confirmed from CC who was pushing me to complete at least two transactions to retain the card.

Today I get a call from another CC rep who tells me to pay postpaid bills using the card and how I would need to spend money to ensure that the annual charges are waived off. I would have chocked on my tea if I had been drinking any at the time. She was referring to the 1L/annum spend criteria.

She had no answer as to how multiple people assured me the card was being issued as LTF during the process and after but finally said that if I use Smartpay app to settle postpaid bills with this card then it would become LTF.

I have never heard of this and suspect that she is just trying to meet her quota. Is there anything I can do here to get the card updated as LTF as originally promised?

If not, then I can just ask them to cancel it.

Quote:

Originally Posted by JithinR

(Post 5435642)

Today I get a call from another CC rep who tells me to pay postpaid bills using the card and how I would need to spend money to ensure that the annual charges are waived off. I would have chocked on my tea if I had been drinking any at the time. She was referring to the 1L/annum spend criteria.

She had no answer as to how multiple people assured me the card was being issued as LTF during the process and after but finally said that if I use Smartpay app to settle postpaid bills with this card then it would become LTF.

I have never heard of this and suspect that she is just trying to meet her quota. Is there anything I can do here to get the card updated as LTF as originally promised?

If not, then I can just ask them to cancel it.

|

Postpaid bill payment is legitimate method for annual fee waiver by HDFC if the same is not otherwise LTF. Many of my colleagues have used it in past for regalia card. I guess enabling auto-pay for those bills is must to fullfill the criteria.

| All times are GMT +5.5. The time now is 08:29. | |