Team-BHP

(

https://www.team-bhp.com/forum/)

From Vidyaranyapura branch. They are aware of the OD loan and promised me the same.

Quote:

Originally Posted by wildsdi5530

(Post 3734331)

Today the idiots at SBI tell me they opened an ordinary loan account instead of an overdraft account. Is there any way it can be converted? Or should I go for a fresh loan and all the paperwork and expense again?

|

This happened to me as well but the Bank Manager (in Mathikere SBI) opened a new one with OD . As per the manager, they cannot convert a Loan account to OD. Now when my see my accounts, it shows the old loan account too (but with zero balance ofcourse).

Harish

Hi,

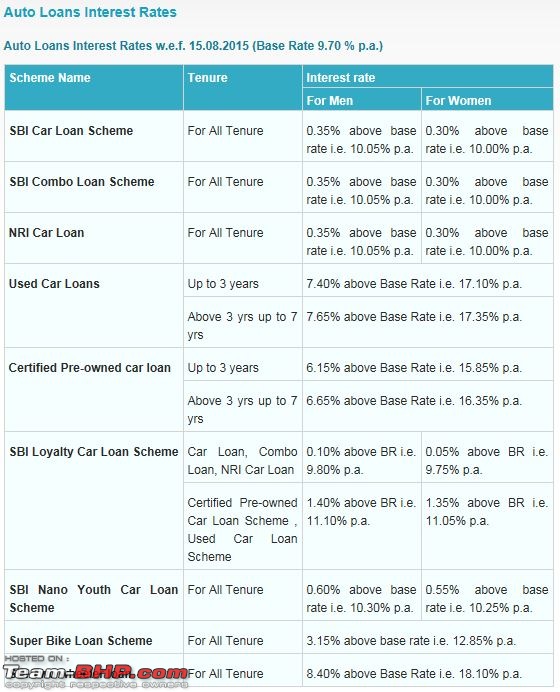

SBI has reduced interest rate on auto loan effective from 15/08

Regards.

I dont understand OD concept. Can someone explain please?

Hi guys,

My first post here. I have to decide between OD and loan against FD. This morning I spoke a person in SBI. She told me that the interest rate in loan against FD is 1 % higher than the FD. Can anyone tell me if this is a better deal the OD?. I understand that the OD is good from a liquidity point of view. But in terms of cost of capital (or the interest outgo), which one is better?. I am sorry if this has already been discussed.

thanks in advance.

@Mods. Sorry about the repeat post. Tried editing it. But it was too late to do so.

@Keyur.

In one of the examples, you talked about the scenario where one deposits the the entire loan amount the very first day. You wrote that, effectively this is equivalent to loan at 0%. (When someone asked how different is that from full cash payment.). Here is my view on this. In order to pay that, you probably need to close some FD's, sell some shares or things like that. So technically its as good as full cash payment. (Except for the fact the you wont pay the dealer directly). Considering this, loan against FD looks a better option. Moreover, its far easier. The sbi person tells me, it takes just 30 minutes to get it. Am I missing something here?

I may be missing something simple. I have my car loan with SBI. But, the only thing I have from the bank is loan account number. I havent received any loan agreement, account access details or anything from the bank.

Can someone provide me details of checking my account details? Reaching out to the branch is probably one of the way. I am looking for something simpler :-)

Quote:

Originally Posted by ravinemala

(Post 3817219)

I may be missing something simple. I have my car loan with SBI. But, the only thing I have from the bank is loan account number. I havent received any loan agreement, account access details or anything from the bank.

Can someone provide me details of checking my account details? Reaching out to the branch is probably one of the way. I am looking for something simpler :-)

|

Usually the loan account is linked to your saving bank account and the details can be checked using net banking.

Quote:

Originally Posted by ravinemala

(Post 3817219)

I may be missing something simple. I have my car loan with SBI. But, the only thing I have from the bank is loan account number. I havent received any loan agreement, account access details or anything from the bank.

Can someone provide me details of checking my account details? Reaching out to the branch is probably one of the way. I am looking for something simpler :-)

|

Hi ravinemala,

You will need to go to the branch in any case. Usually SBI ask you, at the time of loan application, if you already have an SB account with them. If not, they urge you to open one. Your SB and loan accounts are linked to the same customer ID and will have the same NetBanking ID. You need to visit the branch to set these up. Once you have them handy, you can access your account, carry out various transactions and do a lot of other things by logging in at

www.onlinesbi.com.

Hope this helps.

Hi friends

I am planning to buy my first car and approached SBI for an auto loan since they seemed to have the best rates on offer as well as nil foreclosure charges.

The relationship manager sent me a list of required documents which i put together. Im a self employed professional and this was my first loan application and I'd kept everything shipshape. I went to the branch and gave him all the documents.

The RM verified the Documents and said that he ll have to check my CIBIL score (a rating agency). He fed in the data and the system returned a rating of -1 ; against it was mentioned "insufficient history to score"

Now I understand that this CIBIL rating is calculated on previous credit history based on loans and credit cards.

Apparently, since I had never taken a loan or ever owned a credit card (don't believe in the concept) my score became automatically negative - there was no history to check.

All my documents are proper - IT returns of the last 6 years, Service tax payments, IDs, the works. There has never been any instance of cheque bouncing or financial irregularities either. In such a scenario what is one supposed to do?

Its a real catch 22 situation. if you need a good credit rating you need to have a taken a loan and repaid it properly but if you need to take a loan you need to have a good credit rating. Am at my wits end :eek:

The relationship manager was sympathetic and agreed that it was a weird situation and so did the Branch manager who said he didnt believe in it but unfortunately the policy is such. They said they could sanction a loan if i could get a co-applicant who had a good rating! I found it all quite bizarre.

Anyway I got the bank manager to give me a letter stating that they are refusing me the loan and intend to write to the ombudsman but i wonder if it'll be of any use.

Quote:

Originally Posted by famousshoes

(Post 3819994)

He fed in the data and the system returned a rating of -1 ; against it was mentioned "insufficient history to score"

Now I understand that this CIBIL rating is calculated on previous credit history based on loans and credit cards.

Apparently, since I had never taken a loan or ever owned a credit card (don't believe in the concept) my score became automatically negative - there was no history to check.

! I found it all quite bizarre.

Anyway I got the bank manager to give me a letter stating that they are refusing me the loan and intend to write to the ombudsman but i wonder if it'll be of any use.

|

That is a really really bizarre situation. CIBIL score is to check your credit history and credit worthiness. If you have no loan or credit card history, it should return a perfect score.

Maybe you can try running the report personally once more. ( there is a rs 400 fee involved). Definitely raise an escalation in the CIBIL site and to the ombudsman also.

Quote:

Originally Posted by famousshoes

(Post 3819994)

Hi friends

I am planning to buy my first car and approached SBI for an auto loan since they seemed to have the best rates on offer as well as nil foreclosure charges.

The relationship manager sent me a list of required documents which i put together. Im a self employed professional and this was my first loan application and I'd kept everything shipshape. I went to the branch and gave him all the documents.

The RM verified the Documents and said that he ll have to check my CIBIL score (a rating agency). He fed in the data and the system returned a rating of -1 ; against it was mentioned "insufficient history to score"

Now I understand that this CIBIL rating is calculated on previous credit history based on loans and credit cards.

Apparently, since I had never taken a loan or ever owned a credit card (don't believe in the concept) my score became automatically negative - there was no history to check.

All my documents are proper - IT returns of the last 6 years, Service tax payments, IDs, the works. There has never been any instance of cheque bouncing or financial irregularities either. In such a scenario what is one supposed to do?

Its a real catch 22 situation. if you need a good credit rating you need to have a taken a loan and repaid it properly but if you need to take a loan you need to have a good credit rating. Am at my wits end :eek:

The relationship manager was sympathetic and agreed that it was a weird situation and so did the Branch manager who said he didnt believe in it but unfortunately the policy is such. They said they could sanction a loan if i could get a co-applicant who had a good rating! I found it all quite bizarre.

Anyway I got the bank manager to give me a letter stating that they are refusing me the loan and intend to write to the ombudsman but i wonder if it'll be of any use.

|

What a weird predicament! I don't think SBI will go wrong in the CIBIL score calculation. I can think of three solutions:

1. Check with another SBI branch. See if they are flexible.

2. Drop SBI. Check HDFC. They provide auto loans at good rates.

3. IF all fail, delay your purchase by a month and a half if you really need a loan. Get a credit card. Celebrate your car purchase early, pay with your credit card and don't use it again :D. When you pay up the credit amount, your credit score should be perfect ;)

Quote:

Originally Posted by Rajeevraj

(Post 3820176)

That is a really really bizarre situation. CIBIL score is to check your credit history and credit worthiness. If you have no loan or credit card history, it should return a perfect score.

Maybe you can try running the report personally once more. ( there is a rs 400 fee involved). Definitely raise an escalation in the CIBIL site and to the ombudsman also.

|

Yes, a headscratch moment was had by all involved. In fact the score was pulled up twice since I later asked for the letter from the bank and a copy of the CIBIL report.

What i cannot get over is the fact that these agencies can affect the lives of so many people in such a casual manner. It mentions on the report that

"Consumers not in the CIBIL database or with insufficient information for scoring will be classified negative and that CIBIL does not accept any responsibility for the accuracy and veracity of any and all information provided"

i mean isn't this illegal?

I do intend to write to the ombudsman with the letter and the report.

On another note the Vento TSi is the car that i've decided on and your threads have been a great resource to me. The machine is indeed an absolute delight to drive. Thank you :)

Quote:

Originally Posted by famousshoes

(Post 3820203)

On another note the Vento TSi is the car that i've decided on and your threads have been a great resource to me. The machine is indeed an absolute delight to drive. Thank you :)

|

That's a wonderful car. Its the one car in its segment that had put the broadest grin on my face. I felt like James Bond on the road :D. Congratulations on your choice! I had booked the car but then cancelled it in favor of my all-time favorite - the XUV5OO.

Quote:

Originally Posted by achyu

(Post 3820200)

What a weird predicament! I don't think SBI will go wrong in the CIBIL score calculation. I can think of three solutions:

1. Check with another SBI branch. See if they are flexible.

2. Drop SBI. Check HDFC. They provide auto loans at good rates.

3. IF all fail, delay your purchase by a month and a half if you really need a loan. Get a credit card. Celebrate your car purchase early, pay with your credit card and don't use it again :D. When you pay up the credit amount, your credit score should be perfect ;)

|

Quote:

Originally Posted by achyu

(Post 3820236)

That's a wonderful car. Its the one car in its segment that had put the broadest grin on my face. I felt like James Bond on the road :D. Congratulations on your choice! I had booked the car but then cancelled it in favor of my all-time favorite - the XUV5OO.

|

hahahha yeah I guess i ll have to play the game achyu. Its not SBI but CIBIL that actually collates and decides the credit scores, based on information - or the lack thereof - provided by "members".

The RM said that all SBI branches will give the same result since they have a tie-up with CIBIL. I'm now exploring other finance options since i do need that loan, will check out HDFC. love the credit card idea but i just came across threads on TBHP where banks have been pretty lethargic on updating closure information. So i'll have to figure something else to hack that score ;)

The XUV 500 i guess would be more in line with the terminator persona, eh. hope you're enjoying it. cheers

| All times are GMT +5.5. The time now is 18:30. | |