Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by Rajeevraj

(Post 3650685)

Super efficient, extremely polite and friendly officer

|

Thanks for that info. Going to walk in there tomorrow and ask about the loan with OD facility. Is it located in the corner building opposite the temple?

Trying to understand the numbers in this thread as i have to urgently recommend a loan right now to a friend.

Bottomline: How does this compare with option of investing your in hand money for the long term for an expected 16-18% returns combined with the 7 year loan at 4.99 % from Renault for the Duster/lodgy (85% of total cost)

http://www.team-bhp.com/forum/indian...ml#post3851265

I have taken a 7 year Sbi car loan for my nano. I chose 7 years because I recently moved to Bangalore and wanted my emi to be as low as possible. It's just 3 months now and I am having a very good grip on my financials now. My monthly emi is ₹.5000 . I can afford another ₹5000 . Should I transfer it to my loan account monthly or save it as rd and make an yearly payment? Also should I use the extra amount to invest or use it to foreclose the loan?

Quote:

Originally Posted by sairamboko

(Post 3887769)

I have taken a 7 year Sbi car loan for my nano. I chose 7 years because I recently moved to Bangalore and wanted my emi to be as low as possible. It's just 3 months now and I am having a very good grip on my financials now. My monthly emi is ₹.5000 . I can afford another ₹5000 . Should I transfer it to my loan account monthly or save it as rd and make an yearly payment? Also should I use the extra amount to invest or use it to foreclose the loan?

|

In my opinion, transfer monthly. Since it is a new loan, most of the emi will be interest and since anything you pay back goes towards the principal, you will see the tenure dropping rapidly.

On fore closing, my view is that any auto loan should be closed as soon as possible since it is a deprecating asset.

Quote:

Originally Posted by Rajeevraj

(Post 3887784)

In my opinion, transfer monthly. Since it is a new loan, most of the emi will be interest and since anything you pay back goes towards the principal, you will see the tenure dropping rapidly.

On fore closing, my view is that any auto loan should be closed as soon as possible since it is a deprecating asset.

|

Thank you for the advice!! Will make payments monthly from next month onwards :)

Hello All - Does SBI still offer the Advantage loan scheme? Is it called something else now?

Does SBI provide loan for used cars? One of my friend is planning to pick up a used 3-4 month old Brezza ZDi+ from his relative.

Dear all,

Please help me with the procedure prevalent at the SBI for 4 wheeler loan disbursal?

I have already booked my car with the dealership and expect the delivery on March 28th. The invoice amount has been shared with me and likewise 5000 has been paid towards the dealer as booking amount.

What next and how to proceed?

Checking the various pages and the SBI, I have come to a conclusion that all required documents are with me. How does the disbursal occur towards the dealership?

Will dealer get the payment first and then allocate the car to me or will I be in a position to inspect the car before having the bank pay the dealer? Please guide me.

Quote:

Originally Posted by Majumdarda

(Post 4155191)

I have already booked my car with the dealership and expect the delivery on March 28th.

|

Congrats first.

I am in the same process after my booking on Feb 26th.

As part of the loan disbursal process in SBI, you will need to visit the SBI branch releasing your loan and you will be given the loan sanction/allotment letter. This will have all the loan details like the loan amount, interest rate, tenure, etc.. You can clarify your doubts if any at that point and sign the letter once you agree.

Only then, the loan will be released and money paid to the dealer.

In some instances, you might be provided with the sanction letter along with the sales agreement by the dealer. If so, your chance of seeking changes to your loan paper will require more time (as the dealer may need to update his papers) and the process may delay by a day or so.

Quote:

Originally Posted by vijayvelprakash

(Post 4155253)

Congrats first.

I am in the same process after my booking on Feb 26th.

As part of the loan disbursal process in SBI, you will need to visit the SBI branch releasing your loan and you will be given the loan sanction/allotment letter. This will have all the loan details like the loan amount, interest rate, tenure, etc.. You can clarify your doubts if any at that point and sign the letter once you agree.

Only then, the loan will be released and money paid to the dealer.

In some instances, you might be provided with the sanction letter along with the sales agreement by the dealer. If so, your chance of seeking changes to your loan paper will require more time (as the dealer may need to update his papers) and the process may delay by a day or so.

|

Congratulations sir. I have booked mine on the 25th February.

As was advised, I had visited my parent SBI branch (Vallabhnagar, Sant Tukaram Nagar) I have a long standing savings and PPF account with the SBI and they were opened via this branch.

There is this Mr. Bhave, who it seems though takes the payment from the SBI, has intentions in better interests of other banks. I had interacted with this sample way back in 2013 before taking my Bullet 500 and he had played a major deterrent for avoiding taking 2 wheeler loan from SBI. Today also, he played the same role. The summarization is as follows :-

- SBI can only provide 85% on road, even though their site claims an road of 100%.

- Rate of Interest is 9.25% for males and it has got nothing to do with a decent CIBIL score.

When I informed him that I have two types of accounts with the bank, his response was that "it does not matter." After all this when I informed that the dealer representative is willing to provide me upwards of 90% on road at 8.75%, if I have a CIBIL score in excess of 750, his reaction was "Get from them, why bother me?" [though he did not dare pronounce those words, but the expression just expressed his intentions].

And for all this, I had to "WASTE" a good 90 minutes at the branch, and that too after a grueling night-shift at office.

Yes, none had forced me to approach the SBI, but who does not want to reap the benefits? And if a dealer agent can provide the benefits, why can't a senior bank representative provide the same? Moreover, its also mentioned on SBI page.

Yes, I will get the loan approved, via the agent as fortunately I have all the documents in order. But would definitely not advise anyone to approach the bank for the loan. Definitely not if its the SBI SantTukaram Nagar branch at Vallabhnagar with that Mr. Bhave seating on the loan chair. In today's competitive world, I just wonder how elements like these have managed to sustain all these years?

I definitely wish to take this up with the SBI higher management, as to why this difference in options and features.:Frustrati

@Keyur, A heartfelt thanks to you for taking time to write this. I had stumbled upon this thread way back but always kept in mind in case I intend to buy a car with cash. I finally opted for the OD car loan from SBI last week and I was pleasantly surprised by the experience.

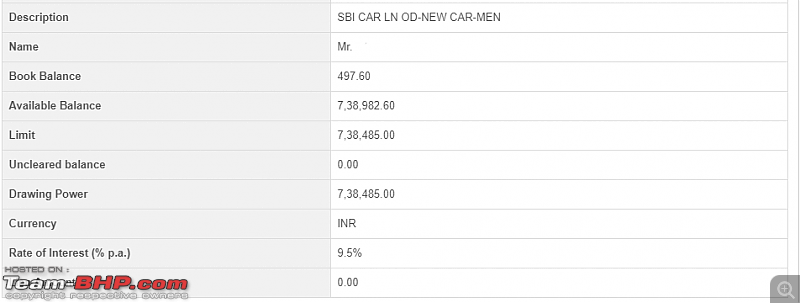

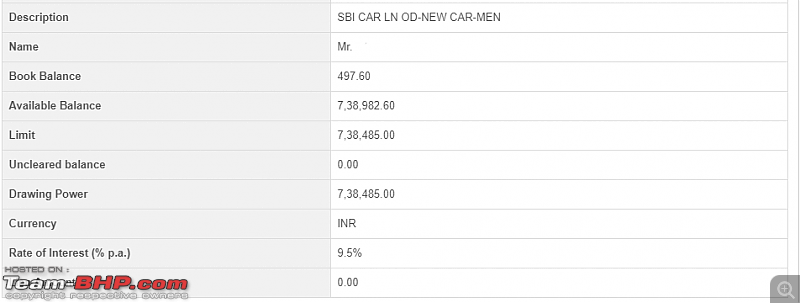

The whole process was pretty straight forward. I approached the HSR layout branch and asked for Car Loan with OD facility. The assistant manager (AGM?) was a nice chap who was aware of the OD facility. I filled in some forms, submitted the required documents and was told that I'll get a call after a couple of days when verification are done and then the disbursal would be processed (was also given an option to hold disbursal till my preferred date). Sure enough, I got a call 2 days later from him and went to the bank to finalize the formalities and the disbursal was processed. Since I never had an Over Draft account before, he opened his own accounts page and showed me the information shown and what they meant. The Branch Manager came as well to sign on the sanction letter and he was a nice person too, had a small chat about the car. All in all, a smooth and pleasant experience and instead of parting with my cash, I will have a reserve w/o interest for emergency for the next few years :)

By the way, the branch also had a spare computer and a printer for customers/applicants to take print outs of soft copies of the documents !

Quote:

Originally Posted by sabby_4c

(Post 4214938)

@Keyur, A heartfelt thanks to you for taking time to write this. I had stumbled upon this thread way back but always kept in mind in case I intend to buy a car with cash. I finally opted for the OD car loan from SBI last week and I was pleasantly surprised by the experience.

The whole process was pretty straight forward. I approached the HSR layout branch and asked for Car Loan with OD facility. The assistant manager (AGM?) was a nice chap who was aware of the OD facility. I filled in some forms, submitted the required documents and was told that I'll get a call after a couple of days when verification are done and then the disbursal would be processed (was also given an option to hold disbursal till my preferred date). Sure enough, I got a call 2 days later from him and went to the bank to finalize the formalities and the disbursal was processed. Since I never had an Over Draft account before, he opened his own accounts page and showed me the information shown and what they meant. The Branch Manager came as well to sign on the sanction letter and he was a nice person too, had a small chat about the car. All in all, a smooth and pleasant experience and instead of parting with my cash, I will have a reserve w/o interest for emergency for the next few years :)

By the way, the branch also had a spare computer and a printer for customers/applicants to take print outs of soft copies of the documents !

|

Could you shed some more light on car loan with OD facility? Just for general knowledge' sake

Quote:

Originally Posted by AdiSinghV12

(Post 4214942)

Could you shed some more light on car loan with OD facility? Just for general knowledge' sake

|

Well, I think Keyur has already done a great job explaining it in the first few posts. To give you a brief idea, the loan account is opened as an Over Draft account where you can park excess amount of cash which you can withdraw anytime. And the main benefit is the interest of the EMI is calculated based on (the outstanding principal - your extra parked cash). So instead of paying cash for your new car or pre-closing a car loan, you get to park it in the OD account to pay reduced/zero interest while still having access to that cash in case of any necessity. If you need further explanation, I suggest reading the first page of this thread but feel free to ask me any question you have.

Can anyone confirm if SBI provides OD account facility for Used Car Loans also? My contact at the SBI branch through whom I'm getting my home loan processed doesn't have any information about OD facility on loan for used car.

Quote:

Originally Posted by nkapoor777

(Post 3096233)

Here's an interesting development. Recently I had been to the SBI branch and casually popped a question to them about foreclosing my car OD loan account. I asked them to tell me the amount I would need to pay up for the same. Also the way the EMI paid every month is apportioned towards the OD balance is something I am not able to understand. Allow me to explain with an example:

Say my EMI is 10000 per month. In a conventional loan, at the start of the loan term, the interest portion of the same would be close to 4000 odd while the rest would go towards principal repayment. However if I have dumped pretty much the entire outstanding loan amount in the OD account, my interest cost is only a few hundred rupees and the rest of the EMI should go towards principal repayment.

This should result in a much quicker paydown of principal amount. However when I check my OD account, the amount shown as Drawing Power (I'm assuming this is the principal outstanding) is still showing as an amount which would have been calculated as per a conventional loan repayment schedule. In other words, I should have paid close to 40000 in interest over the last 10 months in a conventional loan, while my actual interest cost in the OD loan account has been slightly over 5000.

The difference of 35000 should ideally have reduced the principal outstanding but it doesn't show that on the internet banking screen. The branch staff also asked me to pay up the balance after calculating the amount off the screen, which I feel is grossly incorrect.

I did not have time that day to sit down and explain to them how I feel the calculations should have been done. But plan to go there to discuss this with them shortly. Thought I'd flag it here before I bang my head with them over this.

|

I've also taken an SBI Car loan of Rs. 9.38 lakh from Feb' 16 at the rate of 9.85% with an EMI of Rs. 15,500 per month. After a couple of months I was told that by keeping any additional amount that I've in this loan account, I'll have to pay interest only on the outstanding principal amount.

So from the past one year I've kept a little more money than the outstanding principal amount, hence I'm not being charged any interest.

Now my query is as follows

Loan Amount - Rs. 9.38 lakh

Interest added till date - Rs. 26,602

EMI - Rs. 15,500 * 22 months = Rs. 3.41 lakh

Now the outstanding amount should be = Loan Amount + Interest - Principal paid.

Outstanding Amount should be = 938000 + 26602 - 341000 = 623,602.

1. However on the online page I do not see outstanding principal as Rs. 623602.

2. Also if the Available balance goes below the drawing power then I get charged interest. As per my understanding I should be charged interest only if the Available balance goes below Rs. 623,602/-.

Is there some mistake in the way I'm calculating or is there some mistake on SBIs part?

Note - Interest rate has now reduced to 9.5% a few months back.

| All times are GMT +5.5. The time now is 19:42. | |