Quote:

Originally Posted by Rajeevraj  Around a year back, Bajaj Allianz had launched a Drivesmart range of insurance policies which intended to use driving patterns and related data to help drive down insurance costs. |

Thanks for compiling this.

I had worked on a similar project in my college. But instead of it being connected to the obd, it had onboard g sensors that could track acceleration and braking. Also has a GPS and GSM module to track and send data over the internet. It was an interesting project to implement. While testing, most of the people who were told about this being in the car, drove cautiously.

So such devices are a win.

But the biggest concern is the fact that the savings are not much. I will install this device if the proposed premium is 50+ percent lower than the market. Otherwise there is no incentive for a safe driver. It can also be used in chauffeur driven cars to monitor them as well find out the driver behaviour. I also liked the app which looks simple to use and data is readily available. This one stop interface will be useful to those (like me) who have their cars run by the drivers and don't have the time to daily monitor them.

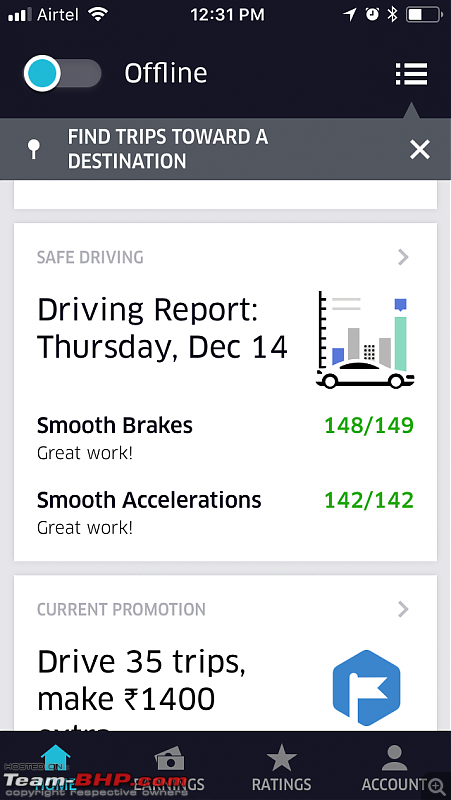

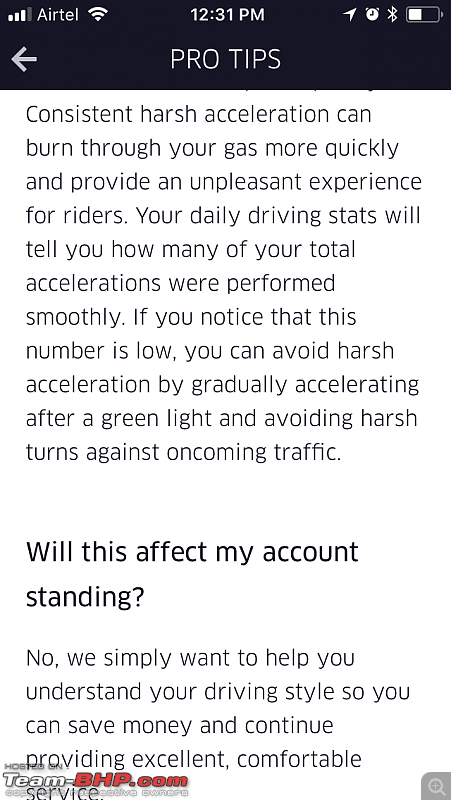

Currently, we have autocop trackpro on the driver driver car. It has geofence and overspeed alert, but nothing like rash or hard braking information. Recently, the Uber driver's app started showing the driving report. Here is the attached pics including the details on the same.

While Uber mentions that this doesn't have implications on the account for now, I'm pretty sure this data is considered to filter out good/bad drivers:

Quote:

Originally Posted by paragsachania  Heck, I feel this should be smart enough to pick up details based on what road you are driving (City road or expressway) and then capture speeds done within city roads or highways and profile you whether you are a safe driver who abides by rules or not.

A long way to go but certainly a very interesting way to leverage telematics! |

+1 Not just insurance, many things can be achieved - eg. understanding traffic patterns, managing signals or toll lanes depending on traffic, real time traffic - the google maps requires your phone to be on, and many more. It will also provide a good way to keep a check the driver of the car.

Quote:

Originally Posted by Santoshbhat  To be honest, I don't see why any customer would want to put this leash around their neck? and that too by paying money out of their own pocket. |

I for one would not mind it. The catch here is that I should not be the only one in the town - all other motorists (at least the majority) should as well. Today, it is in the trial phase. Maybe a couple of years down the line, they will come out with a very good plan which will save a lot of money on renewals, based on your habits.

Quote:

|

What if they say the car was driven very rashly for an hour upto that point or if they say you were driving at 120 kph in a 80 kph zone? or that you did not service the car when it was due and compromised on safety (say brake pads were due for replacement) and deny your claim?

|

Rash is rash, no two ways about it. If you do 120 in an 80 zone, that's risky behaviour. Proper maintenance is also important. I know this seems unfair, but then look at the big picture. We enthusiasts are a handful of the drivers on the road. While we drive sanely, there are many more who are rash. Why do you think there is a discount for being a member of any automobile association on your insurance premium?

Quote:

|

I also have privacy concerns. The way multiple insurance companies and call centres get hold of our phone numbers and hound us just before renewal due date, I won't be surprised if they start selling this data to interested third parties.

|

Yes, this is a valid concern. It won't be very difficult to sell your data, monitor your habits, places you frequent etc.

(3)

Thanks

(3)

Thanks

(3)

Thanks

(3)

Thanks

(4)

Thanks

(4)

Thanks

(2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(2)

Thanks

(2)

Thanks

So such devices are a win.

So such devices are a win.

I understand TPP increased by Rs.1200 or so in 2017 and then the GST. But this is still very high considering the 10% lower IDV. I feel this is primarily targetted at policies up for renewal switch to Bajaj, because existing customers can do an apple to apple.

I understand TPP increased by Rs.1200 or so in 2017 and then the GST. But this is still very high considering the 10% lower IDV. I feel this is primarily targetted at policies up for renewal switch to Bajaj, because existing customers can do an apple to apple.