Team-BHP

(

https://www.team-bhp.com/forum/)

Brilliant article SmartCat, thanks! :thumbs up

This guide helps decide what and when to BUY a stock.

I was wondering if there is a similar guide as to when to SELL a stock.

For example, SBI. Screener.in has no single positive point about it, at current market price, everything is negative.

I bought this stock very long time ago (> 5 Years), sitting on decent profit.

How can I analyze to decide if this stock is worth selling.

Thanks

Quote:

Originally Posted by sahil624

(Post 5016019)

Hi, I am quoting a post from the long back. But is there any Indian centric book that I may refer apart from Thoughtful Investor?

Thanks in

|

Check out books by Saurabh Mukherjee from Marcellus Investment Advisors. His latest book Diamonds in the dust summarises a good framework for long term investing. You can also see some of his Youtube videos to get a flavor.

Quote:

Originally Posted by redCherry

(Post 5177133)

I was wondering if there is a similar guide as to when to SELL a stock. How can I analyze to decide if this stock is worth selling.

|

My post on when to sell a stock:

https://www.team-bhp.com/forum/india...ml#post4219950 Quote:

For example, SBI. Screener.in has no single positive point about it, at current market price, everything is negative.

|

Content under PROS/CONS in screener.in is automated. It is not written by an analyst. Well known consumer, business and industrial brands can be held forever.

Quote:

Originally Posted by SmartCat

(Post 5177158)

|

Exactly. I know PSU banks are not always clean but then, a bank like SBI is in 'too big to fail' category. Before SBI fails there will be enough gloom and doom everywhere.

Quote:

Originally Posted by SmartCat

(Post 5177158)

...

|

Hey SmartCat, what are your thoughts on the Indian EV battery space? Amararaja and Exide have both recently announced they will be getting into Li-ion Cell manufacturing for EV and power applications. Both companies are fairly priced. Amararaja seems to be going through some political turmoil though. Given the oncoming EV revolution, the market is large enough for multiple players including TataChem and Denso-suzuki JV (if that happens). Seems like a good investment opportunity. What do you think?

Quote:

Originally Posted by Electromotive

(Post 5224602)

Hey SmartCat, what are your thoughts on the Indian EV battery space? Given the oncoming EV revolution, the market is large enough for multiple players including TataChem and Denso-suzuki JV (if that happens). Seems like a good investment opportunity. What do you think?

|

Identifying a theme first and then trying to pick stocks is called 'Top Down Investing'

https://www.investopedia.com/terms/t...ninvesting.asp

Now this is something I'm not very good at. I'm a "traditional" value investor who looks at PE ratio, book value and dividend yield of a company before investing.

Quote:

Amararaja and Exide have both recently announced they will be getting into Li-ion Cell manufacturing for EV and power applications. Both companies are fairly priced. Amararaja seems to be going through some political turmoil though.

|

Both Amara Raja and Exide are reasonably priced businesses with excellent financials. Revenues and profits are growing every year.

Amara Raja stock too has not been significantly affected by the promoter's issues with Andhra CM. Both these stocks are stuck in a wide range (which is good for investors who want to accumulate a stock).

Quote:

Originally Posted by SmartCat

(Post 5224615)

Amara Raja stock too has not been significantly affected by the promoter's issues with Andhra CM.

|

That is the only risk, otherwise AmaraRaja management has a good execution record. Guess that's something money can solve.

I prefer investing in a basket of companies related to a sector with potential upside. Li-ion battery space seems to me to be a gold mine so I have started accumulating. Let's see how that goes.

Happy holidays and best wishes for a happy new year to you and your family.

Quote:

Originally Posted by SmartCat

(Post 5224615)

I'm a "traditional" value investor who looks at PE ratio, book value and dividend yield of a company before investing.

|

Hi SmartCat - While I was casually checking, I noticed that Tata Motors has not declared any dividend since 2016 (6 years now). Isn't it a worrisome sign for long term investors or is it normal even for a blue chip company like them?

Quote:

Originally Posted by thanixravindran

(Post 5350612)

Hi SmartCat - While I was casually checking, I noticed that Tata Motors has not declared any dividend since 2016 (6 years now). Isn't it a worrisome sign for long term investors or is it normal even for a blue chip company like them?

|

I personally don't invest in a stock like Tata Motors. For me, large and consistent annual dividend payment is a sign of good health of the company.

But you will always have somebody pointing to Tesla and saying "

Oh look, Tesla does not pay dividends, but the stock price has gone up 1000x".

It all boils down to personal investment preferences.

Quote:

Originally Posted by SmartCat

(Post 4474172)

On similar lines then, another "aviation" stock worth looking at would be Hindustan Aeronautics Limited. Being a PSU, it is ignored by most institutional and retail investors. But that's not a bad thing since it allows you to keep accumulating HAL over time. Eventually value stocks like HAL will make money for investors once it is "discovered". Till then, you get paid 4% tax free dividends for holding the stock.

|

Reading this in 2023 and feel like giving you a 21 guns salute sir :)

Quote:

Originally Posted by SmartCat

(Post 4474172)

On similar lines then, another "aviation" stock worth looking at would be Hindustan Aeronautics Limited. Being a PSU, it is ignored by most institutional and retail investors. But that's not a bad thing since it allows you to keep accumulating HAL over time. Eventually value stocks like HAL will make money for investors once it is "discovered". Till then, you get paid 4% tax free dividends for holding the stock.

|

@SmartCat Tax free dividends? Are there any special exclusions for such stocks or its just the scenario by the year this response was written?

Quote:

Originally Posted by SmartCat

(Post 4474172)

Other defence PSUs like Cochin Shipyard, Bharat Electronics and Bharat Dynamics (they make missiles) are worth looking at too. Guaranteed long term business, zero debt, decent RoE, investor apathy/low valuations, reasonable profit growth (10 to 15% per annum), above average dividend yield are some of the strengths of such companies.

|

True. Recent next stage of Make in INDIA push has raised the valuations of these I believe. What will be your holding pattern given the volatile nature of the market?

Quote:

Originally Posted by Tamarind

(Post 5502731)

@SmartCat Tax free dividends ? Are there any special exclusions for such stocks or its just the scenario by the year this response was written ?

|

That was posted in the year 2018!

Quote:

True. Recent next stage of Make in INDIA push has raised the valuations of these i believe. What will be your holding pattern given the volatile nature of the market ?

|

All PSU defence stocks have gone up in recent times. None of them are visible in my screener list (which means the stock is hold/sell, and not a buy):

https://www.screener.in/user/28210/

Quote:

Originally Posted by SmartCat

(Post 4213248)

CASE STUDY 2: PPAP AUTOMOTIVE

PPAP Automotive's networth is around Rs. 210 Cr (196 + 14 Cr) but its market cap is around Rs. 515 Cr. This means the Price to Book Value is around 2.3. I would buy a stock like PPAP Automotive only at P/BV of less than 1 - that is when market value is equal to networth of the company. Current price of PPAP stock is Rs. 368 but the fair value according to me is 368/2.3 = Rs. 160

|

PPAP is trading near 150 nowadays. Quarterly results aren't great and hence the fall in share prices!

They have made new investments and are supplying to newly launches Toyota/Maruti models. Also supplying to new brands like MG. Nothing seems to have changed from your original analysis.

Are you buying it now? :)

https://www.screener.in/company/PPAP/consolidated/

Quote:

Originally Posted by vikramvicky1984

(Post 5521707)

PPAP is trading near 150 nowadays. Quarterly results aren't great and hence the fall in share prices!

They have made new investments and are supplying to newly launches Toyota/Maruti models. Also supplying to new brands like MG. Nothing seems to have changed from your original analysis.

Are you buying it now? :)

|

wow, blast from the past. Since I made that post, stock doubled from Rs. 350 to Rs. 700, before sliding down to Rs. 150 levels.

I haven't been tracking this stock - but looking at the financials, I wouldn't buy this stock because it has swung into losses. I prefer companies making stable profits, especially if it is a microcap/smallcap.

Adding my 2 bit about Nifty Auto Index.

Here I am adding a monthly chart of Nifty Auto index.

It has consolidated in last few months and attempted a breakdown in March. But it has found immediate support around 12000 area.

From here it can respect this support and continue with its upward journey, however if we see this index coming below 11800 one need to be cautious about this sector.

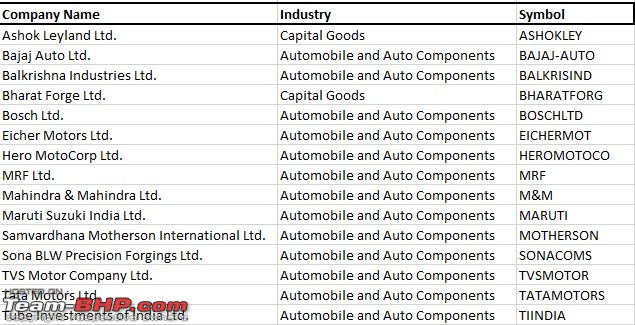

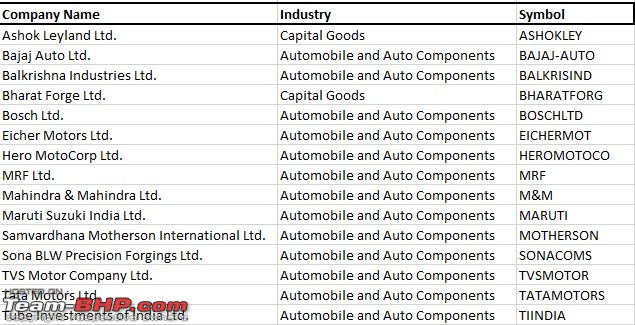

These are the stocks that makes up this index, not the true representation of the entire auto and ancillary industries which has about 100 stocks listed in NSE.

If we compare the returns of this sector to Nifty, for this FY, Nifty has given about -1% where as CNX auto has given about 14%.

We do not have any ETF for this sector unlike other few popular sectors, so the best way to invest into this sector is via thematical MFs, but please note thematical funds have low AUMs, so do understand the risk of investing into a small AUM MF before choosing the fund.

Or the next option is to look at the stocks in the sector and choose depending on the criteria one might have to buy.

There might be some smallcases which invest into Auto sector ( I am not aware as I dont use smallcase for investment) if there are any, that can be another option to take position in Auto sector.

| All times are GMT +5.5. The time now is 12:01. | |