Team-BHP

(

https://www.team-bhp.com/forum/)

NOTES:

1: Thanks to the team at

Auto Punditz for sharing these sales numbers with us!

2: Only cars that sell 500+ units (and thus, the relevant ones) have been included in the gainers & losers chart.

3. These manufacturer-reported sales numbers are factory dispatches to dealerships. They are NOT retail sales figures to end customers.

This vehicle registration data literally just came in from FADA. What timing:

Quote:

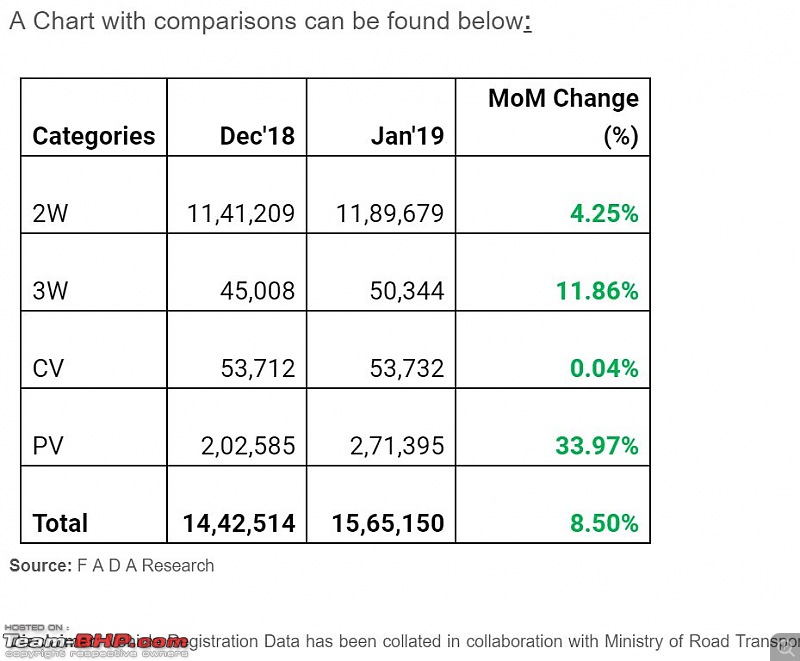

- As predicted in our last update, healthy inquiry of last 2 months finally showed signs of good conversion, which returned some positivity to the PV segment

- Monthly Passenger Vehicle Registration shows a more than expected spike in sales (MoM) due to the extended stock clearance sale coupled with New Model launches resulting into faint signs of positive sentiment restoration

- Despite good PV retails current outlook for PV still remains cautiously optimistic and 2W and CV Retails still under pressure

- 2-Wheeler Dealers Inventory still a cause of Serious Concern. Inventory Levels of PV and CV, though not optimal, stand at reasonable levels

7th January’19, New Delhi: The Federation of Automobile Dealers Associations (F A D A) today released the Monthly Vehicle Registration Data for the month of January’19.

Commenting on the January numbers, F A D A President, Mr Ashish Harsharaj Kale said, “As predicted, healthy inquiry levels seen in December finally showed signs of conversions with the Year End offers continuing in January, especially by Passenger Vehicle OEMs which has helped the customer in making the final purchase.

Consumers interest, which had remained buoyant has slowly but surely started converting to sales in better percentages. Overall Positivity compared to the previous months backed by good retail offerings has helped PV car sales. New Launches in the month also added to the overall excitement and got the attention of the buyer.

Although all the sectors on a monthly basis have shown signs of positive growth, 2W growth rates are not at a healthy high and are seen positive due to a huge de-growth in December. CV growth is flat and has substantially dropped from the high growth rate it had maintained through year to date.

Going forward, F A D A is hopeful of uptick in retail vehicle sales as Interim Budget announcement of new tax rebate for individuals of income up to Rs. 5 Lakhs and assured income to farmers should bring in positive customer sentiment as potential customers sitting on the fence will have increased disposable income. This will hopefully pull up the demand for 2W, Light CV’s and Tractors.

This coupled with Government’s focus on rural roads with an allocation of Rs. 19,000 crores under Pradhan Mantri Gram Sadak Yojna will definitely have a rub off effect on sales uptick for Construction Equipments & Vehicles as well as Tractor used for commercial applications.

F A D A would like to highlight that the Inventory of 2W Dealers still continues to be Very High, as 2W retails are still under pressure and we hope that 2W OEMs will take a realistic stock of the situation prevailing on the ground and reduce wholesale billing.

On this initiative of releasing registration numbers by F A D A, Mr Kale said, “Beginning next month, we will release category wise comparison figures from both monthly and yearly perspective.”

According to a survey conducted by F A D A among its members, the current inventory levels are as following:

PVs ranges from 30-35 days

2W ranges from 50-60 days

CV ranges from 30-35 days

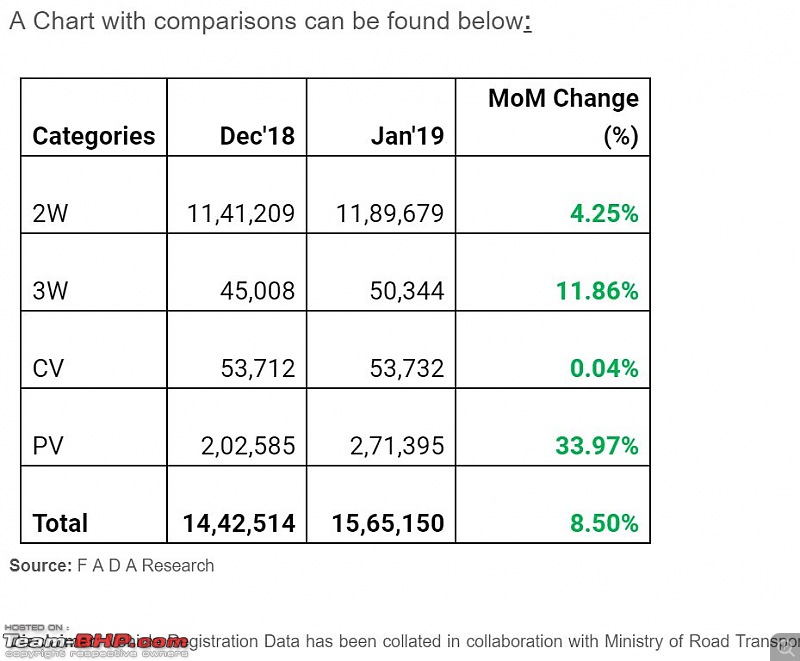

Our study shows that for the month of January and on MoM basis:

2W was up by +4.25%

3W was up by +11.86%

CV was up by +0.04%

PV was up by +33.97%

|

Thanks aditya for the sales data:

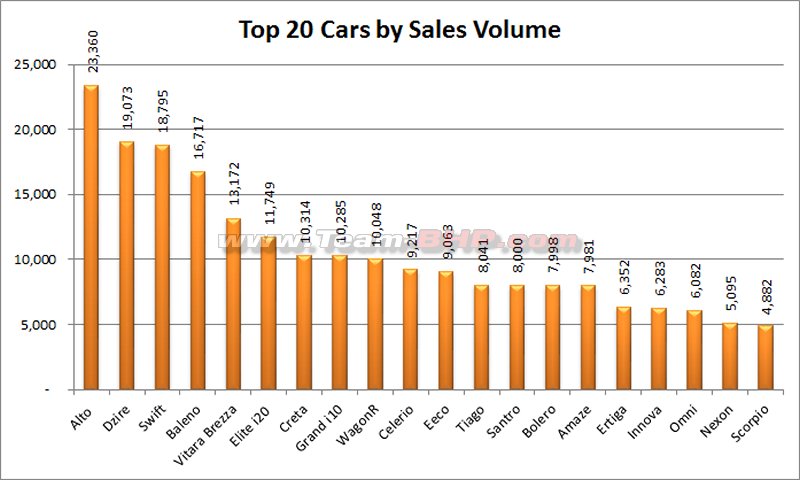

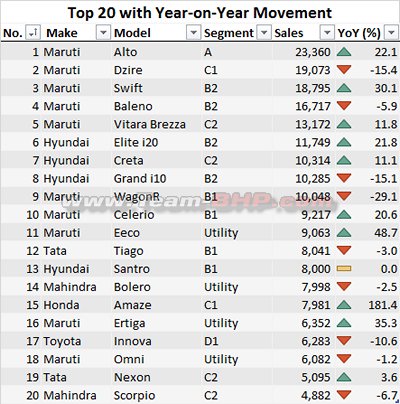

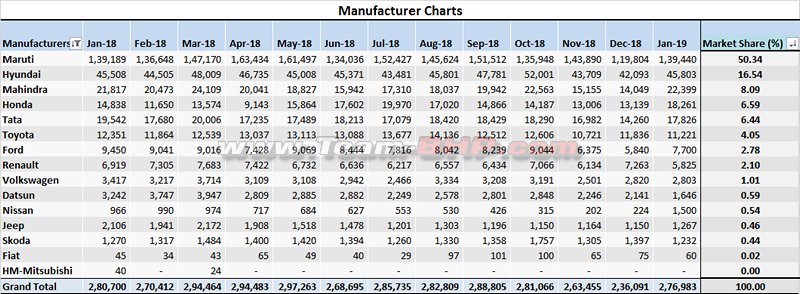

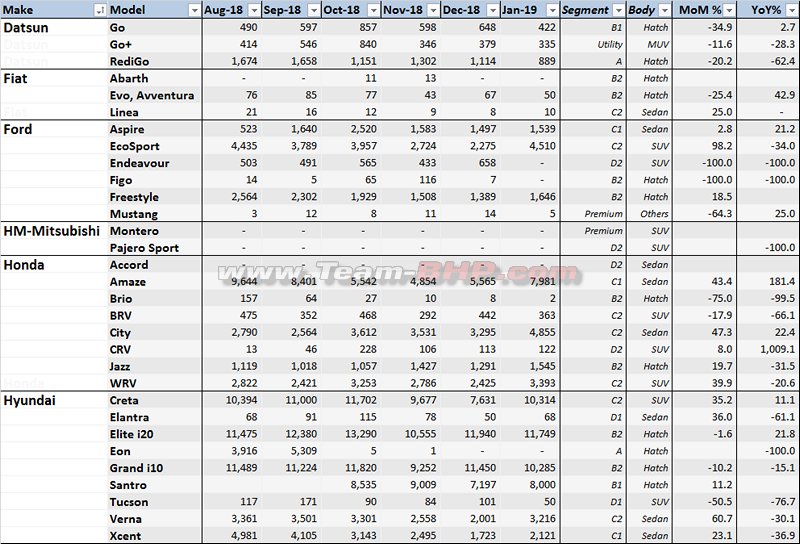

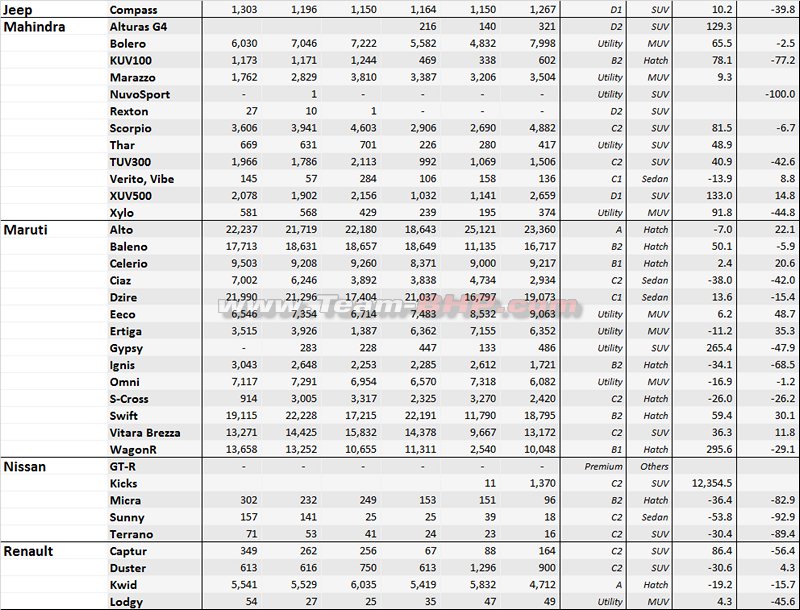

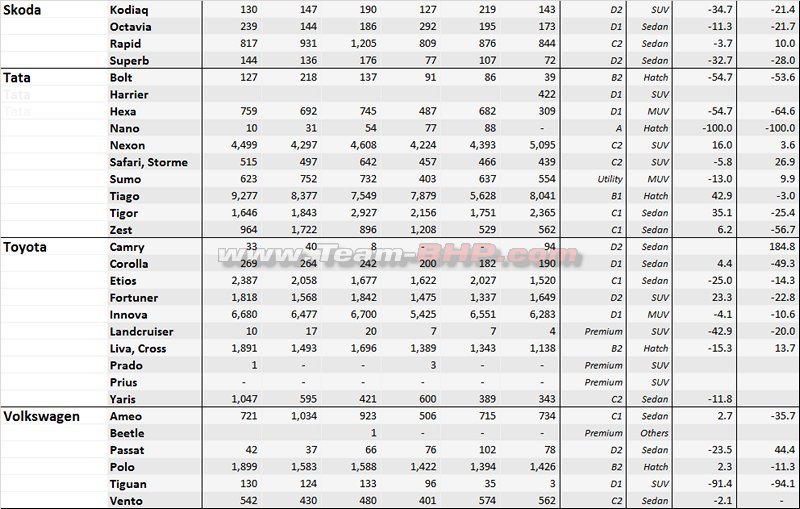

Here are some inferences,

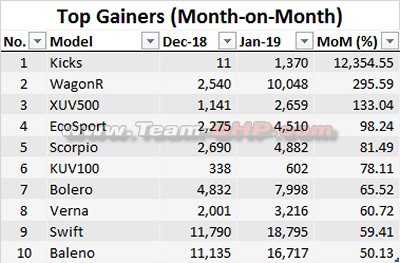

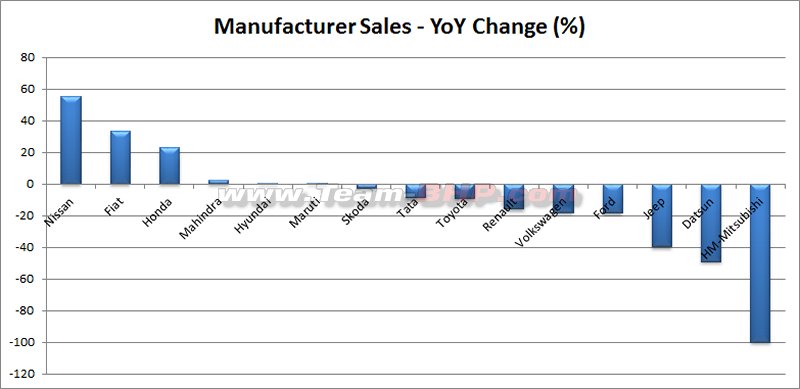

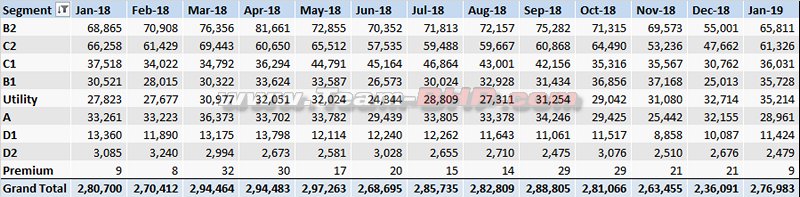

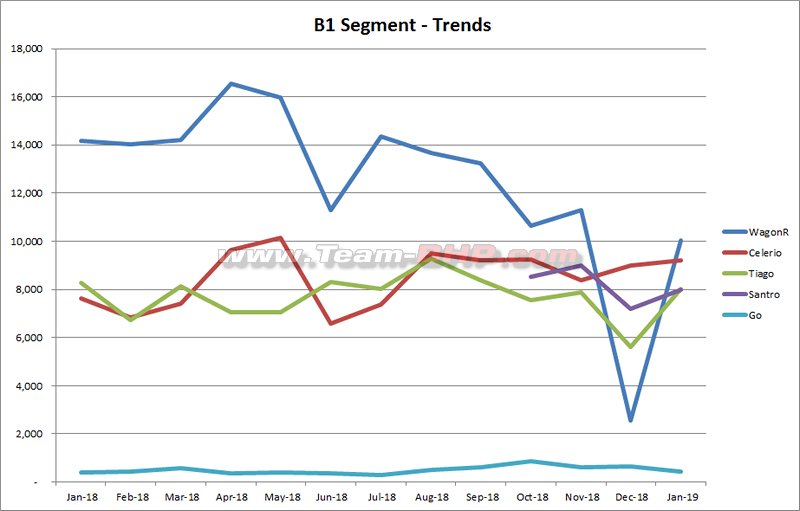

Auto Industry de-grew 1.8 % and the trend continues from the last few months. New launches in January did not do much for their respective companies (WagonR- Kicks –Harrier)

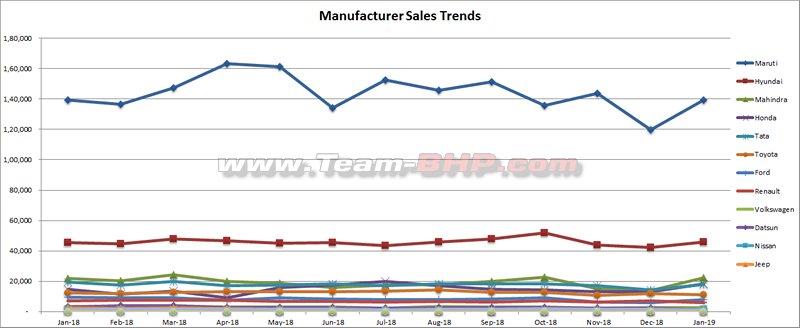

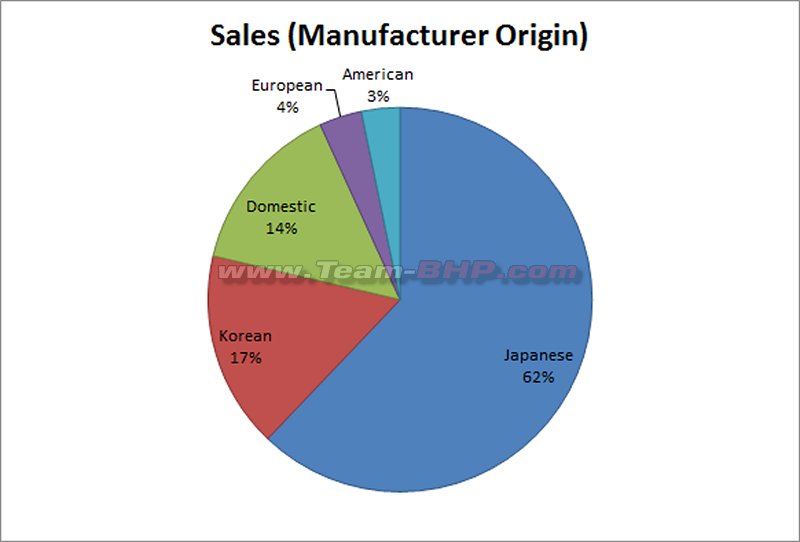

Top 4 manufacturers post positive growth. Though Maruti Suzuki shows a near flat growth, it secures comfortably 50 % market share.

Tata Motors even with the Harrier launch seems to have been pushed to 5th slot, relinquishing the 4th spot to Honda. Tata Motors loses the highest in Market share too.

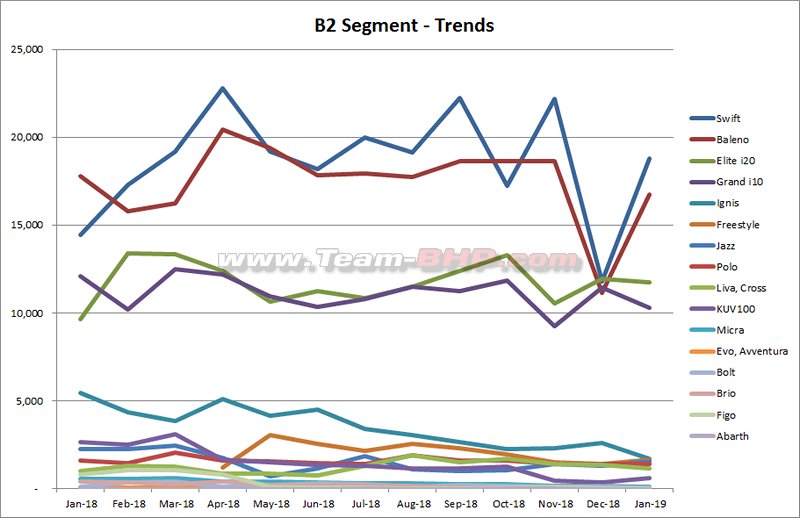

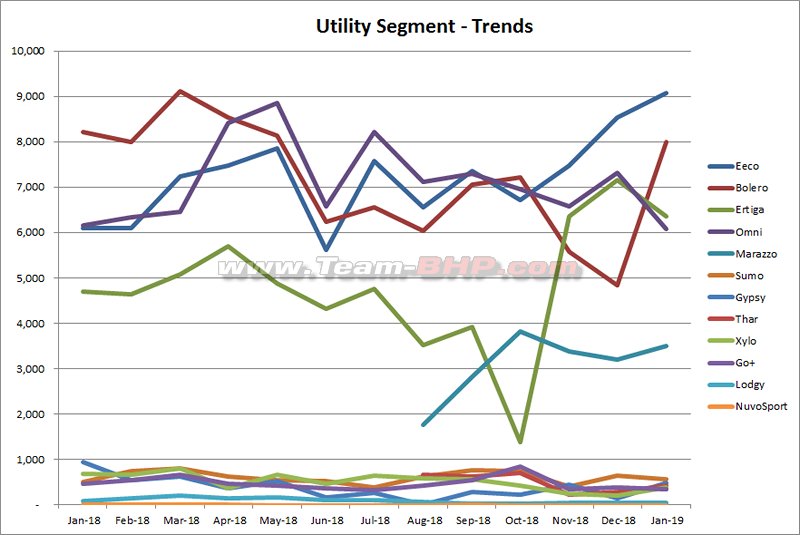

- Maruti Suzuki: Secures its top position in almost all the segments. 7 of its cars are in the top 10. WagonR beats Hyundai’s Santro in the first month itself, after its launch. Maruti was again successful in garnering >50% Market Share. The Market Share has grown by 1% YoY. Ciaz loses out to both Honda City and Hyundai Verna. Not sure if this drop is due to the upcoming New diesel variant of Ciaz. Ertiga leads in the MUV segment. Ignis numbers could be WagonR effect.

Ignis production is speculated to have ended and the new updated model is due for launch shortly.

Armed with new product launches, power-train changes and face-lifts the automaker is likely to secure its market share as seen today.

- Hyundai: Santro launch seem to have not helped in increasing volumes or market share. Will be heavily banking on its C/SUV ( STYX?) and face-lifts ( i10). It will be interesting to see markets response to competition in the Creta segment.

- Mahindra: Flat growth and stagnant market share need to be addressed. XUV3OO a promising product on paper but needs to await the market response. The Flagship Alturas shows decent numbers but need to see what will be its consolidation numbers a few months down the line.

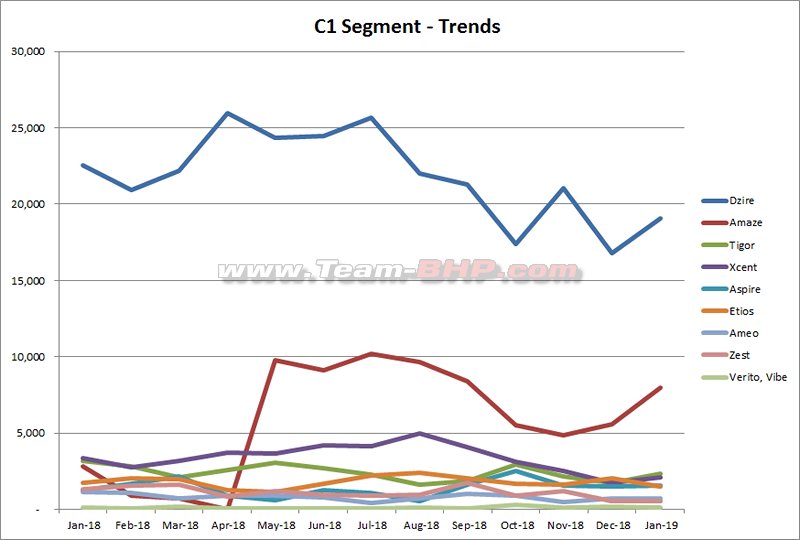

- Honda: Amazing in Growth and Market Share gains. In the process becomes the 4th largest OEM. But the big question is how can it retain this position with no ‘known’ launches in the near future? Honda gets back its leading position in the sedan segment after a very long time.

- Tata Motors: Loses its position in the rankings to Honda. Not sure of Harrier’s delivery. The volumes looks low when compared to Nissan Kick dispatches. However Nexon and Tiago sell in decent numbers, but overall the group shows negative growth and loses Market share.

The rest of the automotive group, except Nissan, shows a negative trend in both Growth and Market Share.

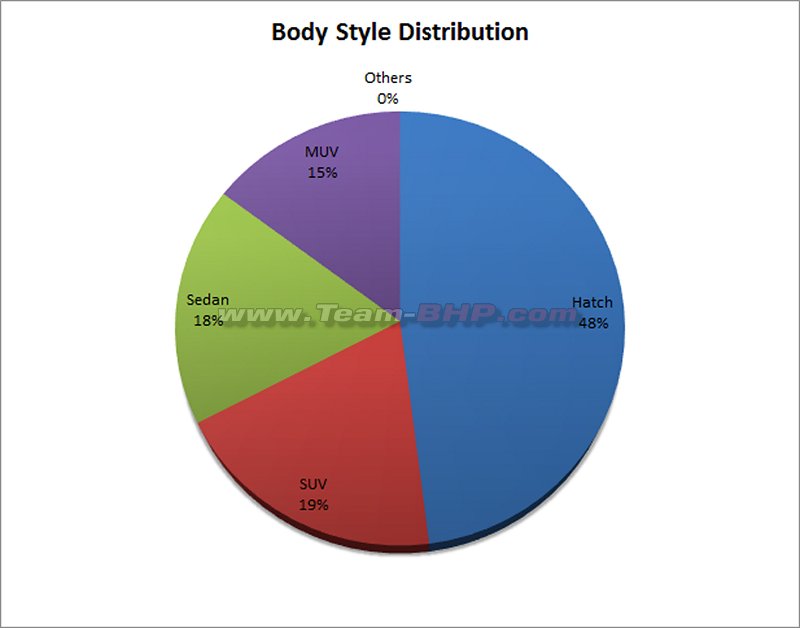

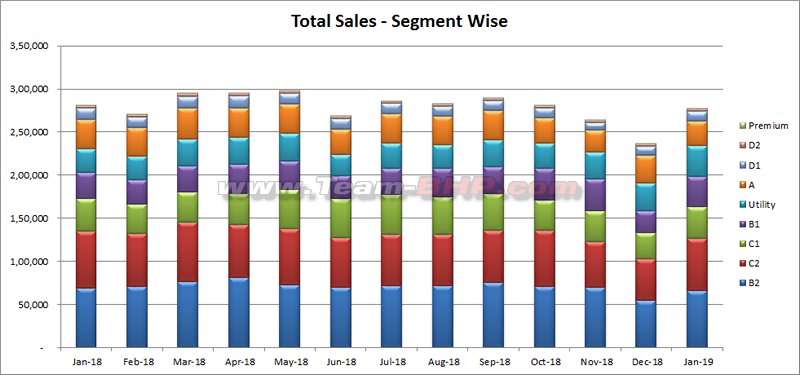

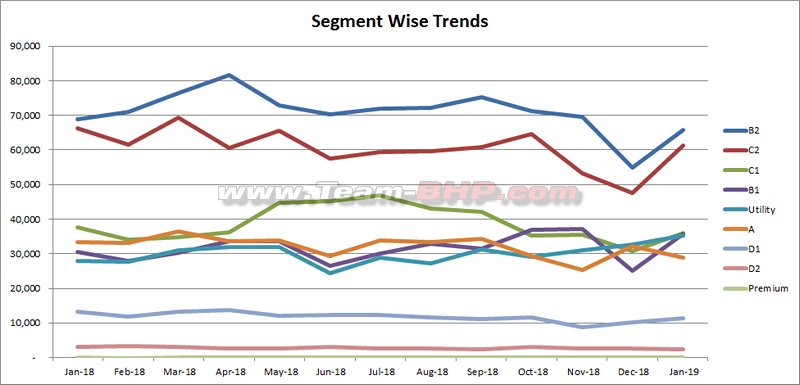

Just noticed that the sales have actually decreased on YOY basis on almost all segments, except the B1 and the utility segments.

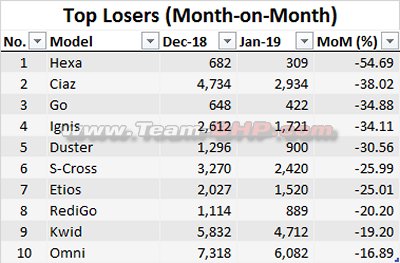

- Datsun - sales falling MoM and YoY - the alarm bells should start ringing.

- Fiat - on their way to closing the brand

- Ford - Good month for Ecosport. Has the plug been pulled for the Figo? If we consider the Freestyle as the de facto new Figo, it's doing moderately well, but no where near the potential it has with the equipment level.

- Honda - Amaze, City and WRV sees sizable sales uptick , and carries Honda above Tata on the sales list.

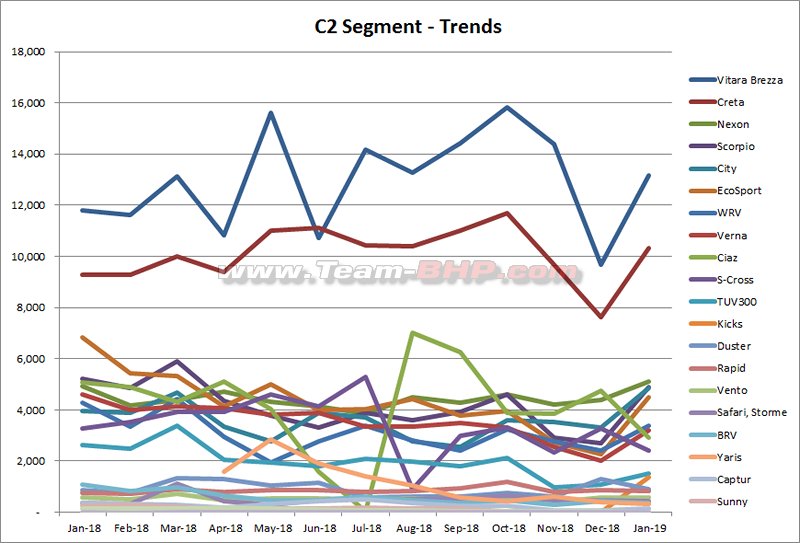

- Hyundai - Creta back to 10k+ numbers. I10 and i20 doing good consistently. Santro still underperformig IMO, although selling better than Eon. Verna back to 3K+ levels.

- Jeep - flat sales curve

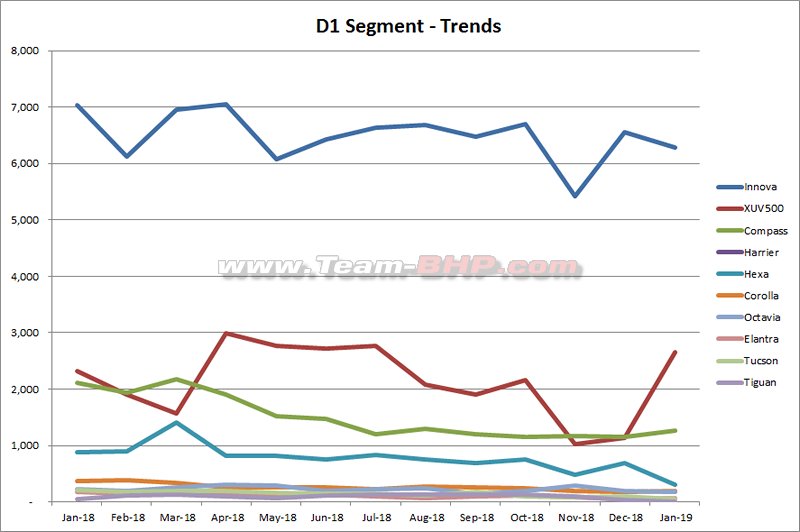

- Mahindra - Bolero, XUV500 & Scorpio sales see a 6 month high. Marazzo doing good too.

- Maruti - WagonR numbers shoot up. Swift, Baleno, and Dzire sees major sales uptick. Is the Ciaz sales being throttled for any reason?

- Nissan - Shall Kicks be the shot in the arm that Nissan needed?

- Renault - How far can a budget hatch pull a brand?

- Skoda - consistency in low numbers is thy name

- Tata - Nexon, Tiago and Tigor sales sees uptick, but still loses position to Honda

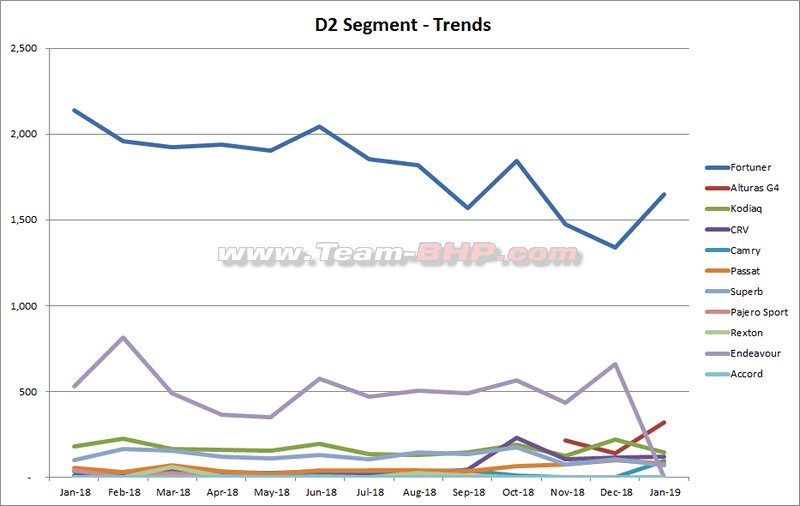

- Toyota - Yaris sees a new low each month, but who cares when you have the double engine of Innova and Fortuner pulling your buggy

- VW - Stablemates to Skoda, churning out low and flat sales

Wondering what made Nissan Sunny shifted from C1 sedan to C2 sedan.

Ford Endeavour with zero sales / delivery from plant?

I know its too early, but one thing sticks out - Creta buyers continued to buy Creta (w/ nice uptrend), Compass buyers continued to buy Compass (flat) and XUV 500 buyers doubled their purchase of XUV 500s between Dec 2018 and Jan 2019.

However, Tata Hexa buyers moved to the Harrier. Does not look like Harrier stole any business from its competitors. Again, I know its early days.

Tata Motors have lost market share, but looking at individual products, loss is mainly due their ageing products like Zest, Bolt etc. The likes of Tiago, Nexon, Tigor have maintained their average sales. Hexa is down though.

Surprising to see zero Endeavours shipped in Jan, on the other hand Alturas have managed a healthy 321 sales.

Why is Maruti categorized as Japanese? I know it's ambiguous, but it's a listed company on Indian bourses, so can be considered Indian too.

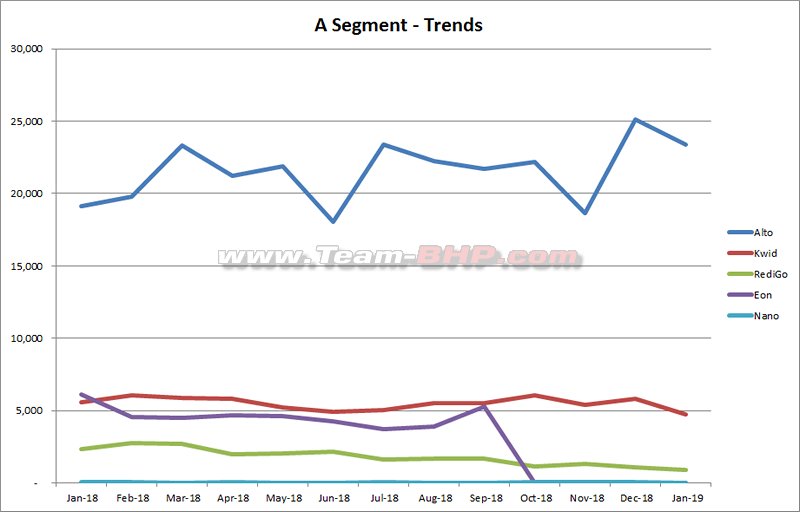

Also, no sales of Nano for this month!

For 2018 sales, best months for manufacturer:

Maruti: April

Hyundai: October

Mahindra: March

Honda: July

Tata: March

Toyota: August

What could be the reason for different months for different sellers ?!

January numbers are always interesting. All 2019 models getting shipped!

Hold on a second, Ford did not sell any Endeavours? At all?

No XUV300's shipped. I was hoping at least some would have gone to dealerships for display / test drives.

Ciaz records one of its lowest numbers. Did somebody mention of a new 1.5L diesel mill?

Kicks at 1370? Has it started kicking? Or will it ever!

422 Harriers. Lets hold the verdict for a couple more months. But look what Harrier did to Hexa. 309 units of Hexa, only!

Yaris from Toyota sells less than Vento from Volkswagen. That says a lot!

| All times are GMT +5.5. The time now is 21:22. | |