Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by AMG1

(Post 5332380)

I have gone through the same ordeal, but my organization was kind enough to provide the signed Form 60 in their own letterhead format along with the addresses of their offices in other states. You can ask the same from your employer and use it for BH registration. I have come to realize that organizations are not comfortable signing documents that require actual pen-based signatures/seals or documents that are from outside the establishment. Hope my input helps you.

|

Hi. Apart from addresses of offices. Good to get the individual GST numbers of these offices.

Quote:

Originally Posted by Mumbaiker

(Post 5332585)

The certificate only states that I am a permanent employee and the certificate is issued to enable for registering the car on his address and not on the company address.

|

Same happened with me earlier but I managed to get Form 60 after reaching out to the right departments. I concur from your explanations that you are facing exact same issues that I was while procuring Form 60. Due to possible sensitive work related details, lets connect over PM and Iíll guide you if I can.

Hi Everyone

Can somebody tell me the status for Tamilnadu. Also if they have started with Bharath registration series , is it applicable for the new motorcycles.

i will be taking delivery of 390 adventure within next two weeks.

cheers !

I too am planning to get the BH regn in Maharashtra. So far my HR seems amenable to the request, not sure if they will provide a signed hardcopy though. Also, the dealership is yet to provide the tax calculation - so keeping fingers crossed on whether it will be just the ex-showroom or incl gst as well.

Quote:

Originally Posted by ranjeetnair

(Post 5336864)

Hi Everyone

Can somebody tell me the status for Tamilnadu. Also if they have started with Bharath registration series , is it applicable for the new motorcycles.

i will be taking delivery of 390 adventure within next two weeks.

cheers !

|

As far as I am aware, as of last month, i.e., May 2022, TN still has not started BH registration in any of its RTO's. Officially it's not canned, but unofficially the word that has been let out to the RTO's, is to go as slow as possible on the BH front. The reason is potential revenue loss for state. Also as owners would be having vehicle taxation in their own hands, the income chances of RTO middlemen & touts making a living decreases.

Quote:

Originally Posted by Speedo

(Post 5339244)

I too am planning to get the BH regn in Maharashtra. So far my HR seems amenable to the request, not sure if they will provide a signed hardcopy though. Also, the dealership is yet to provide the tax calculation - so keeping fingers crossed on whether it will be just the ex-showroom or incl gst as well.

|

Did you get any quote from any dealer, I got quotes from volkswagen, skoda, and honda. All of them said that the MH RTOs are taking the ex showroom price into consideration and not the invoice price excluding gst.

Quote:

Originally Posted by robby0707

(Post 5339829)

Did you get any quote from any dealer, I got quotes from volkswagen, skoda, and honda. All of them said that the MH RTOs are taking the ex showroom price into consideration and not the invoice price excluding gst.

|

Not yet, monday morning is when the dealer's RTO guy shall send it across; apparently its taken from vahan website. I plan to give them a visit in the evening once they have sent it to discuss. Approx nos suggested by them is ~ 1/7th of the one time road tax - lets see what the final nos turn out to be.

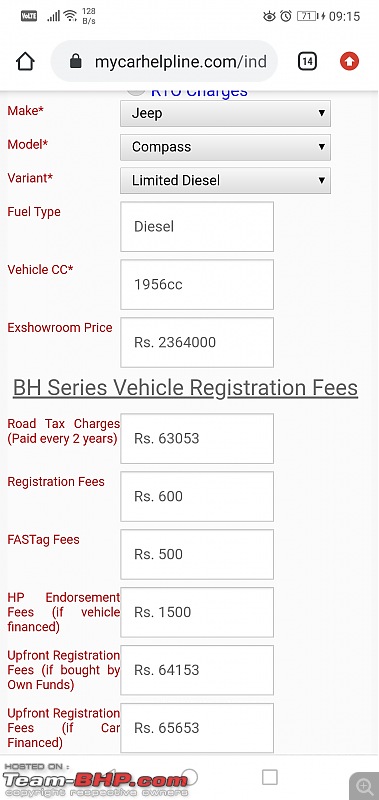

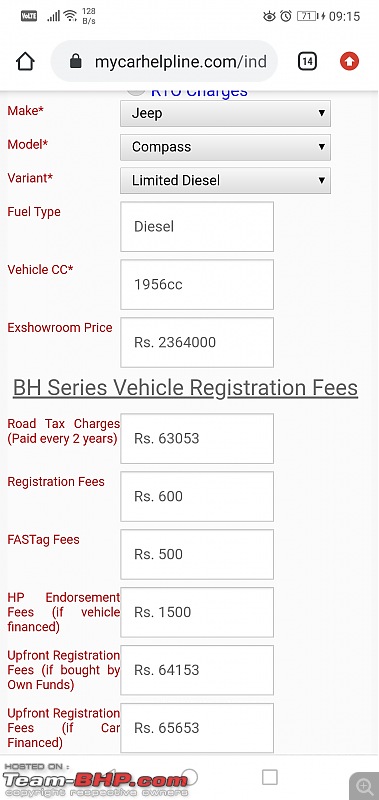

Hi fellow members,

Sorry if this has been answered before, Can anyone who has already got BH registration successfully done help me with this query.

So i got a BH cost of 64k for Jeep Compass Limited diesel with ex showroom 23.64L. Now will I be paying this 64k*7 till 14 years of the ownership or this is the first instalment and the subsequent ones every 2 years would be based on the depreciated cost of the vehicle?

Quote:

Originally Posted by tsi_niks1989

(Post 5340658)

Hi fellow members,

Sorry if this has been answered before, Can anyone who has already got BH registration successfully done help me with this query.

So i got a BH cost of 64k for Jeep Compass Limited diesel with ex showroom 23.64L. Now will I be paying this 64k*7 till 14 years of the ownership or this is the first instalment and the subsequent ones every 2 years would be based on the depreciated cost of the vehicle?

|

As per BH, road tax for a diesel vehicle above 20L, would be 14% (ie 12% + 2% cause its diesel).

23.64 * 14% * 1.25 * 2 / 15 = 55.16k

Not sure why the extra 9k or so, probably its the one time charges like registration fee, hypothecation fee, green tax etc. So your bi-annual outgo would be the above 55k from 3rd year onwards, and there would be no depreciation taken into consideration for your bi-annual payments. Ideally, the pre-GST price should be used for the calculation, but not all states are considering it at this point and that's a separate issue/battle.

Quote:

Originally Posted by robby0707

(Post 5339829)

Did you get any quote from any dealer, I got quotes from volkswagen, skoda, and honda. All of them said that the MH RTOs are taking the ex showroom price into consideration and not the invoice price excluding gst.

|

Dealer's RTO guy is yet to provide the calculations. However, he did confirm it is going to be on the ex-showroom price incl GST in Maha :unhappy he has no clue about other states.

Quote:

Originally Posted by Speedo

(Post 5341094)

Dealer's RTO guy is yet to provide the calculations. However, he did confirm it is going to be on the ex-showroom price incl GST in Maha :unhappy he has no clue about other states.

|

I got a quote from Karnataka too. Its the same case there. No one is taking the invoice price excluding gst!

Quote:

Originally Posted by tsi_niks1989

(Post 5340658)

So i got a BH cost of 64k for Jeep Compass Limited diesel with ex showroom 23.64L. Now will I be paying this 64k*7 till 14 years of the ownership or this is the first instalment and the subsequent ones every 2 years would be based on the depreciated cost of the vehicle?

|

Looks like the calculations are based on ex-showroom price for now. The quote provided to you also seems to be correct based on online calculators.

Yes you will be paying 64k every 2 years for 7 years and then 32k per year going forward. Depreciation is not taken into account.

Source:

https://www.mycarhelpline.com/index....bhn&Itemid=488

1. Regarding the BH Registration tax amount, we have recently purchased a Honda City ZX CVT 5th Gen last week in Noida RTO. The tax charged is as follows :

Invoice price : 10.49L

Discounts (w/o tax) : (-) 0.13L

Discounted Invoice : 10.37L

Add on tax : 4.67L (14% CGST+14%SGST+17%Cess applied on 10.37L)

Net Ex-showrooom price : 15.04L

BH Registration for first 2 years charged : 18087 (As per message from UP RTO)

If we go by the formula of (1.25*10% of Invoice price*2)/15 it comes to ~17500 considering invoice price of 10.37L. This comes close to the 18087 charged

If this was applied on ex-showroom price, it comes to 25305. Unsure why other state RTOs are calculating tax on ex-showroom price when the gazette notification clearly says invoice price

2. My SA and other OEM sales advisor's have mentioned that we need to go to the RTO physically to pay the tax at the end of 2 years and it is a cumbersome process. I am not sure if this is true or it was suggested to me to dissuade me from BH registration. As it has not been 2 years since BH has been introduced, only time will tell. Anyone has heard an alternate version ?

The notification says tax can be paid online every 2 years.

Quote:

Originally Posted by revverend

(Post 5341394)

2. My SA and other OEM sales advisor's have mentioned that we need to go to the RTO physically to pay the tax at the end of 2 years and it is a cumbersome process. I am not sure if this is true or it was suggested to me to dissuade me from BH registration.

|

When owners of All India Permit buses and trucks can pay other state tax for most states online, why should BH cars have a different method.

Rahul

| All times are GMT +5.5. The time now is 13:53. | |