Those who are familiar with my posts in this thread, might know that I don't like the stock market. That is mainly because I believe stock market is a casino, and the stock prices simply have no connection to the true value of the company.

The concept of quantitative finance, which is the very foundation of algorithm based trading and high frequency trading, was

originally invented for gambling in Casinos. When Ed Thorp started winning consistently at the Casinos, he had a close call with the Casino mob. So he looked around realised that the same techniques can be used in stock market, which is even bigger than Casinos when it came to gambling.

In fact, Casinos will

throw you out if they suspect you of using the card counting techniques invented by Ed Thorp. They don't want you to have undue advantage at the casinos. But they will welcome you at the stock market.

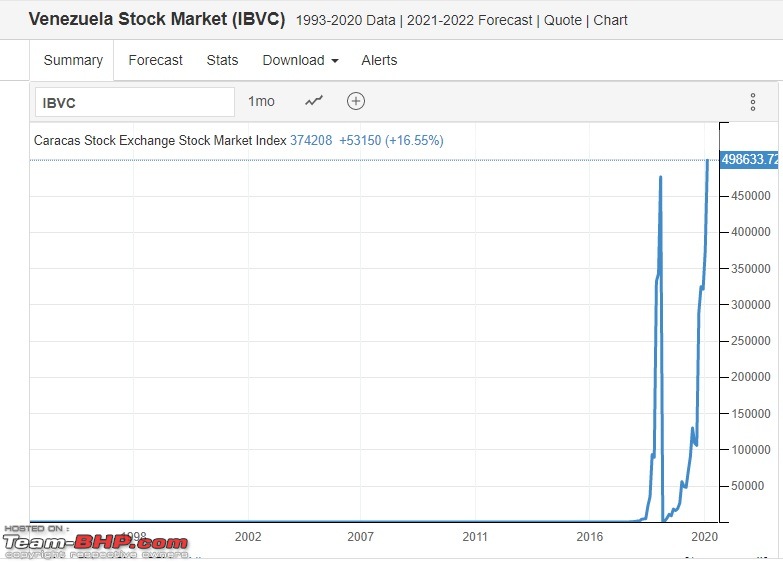

According me, stock market is a giant vacuum cleaner, which sucks wealth from most and delivers it to the few. You don't have to invest directly to have your wealth sucked by the stock market. The 2008 financial crash proved that.

And yes, I have heard every counter argument, mostly by folks who are invested in the stock market and reaping the rewards. They keep telling that the stock market index is the real indication of the health of the economy. There is huge income inequality, so what, look at the stock market soaring, the economy must be in great shape. There is a famous quote by Upton Sinclair, who said

It is difficult to get a man to understand something, when his income depends on his not understanding it.

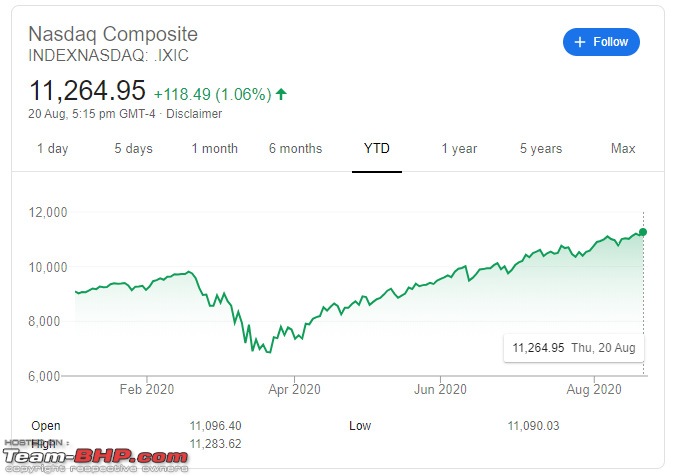

Consider the present times. When most of the world went into lockdown in March, for once stock market behaved correctly and took a dive. And then old habit came back.

The indices around the world has come back closer to pre-covid19 times. In fact, NASDAQ has exceeded the pre-covid19 figures.

Does this mean economy is back to normal and better than pre-covid19 times?

And for people mistaking me to be a socialist, I started another company in Feb 2020, just when Covid started spreading around the world. Luckily for me, Covid19 didn't affect my line of work too much. So I created a few jobs out of business need, and the company is able to pay salaries on time too. But I am entirely aware of how many businesses and employment covid-19 has killed. Just 5% doing well is no indication of the great economy, as stock market generally tends to indicate.

True indication of good economy is how well the small businesses are doing, those who are not financed by overvalued share prices. Small businesses run on positive cashflow or they die.

Yesterday, Mohamed El-Erian made an important statement on CNBC. He is the former CEO of investment powerhouse Pimco.

- If you want capitalism to be sustained, you need buy-in from a lot of people. You cannot get buy-in if it’s all about large corporations.

- Remember what small businesses do. They’re not just large employers, they also are the main way to have inclusive capitalism, an inclusive market-based system.

- As of Aug. 11, there are about 155,000 total business closures reported on Yelp since March 1, according to data from the reviews company. About 91,000 of the closures, or 59%, are permanent.

How is this a good economy?

Source

(17)

Thanks

(17)

Thanks

(1)

Thanks

(1)

Thanks

(5)

Thanks

(5)

Thanks

(5)

Thanks

(5)

Thanks

(3)

Thanks

(3)

Thanks

(1)

Thanks

(1)

Thanks

(7)

Thanks

(7)

Thanks

(9)

Thanks

(9)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(13)

Thanks

(13)

Thanks

(17)

Thanks

(17)

Thanks

(1)

Thanks

(1)

Thanks

The accuracy of "current prices reflecting future economy" is about the same as astrology. Some hits and some misses. That's why I mentioned that if the economy does not recover soon enough, stocks and indices will fall.

The accuracy of "current prices reflecting future economy" is about the same as astrology. Some hits and some misses. That's why I mentioned that if the economy does not recover soon enough, stocks and indices will fall.

That is why stock market index doesn't even indicate the future of the economy, it merely indicates the future of the companies in the list.

That is why stock market index doesn't even indicate the future of the economy, it merely indicates the future of the companies in the list.