| | #46 |

| Senior - BHPian Join Date: May 2013 Location: Mumbai

Posts: 1,518

Thanked: 6,050 Times

| |

| |

| |

| | #47 |

| BHPian Join Date: Jun 2021 Location: Noida

Posts: 255

Thanked: 513 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #48 |

| Newbie Join Date: Feb 2008 Location: Bangalore

Posts: 13

Thanked: 7 Times

| |

| |

| | #49 |

| Newbie Join Date: Jul 2021 Location: Kollam

Posts: 0

Thanked: 28 Times

| |

| |  (2)

Thanks (2)

Thanks

|

| | #50 |

| BHPian Join Date: Oct 2007 Location: Bangalore

Posts: 238

Thanked: 347 Times

| |

| |  (6)

Thanks (6)

Thanks

|

| | #51 |

| Senior - BHPian Join Date: Sep 2009 Location: Pune

Posts: 2,002

Thanked: 2,785 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #52 |

| BHPian Join Date: Nov 2021 Location: Hyderabad

Posts: 69

Thanked: 363 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #53 |

| BHPian Join Date: Jul 2021 Location: Bangalore

Posts: 62

Thanked: 163 Times

| |

| |  (2)

Thanks (2)

Thanks

|

| | #54 |

| BHPian Join Date: Aug 2021 Location: Pune

Posts: 73

Thanked: 249 Times

| |

| |

| | #55 |

| BHPian Join Date: Mar 2018 Location: Thane - MH04

Posts: 594

Thanked: 2,284 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #56 |

| Senior - BHPian Join Date: Sep 2009 Location: Pune

Posts: 2,002

Thanked: 2,785 Times

| |

| |

| |

| | #57 |

| BHPian Join Date: Jul 2021 Location: Bangalore

Posts: 62

Thanked: 163 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #58 |

| BHPian Join Date: Oct 2021 Location: GA/MH/KA

Posts: 55

Thanked: 135 Times

| |

| |

| | #59 |

| Newbie Join Date: Feb 2021 Location: New Delhi

Posts: 0

Thanked: Once

| |

| |  (1)

Thanks (1)

Thanks

|

| | #60 |

| BHPian Join Date: Nov 2013 Location: Bangalore

Posts: 730

Thanked: 2,199 Times

| |

| |

|

Most Viewed

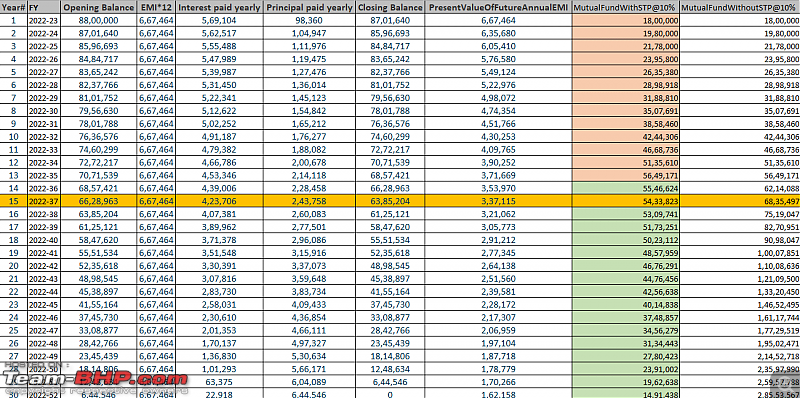

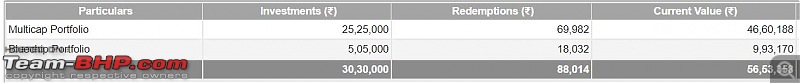

with a CAGR of 22% on multi chip and 30% on blue chip portfolios. Redemptions are the dividends received so far in the bank account.

with a CAGR of 22% on multi chip and 30% on blue chip portfolios. Redemptions are the dividends received so far in the bank account.