| | #436 |

| BHPian | |

| |

| |

| | #437 |

| BHPian Join Date: Oct 2019 Location: Bangalore

Posts: 536

Thanked: 1,413 Times

| |

| |

| | #438 |

| BHPian | |

| |

| | #439 |

| BHPian Join Date: Sep 2010 Location: Bengaluru

Posts: 209

Thanked: 3,303 Times

| |

| |

| | #440 |

| Distinguished - BHPian  Join Date: May 2010 Location: Bengaluru

Posts: 4,328

Thanked: 6,318 Times

| |

| |  (2)

Thanks (2)

Thanks

|

| | #441 |

| BHPian Join Date: Sep 2010 Location: Bengaluru

Posts: 209

Thanked: 3,303 Times

| |

| |  (3)

Thanks (3)

Thanks

|

| | #442 |

| BHPian Join Date: Jun 2014 Location: Mumbai

Posts: 456

Thanked: 962 Times

| |

| |

| | #443 |

| BHPian Join Date: Mar 2013 Location: HR10

Posts: 150

Thanked: 207 Times

| |

| |

| | #444 |

| BHPian Join Date: Jan 2023 Location: KL

Posts: 75

Thanked: 803 Times

| |

| |

| | #445 |

| BHPian Join Date: Mar 2014 Location: Mumbai

Posts: 194

Thanked: 556 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #446 |

| BHPian Join Date: Jan 2023 Location: KL

Posts: 75

Thanked: 803 Times

| |

| |

| |

| | #447 |

| BHPian Join Date: Oct 2012 Location: Bangalore

Posts: 577

Thanked: 1,732 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #448 |

| Senior - BHPian Join Date: Nov 2007 Location: Bangalore

Posts: 4,086

Thanked: 4,434 Times

| |

| |

| | #449 |

| BHPian Join Date: Jan 2020 Location: GAU/PNQ

Posts: 118

Thanked: 745 Times

| |

| |

| | #450 |

| Senior - BHPian Join Date: Jul 2007 Location: Pune

Posts: 2,050

Thanked: 3,515 Times

| |

| |  (1)

Thanks (1)

Thanks

|

|

Most Viewed

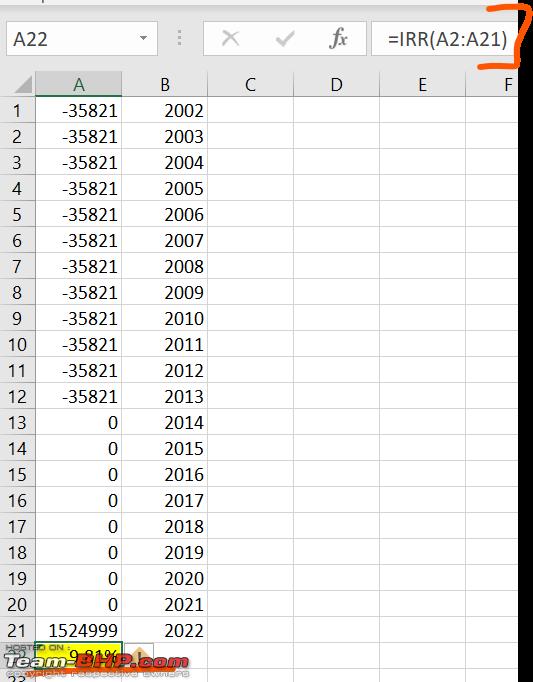

) during 2002. Premiums were to be paid for 12 years with maturity after 20 years.

) during 2002. Premiums were to be paid for 12 years with maturity after 20 years.