Team-BHP

(

https://www.team-bhp.com/forum/)

As the GST exercise is more to 'fit' the rates matching with the existing rates, and cars may not have much cascading taxation, the impact may be minimal, in many states. Of course in high tax states we may see drops in prices, due to a uniform rate.

Here is a speculated list on GST effect!

Quote:

Essential goods, certain vehicle categories likely to be cheaper:

In terms of goods, where an exemption/ lower rate is prescribed for essential goods, GST is expected to marginally better the house economics as a whole. Further, under the GST regime, depending on the current supply chain arrangement and state of operation following may become cheaper:

• Two-wheelers

• Entry-level sedan (except small cars)

• SUVs and luxury or premium cars

|

Link

Any clarity on how GST will impact ex showroom prices in Karnataka? I am planning to buy ecosport ecoboost titanium+ which sells at 10.15 L ex-showroom in Bangalore currently. If there is a 2% reduction in ex-showroom because of GST, then my ex-showroom will come to <10L and thereby I will save heavily on Lifetime Road tax as well as avoid TCS too. This is because road tax % is more in Karnataka for cars > 10L ex showroom. This will mean a significant reduction in on road price. Please advise me if I should wait till July to make my purchase.

Current tax structure for vehicles in India

http://www.mycarhelpline.com/index.p...=572&Itemid=10 http://www.siamindia.com/economic-af...8&pgidtrail=19

Total tax need to be paid for an SUV/Luxury class vehicle is 30% (Exicse Duty) + 4% (Infrastructure Cess ) + 14.5% (VAT) = 48.5 %

Once GST is in place, ( Assuming SUV in Luxury Category) this will be

28% (Highest GST rate ) + 15 % (Highest Cess rate) = 43 %

Effective difference once GST is in place is 5.5%

Even If considering the lowest VAT rate - 12.5%, the current taxation is at 46.5% and the difference is 3.5% after GST is in place.

A fellow member's view on GST from other thread.

Quote:

Originally Posted by lollapalooza

(Post 4184161)

The excise duty is levied on ex factory price (excluding dealer margin) whereas the GST will be levied on total price. But given that dealer margins tend to be really low ( <5% I think) this will not make much of the difference.

Second, currently the VAT is paid on price including excise duty. Whereas in GST the cess will be paid on price excluding GST. Effectively the current duty structure is 34% (excise plus the cess) and the VAT is levied on this 34% also. So effective tax burden comes to around 50% in Maharashtra where the VAT is 13.5%. Under GST the tax burden will simply be 28% + 15% = 43%. So effectively a saving of 7% which is huge. More than 2 lakh rupees!

Now to me this seems to be too good to be true. I don't think the government will want to leave such a big amount on the table for such a low volume category. Plus I don't think the government will like the headline that Luxury SUVs become cheaper by 2 lakhs whereas some small but widely used category becomes even slightly expensive. So my guess is that the actual benefit will be much lower. But we will have to wait and see.

I also think some of the recent price increase is because if companies do get benefit under GST they will be required to pass it on under the 'no-profiteering' clause in the GST. So the companies are simply preparing the ground for retaining some of the tax benefit, if there is some benefit in terms of lower tax rate. So if you do get a 5-6% lower tax rate the companies will have to pass it on but because they have taken a 2-3% price hike effectively they have not passed on the entire benefit but at the same time are not breaking the law. If you look objectively, the rupee has appreciated sharply and commodity prices have generally remained stable or declined in last couple of months. So there is no logical case for a price hike otherwise.

So what I have done is cancelled my booking since I am in no great hurry for the car. The best case is that I save some money. The worst case is that there will be no saving but no additional cost either and the enjoyment of the vehicle gets delayed by 3-4 months - which honestly is no big deal for me. But that is a personal factor.

|

Going by the above logic, taxation for an SUV priced at 19 L ex-factory

Current Taxation :

Ex factory price : 19,00,000 INR

34 % Excise duty + Infra Cess = 6,46,000

----------------------------------------------------------

Price ( before VAT ) = 25,46,000 ( Ex factory + Excise duty & infra Cess)

Dealer's Margin = 1,25,000

14.5 % VAT in Karnataka = 3,69,170 INR

Ex showroom Price = 30,40,170 INR

-----------------------------------------------------------

Road Tax = 6,08,034 INR ( 20 % of ex showroom )

Insurance = 1,15,000

TCS = 30,401

On Road price ( BLR ) = 37,93,605 INR GST :

Ex factory price : 19,00,000 INR

---------------------------------------------------------

Dealer's Margin = 1,25,000

28 % GST = 5,67,000 ( 28 % of 20,25,000 )

15 % Cess = 3,03,750 ( 15% of 20,25,000 )

---------------------------------------------------------

Ex showroom Price : 28,95,750 INR

Road Tax = 5,79,150 INR ( 20 % of ex showroom )

Insurance = 1,15,000

TCS = 28,957

On Road price ( BLR ) = 36,18,857 INR

Difference in

ex showroom price is

1,44,420 INR

Difference in

On Road price is

1,74,748 INR

Quote:

Originally Posted by LionX

(Post 4184984)

Current tax structure for vehicles in India

Total tax need to be paid for an SUV/Luxury class vehicle is 30% (Exicse Duty) + 4% (Infrastructure Cess ) + 14.5% (VAT) = 48.5 %

Once GST is in place, ( Assuming SUV in Luxury Category) this will be

28% (Highest GST rate ) + 15 % (Highest Cess rate) = 43 %

Effective difference once GST is in place is 5.5%

Difference in On Road price is 1,74,748 INR

|

I have a slightly different calculation.

Current effective rate on road is (1+ (Excise Duty+Infra Cess)) X (1+VAT). There is a cascading effect in most (if not all) states. So, with your numbers,

(1+(30%+4%)) X(1+14.5%) = 1.5343 or 53.43% effective tax, not 48.5%

After GST kicks in, max tax rate would be 43% ( 28% + 15% cess)

So, the reduction in prices (if all benefit is passed on to consumers) would be around (1.5343 - 1.43)/1.5343 = 6.80%

However, I am hopeful based on some statements, that actually cess on cars could be 12% leading to overall GST rate of 40%, in which case the overall price reduction would be (1.5343 - 1.40)/1.5343 = 8.75%

Seems like no GST relief for prospective buyers of small and mid-sized cars

According to an article in today's 'The Hindu'

Small and mid-sized cars may see a small increase in prices after the Goods and Services Tax (GST) is rolled out from July 1 as different goods are fitted into the four-slab rate structure.

...

Small cars currently attract a 12.5% central excise duty. States levy 14.5-15% VAT, with total tax incidence at 27-27.5%. A senior finance ministry official said the closest slab for this category of cars would be 28%, resulting in a small increase in price.

....

Mid-sized cars of up to 1500 cc are levied 24% excise and 14.5% VAT taking the tax incidence to 38.5%. This category will attract the highest tax rate of 28% and a state compensation cess to take the total incidence closer to current levels, the official said.

Full article here

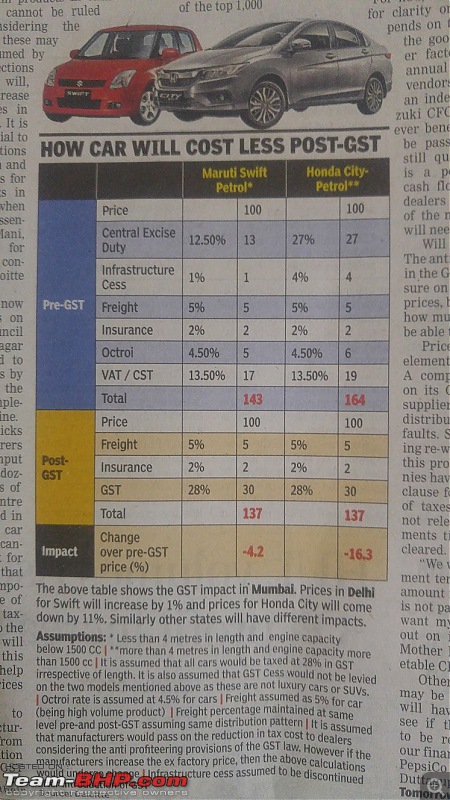

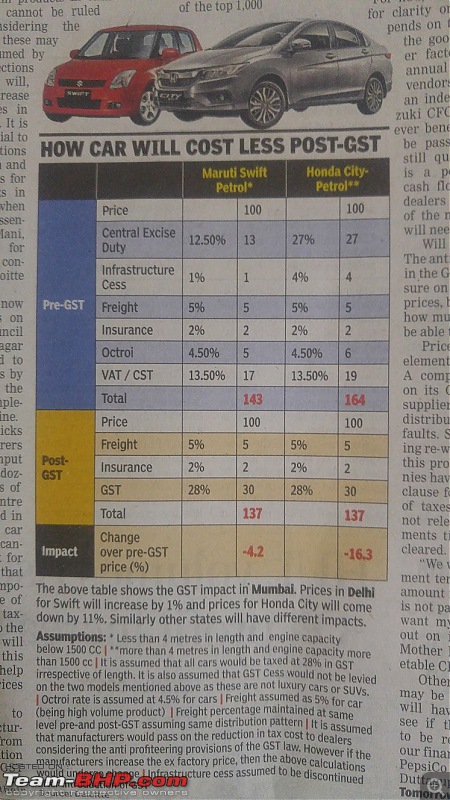

In today's Times of India they are speculating that Car Prices would come down. Attached is a snip from today's paper showing examples for Swift Petrol and Honda City:

Based on some of the recent reports, they were predicting a minimal increase in prices for small cars but it looks like there would be some price reductions here as well...

My understanding of GST is that it's revenue neutral. Not sure the govt will take a 16% impact on every Honda city or equivalent. Alternatively if it does bring down the prices I expect car companies to increase the prices of hot selling models and improve their profits. Though there is some clause against profiteering not sure how that works.

http://timesofindia.indiatimes.com/b...w/58736375.cms

So best bet would be for cars like Etios Petrol and early trims for Ciaz. which are longer than 4m but under 10 Lakh (considering definition of luxury car is still the same ie above 10 Lakh)

Currently from 24% (excise) + 15% (VAT) + 2% CST = 41% net to 28% +3% cess ~ 31% which shows the difference of 10%

(assumption that max cess on non luxury car will be 2~3%. This is because current tax on small cars is about ~30% and just 2% cess over and above 28% will accomplish that)=

There are only 2 possibilities

A) Govt will have higher cess for longer cars to make GST revenue neutral (most probable)

B) If govt reduces price, automobile companies will cite higher costs and gobble up the benefits.

I dont think any change is coming anymore, primarily because of the Cess which I didnt really expect in GST regime.

Anyways.

Luxury cars will attract 28 per cent levy plus a cess of 15 per cent, while small petrol cars will face 28 per cent tax plus 1 per cent cess. Diesel small cars will be taxed at 28 per cent with 3 per cent cess.

Now let us wait for the definition of Luxury.

Read more at:

http://economictimes.indiatimes.com/...campaign=cppst

Small / petrol cars look to gain most, though not a major difference IMO.

Wonder how will they classify the cars. What does mid-range mean - capacity or cost ? The clarity is mostly required for the cars in the 10-20 L bracket, or there-abouts.

Quote:

Originally Posted by condor

(Post 4201002)

So looks like small / petrol cars will have max benefit, though not a big difference.

|

It looks like approximately same price price for small cars right?

As per the earlier post, the tax on small cars currently is approx.30%, If that is correct, then petrol small car prices would decrease by approx. 1% and diesel small car prices would increase by approx. 1%. Did I get it correct?

Quote:

Originally Posted by vsrivatsa

(Post 4201010)

It looks like approximately same price price for small cars right?

As per the earlier post, the tax on small cars currently is approx.30%, If that is correct, then petrol small car prices would decrease by approx. 1% and diesel small car prices would increase by approx. 1%. Did I get it correct?

|

1% of tax reduced .. not 1% of OTR.

Guess We need to wait for the actual classifications, before we get the prices

Quote:

Originally Posted by ashishs

(Post 4201000)

Luxury cars will attract 28 per cent levy plus a cess of 15 per cent,

|

Current taxation for luxury cars & SUV's are beyond 50% so GST will bring down the price even at the highest slab. 28+15 = 43 %

All cars except small cars attract a levy of 28% + cess of 15%.Small cars (length less than 4m and petrol less than 1200cc). attract a levy of 28% + cess 1%

Small cars (length less than 4m and diesel less than 1500cc) attract a levy of 28% + cess 3%. All Electrically operated vehicles attract a levy of 12%.

| All times are GMT +5.5. The time now is 02:45. | |