|

| Leading automobile companies including Maruti Suzuki, Bajaj Auto and Hyundai Motor India have agreed to absorb losses to dealers on inventories at their stockyards as the country transitions to goods and services tax. |

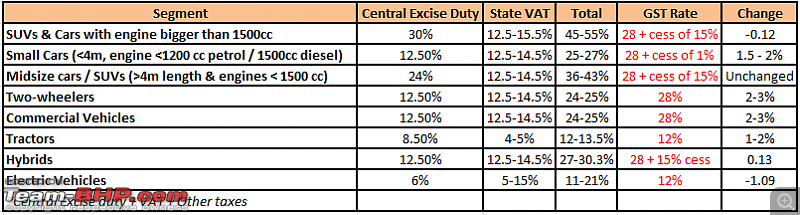

| No more cess on 28% GST for automobiles |

|

Originally Posted by Turbanator

(Post 4212936)

Cannot be correct, it is simply not going to happen. |

|

Originally Posted by Herbie98

(Post 4212491)

Experts, Need your opinion on cars that were classified as mild-hybrids. What would be the GST impact on cars like Ertiga (SHVS) diesel and Scorpio IntelliHybrid. Were these cars on the 30% Excise or on the 12.5% Excise meant for hybrids? If these were in the 12.5% Excise as of now, then post GST these cars would become expensive I guess. |

|

Originally Posted by M00M

(Post 4213114)

what happened to the GST revision for hybrid cars ? have they cancelled it and finalised 28% +15 % on hybrid as final ? |

|

Originally Posted by volkman10

(Post 4213006)

Through the Taxation Law Amendment Act 2017, The Industries (Development and Regulation) Act 151 – cess on automobiles (cars and motorcycles) will no longer be applicable. Attachment 1646609 link |

|

Originally Posted by blackwasp

(Post 4213081)

Ciaz SHVS and Ertiga SHVS prices will definitely increase to the tune of 10% on ex-showroom. We've been told to liquidate all stocks by month end else the buyers will have to bear the additional cost. |

|

Originally Posted by Arjun Reddy

(Post 4213182)

So what happens to luxury cars with a similar function for example the Mercedes C Class. Will it be 28+ 15% cess instead of 28+13%. So a Mercedes with this auto stop function will be 2% costlier than one without that function. |

|

Originally Posted by Arjun Reddy

(Post 4213182)

So what happens to luxury cars with a similar function for example the Mercedes C Class. Will it be 28+ 15% cess instead of 28+13%. So a Mercedes with this auto stop function will be 2% costlier than one without that function. |

|

Originally Posted by BeamerBoy

(Post 4213191)

No, the luxury car companies were not as creative with the Start Stop function to call them mild hybrid and lower the tax liability. Read: no affect on luxury cars. |

| doesn't have any of the other systems that the mild-hybrids have such as the brake energy regeneration. |

| All times are GMT +5.5. The time now is 17:00. |