Team-BHP

(

https://www.team-bhp.com/forum/)

The discussion on the thread has so far focussed on the actual price of the car, i.e the ex-showroom price. Is there any chance of GSTification of Road Tax? Going by the minimum rate of taxation fixed, it is better that the road taxes are left alone. However, isn't it time even they are brought under the One nation one tax bracket?

And, will our insurance premiums go up a notch with the implementation of GST? We are currently paying around 15% tax here. Will it go up to 18%, thereby increasing the premiums?

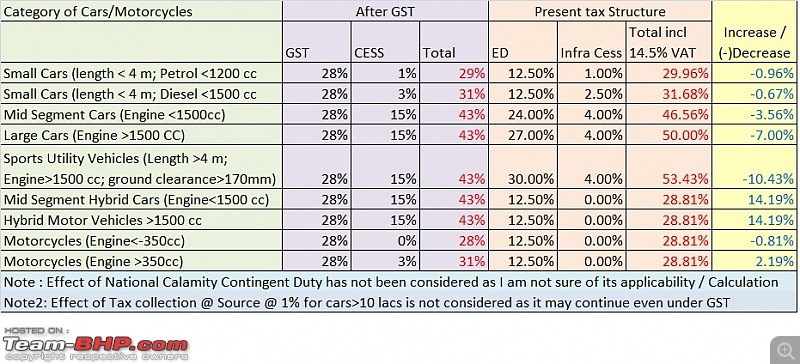

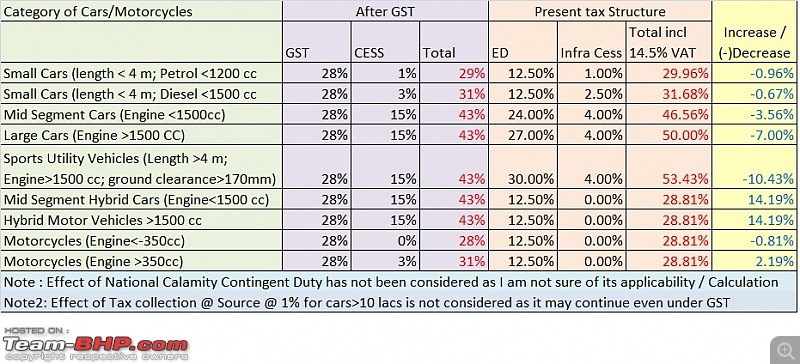

I have revised the Comparison of taxes under GST with present taxes already posted earlier in post#178 by including the effect of infrastructure cess.

It is clear that all non-hybrid cars will be cheaper post-GST with SUVs benefitting the most.

Government must remove the cess applicable on Hybrid cars and also take Hybrid cars to lower GST slab if it is serious about pollution and environment.

Quote:

Originally Posted by DImPo

(Post 4202378)

I have revised the Comparison of taxes under GST with present taxes already posted earlier in post#178 by including the effect of infrastructure cess.

|

Hi, thanks for the chart. You need to include the Central Sales Tax of 2% into your calculation for the present tax structure. Also, since you are from Chennai, you should also consider the fact that our state is one of those states which charges VAT as a cumulative tax :Frustrati. Taking those into account, the difference between current rates and GST rates will be a little more. Don't know about other states, but atleast in TN, I expect prices of all non hybrid cars to come down ranging from 2% to 13%.

Can somebody also put light on GST on Auto ancillaries like Tyres, What is the current tax structure & what will be the effect after GST implementation....

I read on the internet currently total taxes on them come out to be ~34% but not sure...

Quote:

Presently, there is Excise tax, added to the manufacturing goods , or produced goods or services., on this total is charged CST ( central sales tax ), again added and charged VAT, again added and on that total amounts is charged Octroi or Entry tax.

|

GST Council may reconsider the steep levy on hybrid cars next week.

Link

Quote:

I have revised the Comparison of taxes under GST with present taxes already posted earlier in post#178

|

Infra Cess is levied on Excise Duty and not on Basic rates as far as I know. So for any SUV with Rs 100 Basic price - present cost to customer or MRP will be 100 + 30 % ED + 4 % Cess on ED + 2% CST + Dealer Margin say 5 % + VAT 12.5-15 % = Rs 158 to Rs 161 depending on VAT.

In case of GST Scenario - new costs/MRP considering same Basic rate Rs 100 + 5 % Dealer Margin + 43 % = Rs 150 so net reduction can vary from 5 % - 7 % based on present VAT. Reduction on Sedans (luxury incuded) will be even less.

Also in few states like here in Chandigarh & Punjab, presently Road Tax is calculated on Basic rates minus VAT which in all probability will change as states will like to charge Road Tax on final billing price including GST unless Government comes out with specific notification otherwise. So in places like Chandigarh, there will be limited benefits.

Best will be to negotiate & buy before implementation, although Government has not yet notified % of Excise they will allow to non-registered dealers as a set-off against GST on unsold inventories ( almost all Auto Dealers are not registered with excise & fall in this category). Some are expecting 40 % or so but we will have the clear picture on 3rd June.

Time to pick up slow mover models probably as dealers sitting with high inventories will be worst sufferers in my opinion.

Quote:

Originally Posted by volkman10

(Post 4204188)

GST Council may reconsider the steep levy on hybrid cars next week. Link

|

Hybrids have to be catagorised as Series Hybrid, Parallel Hybrid, Plug in type series Hybrid. The things like brake energy regeneration, automated start stop, traction crawl without engine etc should not be considered as Hybrid at all.

Once these catagories are formed. Plug in type series Hybrids which can be driven a particular distance on battery only should be taxed at a fraction above electric cars. Parallel Hybrid cars a bit more.

For the other catagories a small discount (say 1% less cess) on prevaling tax structure for combustible fuel powered vehicles in same catagory is acceptable.

Rahul

Mercedes has taken the lead on this.

"German luxury car maker Mercedes Benz is slashing prices of its vehicles produced in India by up to Rs. 7 lakh to pass on benefits of new tax rate under GST due in July. The new prices will be effective tomorrow through the whole of June, but in case GST is deferred, the company said it would revert to the old prices till its rollout. Mercedes Benz India locally produces nine models — CLA sedan, SUVs GLA, GLC, GLE and GLS, luxury sedans C-Class, E- Class, S-Class and Maybach S 500 — which are priced between Rs. 32 lakh and Rs. 1.87 crore (ex-showroom Delhi).

The price reduction will range from Rs. 1.4 lakh on the CLA sedan to Rs. 7 lakh on Maybach S 500."

http://www.thehindubusinessline.com/...cle9712492.ece

Quote:

Originally Posted by Vitalstatistiks

(Post 4205113)

Mercedes has taken the lead on this.

"German luxury car maker Mercedes Benz is slashing prices of its vehicles produced in India by up to Rs. 7 lakh to pass on benefits of new tax rate under GST due in July. The new prices will be effective tomorrow through the whole of June, but in case GST is deferred, the company said it would revert to the old prices till its rollout. Mercedes Benz India locally produces nine models — CLA sedan, SUVs GLA, GLC, GLE and GLS, luxury sedans C-Class, E- Class, S-Class and Maybach S 500 — which are priced between Rs. 32 lakh and Rs. 1.87 crore (ex-showroom Delhi). The price reduction will range from Rs. 1.4 lakh on the CLA sedan to Rs. 7 lakh on Maybach S 500." http://www.thehindubusinessline.com/...cle9712492.ece

|

I think the % of reduction should be same across all Mercedes models as all of them belongs to either luxury/ SUV category. Not sure about the average 4 % calculation. Looks like they are trying to clear the inventory.

"On an average, there will be a reduction of 4 per cent in the transaction prices for customers of all models produced in India, Folger added.

Price reduction varies by state between 2 per cent to 9 per cent and is dependent on current tax structure and local body taxes of states, the company said"

Quote:

Originally Posted by rameshwiz07

(Post 4202013)

I would suggest you to take the delivery in July , as per my understanding there would be minimum 7% reduction in prices for Hexa

Current tax structure

Excise Duty 30

Infra cess 4

VAT 14.5

NCCD 1

Total 49.5

Post GST: 28+15 = 43%

|

Thats quite informative of you to post the breakup of the implementation of tax on vehicles. I have requested the dealer to postpone the delivery to july but he insists that post GST implementation prices may further increase which is absolutely ridiculous I think.

Quote:

Originally Posted by quickdraw

(Post 4205797)

|

I believe this was in response to Mr. Musk saying in response to another tweet, that the FDI policies weren't favourable yet (sourcing parts locally) for Tesla to launch. I don't think it had much to do with GST.

Quote:

Originally Posted by dailydriver

(Post 4202228)

And, will our insurance premiums go up a notch with the implementation of GST?

|

I also remember reading somewhere that cost of servicing will go up. So effectively, the total cost of ownership will be higher.

Not sure if I missed any post here but I would like to know how will GST change price of electric cars, heck we hardly have choice now

Will E20plus be cheaper ?How much ?

Quote:

Originally Posted by wolf_lone

(Post 4203650)

Can somebody also put light on GST on Auto ancillaries like Tyres, What is the current tax structure & what will be the effect after GST implementation....

I read on the internet currently total taxes on them come out to be ~34% but not sure...

|

http://www.cbec.gov.in/resources//ht...18.05.2017.pdf

On the website of CBEC you can get the new rates of goods and services. The link above gets you the rates for goods.

Batteries and Tyres will come at 28%. Most of the auto ancillaries come at a similar level. Current taxation for Batteries work out to around 29-31% (12.5% Excise, 12.5-14.5% VAT, 2% CST , 1-1.5% Octroi/Entry Tax)

| All times are GMT +5.5. The time now is 00:04. | |