Team-BHP

(

https://www.team-bhp.com/forum/)

I have been looking forward to the GST tax rates forever, and I am happy to an extent that majority of cars will see some reduction in taxes - either directly or through input credits, so it is better for car industry and consumers in general.

But while everybody is busy calculating tax differences on this forum, something that is making me really angry is the 1% cess on small cars. Everyone has let it slip by, but this 1% needs a discussion, it needs a consensus opinion and it needs nothing short of a protest.

Cess is only for Sin goods (demerit goods). Without having any proper public transport in place, with week long waiting lists on trains, with so much unplanned urban growth, with majority of Indians still aspiring to buy their 1st ever car - may be an Alto or a Kwid price range, is it fair to categorise it in the list of Sin goods? Are you calling all cars demerit goods? Is your transport infrastructure world class like Singapore that you start discouraging people form buying cars by calling them SIN goods?

I understand that 1% doesn't make much difference to the price, but whats stopping them from making it 5% or 10% later? They are setting such a bad example. The whole concept of cess if flawed. We could have accepted it as a temporary measure on luxury cars, but this cess on small cars is completely unacceptable. :Frustrati

Can some shed some light on price of Crete, Hexa. Contradicting reports are confusing me. Planning to buy a SUV/Sedan at around 12-15 lac Range.

As per some post here it is going to reduce by 6-8% & as per Financial Express the change would be nil?

What should the change be finally for SUV?

Quote:

Originally Posted by DImPo

(Post 4202378)

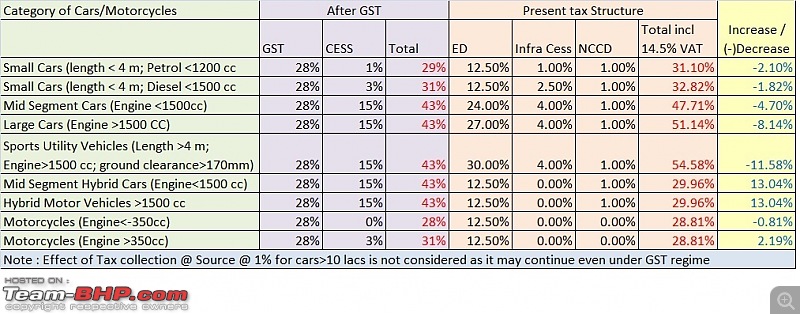

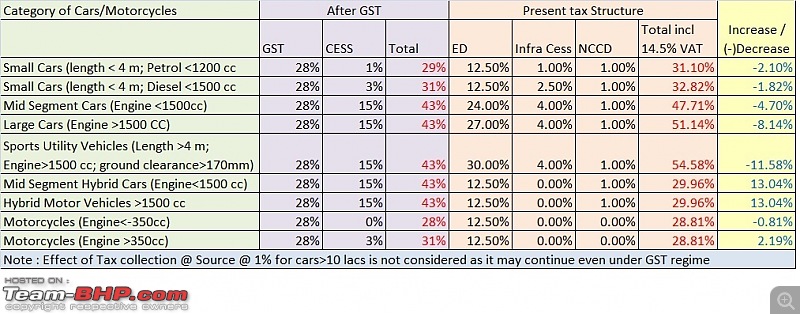

I have revised the Comparison of taxes under GST with present taxes already posted earlier in post#178 by including the effect of infrastructure cess. Attachment 1640982

|

Just wondering if this requires an update for:

- NCCD(National Calamity Contingent duty)

- Calculation to illustrate the cascading effect of current taxation regime.

Both these would effectively increase the present values.

The way it looks it, the reduction/variation in prices will be state specific. The high tax states like MH and KA should see prices drop across the board (almost). Lower tax states may have a mixed bag. See the luxury makers are already dropping prices in full page advts.

Ford announced discounts of upto 30k rupees due to GST tax benefits on its Ecosport and figo twins.

http://timesofindia.indiatimes.com/a...w/58894917.cms

I am not sure if this article is accurate or not but wasn't Taxes for small cars post GST(<4m and <1.5/1.2 engine) supposed to increase slightly? How is ford giving such discounts or have i missed something?

Also surprisingly there is no mention of any discount on the Ford endeavour ,which should be getting a big Tax relief post GST!

Quote:

Originally Posted by torquehead

(Post 4207238)

Just wondering if this requires an update for:

- NCCD(National Calamity Contingent duty)

- Calculation to illustrate the cascading effect of current taxation regime.

Both these would effectively increase the present values.

|

Here is the update you asked for (including NCCD)

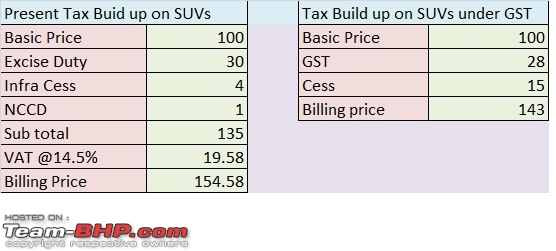

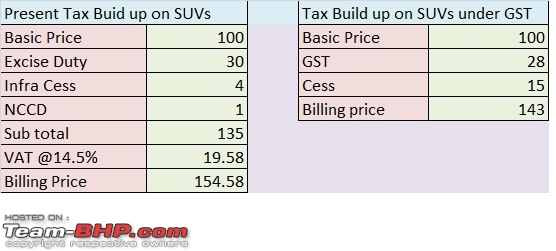

The cascading effect of the present tax structure is illustrated below:

Quote:

Originally Posted by DImPo

(Post 4207415)

|

Thanks, the numbers have increased now as expected.

In fact, there is an additional component called Local Body Tax(L.B.T.) in Pune and other Municipal Corporations of Maharashtra. At Pune, it is charged as below:

- For Cars, priced under 10 lacs: 2%

- For cars priced over 10 lacs: 4%

Through some contacts who provide consulting to Auto manufacturers, I have found that there may be a marginal hike 'initially'. The excuse being given is their inability to claim input tax credits for their vendors who may not part of the GST system currently. This may change once all their vendors formally become part of the system.

Not sure if I should take this argument with a pinch of salt OR close my car's deal before GST roll-out. I plan to buy S Cross 1.3(>4m, <1500cc) that should lose something in excess of 6-7% based on above calculations post GST implementation.

Local Body Tax will go under the GST. As will Octroi. That prices will go up slightly post GST is just a ploy to get people to buy now and avoid build up of inventory IMHO. If yours is an SUV (as per the legal definition) then I feel it is best to wait another few weeks for GST to actually kick in.

As much as Trump govt has been criticized for being a Reverse Robin hood, it's easy to see a somewhat similar thing being done as far as the GST on cars go.

Small cars are taxed more

Luxury cars getting cheaper

And the worst of all, hybrids being taxed more.

Although there is a rethink scheduled on the hybrid thing. I hope they make a better decision this time

Quote:

Originally Posted by lollapalooza

(Post 4207501)

If yours is an SUV (as per the legal definition) then I feel it is best to wait another few weeks for GST to actually kick in.

|

Yes I too feel the same (even in case of MUV like Innova also).

I am about to book Innova Crysta, but due to GST, I decided to wait for few weeks.

The sales executive from Toyota called me over phone and telling that "Sir, book the vehicle immediately and take the delivery before GST comes to effect. Only the price of luxury vehicles like Mercedes and BMW will be reduced with the effect of GST. The price of Innova Crysta may be increased by 40 to 50 thousands after GST, and If it happen, I cannot help you".

I asked him "OK I will go by your suggestion, and buy the car now itself. After my purchase, if the price of the car decreases, can you help me in that case?". He has no answer for that :D. I decided to wait.

Going by the above calculations, here is the estimated price difference post GST in Tata Hexa (>4m, >1500cc engine, >170mm gc)

Model Reference: Tata Hexa XTA

Ex-Showroom Price (Delhi): 17.57L

On Road Price (inc of RTO, insurance & TCS):20.77L

Current Tax Rate: 54.58% (as estimated in a previous post)

Factory Price: 11.37L

Post GST (Tax Rate at 43%)

Ex Showroom Price: 16.25L

On Road Price (inc of RTO, insurance & TCS): 19.27L

That's a whopping 1.5L difference :Shockked: in final OTR price if the manufacturer passes on the entire benefit to the customers. Sounds too good to be true, right?!

Not sure, but I don't think the Govt would like to lose this much revenue and would surely come up with some way to make up the difference.

Looks like we are seeing another real-time impact of GST on cars

GST Effect: Ford Figo, Aspire, EcoSport Get Discounts Of Up To Rs 30,000

Ford has announced discounts in view of the upcoming GST to Ecosport (30K discount), Aspire (20K discount) and Figo (10k discount). A good move, but going by the calculations in this thread, i had hoped the prices would have been bit more lower. Anyways, any discount is a good.:thumbs up

I have been told that "Thane" pricing might go up for SUV & for D Segment cars as they want to regularize Thane prices with Mumbai.

Ex-Showroom prices for Thane will be similar to Mumbai from 1st July 2017.

How true it is?

Quote:

Originally Posted by shahbaz63

(Post 4207825)

I have been told that "Thane" pricing might go up for SUV & for D Segment cars as they want to regularize Thane prices with Mumbai.

Ex-Showroom prices for Thane will be similar to Mumbai from 1st July 2017.

How true it is?

|

I'm not sure about ex-showroom prices being regularised, but on-road prices will get slightly regularised by default with octroi going away. The main reason cars would get registered in Thane was the ability to save the 4.5-5% of octroi that one pays to register the car in Mumbai.

Quote:

Originally Posted by vsun

(Post 4207760)

The sales executive from Toyota called me over phone and telling that "Sir, book the vehicle immediately and take the delivery before GST comes to effect."

|

I think booking the vehicle now should not be a problem. The dealer should be deducting the booking amount from the new price if you take delivery post GST comes into effect.

Also, how is the GST going to impact small sedans like the recently launched Maruti Dzire? Apologies for the noob question.

| All times are GMT +5.5. The time now is 06:34. | |