India's numero uno carmaker company, Maruti-Suzuki India Limited, has plenty of reasons to celebrate in recent times, the biggest of which is - it has finally managed to crack the Rs 6-10 lakh higher-margin segment.

With new launches which are seeing consistent sales and demand, the company is now a proud leader in almost all the segments it is vying within the sub-Rs 10 lakh range - be it mini, compact, super-compact, mid-sized sedan or the entry-level UV - with as many as five of it's market leading brands now commanding sizeable waiting periods.

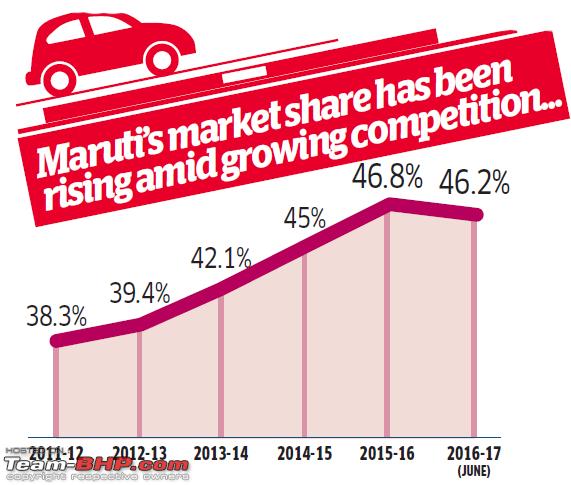

As for the company's own performance over the years, it has managed to sustain a steady upward growth in numbers in the past 4 fiscals. From having a stake of 38.3% market share in 2011-12, the homegrown auto giant ended 2015-16 with a healthy percentage of 46.8%,

an overall rise of 8.5%!

More notably, all of this was achieved during times when the auto industry went through a difficult period as customer response remained largely muted and flat.

Apart from increasing it's footprint across segments which are seeing the biggest growth in recent times, Maruti-Suzuki has also been equipping it's cars with updated, contemporary features and newer technologies such as the AMT and the SHVS system to take on the competition which has increasingly grown fiercer over the years, while not compromising on quality.

Newest products such as the Baleno and the S-Cross, sold through the Nexa channel, have changed the perception of the customers who equated the car company with cheaper, plasticky models.

As for market demand for it's offerings, it's newest challenger in the UV space, the Vitara Brezza, sees a long 8-month waiting period, while it's premium hatchback offering, the Baleno, commands an eight to nine month waiting period. Even old warhorses such as the Swift and the DZire command 4-month waiting periods, while the demand for the Ciaz (now equipped with a mild diesel hybrid option) is on the rise, as it has dethroned the mighty Honda City from the top position in the mid-size sedan segment.

As the competition grew, so did the company. Today, the compact segment is the most fiercely contested one which contributes to over 40% of the overall passenger vehicle sales, with 12 automakers vying for the proverbial pie with 37 different models. But with the Ertiga, the Baleno and the Brezza, Maruti-Suzuki has grabbed the biggest chunk of this pie.

Even the mid-size sedan segment in which Maruti-Suzuki didn't have a presence until the Ciaz came about, it now commands a healthy 36% share.

Of course, a new, ultra-modern and fully equipped R&D center in Rohtak with a staff of 1,200 played an important role in the recent new launches, such as the Vitara Brezza which was wholly conceptualised, engineered and developed in India itself.

Then there's the vast 1,800-dealer network spread across 1,450 cities across the country, and the new 125 Nexa outlets which are contributing about 10% of the overall Maruti-Suzuki sales. These numbers are expected to only increase, as MSIL (company abbreviation) has set itself a target of increasing the total number of Nexa outlets to 250 by this fiscal-end, and which would contribute at least 15% of the overall annual sales.

New segments, newer technologies, dynamic products at an unbeatable price tag - you name it, India's number 1 automaker has it. Whoever said that competition doesn't bring out the best in the market leader better eat their words, because the market leader is showing no signs of relenting anytime soon as it goes from strength to strength in it's quest to keep the number 1 tag firmly held in it's iron-clad fists.

VG Ramakrishnan, a former managing director of Frost & Sullivan:

Quote:

|

"Credit goes to Maruti. But it says a lot about the competition, too. From product to price, sales reach to after-sales experience, Maruti has excelled in its entire package of offering. Take for example Baleno, its fit and finish and the features it packs. You would never say it is a Maruti product."

|

Hormazd Sorabjee, editor, Autocar India:

Quote:

|

"Maruti's biggest achievement is that it has managed to crack the higher-margin Rs 6-10 lakh segment with its new launches (which it had consistently failed at in the past). Brezza ticks all the right boxes. It is pulling customers from everywhere - hatchbacks, compact sedans, sedans, SUVs."

|

Deepesh Rathore, director, EMMAAA, an automobile consultancy firm:

Quote:

|

"Often, Maruti has not been the first one to get in. But whenever it does, it does a great job of grabbing market share."

|

Mohit Arora, executive director, JD Power:

Quote:

|

"Maruti's average transaction price has moved up. Customers in that segment have much higher expectations on quality and refinement."

|

Suzuki Corporation Global CEO Toshihiro Suzuki:

Quote:

|

"We have been selling compact cars. Now we are aiming at (Indian) customers who buy vehicles that are slightly bigger than compacts. We would like to expand here (in the bigger segment)."

|

ET

(38)

Thanks

(38)

Thanks

(30)

Thanks

(30)

Thanks

(23)

Thanks

(23)

Thanks

(2)

Thanks

(2)

Thanks

(7)

Thanks

(7)

Thanks

(4)

Thanks

(4)

Thanks

(25)

Thanks

(25)

Thanks

(4)

Thanks

(4)

Thanks

(1)

Thanks

(1)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(32)

Thanks

(32)

Thanks

(2)

Thanks

(2)

Thanks

(4)

Thanks

(4)

Thanks

. Even the Creta proves that you can successfully sell 3 lakh hatchbacks & 15 lakh SUVs from the same brand / showroom.

. Even the Creta proves that you can successfully sell 3 lakh hatchbacks & 15 lakh SUVs from the same brand / showroom.

)

)